- US President Trump did not sign reciprocal tariffs order on Wednesday after stating that he may, while the White House schedule showed President Trump is to sign executive orders on Thursday at 13:00EST/18:00GMT.

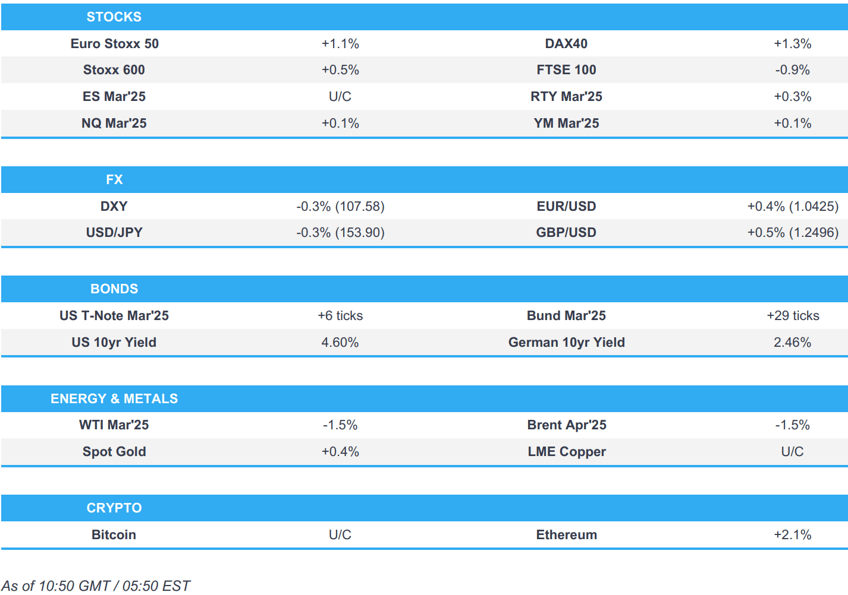

- Stocks mostly firmer on constructive geopolitical updates; US futures are mixed ahead of PPI.

- USD softer as markets weigh potential Ukraine peace deal and lack of reciprocal tariffs (so far).

- Bonds attempt to recoup CPI-driven losses into PPI though geopols is capping.

- Crude continues the Russia/Ukraine downside seen in the prior session; reports suggested Israel/Hamas had come to an understanding, but this was subsequently denied by Israeli PM Netanyahu's Office.

- Looking ahead, US Jobless Claims, PPI, Supply from the US. Earnings from Datadog, Baxter, Deere, Duke Energy, GE Healthcare, PG&E, Coinbase, Draftkings, Applied Materials, Airbnb, Palo Alto, Roku, Wynn.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS

- US President Trump did not sign reciprocal tariffs order on Wednesday after stating that he may, while the White House schedule showed President Trump is to sign executive orders on Thursday at 13:00EST/18:00GMT.

- South Korea is to discuss tariffs on Chinese steel plates on February 20th, according to Yonhap.

- Click for the Newsquawk tariff analysis.

EUROPEAN TRADE

EQUITIES

- European bourses (Stoxx 600 +0.4%) are mostly firmer as market digest the constructive commentary from Trump surrounding the potential of Russia-Ukraine peace talks; though indices have cooled a touch off highs as traders await US PPI and then President Trump who is set to sign executive orders at 18:00 GMT.

- European sectors hold a strong positive bias, with the clear winners/losers associated with recent remarks out of the US. Energy underperforms given the slump in oil prices, as markets digest comments via Trump who said peace negotiations with Russia is to start "immediately" - this also weighed on the Defense sector; downside which has since pared as traders focus on comments via US Defense Secretary Hagseth who called for higher defence spending.

- US equity futures are mixed and trading on either side of the unchanged mark, despite a stronger session in Europe, but ahead of key risks events which include US PPI and President Trump who is set to sign executive orders at 13:00 EST / 18:00 GMT.

- German Cartel Office expresses concerns over Apple (AAPL) app tracking tool.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

Earnings Summary

- Commerzbank (CBK GY) +0.6% ; strong metrics, raised 2027 targets.

