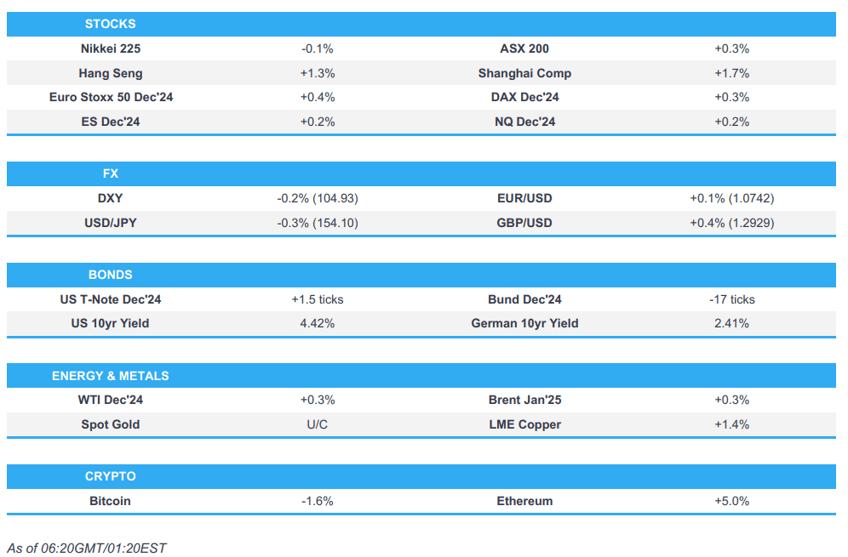

- APAC stocks held a mostly positive bias as the dust settled from the US election, participants also digested Chinese trade data.

- European equity futures are indicative of a firmer cash open with the Euro Stoxx 50 future +0.3% after the cash market closed lower by 1.4% on Wednesday.

- DXY has pulled back onto a 104 handle with antipodeans leading the fight back vs. the USD, USD/JPY sits on a 154 handle.

- German Chancellor Scholz dismissed Finance Minister Lindner and will call for a confidence vote on January 15th which could allow elections by the end of March.

- Looking ahead, highlights include German Industrial Output, EZ Retail Sales, US Initial Jobless Claims, Wholesale Inventory, Riksbank, Norges Bank, BoE & Fed Policy Announcements, ECB’s Lane, Schnabel, Elderson, BoE Governor Bailey & Fed Chair Powell, Supply from Spain & France.

- Earnings from Hochtief, Munich Re, Heidelberg Materials, Rheinmetall, Delivery Hero, Daimler Truck, Lanxess, Euronext, Engie, SES, Veolia Environment, Legrand, Zealand Pharma, GN Store Nord, Banca Monte dei Paschi di Siena, Azimut Holding, Leonardo, Nexi, Cellnex, Grifols, Telefonica, BT Group, Hiscox, Taylor Wimpey, National Grid, J Sainsbury, ITV, Hikma Pharmaceuticals, ArcelorMittal, PG&E Corp, Duke Energy Corp, Becton Dickinson and Co, Air Products and Chemicals Inc, Airbnb Inc, Ralph Lauren Corp, Moderna Inc & Warner Bros Discovery Inc.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

US TRADE

EQUITIES

- US stocks surged while the Dollar rallied and bonds plummeted, with bonds and the dollar posting the largest intraday moves since the COVID-era in response to Trump's victory in the US Presidential Election as Trump proposals of tax cuts supported stocks while the inflationary impacts of tariffs and increased spending (and increased issuance) weighed on T-notes and boosted the buck.

- SPX +2.53% at 5,929, NDX +2.74% at 20,781, DJIA +3.57% at 43,730, RUT +5.84% at 2,393.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President Biden spoke with Trump and is committed to a smooth transition, while he invited Trump to meet with him in the White House.

- US VP Harris called Trump to concede the election and later delivered a concession speech.

- Top Trump fundraiser and billionaire hedge fund manager Scott Bessent is reportedly lining himself up for Treasury Secretary and is canvassing for deputies, according to FT.

- Decision Desk's US House tracker has increased to a 94.7% chance of Republicans winning the US House which would result in a Trump + Republican Congress scenario and it is projecting a 223 vs 212 final House result (218 required for control) in favour of Republicans.

