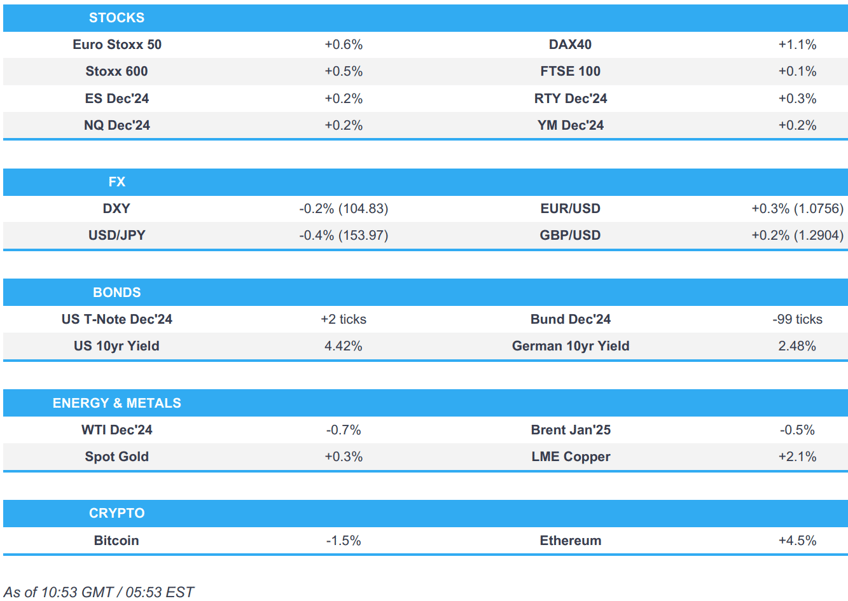

- European bourses are modestly firmer across the board, with US futures also slightly higher, but ultimately taking a breather following the significant strength in the prior session.

- Dollar is giving back recent gains, Antipodeans outperform attempting to claw back post-election losses amid resilience in China.

- USTs are a touch firmer awaiting today’s FOMC meeting, Bunds are the clear underperformer after the German coalition collapses.

- Crude is modestly weaker, paring back some of gains seen in the prior session; XAU benefits from the softer Dollar and base metals gain amid positive price action in China overnight.

- Looking ahead, US Initial Jobless Claims, Wholesale Inventory, BoE & Fed Policy Announcement, ECB’s Lane, Schnabel, Elderson, BoE Governor Bailey & Fed Chair Powell.

- Earnings from PG&E Corp, Duke Energy Corp, Becton Dickinson and Co, Air Products and Chemicals Inc, Arista Networks Inc, TransDigm Group Inc, EOG Resources Inc, Motorola Solutions Inc, Airbnb Inc, Fortinet Inc, Trade Desk Inc, Ralph Lauren Corp, Moderna Inc & Warner Bros Discovery Inc.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.6%) began the session on a modestly firmer footing and continued to edge higher as the morning progressed. Today’s EZ-specific docket has been relatively light, but focus ahead will lie on policy announcements from the BoE and the Fed thereafter.

- Region awaiting updates on China's stimulus and also sensitive to ongoing political uncertainty in Germany.

- European sectors hold a strong positive bias. Basic Resources is by far the clear outperformer, lifted by strength in underlying metals prices after strong Chinese price action overnight. Telecoms is found at the foot of the pile, dragged down by losses in Telefonica (-1.5%) and BT (-5.2%), with the latter also lowering its FY25 guidance.

- US Equity Futures (ES +0.2%, NQ +0.2%, RTY +0.3%) are modestly firmer across the board, taking a breather following the significant gains seen in the prior session, where the S&P500 soared to record highs after Trump returned to Presidency.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is giving back some ground to major peers after the DXY sky-rocketed from 103.70 to 105.44 on account of the Trump victory. Attention now turns to today's FOMC announcement which is expected to see the Fed step down to a 25bps cadence of rate cuts.

- EUR has been able to make some headway vs. the USD. However, today's peak at 1.0771 is some way off Wednesday's best at 1.0936. As such, it remains to be seen how much legs the attempted recovery has, particularly given the political instability in Germany with the prospect of a general election in March next year.

- GBP is attempting to undo some of the damage seen during yesterday's session with Cable returning to a 1.29 handle after delving as low as 1.2835. Expectations are for a 25bps cut via a 7-2 vote split.

