By John Liu and Zheng Wu, Bloomberg markets live reporters and strategist

Three things we learned last week:

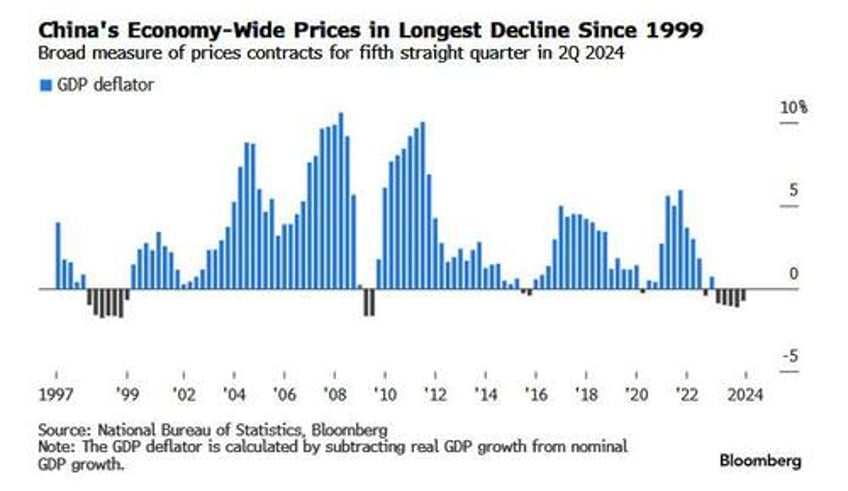

1. China’s former central bank chief made a rare admission that the nation should tackle deflation. The economy faces its worst deflationary streak since 1999, putting pressure on corporate profits, wages and asset prices.

China should focus on fighting deflationary pressure now, former Governor Yi Gang said in Shanghai on Friday. The unambiguous message contrasts with the People’s Bank of China’s restrained efforts in monetary easing so far. The PBOC has repeatedly signaled it would refrain from any “drastic easing.”

Competing priorities have hampered China’s fight against deflation up to now. The PBOC has been reluctant to cut interest rates aggressively because of concerns about currency weakness and banks’ profit margins.

Illustrating that tension, the head of the PBOC’s monetary policy department cautioned on Thursday about constraints on decreasing deposit and lending rates further. The central bank may be inclined to reduce banks’ reserve requirements before acting again to cut its policy rate.

* * *

2. Bearish sentiment intensified in financial markets as investors saw no near-term escape from China’s economic malaise. Although the yuan got a boost from anticipation of a rate cut by the Federal Reserve later in the month, risk-off sentiment remained dominant in equity and bond markets.

The benchmark CSI 300 index declined to the lowest level since early February, when China unexpectedly replaced the chief of its stock-market watchdog amid a market selloff.

JPMorgan Chase last week abandoned its buy recommendation for Chinese stocks, following similar moves by former China bulls UBS Global Wealth Management and Nomura.

Investors again piled into government bonds despite the PBOC’s constant pushback. The yield on the most actively traded 10-year government bond touched the lowest level on record Wednesday. There were signs that PBOC once again stepped in to curb the rally.

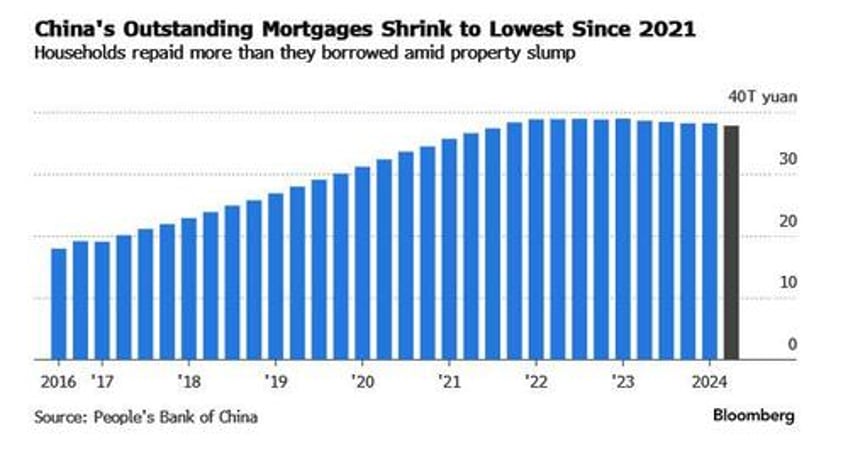

3. Moving quickly to cut mortgage rates may be China’s best shot to fight persistent deflation and the property slump. Financial regulators proposed reducing rates on outstanding mortgages nationwide by a total of about 80 basis points, and the first cut may come in the next few weeks, according to people familiar with the matter.

In May, the PBOC relaxed mortgage rules and made available 300 billion yuan ($42 billion) of funding to buy unsold homes. A Bloomberg index of Chinese developer stocks has dropped more than a third since then as the rescue efforts failed to lift home sales.

Existing homeowners were left out, as the steps taken in May mostly benefited new buyers. The new plan targets existing borrowers and may be the PBOC’s best chance to shift market sentiment.