- Siemens (SIE GY) +6.5% ; strong results and FY comp. revenue topped expectations.

- thyssenkrupp (TKA GY) +10% ; Q1 loss narrowed and saw improved orders, but cut outlook.

- Unilever (ULVR LN) -6% ; in-line, anticipates a slower start to 2025 with subdued market growth in the near term.

- Barclays (BARC LN) -5% ; headline metrics beat but saw credit impairment charges of GBP 2bln.

- British American Tobacco -8% ; FY rev. miss, highlights GBP 6.2bln Canadian lawsuit.

- Cisco (CSCO) +6% pre-market ; raised its annual forecast, driven by increased AI-related networking investments.

- Robinhood Markets (HOOD) +15% pre-market ; revenue up +115% Y/Y, driven by a +700% jump in cryptocurrency revenue.

FX

- DXY is on the backfoot after struggling to hold onto post-CPI gains yesterday. USD faded it's initial surge to 108.52 after being outmuscled by the EUR in the wake of comments from President Trump that he had a "highly productive" phone call with Russian President Putin, and they agreed to have their respective teams start negotiations immediately. Additionally, Trump's lack of signing of reciprocal tariffs yesterday has also acted as a headwind for the USD. Albeit, it is worth noting that he is due to sign another round of executive orders at 18:00GMT. Today's docket includes weekly claims data and PPI.

- EUR is one of the better performers vs. the USD with EUR/USD now up for a fourth session in a row after starting the week out just below the 1.03 mark. Gains stem via Trump refraining from signing reciprocal tariffs, as well as positive developments regarding Russia/Ukraine peace talks. EUR/USD is back above its 50DMA at 1.0396 and eyeing the Feb high at 1.0442.

- JPY is attempting to claw back some of the lost ground vs. the USD which has brought USD/JPY from a 150.92 base last Friday to a peak at 154.80 yesterday. JPY benefits via the softer Dollar as well as firmer-than-expected outturn for Japanese PPI metrics overnight. USD/JPY has been as low as 153.91 today but is still some way above its 200DMA at 152.72 and Wednesday's low at 152.39.

- GBP is firmer vs. the USD and steady vs. the EUR. Today's main macro event for the UK has come via a better-than-expected outturn for UK GDP which saw the December M/M print at 0.4% vs. Exp. 0.1%, leaving the Q4 print at 0.1% vs. Exp. -0.1%. As it stands, markets fully price the next cut in June with a total of 55bps of easing seen by year-end. Cable is back above its 50DMA at 1.2472 but sub-the Feb peak at 1.2549.

- Antipodeans are both softer vs. the USD and unable to benefit from the broad-based weakness seen in the dollar as participants still await the touted US reciprocal tariffs. AUD's exposure to China is currently acting as a greater source of price action as opposed to domestic events.

- PBoC set USD/CNY mid-point at 7.1719 vs exp. 7.3000 (prev. 7.1710).

- Click for a detailed summary

FIXED INCOME

- USTs are gradually lifting off the CPI-driven 108-04 WTD trough. As such, USTs find themselves comfortably in the green and around 10 ticks above that mark at best. Ahead, weekly claims prints alongside PPI though the jobs metrics do not coincide with the BLS period. Thereafter, 30yr supply due and in focus after the 10yr tailed by 0.9bps and the b/c came in softer than the prior and six-auction average.

- Bunds are firmer, also picking themselves up from their 132.10 US CPI-driven WTD low. However, and similarly to USTs, they have only managed to lift modestly from this to a current 132.38 session high; with the constructive geopolitical risk tone seemingly preventing a more pronounced move just yet in Europe. On this, some modest pressure was seen around reports in AFP that there is progress towards ending the Gaza truce crisis. Before that, no reaction to unrevised German inflation data or any pronounced follow through from UK data. ECB's Nagel is due. Bunds currently at the session's best at 133.43.

- Gilts are firmer, following the above. Gapped lower by nine ticks to a 92.36 low as the benchmark reacted to December/Q4 GDP data. Releases which were stronger than expected across the board and serve to provide the Chancellor with some much needed positive growth news after recent reports around the OBR. The release modestly tempered BoE cut expectations with 50bps no longer priced by September.

