Shares of the Toronto-Dominion Bank have fallen nearly 8% since last Thursday's Wall Street Journal report that revealed the bank's involvement in a $653 million drug money-laundering scheme.

The WSJ said a Justice Department investigation was opened into TD Bank's anti-money-laundering controls, specifically concentrating on how Chinese crime groups and drug traffickers used the Canadian lender to launder money from US fentanyl sales.

The investigation was launched after agents uncovered an operation in New York and New Jersey that laundered hundreds of millions of dollars in proceeds from illicit narcotics through TD and other banks, according to court documents and people familiar with the matter. In that case and at least one other, prosecutors also allege the criminals bribed TD employees.

While TD disclosed a Justice Department probe into its anti-money-laundering practices last year, the focus on money laundering related to illegal drug sales hasn't been previously reported. -WSJ.

On Monday, Jefferies analyst John Aiken warned TD's anti-money-laundering case risks the bank "entering a lost decade."

"With the bank allegedly a focal institution in a drug money-laundering scheme, the worst-case scenario has become more likely with TD potentially entering a lost decade," Aiken told clients, adding, "Growth in the US will likely be constrained, and the timeline for a fix is extended by several years."

Last Friday, the bank announced that $450 million was set aside to resolve regulatory penalties. However, Aiken said "simple math" suggests the lender will have to pay as much as $2 billion in fines.

In a statement, Chief Executive Bharat Masranis said the bank's anti-money laundering program "fell short and did not effectively monitor, detect, report or respond."

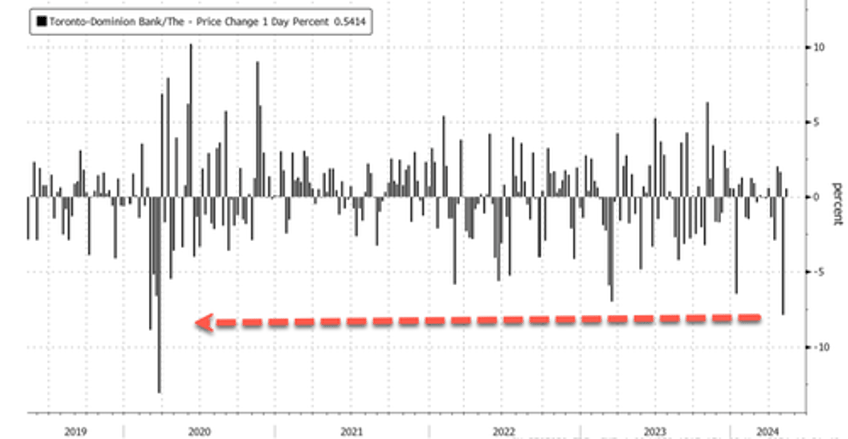

Shares of TD trading in Canada have fallen 7.9% since the WSJ report.

Largest weekly decline since early 2020.

Shares are touching early 2021 levels.

Meanwhile, Keefe Bruyette & Woods analyst Mike Rizvanovic told clients, "While optics around the new anti-money-laundering details are negative, we believe the market has overreacted." He cut his price target to C$88 from C$92.