APAC TRADE

EQUITIES

- APAC stocks were somewhat mixed albeit with a mostly positive bias as the dust settled from the US election and the Trump trade began to wane after reverberating across global markets with participants bracing for higher US tariffs, while participants also digested Chinese trade data as the attention turned to the incoming central bank rate decisions including from the FOMC.

- ASX 200 was indecisive but eventually finished positive as strength in energy, tech, industrials and financials gradually picked up the slack from weakness in real estate and defensives, while weak Australian trade data capped the upside.

- Nikkei 225 initially surged on the back of a weaker currency but failed to sustain the momentum and gave back its spoils.

- Hang Seng and Shanghai Comp shrugged off the threat of incoming blanket tariffs from the next US administration as participants continued to await a potential fiscal stimulus announcement and as the latest Chinese trade data was mostly better-than-expected with double-digit export growth. Furthermore, the PBoC held a meeting with international financial institutions and affirmed to continue its accommodative monetary policy, while China told banks to cut interbank deposit rates to boost growth.

- US equity futures (ES +0.2%, NQ +0.3%, RTY +0.3%) gradually extended on gains after rallying yesterday on the Trump election victory.

- European equity futures are indicative of a firmer cash open with the Euro Stoxx 50 future +0.3% after the cash market closed lower by 1.4% on Wednesday.

FX

- DXY took a breather after briefly rallying above the 105.00 level on what was the largest daily move in the dollar since March 2020 owing to the Trump election victory and as Republicans also took control of the Senate. Furthermore, the House remains up for grabs but is seen as likely to remain a Republican majority with participants viewing Trump's policies of tariffs, tax cuts, less regulation and spending, as supportive of an inflationary theme, while the attention now turns to the FOMC decision.

- EUR/USD found some slight respite from the recent heavy selling pressure which was spurred by the dollar strength and amid concerns related to tariffs, defence and Ukraine in a second Trump presidency, while the single currency was also not helped by political turbulence in Germany after Chancellor Scholz dismissed Finance Minister Lindner over budget disputes and will call for a confidence vote on January 15th which could allow elections by the end of March.

- GBP/USD partially recouped lost ground and returned to the 1.2900 handle although the rebound was contained as participants also awaited the BoE rate decision in which the central bank is expected to deliver a 25bps cut.

- USD/JPY held on to most of the prior day's gains after coat-tailing on the dollar strength and a surge in US yields owing to the anticipation of incoming US inflationary policies from Trump 2.0, with support seen around the recently reclaimed 154.00 level.

- Antipodeans outperformed and continued to claw back post-election losses amid resilience seen in China.

- China state-owned banks were seen selling US dollars and buying yuan, according to traders.

- PBoC set USD/CNY mid-point at 7.1659 vs exp. 7.1679 (prev. 7.0993).

- Brazil Central Bank hiked the Selic rate by 50bps to 11.25%, as expected, with the decision unanimous. BCB stated the pace of future interest rate adjustments and total magnitude of the cycle will be determined by the firm commitment to reaching the inflation target. Furthermore, it stated the pace of future interest rate adjustments and total cycle magnitude will depend on inflation dynamics, expectations and projections, the output gap, and the balance of risks, while it added that risks to inflation scenarios are tilted to the upside.

FIXED INCOME

- 10yr UST futures traded sideways, attempting to regain composure following the post-election selling across the curve in response to the incoming Trump presidency, while a strong 30yr auction also provided some brief support.

- Bund futures remained lacklustre after recent fluctuations and amid political uncertainty in Germany where the coalition collapsed after Chancellor Scholz sacked Finance Minister Lindner and announced to hold a confidence vote in mid-January.

- 10yr JGB futures tracked recent downside in peers with demand also constrained after weaker 10yr JGB auction results.

COMMODITIES

- Crude futures marginally gained after the prior day's choppy performance as traders digested recent dollar strength, a slightly larger-than-expected crude inventory build and with some output in the US Gulf of Mexico shut-in due to hurricane Rafael.

- BSEE stated that 17.4% of oil production and 7% of nat gas output in the US Gulf of Mexico is shut-in due to hurricane Rafael. NHC later updated that the centre of Rafael is moving into the southeastern Gulf of Mexico with a life-threatening storm surge, damaging hurricane-force winds, and flash flooding continuing over portions of western Cuba.

- Spot gold languished beneath the USD 2,700/oz level after the Trump election victory underpinned the dollar and yields.

