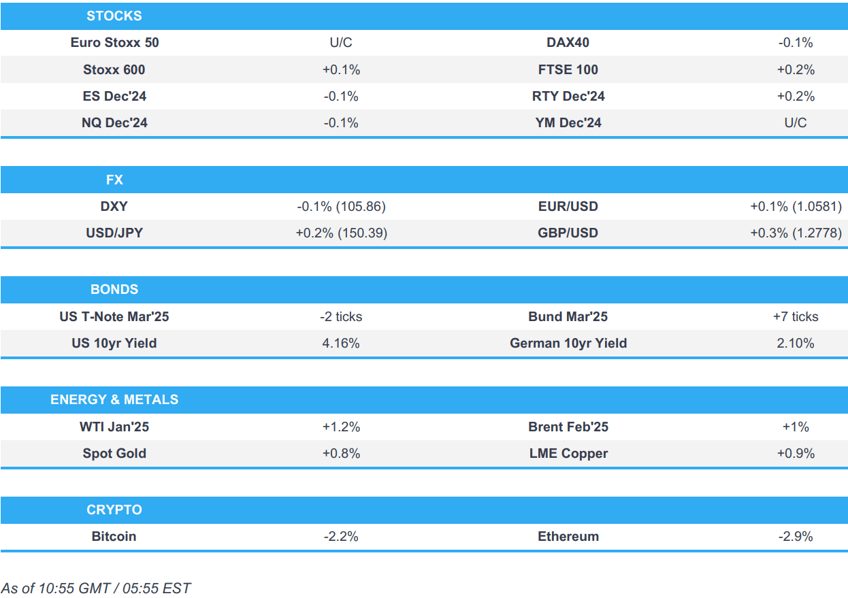

- European bourses initially gained, taking impetus from positive commentary via the Chinese Politburo; upside which has since faded. US equity futures are mixed.

- China's Politburo says next year must seek progress while maintaining stability; China's fiscal policy to be more proactive next year. Monetary policy is to be moderately loose, via Xinhua.

- Dollar is at incremental session lows; Antipodeans benefit from the positive sentiment, whilst havens lag.

- Bonds were initially weighed on from the Politburo read-out, but now off worst levels; USTs a touch lower whilst European paper is slightly higher.

- Commodities benefit from the risk tone sparked by the positive commentary from the Chinese Politburo.

- Looking ahead, US Employment Trends, US Wholesale Sales, NY Fed SCE, Commentary from BoE's Ramsden, EZ finance ministers' meeting, Earnings from Oracle.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses began the session entirely in the green, with sentiment in the region lifted following the readout from the Chinese Politburo meeting. On that, it noted that China’s fiscal policy is to be more proactive next year and that monetary policy is to be moderately loose. Since, some indices have given back initial gains and slipped into negative territory to display a mixed picture in Europe.

- European sectors began the European session with a strong positive bias, given the risk-on sentiment vs a current mixed picture. Unsurprisingly, the China-exposed sectors top the pile following the Chinese Politburo meeting; Consumer Products topped the pile, followed closely by Basic Resources. Real Estate is found at the foot of the pile.

- US equity futures are mixed vs with the initial readout from the Chinese Politburo meeting sparking some modest upside in the price action; upside which has since faded.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is showing a mixed performance vs. peers (weaker vs. cyclicals, stronger vs. havens). US President-elect Trump over the weekend said he has no plans to remove Powell and said he cannot guarantee Americans will not pay more as a result of tariffs. DXY briefly breached Friday's high at 106.15 before fading upside and slipping back onto a 105 handle.

- EUR is incrementally firmer against the USD and off worst levels. Focus for the Eurozone this week is on events in Frankfurt with the ECB set to pull the trigger on a 25bps cut. After struggling to hold above 1.06 post-NFP, EUR/USD remains stuck on a 1.05 handle, just above the 1.0550 mark.

- JPY, along with CHF is lagging across the majors as news out of China has triggered a pick-up in sentiment and subsequently weighed on havens. For Japan specifically, focus overnight was on an upward revision to Q3 GDP. USD/JPY is back on a 150 handle with the pair now showing a great deal of direction over the past few sessions.

- GBP is slightly firmer in what has been a catalyst-thin session for the Pound thus far. As such, it is possible that the USD leg of the equation will do the heavy lifting for the pair. Cable has gained a firmer footing on a 1.27 handle.