- Italy sells EUR 5.75bln vs exp. EUR 4.75-5.75bln 2.70% 2027, 3.15% 2031 & 3.45% 2031 BTP

- Click for a detailed summary

COMMODITIES

- The weakness in the crude complex continues after retreating yesterday amid reports that US President Trump conducted calls with Russian President Putin and Ukrainian President Zelensky about ending the war. Further downside was seen following reports the parties (Israel/Hamas) have come to an understanding, and the ceasefire agreement will be implemented; this was subsequently denied by Israeli PM Netanyahu's Office. Brent trades towards the bottom of a USD 74.06-75.05/bbl parameter.

- Spot gold gradually edged higher overnight after rebounding from yesterday's trough to back above the USD 2,900/oz level, while the recent fluctuations in the precious metal coincided with the swings in the greenback. Spot gold trades in a USD 2,900.54-2,922.88/oz parameter.

- Mixed trade across base metals as traders juggle the Russia-Ukraine market optimism with the looming reciprocal tariffs poised to be announced. 3M LME copper currently resides in a current 9,440.95-9,518.55/t range.

- IEA OMR: raises 2025 world oil demand growth forecast to 1.1mln BPD (prev. 1.05mln BPD). Fresh US sanctions on Russia and Iran roiled markets at the start of the year but they have yet to materially impact global oil supply. Iranian crude oil exports are only marginally lower while Russian flows, so far, continue largely unaffected.

- Russia's Kremlin says Russian President Putin and US President Trump discussed the energy sector.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK RICS Housing Survey (Jan) 22.0 vs. Exp. 27.0 (Prev. 28.0, Rev. 26)

- UK GDP Prelim QQ (Q4) 0.1% vs. Exp. -0.1%; YY (Q4) 1.4% vs. Exp. 1.1% (Prev. 0.9%, Rev. 1.0%)

- UK GDP Estimate MM (Dec) 0.4% vs. Exp. 0.10% (Prev. 0.10%); YY (Dec) 1.5% vs. Exp. 1.00% (Prev. 1.00%, Rev. 1.1%); Est 3M/3M (Dec) 0.1% vs. Exp. -0.10% (Prev. 0.00%, Rev. -0.1%)

- Swiss CPI YY (Jan) 0.4% vs. Exp. 0.4% (Prev. 0.6%); MM (Jan) -0.1% vs. Exp. -0.1% (Prev. -0.1%)

- EU Industrial Production YY (Dec) -2.0% vs. Exp. -3.1% (Prev. -1.9%, Rev. -1.8%); Industrial Production MM (Dec) -1.1% vs. Exp. -0.6% (Prev. 0.2%, Rev. 0.4%)

NOTABLE EUROPEAN HEADLINES

- BoE Chief Economist Pill said he expects further rate cuts but urges caution on cutting interest rates and said the disinflation process is not yet complete, while he added that the BoE wage deal intentions survey shows the job is not done. Pill also commented that US trade tariffs could have substantial effects and the risk of second-round effects from the 2025 inflation hump is lower than after COVID.

- ECB sources "confirm growing confidence in disinflation, partly due to further economic weakness", via Econostream; ‘I cannot see anything beyond March. Nothing. Nothing at all. Agree that likelihood of inflation going below 2% has risen lately. Market pricing is not unreasonable’ if projections keep materialising".

- German Economy Ministry Report say noticeable economic recovery is not yet evident at the beginning of the year; still no sign of turnaround in the industrial economy, concerns about job security and ongoing political uncertainties to hinder a recovery.

- French Public Audit Office says debt service payments are set to increase to 3.2% of GDP by 2029, will need to reduce annual spending by EUR 110bln to achieve deficit target of 3% of GDP in 2029.

NOTABLE US HEADLINES

- About 75,000 federal workers accepted the Trump administration’s deferred buyout program, according to an official.

- US Senate Budget Committee Chair Graham's budget proposal could go to the Senate floor sometime the next couple weeks, via Punchbowl citing comments from Senate Majority Leader Thune.

GEOPOLITICS

RUSSIA-UKRAINE

- Ukraine Foreign Minister says NATO membership remains a strategic objective of Ukraine.