- Copper futures partially nursed recent losses in some mild reprieve from yesterday's aggressive slide.

CRYPTO

- Bitcoin continued its gradual pullback from record levels with prices back beneath the USD 75,000 level.

NOTABLE ASIA-PAC HEADLINES

- PBoC held a meeting with international financial institutions including HSBC (5 HK), Standard Chartered (2888 HK) and Citi (C), while it affirmed to continue accommodative monetary policy stance and vowed to strengthen communication with the market. Furthermore, Governor Pan said they are to expand connectivity between domestic and overseas markets.

- China instructed banks to cut interbank deposit rates to boost growth, according to Bloomberg.

- Chinese President Xi congratulated Trump on winning the US presidential election and said he hopes that the two sides will respect each other, coexist peacefully, and achieve win-win cooperation. Furthermore, Xi said both sides should strengthen dialogue and that US-China cooperation is a long-term goal, according to Xinhua.

- Japanese top currency diplomat Mimura said they are closely watching market moves with a high sense of urgency and are ready to take appropriate actions for excess FX moves if needed.

DATA RECAP

- Chinese Trade Balance (USD)(Oct) 95.72B vs. Exp. 76.03B (Prev. 81.71B)

- Chinese Exports YY (USD)(Oct) 12.7% vs. Exp. 5.2% (Prev. 2.4%)

- Chinese Imports YY (USD)(Oct) -2.3% vs. Exp. -1.5% (Prev. 0.3%)

- Chinese Trade Balance (CNY)(Oct) 679.1B (Prev. 582.6B)

- Chinese Exports YY (CNY)(Oct) 11.2% (Prev. 1.6%)

- Chinese Imports YY (CNY)(Oct) -3.7% (Prev. -0.5%)

- Japanese Labour Cash Earnings (Sep) 2.8% vs. Exp. 3.0% (Prev. 3.0%, Rev. 2.8%)

- Australian Balance on Goods (USD) (Sep) 4,609M vs. Exp. 5,300M (Prev. 5,644M)

- Australian Goods/Services Exports MM (Sep) -4.30% (Prev. -0.20%)

- Australian Goods/Services Imports MM (Sep) -3.10% (Prev. -0.20%)

GEOPOLITICS

MIDDLE EAST

- Israeli official said the US transition period may provide Israel with an opportunity to strike the Iranian nuclear programme, according to Bloomberg.

- Israeli Army Chief of Staff announced the country's forces should prepare for the expansion of ground operations against Hezbollah in Lebanon, according to Iran International.

- Israeli warplanes heavily bombard a number of areas in the southern suburbs of Beirut, according to Al Qahera News.

- Hezbollah said it targeted a military base south of Israel's Tel Aviv "for the first time" with a swarm of drones, according to a statement.

OTHER

- Ukrainian President Zelensky said he congratulated Trump by phone and they agreed to maintain close dialogue and advance cooperation, according to Reuters.

- Taiwan's Foreign Ministry said it is fully confident the US will continue strong cross-party support for Taiwan going forward and noted that Taiwan-US relations are solid as a rock. It also stated that Taiwan's government looks forward to continuing to deepen ties with the US under the Trump administration and they will continue to strengthen cooperation on combating economic coercion, while they cannot rule out that during the US transition, China will test the bottom line of the new US President by increasing “grey zone” activities which may not only be limited to military drills but could also involve internet attacks.

- South Korean President Yoon said in a phone call with US President-elect Trump that he looks forward to continuing a close relationship on security and economy, while they agreed to meet in the near future and Trump said the American shipbuilding industry needs South Korea's help and cooperation. They also agreed on the need for a strong partnership in the Asia-Pacific and discussed North Korea's ICBM launch, as well as the release of trash balloons into South Korea.

- Panama's maritime authority said they will cancel flags on four LNG vessels sanctioned by the US over links with Russia's Novatek.

EU/UK

NOTABLE HEADLINES

- ECB's Villeroy said a Trump administration will likely lead to a higher deficit and rate cuts will continue.

- German Chancellor Scholz dismissed Finance Minister Lindner over budget disputes, according to Reuters citing sources. It was also reported that Scholz announced he will call for a confidence vote on January 15th which could allow elections by the end of March and he will talk to opposition leader Merz, while he noted the economy cannot wait until after the elections.