- JPY is attempting to recoup some of the lost ground vs. the USD brought on by Trump's victory. However, progress has been relatively limited with USD/JPY's current low at 153.66 standing in contrast to Wednesday's 151.27 trough.

- Antipodeans are both markedly higher and leading the charge against the USD after what was a particularly bruising session on Wednesday given exposure to China. Accordingly, AUD/USD has almost pared a bulk of yesterday's move that dragged it down from a 0.6644 high to a 0.6511 low.

- SEK is flat following the Riksbank's decision to cut rates by 50bps as expected (despite some outside calls for a 25bps) reduction and reiterate guidance on rates. EUR/NOK has extended on yesterday's downside with an in-line decision from the Norges Bank underscoring the Bank's hawkish credentials relative to most other peers.

- China state-owned banks were seen selling US dollars and buying yuan, according to traders.

- PBoC set USD/CNY mid-point at 7.1659 vs exp. 7.1679 (prev. 7.0993).

- Brazil Central Bank hiked the Selic rate by 50bps to 11.25%, as expected, with the decision unanimous. BCB stated the pace of future interest rate adjustments and total magnitude of the cycle will be determined by the firm commitment to reaching the inflation target. Furthermore, it stated the pace of future interest rate adjustments and total cycle magnitude will depend on inflation dynamics, expectations and projections, the output gap, and the balance of risks, while it added that risks to inflation scenarios are tilted to the upside.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are a touch firmer and holding around 109-20, but has been as low as 109-14. Despite the slight bid, the curve remains steeper with the long-end picking up while the short end pulls back slightly as attention turns to the FOMC later tonight, where a 25bps cut is entirely priced in. On the election, the story is much the same as we continue to await a decision on the House race to determine whether markets are contending with a Trump with or without Congress scenario

- Bunds have recently lost the 131.00 mark, down to a 130.74 low which is clear of Wednesday's 130.58 trough. The main update has been the sacking of Germany’s Finance Minister Lindner (a debt brake advocate). An update which broke the already-fractured coalition and has seen Chancellor Scholz pencil in an early-January confidence vote, which he will likely lose, paving the way for snap-elections in Q1.

- Gilts are firmer on the session as we count down to the BoE. A meeting which is expected to deliver a 25bps cut with the focus largely on forward guidance. Currently, pivoting the 93.00 mark, picking up slightly from an opening 92.89 base and clear of Wednesday’s 92.53 trough.

- Spain sells EUR 4bln vs exp. EUR 3.5-4.5bln 2.70% 2030, 4.00% 2054 Bono & EUR 0.495bln vs exp. EUR 0.25-0.75bln 0.70% 2033 I/L Bono Auction.

- France sells EUR 12.5bln vs exp. EUR 10.5-12.5bln 3.0% 2034, 4.00% 2035, 0.50% 2044 and 3.25% 2055 OAT Auction.

- Click for a detailed summary

COMMODITIES

- Crude is modestly weaker and around USD 1.50/bbl off Wednesday’s best but still almost twice that from the troughs. The complex continues to await geopolitical updates out of the Middle East and whether Trump achieves an election sweep.

- Recent attention on a comment from Kann News, which wrote "The preparation for an Iranian attack: the US moved a squadron of F15s to the Middle East - after dozens of fighter jets and 6 B-52 strategic bombers were moved to the region last week" in reference to recent flight radar data.

- Spot gold is a touch firmer, benefitting from the DXY easing below the 105.00 mark. However, magnitudes are relatively slim and XAU remains some way off the virtual double-top from Tuesday & Wednesday at USD 2748-49/oz.

- Base metals are firmer, rebounding after yesterday’s pressure and benefitting from bullish remarks on “green shoots” in China from the BHP CEO and anticipation of Chinese stimulus. Overnight, Chinese exports were particularly strong though desks caution on reading too much into this given looming Trump tariffs (potentially as much as 60% on China).

