With the ECB effectively ending its hiking cycle, and the Fed said to pause in September (and unlikely to hike in November) thereby also ending its tightening, Chins is way ahead of both central banks and continues to ease ahead of the coming global recession.

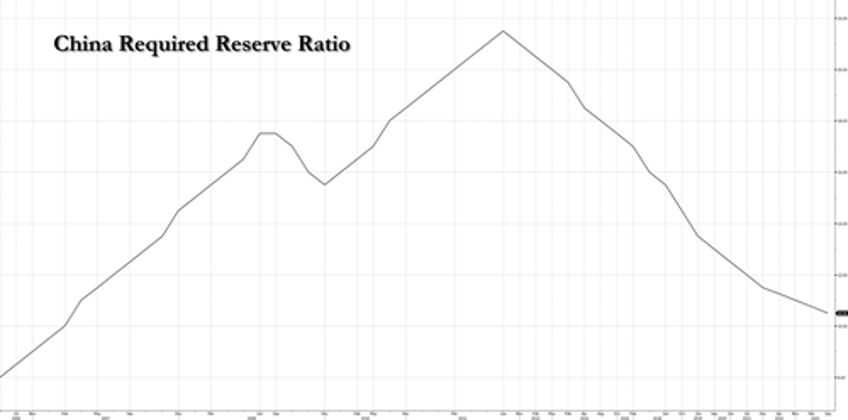

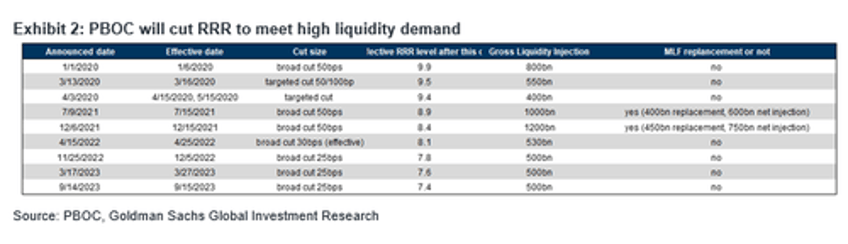

The PBOC announced today (September 14th) it would cut the reserve requirement ratio (RRR) by 25bp for a second time this year in a bid to bolster the country's sinking economy. The weighted average RRR for most banks will be 7.4% after the cut, the lowest in more than 15 years, a move which will release a fresh 500BN yuan in liquidity. The reduction, which takes place from Friday, is to help maintain reasonably ample liquidity, the PBOC said in the statement.

“The economy continues to recover and its internal driver keeps strengthening,” the central bank said.

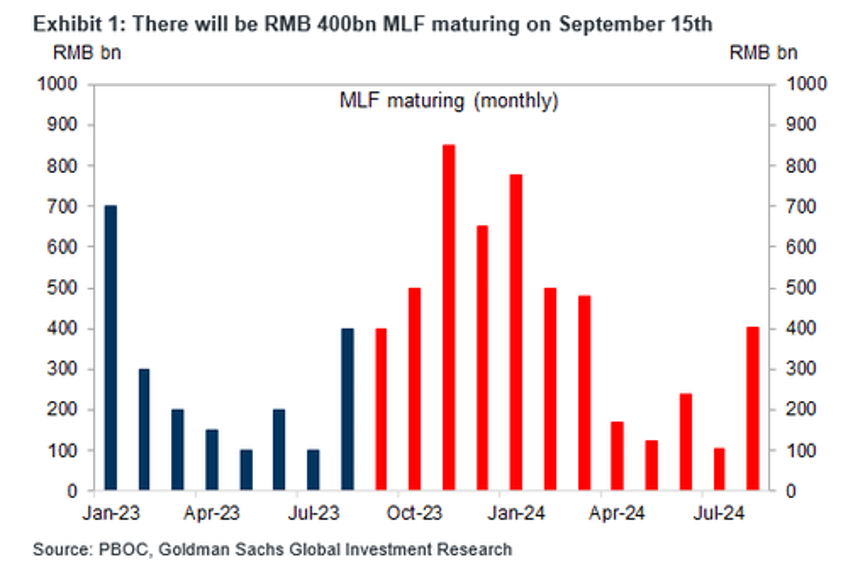

Analysts had expected the central bank to take additional steps to ease policy, including through adjusting the RRR. The PBOC last lowered the RRR by 25 basis points for most banks in March. In August, the PBOC stepped up policy support with a surprise cut to the rate on its one-year loans (medium-term lending facility or MLF) the second reduction this year. Most economists expect the PBOC to keep the rate unchanged on Friday.

A reduction in the ratio frees up cheap long-term cash for banks, allowing them to extend more loans to businesses and consumers.

The government set a fairly conservative economic growth target of around 5% for this year, which economists expect Beijing will meet.

The decision is in line with growing consensus that the PBOC would cut RRR to meet high liquidity demand before the end of September; and the central bank is hardly done: Goldman continues to expect further policy easing, including another 25bp RRR cut and 10bp policy interest rate cut in Q4, additional RMB500bn local government special bond issuance quota to be utilized in Q4 this year, and further property policy easing such as relaxation of home purchase restrictions and downpayment ratio cuts in large cities.

Courtesy of Goldman, here are the main points:

1. This 25bp RRR cut can release around RMB 500bn liquidity in the interbank market. After this cut, the weighted average of RRR would be 7.4%. Similar to their recent communications, PBOC claimed the authority would "maintain liquidity at a reasonably adequate level and credit growth at a reasonable pace to facilitate both quantity and quality improvement of the economy".

2. Goldman sees a few reasons behind this RRR cut:

- 1) higher liquidity demand partially due to the large volume of government bond issuance. Interbank rates drifted higher in recent weeks on strong government bond issuance in recent weeks. There remains around RMB 660bn local government special bonds to be issued in September. Injecting liquidity through RRR cut would help suppress interbank interest rates amid high liquidity demand, and ensure low funding cost for banks.

- 2) RRR cut is a high-profile monetary policy easing tool. This move can help boost sentiment following a series of policy easing announced over the past two weeks. While August credit data beat expectations and credit extension likely remained fast in the first two weeks of September, policymakers may want to step up easing efforts amid uncertainties around the property market and the still dampened sentiment towards the growth outlook.

- 3) The recent more aggressive policy reactions to RMB depreciation (such as the very negative countercyclical factors, tightened capital controls according to media reports) paved the way for additional monetary policy easing.

3. There will be RMB 400bn MLF maturing on September 15th and the PBOC will roll over the maturing amount in full like they did in March. To facilitate economic growth and improve confidence, the central bank will pursue further policy easing, including another 25bp RRR cut and 10bp policy interest rate cut in Q4, additional RMB500bn local government special bond issuance quota to be utilized in Q4 this year, and further property policy easing such as relaxation of home purchase restrictions and cuts to downpayment ratios in large cities.

Exhibit 1: There will be RMB 400bn MLF maturing on September 15th

Exhibit 2: PBOC will cut RRR to meet high liquidity demand