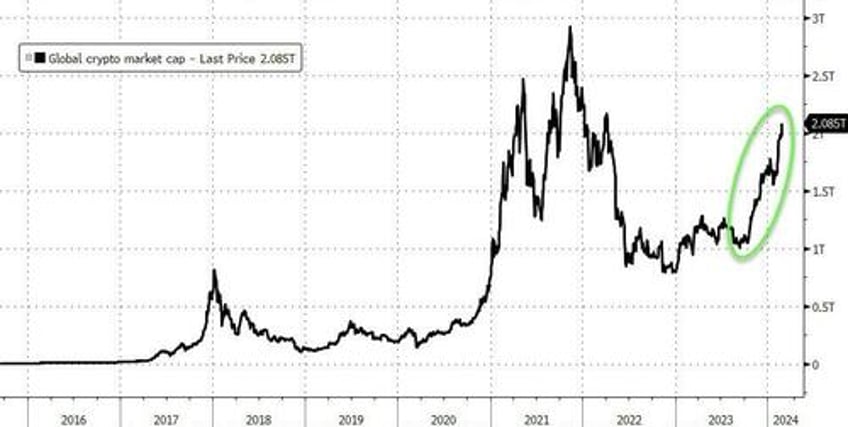

For the second day in a row, the biggest shorts, crypto, and oil prices ripped while the rest of the market wistfully drifted unphased by more dismal data.

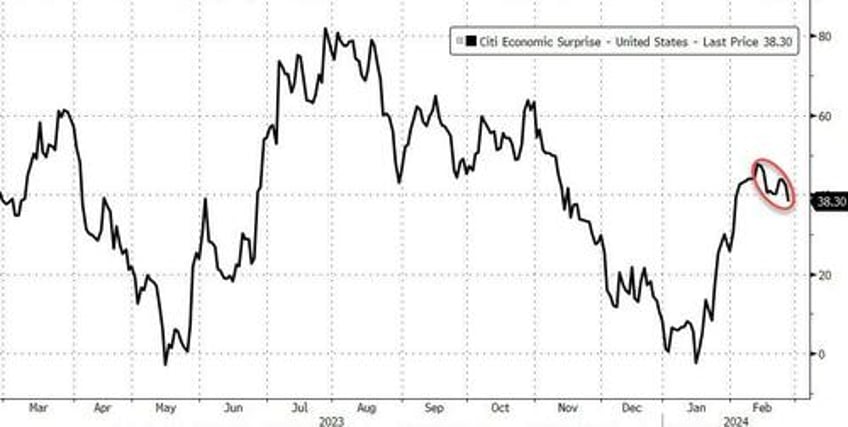

Durable-goods - ugly (blame Boeing); Home-prices higher-er (blame Powell's pivot for unaffordability); consumer sentiment shitshow (and oddly large downward revisions)

Source: Bloomberg

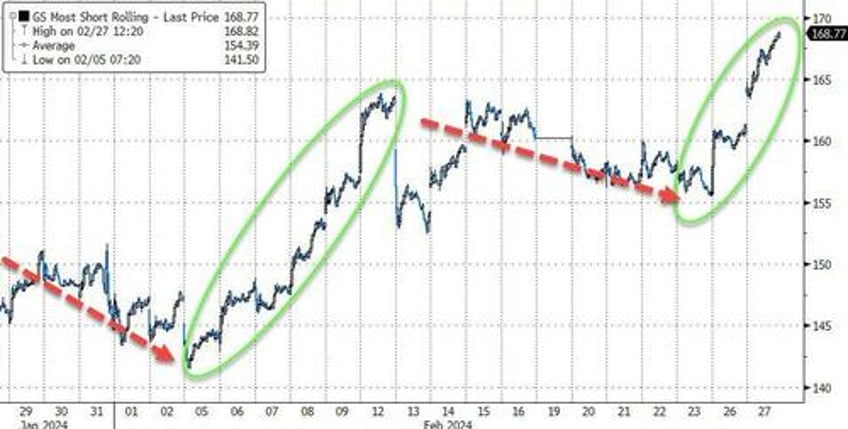

'Most Shorted' stocks were squeezed bigly once again... up 9% from Friday's close...

Source: Bloomberg

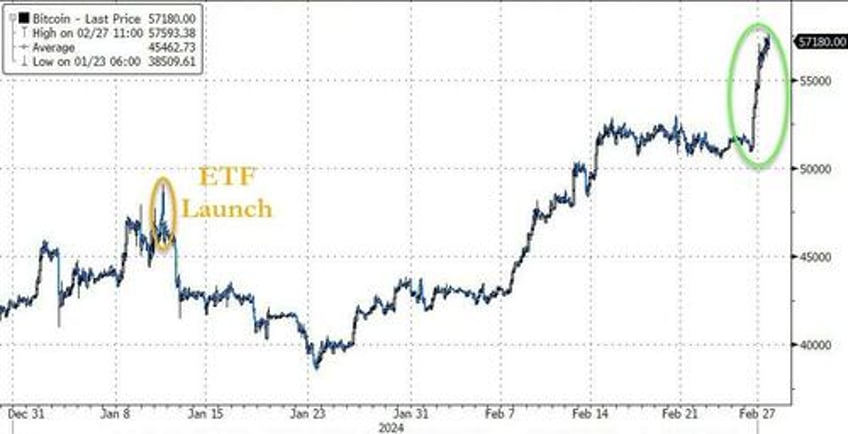

Bitcoin ripped once again... topping $57,000 for the first time since Nov 2021...

