By Peter Tchir of Academy Securities

Catalysts and What Type Of Landing?

AI came back with a vengeance as equal weighted and small cap indices lagged.

Inflation seems to be under control (by recent standards), which helped markets. We were a bit surprised how strongly the market reacted to PPI, as it is generally a tier 2 piece of data, and we seem to continue to underestimate how many people are very concerned about a rebound in inflation (we are not).

But the big story seems to have been that we are back to a “soft” or “no” landing. Better than expected retail sales seemed to pave the way for many to wipe out the “recession” risk narrative. Retail sales and jobless claims (not anything I would hang my hat on) helped reverse all the fears about the economy.

In some ways, we saw less evidence of froth as some of the larger, tech-focused ETFs didn’t see a surge of inflows. Offsetting that, at least a little, is the successful launch of MSTX. Anything that has $16 million in AUM in two days seems pretty decent, since all it does is leverage MSTR’s daily returns. I need to dig out an “April Fools’ Day” note I did on ETFs – as dark comedy becomes reality. Evidence that quantitative funds were loading back up on stocks as they retook various technical levels made sense. Somewhat more difficult to digest was chatter that people were piling back into the “yen carry trade” based on the BOJ’s “promises” not to mess with the currency during times of volatility.

One thing we continue to witness that makes us very cautious on position size is the lack of liquidity in both directions. Moves in both directions seem amplified relative to the data or catalyst for the move. Yes, everything felt great most days last week, but I put very little faith in the idea that we’ve developed a “strong base” of support here.

Let’s look at the potential catalysts.

Catalysts – The Fed

We get Jackson Hole this week. Back during the financial crisis, this event provided a great forum for Bernanke and others to lay out policy shifts (sometimes radical policy shifts). Don’t expect much this time around. The topic is “Reassessing the Effectiveness and Transmission of Monetary Policy.” While we could glean some information about future Fed decisions, they will likely try to avoid that and focus on how they will behave in some more distant future. Personally, I think QE should be categorized as a “nuclear option” and only used when absolutely necessary, and on the smallest possible scale, for the shortest period of time, but that is unlikely to occur.

The Fed minutes might tell us how close they were to cutting in July (we think they should have), but again, that seems largely priced in now.

With the market pricing in cuts at a pace only marginally faster than our base case, I’m not expecting a lot of movement in bonds or stocks based on the Fed this week.

Catalysts – Earnings

NVDA isn’t until August 28th. Other earnings will matter. The AI front is important, and it was incredibly important that Walmart highlighted how important AI had been in driving their performance in a recent earnings release. The one thing we’ve been looking for is “AI Success” stories. Not from the companies that benefit from AI adoption, but from AI users. That note fit the bill and more notes like that will convince us that valuations might not have gotten ahead of themselves in the space. The other thing we will all be looking for is anything that points to the direction of the economy and the consumer.

Catalysts – The U.S. Election

My head already hurts thinking about this election. Presumably, we will get a bit more policy information during this week’s DNC in Chicago and a likely additional bump in the polls (as is typical). Then I think – and I had to recheck the math a few times – more than 10 weeks of campaigning remain. I’m not sure how many more twists, plot turns, and truly “unprecedented” things will happen between now and the election, but I think we will get some more shocks.

I remain wedded to the view that as the campaign heats up and policies get announced, we will realize that large annual budget deficits are on the horizon regardless of who wins. The amount of debt that needs to be issued, with a “cavalier” attitude towards debt creation, is going to continue to grow. The Fed will control the front end, but I expect the market will respond by re-installing some element of term premium.

Catalysts – Geopolitical Risk

For the first time in weeks, we are decreasing the near-term geopolitical risk, for two key reasons.

- The consensus view is that when Iran attacked Israel with hundreds of rockets, missiles, and drones, it was merely “for show” as it was well-telegraphed and failed to damage Israel. Several members of the Geopolitical Intelligence Group pointed out that the attack was too large and too well-coordinated to be “merely” a show. That it wasn’t a coincidence that after the failed attack, Iran seemed to reduce sales to Russia (forcing the Russians to turn to North Korea) so that Iran could rebuild their stockpiles. One reason why Iran may not have retaliated since Israel killed the political leader of Hamas in Tehran, is that they haven’t figured out a better strategy and are too worried about another failed attempt (while at the same time, they are worried about being too successful and prompting Israel to attack Iran’s facilities).

- Political uncertainty in the U.S. seemed to have created an opportunity to “test” us. Now, from a variety of conversations, there might be a willingness to see how this plays out. The chance that the new administration will be easier to work with than the current administration, from their perspective, might have them wait.

The big caveat to that is how will Russia respond to Ukraine’s incursion into Russian territory. For many, you could see this as an event bringing both sides to the negotiating table. On the other hand, Russia may view this as a reason to up the ante on their offensives in Ukraine.

Catalysts – The Economy

Talk about burying the lede. Normally we start with the most important piece and work our way down. But today we wanted to address the other potential catalysts briefly, before digging into the main event – the direction of the economy!

