The banking sector is facing renewed turmoil following significant credit losses and write-downs on US commercial real estate loans, primarily in office and some in multi-family. In recent weeks, such turbulence erupted in New York Community Bank and other global lenders from Japan, Germany, and Canada. Now, a new report shows cracks are emerging in yet another corner of the CRE market.

The Wall Street Journal explains major retailers are returning to a "just-in-time" lean inventory management strategy after Covid forced "just-in-case" inventory management due to snarled supply chains. This shift in inventory management style has forced consumer goods maker Newell Brands, retail pharmacy chain Rite Aid, and sports apparel retailer Fanatics to shrink warehouse footprints.

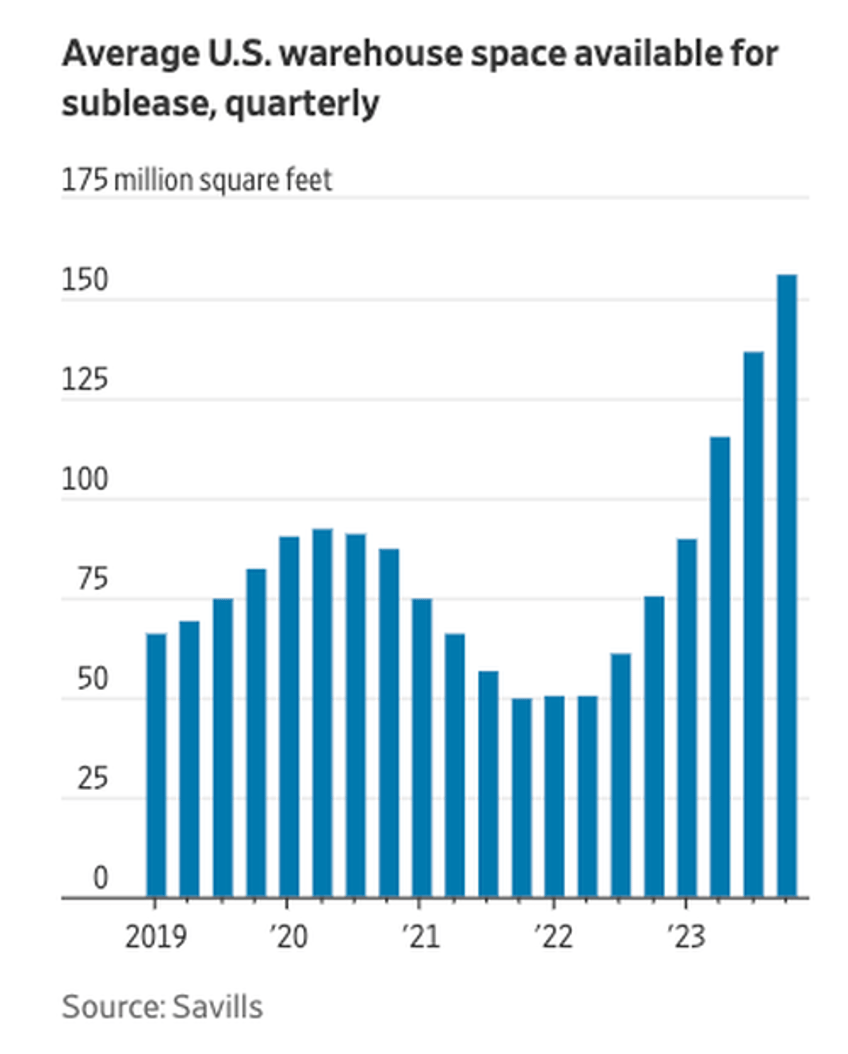

In the third quarter of 2023, the amount of US warehouse space listed for sublease hit a record high of more than 156 million square feet - or more than three times the space available in the fourth quarter of 2021, according to real-estate services firm Savills.

"That marks a significant change for an industrial real-estate market that saw demand explode and vacancy rates plummet during the pandemic, as e-commerce orders soared and retailers stocked up on goods to avoid supply-chain disruptions," WSJ noted.

Real-estate services firm JLL said warehouse demand during Covid pushed asking rents up 24% in 2022 year-over-year, compared with an annual increase of 6.3% in 2019. Now, growth in warehouse rents is slowing, only rising 12.5% in 2023 - and expected to slow further this year.

Mark Russo, head of industrial research at Savills, said companies are normalizing supply chains to match demand: "We're coming off of a really unusual heightened period of demand, and that's normalizing."

"If you've got three different facilities or four different facilities and your real-estate costs are high, if you're coming up on renewal, it might make sense to go down from four to three in a more efficient facility," said Mehtab Randhawa, global head of industrial research at JLL. She added that companies are shrinking warehouse footprints and upgrading to more modern buildings that can support automation and require less labor.

Industrial properties have largely been insulated from the downturn in the CRE market that has rocked office. However, a change in inventory management is increasing warehouse supply, which could be another headache for banks with high CRE exposure.