By Bas van Geffen, Senior Macro Strategist at Rabobank

Last Wednesday, Powell said that there had been a lack of further progress toward the Fed’s 2% inflation objective. Indeed, both the latest CPI and PCE prints had already dashed hopes that the Fed would cut rates by summer. It would, therefore, take more time for the FOMC to gain enough confidence to start cutting rates, the Fed Chair added.

Just two days later, the April employment report gave policymakers quite the confidence boost.

The growth in non-farm payrolls slowed substantially to 175,000. The data suggest that jobs creation peaked at 315,000 in March. Sectors like construction and leisure and hospitality were strong drivers of employment growth, but job growth in these sectors virtually came to a standstill in April. The largest increase in new jobs came from healthcare, which is a non-cyclical sector. What’s more, the household survey reported even weaker employment growth, resulting in an increase in the unemployment rate from 3.8% to 3.9%. In line with the slowing demand for labour, average hourly earnings growth slowed down to 0.2% m/m or 3.9% y/y.

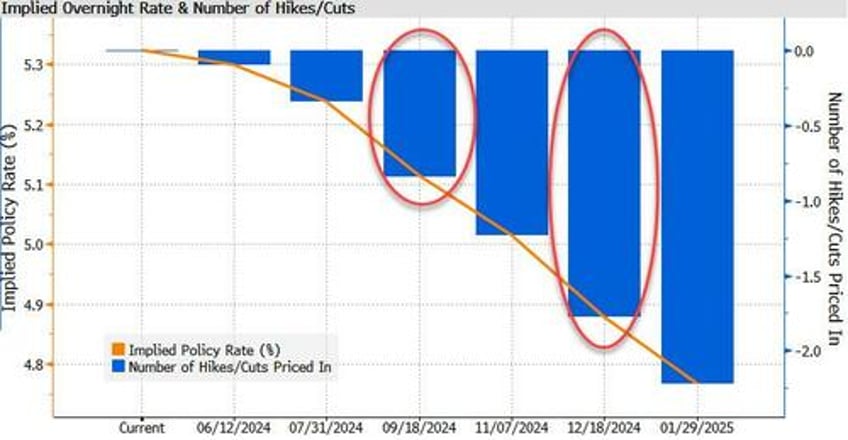

The employment report therefore puts both doors to a first rate cut a bit further ajar: the deceleration in wages should give the FOMC more confidence that inflation will continue to slow in the coming months, and a deterioration in the employment metrics could also convince policymakers that a rate cut is warranted. This strengthens our conviction that the Fed will cut rates in September and December.

The market seems to agree. Following the release of the non-farm payrolls, yields plummeted across the board as traders brought forward their expectations of a first rate cut from November to September. European markets are holding on to this rate cut optimism amidst relatively quiet trading this morning, with equities posting modest gains and bond yields taking another leg down.