Source: Bloomberg

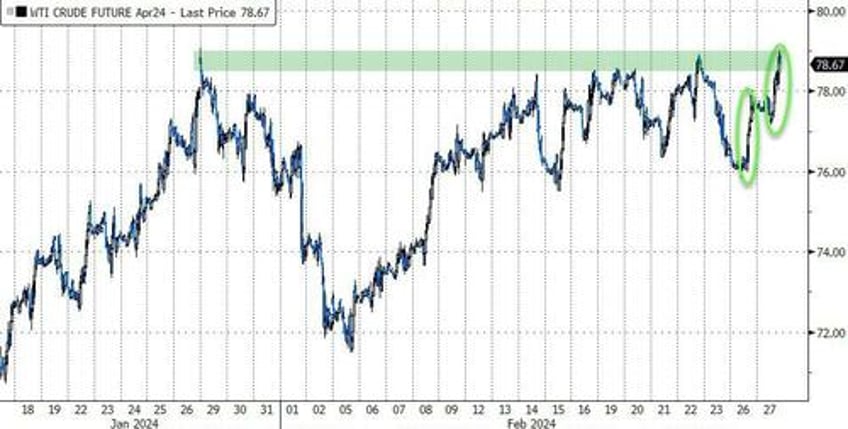

And oil prices jumped once again... to their highest close since early November...

Source: Bloomberg

Small Caps were the biggest beneficiary of the short squeeze... now up 2% in the last two days while The Dow lags. S&P and Nasdaq managed gains today but are marginally lower and marginally higher on the week so far...

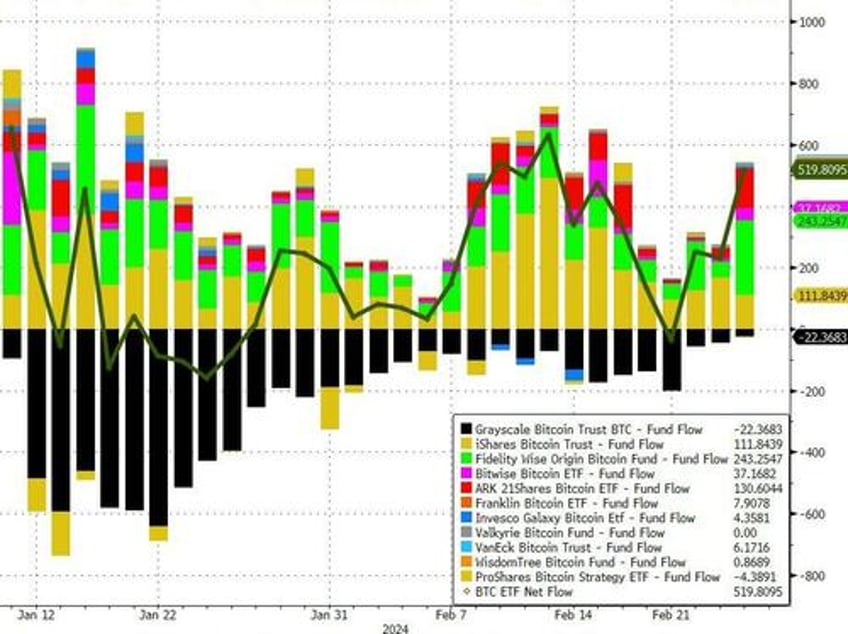

Bitcoin ETF inflows have been soaring...

Source: Bloomberg

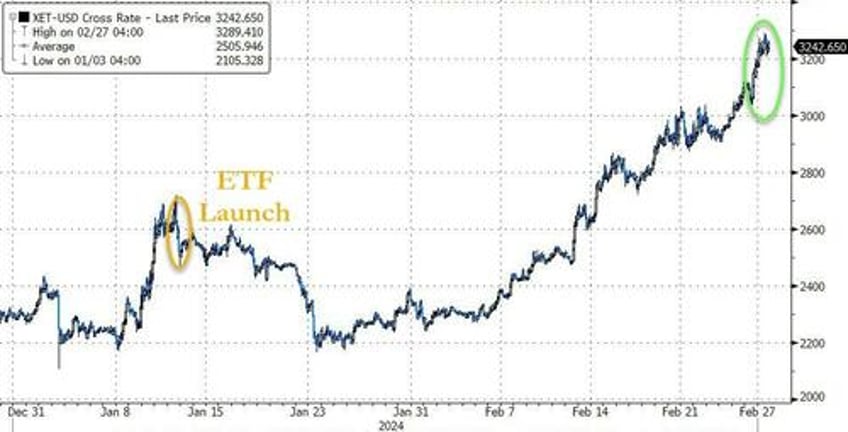

And that's started to drive Ethereum higher too (to its its highest since April 2022)...

