By Michael Msika, Bloomberg Markets Live reporter and strategist

Market gains in recent months have been heavily concentrated in the tech sector, but cyclicals have also been in favor. Now warning signs are flashing both in technicals and fundamentals for stocks whose fortunes depend on the business cycle.

Cyclicals have been keeping up with growth stocks over the past year, including the rally since the market bottom in late October. Both segments of the market are up nearly 25% over the period. That’s an outperformance of about 17 percentage points relative to defensive peers. In addition, cyclicals have reached overbought levels. It’s a bad combination, if history is any guide.

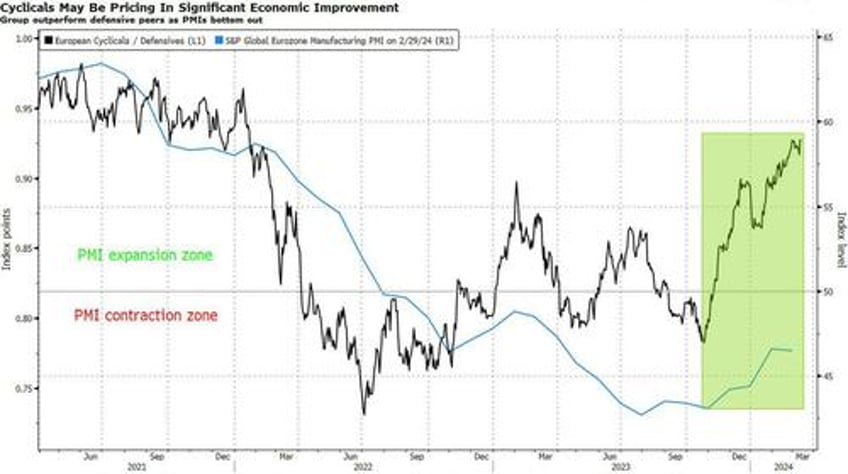

Fundamentals are not looking much better. True, the latest surge seems to have been on the back of improving macro-economic data, with PMIs showing signs of bottoming out, while economic surprises have also been rising. But cyclicals may already be pricing in way more economic expansion than the numbers suggest, leaving them vulnerable to setbacks.

While the economy may not weaken as much as could be expected in the face of monetary tightening, “it is too early to see this as the base case,” say Bank of America strategists led by Sebastian Raedler, who are keeping an underweight view on cyclicals versus defensives and expecting 15% underperformance as the economy loses traction. Within the groups, their favorite defensive overweights are food and beverages and pharma, while their preferred cyclical underweights are banks and autos.

The strategists see much of the good news already in the price, while economic resilience could prompt investors to lower their expectations for rate cuts this year. “Even if the current macro sweet spot were to continue for a while longer, we think equity market upside is capped in the low-to-mid single digits for the year as a whole,” they say.

Valuation levels are starting to look stretched, especially against defensives. Analysts have been raising estimates for cyclicals to reflect the better economic data, and relative forward P/E is well above the 10-year average. Meanwhile, based on price-to-book, cyclicals are now the most expensive they have been versus defensives in more than a decade.

For JPMorgan strategists, cyclicals are now “outright expensive” against defensives, even without tech, and their recent acceleration as well as consensus hopes for an earnings rebound could falter. In fact, weakness in the IFO business survey suggests that cyclicals’ earnings are set to soften versus defensives over the next few quarters. “This is in contrast to the prevailing view which argues that earnings for cyclicals will accelerate from here,” the strategists say, adding that autos, chemicals and transport are among the most sensitive to this.

Many investors want to buy the group now that PMIs appear to be bottoming out, the JPMorgan strategists note. Yet, they see the data flow as still mixed, while the US ISM recently weakened. “Cyclicals didn’t underperform when PMIs were weak last year in the first place, so why should they now benefit from any potential bottoming out?”

Over the past five months or so, industrials, construction, autos and travel and leisure have all surged between 26% and 30%; technology, at 35%, is the only group with a bigger gain. Banks have performed in line with the broader market, up about 17%, and commodity sectors are the only cyclical industries in the red over the period.

“For the more volatile stock-market phase we expect to see in the second quarter, consumer-related and defensive sectors in particular are likely to provide support to portfolios from a valuation point of view, while cyclicals and sectors with an above-average P/E ratio are likely to suffer,” says Unicredit strategist Christian Stocker.