In the past year we have discussed on multiple occasions that US labor market data has been repeatedly doctored to artificially appear better than it really is (see "Here Is The "Unexpected" Reason Why The Fed Will Rush To Cut Rates As Soon As Possible", "Philadelphia Fed Admits US Payrolls Overstated By At Least 800,000" and "Here Comes The Job Shock: Philadelphia Fed Admits US Jobs "Overstated" By At Least 1.1 Million"), although thanks to a quirk of BLS data revision reporting, we won't have definitive proof of just how ugly the real job market has been in recent years until some time in 2025, well into Trump's second administration.

However, while the BLS will be able to maintain the facade of "strong job gains" lies into early 2025, the dismal reality has already made an appearance in America's largest labor market.

According to a report published by the non-partisan California Legislative Analyst's Office (LAO) which is an agency of the California government, is overseen by the Joint Legislative Budget Committee of the California State Legislature, and performs and publishes extensive analyses of the state's budget in addition to providing fiscal and policy advice to the California Legislature, contrary to prior reports of over substantial job gains in the deep blue state in 2023, the reality was far uglier.

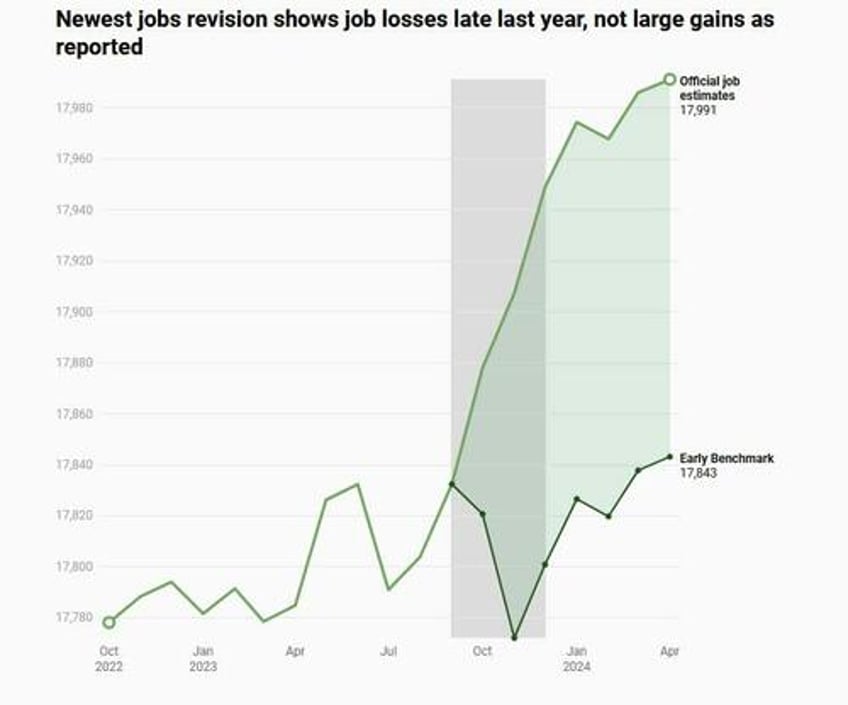

In a report titled "Newest Early Jobs Revision Shows No Net Job Growth During 2023" we learn just that: the Early Revisions to state-level data flagged here previously, suggests that California actually lost jobs during the fourth quarter of last year. As the report details, "based on the most recent release of the early benchmarks, payroll jobs declined by 32,000 from September 2023 through December 2023. On the contrary, the preliminary monthly reports showed a solid increase in job growth (+117,000 jobs) at the time."

This, according to the LAO, means that "with the fourth quarter revision, calendar year 2023 saw essentially no net job growth (+9,000 jobs overall)."

For those unfamiliar with the sequence of revisions to the jobs data, here is a quick primer from the LAO:

Monthly State Jobs Estimates Are Revised Annually. Each month our office publishes the most recent state employment figures from the the Current Employment Statistics (CES) survey. State employment figures come from this monthly survey, which is based on a small sample of businesses in the state. As a result, once per year the U.S. Bureau of Labor Statistics (BLS) does a benchmark revision, updating the monthly CES estimates to match more reliable administrative data from states’ Unemployment Insurance programs.

Federal Researchers Now Publishing Quarterly Revisions. Although the BLS only revises the state-level CES once per year, the underlying data used to revise the CES survey is collected quarterly. Taking advantage of this asynchrony, in 2021, researchers at the Federal Reserve Bank of Philadelphia began publishing state-level “early revisions” based on the same underlying data but revised more frequently.

In any event, the huge delta between the previously reported, CES survey-based fake Q4 numbers and the actual, post revision numbers is shown in the gray highlight in the chart below.

The data since January 2024 has not yet been rebenched, which means that the figure includes the Early Benchmark Revision for these recent months are growing at the same rate as the official CES estimates. But one can be absolutely certain that once the next set of revisions come in, California will not have generated any actual job growth for the second year in a row. In fact, make that all of America.

Of course, the shocking 'realization' that inflation-sparking Bidenomics was a complete disaster for the US labor market won't be disclosed until well into Trump's second (technically third) term. By then Biden, and his catastrophic economic policies, will be long forgotten.

Source: Legislative Analyst's Office