- Russia's Kremlin says sanctions were not discussed on US President Putin and US President Trump's call, Issue of recognition of Crimea and other territories was not raised on Putin-Trump callContacts will continue with Trump team. Focused on preparing a personal meeting with Trump, will need to wait for a time and place for such meeting.

- Chinese officials in recent weeks have floated a proposal to the Trump team through intermediaries to hold a summit between US President Trump and Russian President Putin and to facilitate peacekeeping efforts in Ukraine after an eventual truce, according to WSJ.

- Germany, France, the UK, the European Commission, and others express readiness to enhance support for Ukraine and commit to its independence, while it was separately reported that UK Defence Minister Healey said it is for Ukraine to decide when to begin negotiations and on what terms.

- Romanian Defence Ministry said radar detected drone breaches of its territory in Russian overnight attack on Ukraine.

MIDDLE EAST

- Israeli PM Netanyahu's Office says the reaching of understandings with Hamas is "Fake-News", according to Al Arabiya.

- "Al Jazeera sources: A statement will be issued shortly confirming the consensus on the commitment of the parties to implement the ceasefire agreement", according to Al Jazeera.

- "Israel's Channel 12 on official sources: After signals we received about Hamas' commitment to the deal, we are committed to the agreement", according to Al Jazeera

- US intelligence agencies concluded during the final days of the Biden administration that Israel is considering significant strikes on Iranian nuclear sites this year and is aiming to take advantage of Iran’s weakness, according to WSJ. It was separately reported that Israel is likely to attempt a strike on Iran’s nuclear program in the coming months in a pre-emptive attack that would set back Tehran’s program by weeks or perhaps months, according to Washington Post citing a US intelligence report.

- "AFP quoting a source: Progress towards ending the crisis related to the Gaza truce", according to Sky News Arabia.

OTHER

- South Korea said North Korea is removing a facility at Mount Kumgang meant for meetings between separated families, according to Yonhap.

- US Defence Secretary Hagseth says 2% defence spending is not enough; ultimately 5%/GDP as defence spending is critical.

CRYPTO

- Bitcoin is little moved and holds around USD 96k; Ethereum sees modest gains.

APAC TRADE

- APAC stocks traded somewhat mixed albeit with a mostly positive bias among the major indices following the two-way price action across global markets owing to hot US CPI data and geopolitical optimism.

- ASX 200 touched a record high with advances led by the mining sector following results from South32 and Northern Star.

- Nikkei 225 climbed on the back of recent currency weakness despite the firmer-than-expected PPI data from Japan.

- Hang Seng and Shanghai Comp saw mixed price action as the Hong Kong benchmark extended its recent strong upward momentum, while the mainland traded cautiously as participants continued to await Trump's reciprocal tariffs.

NOTABLE ASIA-PAC HEADLINES

- PBoC releases Q4 policy implementation report: Will implement appropriately loose monetary policy. Will adjust and optimise policy strength and pace at the appropriate time. Will revitalise stock of financial resources and improve efficiency of capital use. Will give full play to decisive role of markets in formation of exchange rates. Enhance the resilience and stabilise FX market expectations while strengthening market management. Will use policy tools including interest rates and RRR.

- US private equity groups invested billions of dollars in data centres serving ByteDance, according to FT.

- Nissan (7201 JT) 9M Net Profit 5.15bln (-98.4% Y/Y), 2024/25 forecast loss JPY 80bln. Cuts FY operating income to JPY 120bln (prev. JPY 150bln); Sees FY24/25 China sales of 697k (prev. 690k), North America Sales reaffirmed.

DATA RECAP

- Japanese Corp Goods Price MM (Jan) 0.3% vs. Exp. 0.3% (Prev. 0.3%, Rev. 0.4%)

- Japanese Corp Goods Price YY (Jan) 4.2% vs. Exp. 4.0% (Prev. 3.8%, Rev. 3.9%)

- New Zealand Inflation Forecast 1 Yr (Q1) 2.15% (Prev. 2.05%)

- New Zealand Inflation Forecast 2 yrs (Q1) Q1 2.06% (Prev. 2.12%)