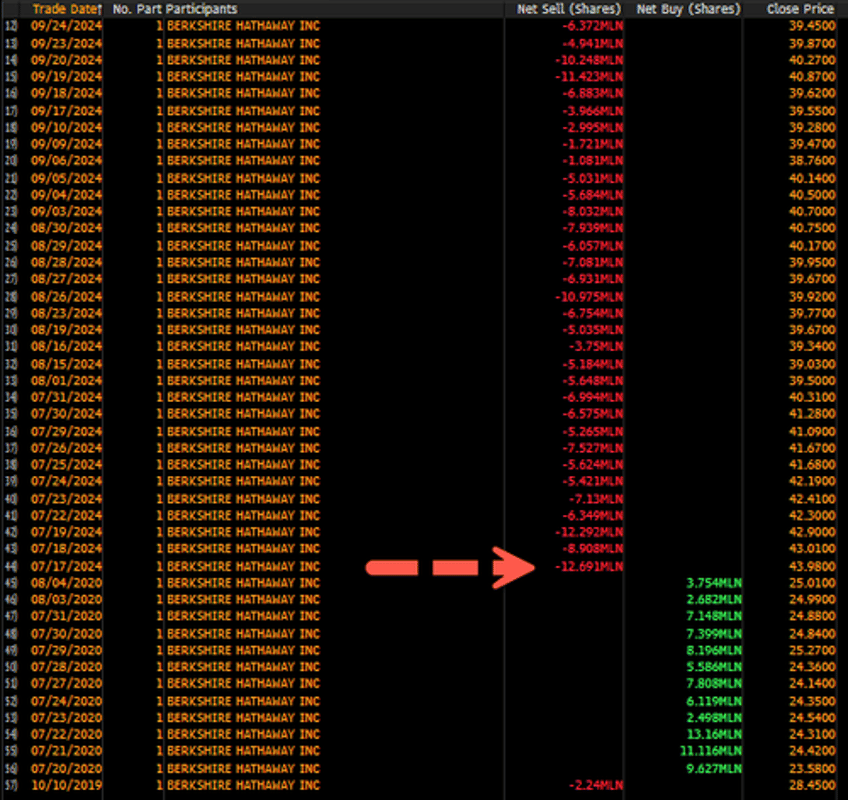

94-year-old Warren Buffett's Berkshire Hathaway has been steadily offloading Bank of America shares over the past several months.

The latest data from Bloomberg reveals that Berkshire sold millions more in recent days, bringing its stake closer to the 10% regulatory threshold, after which it will no longer have to report sales.

Before Berkshire started selling BofA shares in mid-July, Buffett's firm held just over a billion shares. In just a few months, that stake has been reduced to around 814 million.

Berkshire's selling of BofA was abrupt and without warning in mid-July.

We offered some theories about possible motives behind Buffett's BofA dumping, including an overvalued market, recession risk, consumer downturn, and the possibility that a US regulatory probe into anti-money laundering surrounding fentanyl cash laundering could expand to major US banks.

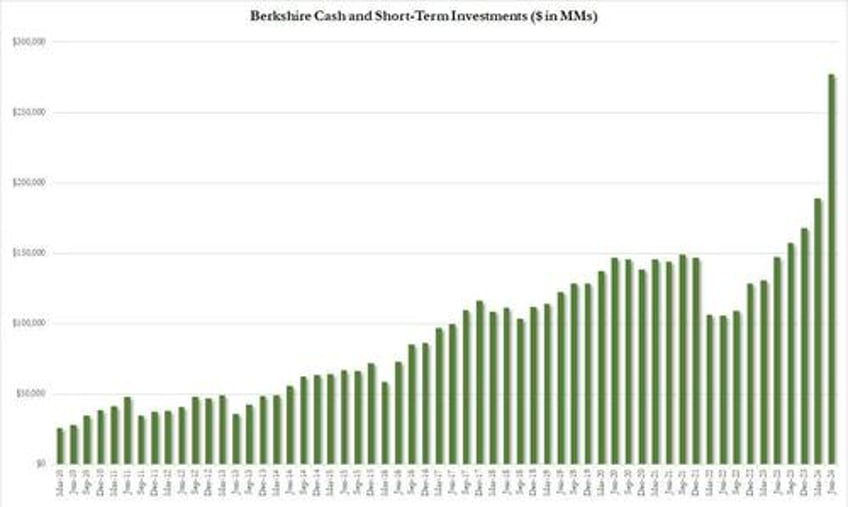

Buffett's cash pile has also soared to record highs.

Hmm.

Maybe.

Buffett's move to dump BofA shares comes as Berkshire's stake slides to 10.49%. Dropping below the critical 10% threshold would free Berkshire from reporting future sales transactions, and we suspect this is the likely move.