- Antipodeans are both at the top of the G10 leaderboard following positive commentary out of China in which the Politburo noted that fiscal policy is to be more proactive next year, whilst monetary policy is to be moderately loose. AUD/USD has reclaimed the 0.64 mark but is below Friday's 0.6455 high. RBA is expected to deliver an unchanged decision on Tuesday.

- PBoC set USD/CNY mid-point at 7.1870 vs exp. 7.2627 (prev. 7.1848)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Mar'25 UST contract is a touch lower after pulling back from highs after positive commentary from the Chinese Politburo which noted that fiscal policy is to be more proactive next year, whilst monetary policy is to be moderately loose; first shift in monetary policy since 2011. The main focus this week will be on US CPI on Wednesday. Mar'25 UST is currently tucked within Friday's 110.28+ to 111.20+ range.

- European paper is a touch higher but off best levels following updates out of China. For the Eurozone this week, focus will largely be on the ECB's rate decision which is expected to see the GC deliver a 25bps rate cut with policymakers refraining from publicly backing a 50bps move ahead of the meeting. Bunds are currently holding above the 136 mark and within Friday's 135.94-136.52 range, with the corresponding 10yr yield back above 2.1%.

- Gilts are marginally higher after moving sideways for the past few sessions. As has been the case for the past several sessions, fresh UK drivers have been lacking. BoE's Ramsden is due later today. As it stands, the Mar'25 Gilt contract has met resistance at 96.00 with the corresponding 10yr yield holding above 4.25%.

- Amundi tactically downgrades core European Fixed Income to Neutral.

- Click for a detailed summary

COMMODITIES

- WTI and Brent began the European session on a slightly firmer footing, with the complex lifted amid geopolitical uncertainty in the Middle Eastern region after Syrian fighters toppled the Assad regime. Just ahead of the European cash open, the Chinese Politburo meeting sparked considerable upside in the oil complex, with Brent'Jan 25 rising to a session peak of USD 72.15/bbl.

- In a similar vein to the above, spot gold began the European session on a firmer footing with sentiment lifted amid the geopolitical uncertainty in the Middle Eastern region. Alongside this, Reuters reported that the PBoC resumed gold purchases in November after a six-month hiatus. Upside was also seen following the Politburo release. XAU currently sits at the upper end of a USD 2,627.62-2,651.22/oz range, and just shy of its 50 DMA at 2,667.96/oz.

- Base metals were mixed overnight, with copper initially benefiting from the better-than-feared Chinese PPI figures; thereafter the red-metal moved lower in tandem with a pick-up in the Dollar. After that, metals jumped to session highs following the Chinese Politburo meeting.

- Saudi Arabia set January Arab Light crude OSP to Asia at +USD 0.90 vs Oman/Dubai average (prev. +USD 1.70); NW Europe at -USD 1.25 vs ICE Brent (prev. -0.15); United States at +USD 3.80 vs ASCI (prev. +USD 3.80), according to Reuters.

- Polish pipeline operator Pern said it has restored proper operation of first branch of Western Druzhba pipeline after incident on December 1st, according to Reuters.

- PBoC resumed gold purchases in November after a six-month hiatus, according to Reuters.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU Sentix Index (Dec) -17.5 vs. Exp. -13.5 (Prev. -12.8)

NOTABLE EUROPEAN HEADLINES

- Fitch affirmed Hungary at "BBB", revised outlook to "Stable" from "Negative"

NOTABLE US HEADLINES

- US President-elect Trump announces Michael Needham will serve as Counsellor of the Department of State, and Christopher Landau to serve as Deputy Secretary of State, via Truth Social.

- Trump aides reportedly contacted Google (GOOG), Meta (META), and Snap (SNAP) over online drug sales, according to The Information.

- Meta (META) rolls out internal AI tool as it pushes into business market, according to the FT.

- Tesla (TSLA) exported 5,366 China-made vehicles in November (prev. 27,795 in October).

GEOPOLITICS

MIDDLE EAST - EUROPEAN MORNING

- Israel says it struck suspected chemical weapons sites and long-range rockets in Syria in order to prevent them from falling into the hands of hostile actors, according to Guy Elster.

- Syrian rebel fighters captured the capital Damascus and toppled Bashar al-Assad's regime.

