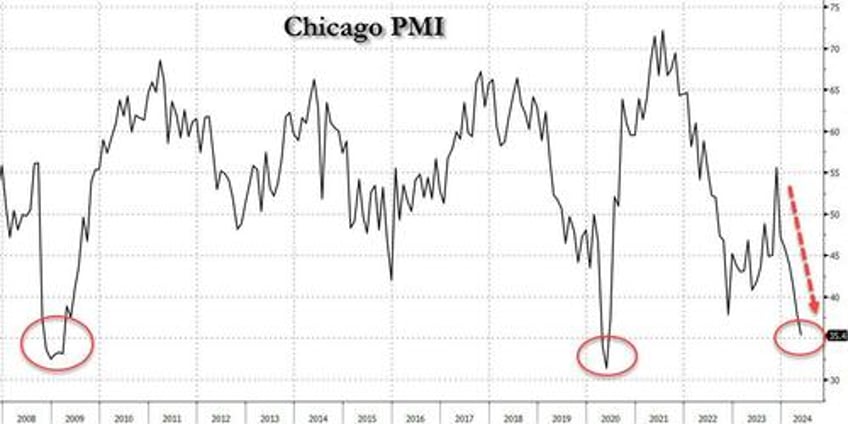

After unexpectedly slumping last month to 37.9, the Chicago PMI index cratered even more unexpectedly in May, when it defied hopes of a rebound to 41.5, and instead tumbled even more, sliding to a cycle low of 35.4 which was not only below the lowest estimate, but was staggeringly low. To get a sense of just how low, the last two times it printed here was during the peak of the covid and global financial crises...

... which seems to suggest that at least according to Chicago-based purchasing managers, the economy is in a depression.

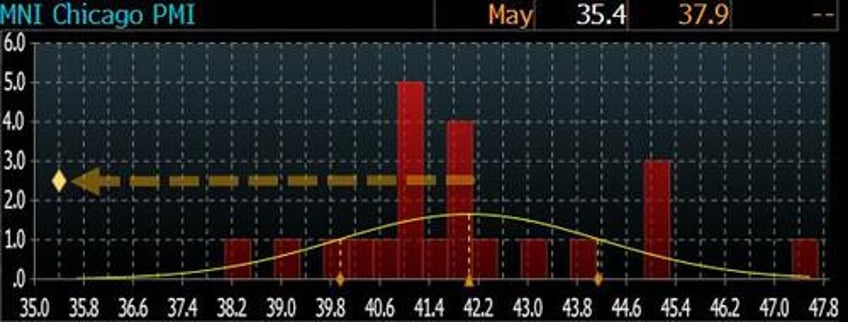

This is how the final number looked relative to expectations.

Looking at the report we find the following:

- Business barometer fell at a faster pace; signaling contraction

- New orders fell at a faster pace; signaling contraction

- Employment fell at a faster pace; signaling contraction

- Inventories fell at a faster pace; signaling contraction

- Supplier deliveries fell at a slower pace; signaling contraction

- Production fell at a slower pace; signaling contraction

- Order backlogs fell at a faster pace; signaling contraction

Did nothing rise? One thing did:

- Prices paid rose at a slower pace; signaling expansion

So we have not just a depression, but a stagflationary depression in which everything else is going to hell, except prices: they keep on rising.

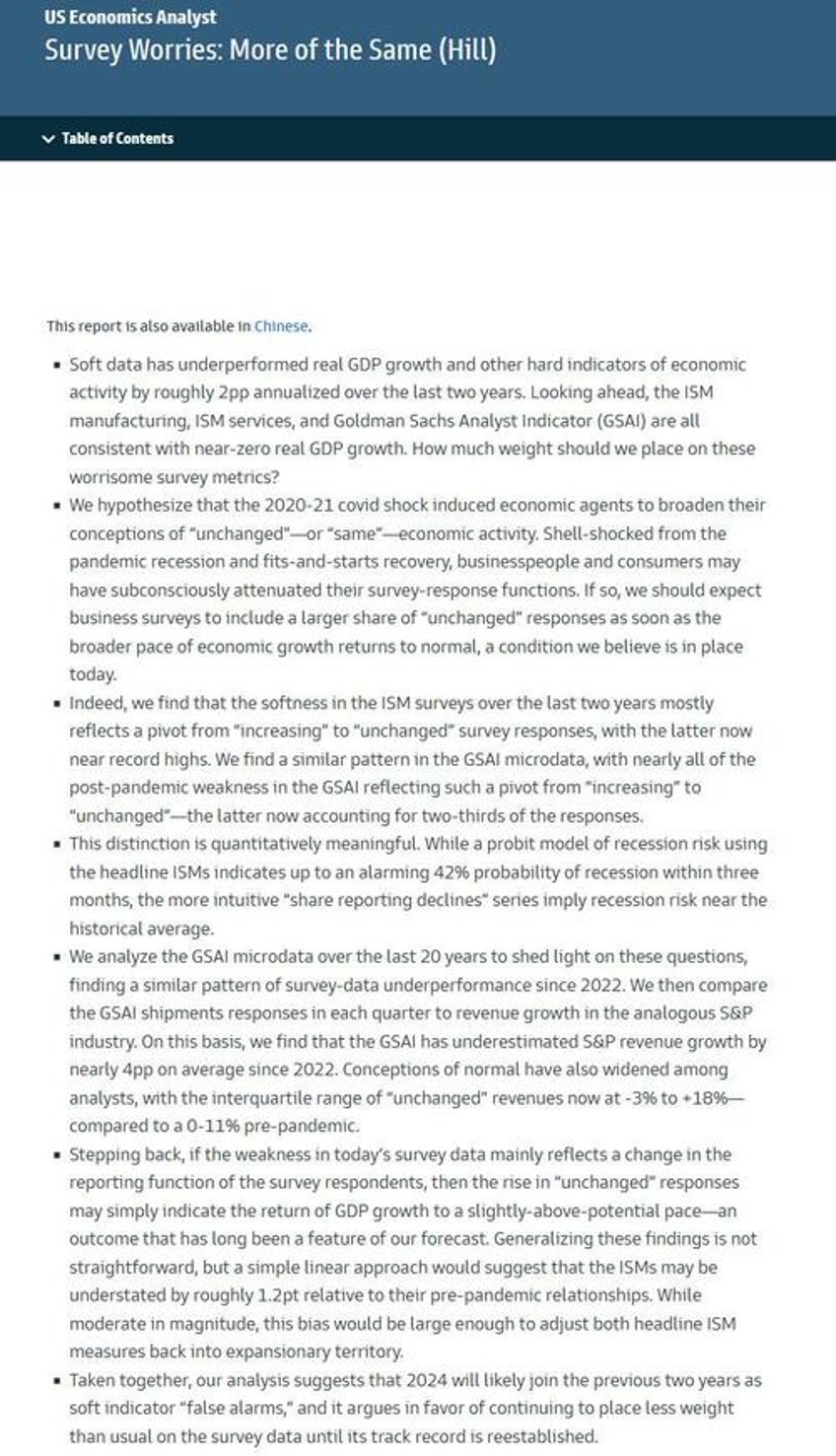

And while it is unclear what has prompted this unprecedented bearishness (the surely negative contribution from Boeing is likely to blame for a substantial portion of the apocalyptic outlook), one thing is certain: Goldman will have to come up with even more goalseeked surveys that explain away reality and tell us how purchasing managers really should feel...

... if only they knew just how great Bidenomics was for them.