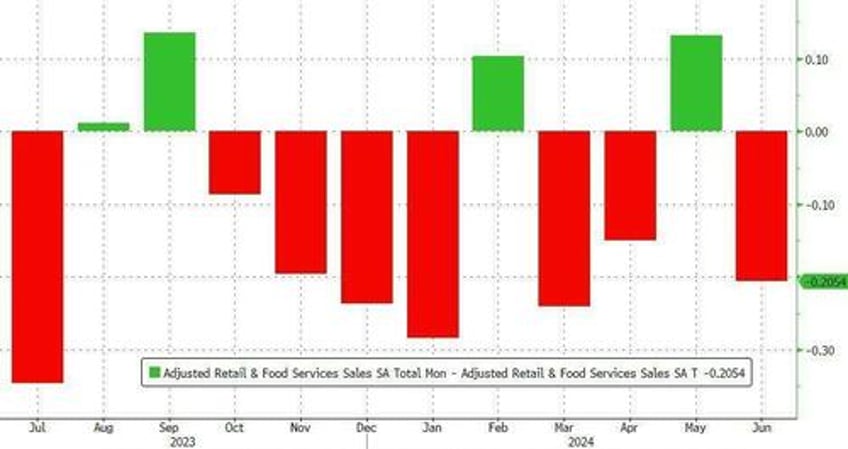

Advance retail sales popped nicely, but the control group, while still “ok,” declined. In general, these numbers had been tracking each other reasonably well in terms of direction and it looks like last month’s deviation was just corrected. Not a big knock-on retail sales, but at least a question mark.

“Amazon Prime Day” was July 16th and 17th. That event has become so big that it has spurred all sorts of price competition in and around it. So “goods were for sale” this past month – which the American consumer loves! How much demand was pulled forward by the sales? Many economists who predict these data points had discussed the possibility of upside surprises due to the sales. While encouraging, I would take this uptick in sales with some caution, as it likely indicated that demand was pulled forward to buy items on sale, rather than truly strong consumer spending.

From Zerohedge, we get this chart of revisions.

Revisions for the past year have been consistently to the downside, and to a non-trivial amount. No guarantee that this one was also overstated, but it is worth paying some attention to.

This fits a running theme: that for whatever reason, initial readings on jobs and sales seem to overstate what actually occurred as the officials have more time to collect data.

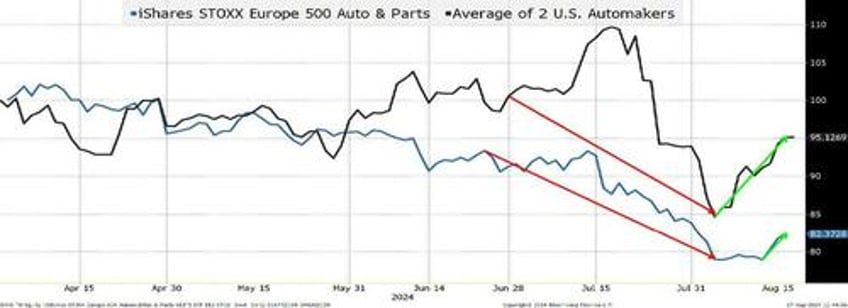

The other “intriguing” part of the report was that auto sales were a big contributor.

That is possible, as U.S. Auto Sales Total Annualized SAAR popped from 15.3mm to 15.8mm between June and July.

I could not find an ETF for U.S. or global automakers. I found a European centric one and did a simple calc for a U.S. proxy. Again, the charts tell more of a mixed story.

The stocks, which should capture the future expectations, have rebounded of late (positive) but are still well below where we were at the start of July (not positive).

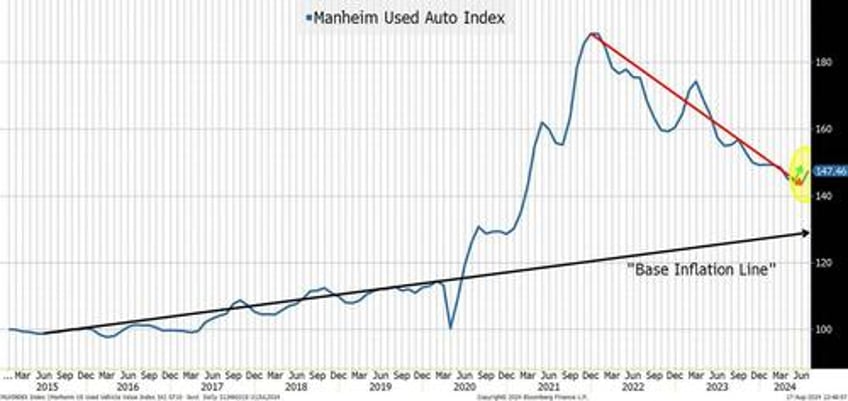

The Manheim Used Auto Index, one of my “favorites” since the start of COVID, did see a small uptick in values in July, but it was not the first month with an uptick in what has been a pretty steady decline from the “I cannot find a vehicle anywhere” peak as we reopened from COVID. While not a “perfect substitute” for new car prices, it probably doesn’t help the price of new cars when used ones are more readily available.