- Syria's ousted President Bashar al Assad has arrived in Moscow, according Russian state media. Kremlin sources suggested a deal has been done to ensure the safety of Russian military bases in Syria, according to Reuters.

- Israeli ground forces advanced beyond the demilitarized zone on the Israel-Syria border over the weekend, "marking their first overt entry into Syrian territory since the 1973 October War", according to Israeli officials cited by NYT

- IDF called Syria 'fourth front', according to Sky News Arabia.

- Israeli military was instructed to seize the buffer zone and control points in order to ensure the protection of all Israeli communities in the Golan Heights, according to Israeli Defense Minister Katz.

- Israeli official said that in the coming days, Israel might capture more areas inside Syria, and further deepen the attacks against strategic targets in Syria, to prevent weapons from falling into the hands of the rebels, according to Kann's Stein.

- Israel's Channel 13 said "The Israeli army is considering continuing the incursion into Syrian territory to expand the buffer zone in the Golan., according to Sky News Arabia.

- Israel's Channel 13 said "Israeli intelligence is monitoring what is happening in Iran for fear that the collapse of the axis loyal to it will push it to develop nuclear weapons", according to Sky News Arabia.

- "US administration officials fear that Assad's fall will increase pressure on Iran's Supreme Leader Ali Khamenei to give the green light to produce a nuclear bomb.", according to Kann News.

- Israeli PM Netanyahu said the fall of Assad was a direct result of blows dealt to Hezbollah and Iran by Israel, and added that Israel will not allow any hostile force to establish itself on its borders, according to Reuters.

- Hezbollah pulled all forces out of Syria on Saturday, according to Lebanese security sources cited by Reuters.

- US encouraged Iraq to not get drawn into Syrian unrest, according to a Senior US official cited by Reuters, and US has been in discussions with Turkish officials and US focus is "a new Syria". Senior US official does not see role for US troops on the ground addressing chemical weapons in Syria.

- US Central Command said its forces conducted dozens of airstrikes on Islamic State camps in central Syria on Sunday, and struck over 75 Islamic State targets in central Syria, according to Reuters.

- US President Biden said the US will support Syria's neighbours through period of transition, and will speak with leaders in region in coming days and send administration officials, according to Reuters.

- US-backed Syrian Kurdish forces said they are still fighting Turkish-backed forces in Syria's Manbij, according to Reuters.

- Iran said it will monitor developments in Syria and the region closely, and will adopt appropriate approaches and positions, according to a Foreign Ministry statement, adding that the long-standing and friendly relations between the Iranian and Syrian nations are expected to continue.

- "Iranian Foreign Minister: Conflicts are expected to spread not only to Iraq but to the entire region", according to Sky News Arabia.

- President-elect Trump's Middle East envoy met Israel and Qatar PMs to broker a ceasefire, according to the FT.

OTHER

- US president-elect Trump said there should be an immediate ceasefire and negotiations in Ukraine this is time for Russia's Putin to act, and China can help, via Truth Social.

- US president-elect Trump, French President Macron and Ukrainian President Zelenskyy had "very good conversation" over the weekend, according to a source close to Macron cited by Reuters.

- Taiwan’s Defence Ministry said on Sunday China has almost doubled the number of warships around Taiwan in the past 24 hours, ahead of what is suspected to be a new round of war games, according to Reuters.

- Taiwan Defence Ministry said it instructed troops to closely monitor situation, maintain high alert on Chinese PLA drills; have raised alert level on Taiwan's outlying islands; activated combat readiness drills to carry out at strategic locations, according to Reuters.

- Chinese military and coast guard boats have entered waters around Taiwan and the Western Pacific to carry out missions, according to Reuters.

- Taiwan Coast Guard said seven Chinese Coast Guard ships began conducting “grey-zone harassment' against Taiwan from early Monday, according to Reuters.

- China currently has almost 90 navy and coast ships in the waters near Taiwan, Southern Japanese islands, East and South China Seas, according to Reuters.

CRYPTO

- Bitcoin edges lower and has dipped below the 100k mark, to a current session trough of USD 98,274.

- MicroStrategy (MSTR) - Negative mention in Barron's; the newspaper warned against investing in MicroStrategy, noting its stock price is inflated, driven by its large Bitcoin (BTC) holdings. With the company's market value exceeding its Bitcoin and software business by a significant margin, the stock's premium appears unsustainable, especially if Bitcoin's post-election rally falters.