Source: Bloomberg

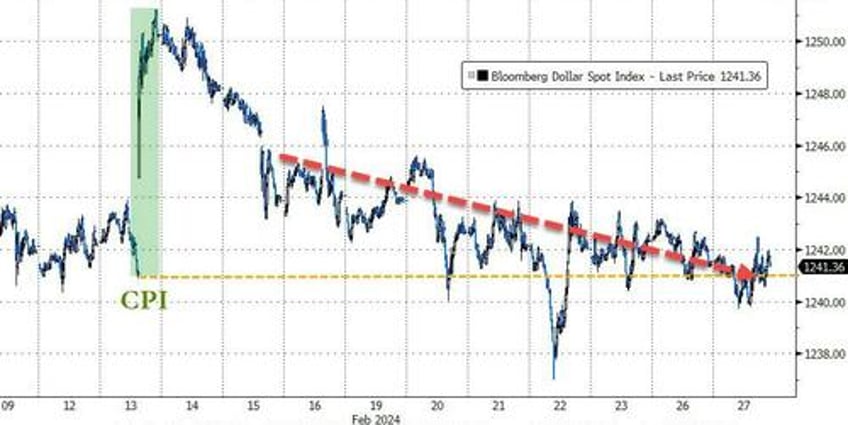

The dollar continued its slow drift lower, back to pre-CPI lows...

Source: Bloomberg

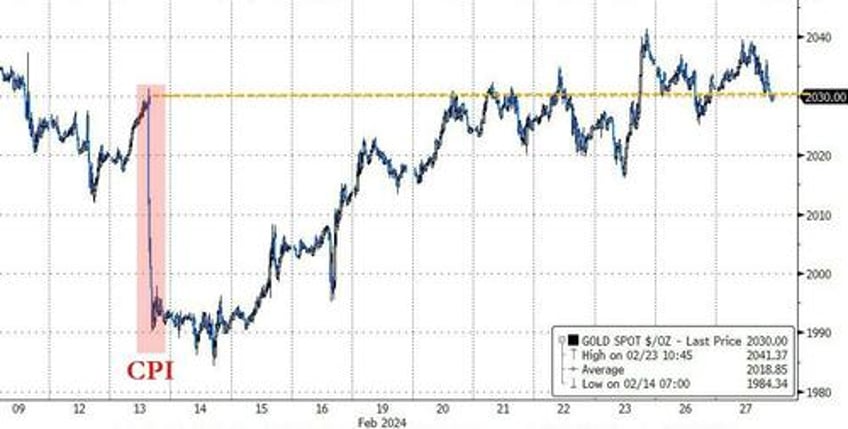

Gold was steady again today at pre-CPI highs...

Source: Bloomberg

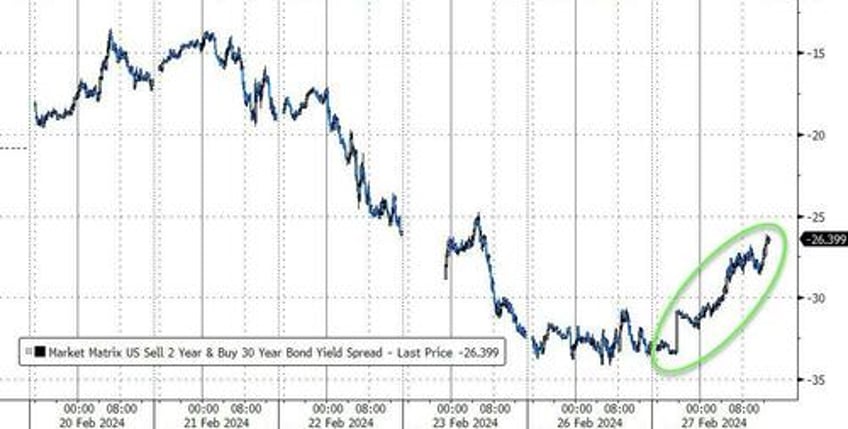

Treasuries were mixed today with the short-end outperforming (2Y unch, 30Y +4bps)...

Source: Bloomberg

And that sent the yield curve (2s30s) bear-steepening - after some serious flattening recently...

Source: Bloomberg

Finally, crypto's total market cap is back above $2 trillion for the first time in two years...

Source: Bloomberg

No wonder 'unknown' officials have started to spread rumors that they fear bitcoin-mining could put the grid in jeopardy (now that the "only terrorists and money-launderers use crypto" narrative has exploded)! How f**king pathetic and predictable are these people!!!

We look forward to hearing how crypto is in a bubble... but NVDA isn't...

Source: Bloomberg

It's different, of course.