- NHC updated that the centre of Rafael is moving into the southeastern Gulf of Mexico with a life-threatening storm surge, damaging hurricane-force winds, and flash flooding continuing over portions of western Cuba.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Industrial Output MM (Sep) -2.5% vs. Exp. -1.0% (Prev. 2.9%)

- German Exports MM SA (Sep) -1.7% vs. Exp. -1.4% (Prev. 1.3%); Imports MM SA (Sep) 2.1% vs. Exp. 0.5% (Prev. -3.4%); Trade Balance, EUR, SA (Sep) 17.0B vs. Exp. 20.9B (Prev. 22.5B)

- EU Retail Sales MM (Sep) 0.5% vs. Exp. 0.4% (Prev. 0.2%, Rev. 1.1%); Retail Sales YY (Sep) 2.9% vs. Exp. 1.3% (Prev. 0.8%, Rev. 2.4%)

- Swedish CPIF Ex Energy Flash YY (Oct) 2.1% vs. Exp. 2.00% (Prev. 2.00%); CPIF Ex Energy Flash MM (Oct) 0.2% vs. Exp. 0.10% (Prev. 0.40%); CPIF Flash MM (Oct) 0.4% vs. Exp. 0.30% (Prev. 0.30%); CPI YY Flash (Oct) 1.6% vs. Exp. 1.50% (Prev. 1.60%); CPI MM Flash (Oct) 0.2% vs. Exp. 0.10% (Prev. 0.20%); CPIF Flash YY (Oct) 1.5% vs. Exp. 1.30% (Prev. 1.10%)

- UK Halifax House Prices MM (Oct) 0.2% vs. Exp. 0.2% (Prev. 0.3%)

- French Non-Farm Payrolls QQ (Q3) -0.1% (prev. 0.0%)

- Spanish Ind Output Cal Adj YY (Sep) 0.6% vs. Exp. 0.2% (Prev. -0.1%)

- French HCOB Construction PMI (Oct) 42.2 (Prev. 37.9); German HCOB Construction PMI (Oct) 40.2 (Prev. 41.7); Italian HCOB Construction PMI (Oct) 48.2 (Prev. 47.8); EU HCOB Construction PMI (Oct) 43.0 (Prev. 42.1)

NOTABLE EUROPEAN HEADLINES

- Riksbank cuts its Rate by 50bps as expected to 2.75% (prev. 3.25%); policy rate may also be lowered in December and H1 2025 (in line with what was communicated in September). Click for details.. Riksbank's Theeden says flash CPI data for October do not change the overall picture; Crown is a risk factor "but we don't think it will affect out inflation picture". Says the rate path is more uncertain than usual.

- Norges Bank leaves its Key Policy Rate at 4.50% as expected; "the policy rate will most likely be kept at 4.5 percent to the end of 2024". Click for details.

- Deutsche Bank lowers its terminal ECB rate forecast to 1.5% from 2.25%

- ECB's Schnabel says the balance sheet reduction has not left any significant footprint in many areas, thus far.

- ECB survey on Survey on the Access to Finance of Enterprises: firms report moderate tightening of financing conditions shows cost pressures remain widespread across businesses of all sizes. Firms reported little changes regarding the availability of bank loans. However, firms’ need for bank loans has declined moderately, partly due to high internal funds. Substantially fewer firms reported rising bank interest rates on loans, although many indicated a further tightening of other conditions. Firms’ inflation expectations continued to decline, with their median expectations for annual inflation in one, three and five years all standing at 2.9%.

- Joerg Kukies has been appointed German Finance Minister, replacing Lindner.

- Maersk (MAERSKB DC) says overall freight volumes from Europe continue to report a slight 4% Y/Y increase; freight rates continue to decline. Seeing demand in Europe bounce back a lot stronger this year.

NOTABLE US HEADLINES

- Top Trump fundraiser and billionaire hedge fund manager Scott Bessent is reportedly lining himself up for Treasury Secretary and is canvassing for deputies, according to FT.

- Decision Desk's US House tracker has increased to a 94.7% chance of Republicans winning the US House which would result in a Trump + Republican Congress scenario and it is projecting a 223 vs 212 final House result (218 required for control) in favour of Republicans.

GEOPOLITICS

MIDDLE EAST

- Kann News writes "The preparation for an Iranian attack: the US moved a squadron of F15s to the Middle East - after dozens of fighter jets and 6 B-52 strategic bombers were moved to the region last week" in reference to recent flight radar data.

- Israeli warplanes heavily bombard a number of areas in the southern suburbs of Beirut, according to Al Qahera News.

OTHER

- Ukrainian President Zelensky said he congratulated Trump by phone and they agreed to maintain close dialogue and advance cooperation, according to Reuters.