We’ve also seen inventory-to-sales ratios creep higher. Still below pre-COVID levels, but it is nearing those levels, and heading in a direction that is not great for pricing power on the part of dealers.

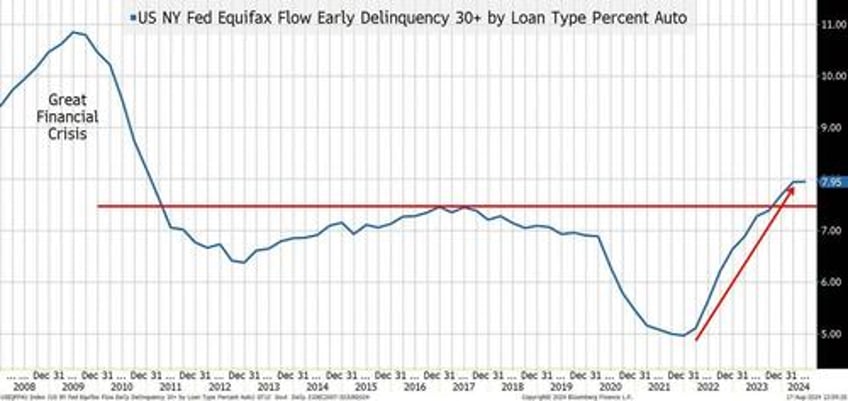

Then we get to the nitty gritty of the consumer. There are a variety of “auto delinquency” indices on Bloomberg. We chose this one, but they all tell a similar story – delinquencies are rising. They are nearing or above “normal” levels. What we don’t know (or at least I don’t know) is how many loans were issued based on high residual values when the used car market was en fuego, hence exposing the lender to some potential losses as the used car market has softened since the peak.

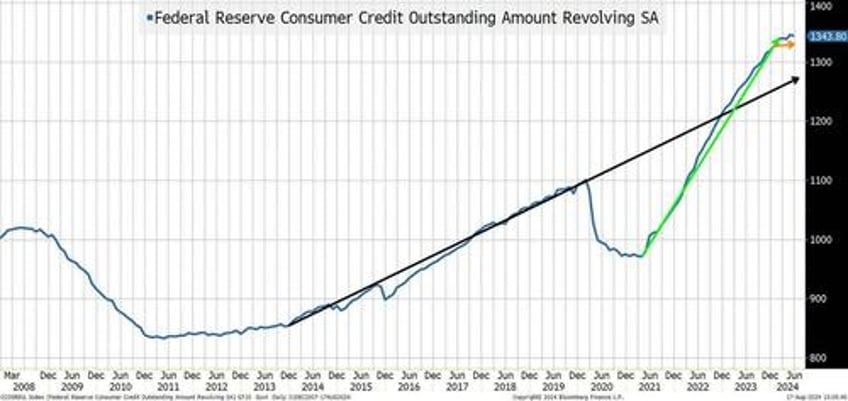

As credit card delinquencies are also rising (depending on which measure you use, back above pre-COVID levels), we can see that the amount of revolving debt for the consumer has expanded well above the trend line. While consumers are still willing and/or able to borrow – we see no problems. But we’ve seen credit stabilize and even dip in some months lately. That could be a function of some consumers putting the brakes on themselves (they know their own job prospects, etc.) or it could be lenders tightening. In any case, not sure how supportive this chart is for consumer consumption going forward!

Yes, bank deposits remain high and money market funds continue to set new records, but as the economy continues to bifurcate into the “haves” and “have nots,” not sure how useful the “money on the sidelines” argument is. Those with money are fully gorged, and those without are losing access to what they need.

Yes, the economy is largely driven by what people in the middle do, but my concern is that (and we see some of this in which retailers are doing well versus those that are doing less well) much of the middle class it close to tapping out (or just willing to spend on bargains).

We won’t have much clarity on the economy until the first week of September when the jobs reports start hitting, but I am leaning towards investors getting concerned about recession risk.

Bottom Line

Far from out of the woods on the economy and markets. Stocks staged an impressive rally last week.

- Lack of liquidity helped push markets further on data than they might have moved otherwise.

- We never saw panic - a touch of fear, but not panic. And while not back to full froth, it seems clear that we are back in greed mode.

It would be great to see a resilient economy, and that any indications of slowing were an anomaly. Over the coming days and weeks, I think retail sales and a couple of initial jobless claims reports will be exposed as the anomalies.

I fail to see how the election campaigns give any comfort to buyers of longer-dated Treasuries. Yes, the Fed helps. Yes, lower inflation helps. Yes, a potential slowdown helps, but as every politician seems to create policies that are variations of “vote or donation buying,” I am not sure bond investors can be as comfortable as they currently are.

Clearly I’m still in some sort of the “bumpy” landing crowd, and this week’s data did little to dissuade me from that. The most bullish information that I’m trying to work into my analysis is the actual praise of AI by a user, which we had not seen enough of, and this could turn the tide.

There are many potential catalysts, but at this point, anything that drives us one way or the other on the “type of landing” to expect will be extra important to markets.

Good luck, and for those trying to take some vacation time, hopefully this week plays out calmly. But I suspect volatility and dramatic moves will be the norm again this week across markets.