- Since Donald Trump became president-elect, nearly USD 10bln has flowed into US ETFs that invest directly in Bitcoin (BTC), Bloomberg reports. This surge in investment is driven by optimism that Trump's crypto-friendly policies will fuel market growth. The funds now total approximately USD 113bln, BBG added. (Bloomberg)

APAC TRADE

- APAC stocks were mixed for a bulk of the session before eventually trading mostly lower, with South Korean stocks underperforming after the vote to impeach South Korea’s President failed following a boycott by ruling party MPs.

- ASX 200 was relatively flat for most of the session before tilting lower amid a late pullback in base metals and ahead of the RBA announcement tomorrow which is expected to keep rates unchanged at 4.35%.

- Nikkei 225 traded between gains and losses before adopting an upward bias as Q3 GDP was revised higher.

- Hang Seng and Shanghai Comp opened mixed but later traded lower with the former subdued by property names whilst the latter gears up for China’s Central Economic Work Conference on December 11th and 12th, whilst Chinese CPI missed expectations whilst PPI printed slightly above forecasts - with no major price action seen on the release.

NOTABLE ASIA-PAC HEADLINES

- China's Politburo says next year must seek progress while maintaining stability; China's fiscal policy to be more proactive next year, according to Xinhua. Will enrich and improve policy toolbox. Must stabilise foreign trade and investment. Will step up unconventional counter-cyclical adjustments. Monetary policy is to be moderately loose. To boost consumption forcefully. Will stabilise property and stock markets.

- Chinese President Xi says "we must affirm the confidence to win whilst doing next year's economic work", via Xinhua.

- China's Commerce Ministry say China and South Korea are to accelerate free trade talks.

- China Securities Regulators have asked investment banks to help speed up offshore listings, according to Reuters sources.

- China CPCA says China sold 2.45mln passenger cars in November (+16.6% Y/Y) vs 2.28mln in October.

- Acer (2353 TT) announces November revenues of TWD 22.75bln (+20.9% M/M, and +13.1% Y/Y).

- South Korean President Yoon has been banned from leaving the country, according to Yonhap.

- China’s regulators will try to bolster the property market with improved policies on land usage, tax and other financial measures, according to Xinhua.

- Fitch Ratings downgraded China's 2025 GDP growth forecast to 4.3% (prev. 4.5% in September); 2026 forecast cut to 4.0% (prev. 4.3%). Fitch said the prolonged downturn in the property market remains a risk.

- South Korean President Yoon survived an impeachment motion in the opposition-led parliament on Saturday after members of his party boycotted the vote - with too few members present to pass the measure as voting began., according to Reuters.

- South Korea's opposition party to propose new impeachment bill on December 11 for vote on December 14, according to Yonhap.

- South Korean Finance Ministry said it is making all-out efforts to stabilise markets and deploying contingency plans; will work with BoK on outright purchase of KTBs if needed; will announce measures to improve FX liquidity before end-Dec, according to Reuters.

- South Korean opposition leader Lee said some irreversible economic fallout expected on chips industry, and financial markets unless President Yoon steps down immediately, according to Reuters.

- RBNZ said the Board has engaged with finance minister over new financial policy remit, and welcomes an updated remit that is relevant to RBNZ’s current and future work programme.

DATA RECAP

- Chinese CPI YY (Nov) 0.2% vs. Exp. 0.5% (Prev. 0.3%)

- Chinese PPI YY (Nov) -2.5% vs. Exp. -2.8% (Prev. -2.9%)

- Chinese CPI MM (Nov) -0.6% vs. Exp. -0.4% (Prev. -0.3%)

- Japanese GDP Revised QQ (Q3) 0.3% vs. Exp. 0.2% (Prev. 0.2%)

- Japanese GDP Rev QQ Annualised (Q3) 1.2% vs. Exp. 0.9% (Prev. 0.9%)

- Japanese GDP Cap Ex Rev QQ (Q3) -0.1% vs. Exp. 0.1% (Prev. -0.2%)

MIDDLE EAST

US President-elect Trump's Middle East Envoy says "the hostages better be released before inauguration, it would not be a pretty day if they are not".