- Taiwan's Foreign Ministry said it is fully confident the US will continue strong cross-party support for Taiwan going forward and noted that Taiwan-US relations are solid as a rock. It also stated that Taiwan's government looks forward to continuing to deepen ties with the US under the Trump administration and they will continue to strengthen cooperation on combating economic coercion, while they cannot rule out that during the US transition, China will test the bottom line of the new US President by increasing “grey zone” activities which may not only be limited to military drills but could also involve internet attacks.

- South Korean President Yoon said in a phone call with US President-elect Trump that he looks forward to continuing a close relationship on security and economy, while they agreed to meet in the near future and Trump said the American shipbuilding industry needs South Korea's help and cooperation. They also agreed on the need for a strong partnership in the Asia-Pacific and discussed North Korea's ICBM launch, as well as the release of trash balloons into South Korea.

CRYPTO

- Bitcoin is slightly weaker and traded beneath USD 75k, whilst Ethereum continues to march higher.

APAC TRADE

- APAC stocks were somewhat mixed albeit with a mostly positive bias as the dust settled from the US election and the Trump trade began to wane after reverberating across global markets with participants bracing for higher US tariffs, while participants also digested Chinese trade data as the attention turned to the incoming central bank rate decisions including from the FOMC.

- ASX 200 was indecisive but eventually finished positive as strength in energy, tech, industrials and financials gradually picked up the slack from weakness in real estate and defensives, while weak Australian trade data capped the upside.

- Nikkei 225 initially surged on the back of a weaker currency but failed to sustain the momentum and gave back its spoils.

- Hang Seng and Shanghai Comp shrugged off the threat of incoming blanket tariffs from the next US administration as participants continued to await a potential fiscal stimulus announcement and as the latest Chinese trade data was mostly better-than-expected with double-digit export growth. Furthermore, the PBoC held a meeting with international financial institutions and affirmed to continue its accommodative monetary policy, while China told banks to cut interbank deposit rates to boost growth.

NOTABLE ASIA-PAC HEADLINES

- PBoC held a meeting with international financial institutions including HSBC (5 HK), Standard Chartered (2888 HK) and Citi (C), while it affirmed to continue accommodative monetary policy stance and vowed to strengthen communication with the market. Furthermore, Governor Pan said they are to expand connectivity between domestic and overseas markets.

- China instructed banks to cut interbank deposit rates to boost growth, according to Bloomberg.

- Chinese President Xi congratulated Trump on winning the US presidential election and said he hopes that the two sides will respect each other, coexist peacefully, and achieve win-win cooperation. Furthermore, Xi said both sides should strengthen dialogue and that US-China cooperation is a long-term goal, according to Xinhua.

- Japanese top currency diplomat Mimura said they are closely watching market moves with a high sense of urgency and are ready to take appropriate actions for excess FX moves if needed.

- Nissan (7201 JT) is revising its FY24/25 operating profit forecast to JPY 150bln (prev. guided 500bln), withdraws net forecast; to sell a partial stake in Mitsubishi Motors (8058 JT). To reduce the global headcount by 9k & production capacity by 20%.

- Acer (2353 TT) Jan-Sept (TWD): net profit 4.11bln, sales 198.66bln

DATA RECAP

- Chinese Trade Balance (USD)(Oct) 95.72B vs. Exp. 76.03B (Prev. 81.71B)

- Chinese Exports YY (USD)(Oct) 12.7% vs. Exp. 5.2% (Prev. 2.4%); Imports -2.3% vs. Exp. -1.5% (Prev. 0.3%)

- Chinese Trade Balance (CNY)(Oct) 679.1B (Prev. 582.6B)

- Chinese Exports YY (CNY)(Oct) 11.2% (Prev. 1.6%); Imports YY -3.7% (Prev. -0.5%)

- Japanese Labour Cash Earnings (Sep) 2.8% vs. Exp. 3.0% (Prev. 3.0%, Rev. 2.8%)

- Australian Balance on Goods (USD) (Sep) 4,609M vs. Exp. 5,300M (Prev. 5,644M)

- Australian Goods/Services Exports MM (Sep) -4.30% (Prev. -0.20%)

- Australian Goods/Services Imports MM (Sep) -3.10% (Prev. -0.20%)