Shares of Dollar Tree Inc. are sliding Wednesday premarket. The discount retailer missed fourth-quarter profit expectations and offered a dismal outlook for the first quarter as shoppers spend less. The retailer plans to shutter more than 600 stores.

Dollar Tree posted adjusted earnings for the fourth quarter of $2.55 per share on revenue of $8.63 billion. Analysts polled by Bloomberg had anticipated $2.66 per share on revenue of $8.67 billion.

Here's a snapshot of the fourth quarter (courtesy of Bloomberg):

Adjusted EPS $2.55, estimate $2.66

Loss per share $7.85 vs. EPS $2.04 y/y

Net sales $8.63 billion, +12% y/y, estimate $8.67 billion

Dollar Tree net sales $4.96 billion, +15% y/y, estimate $4.91 billion

Family Dollar net sales $3.67 billion, +7.4% y/y, estimate $3.73 billion

Gross profit margin 32.1% vs. 30.9% y/y, estimate 32.1%

Dollar Tree gross margin 39% vs. 36.7% y/y, estimate 37.7%

Family Dollar gross margin 22.8% vs. 23.6% y/y, estimate 24.7%

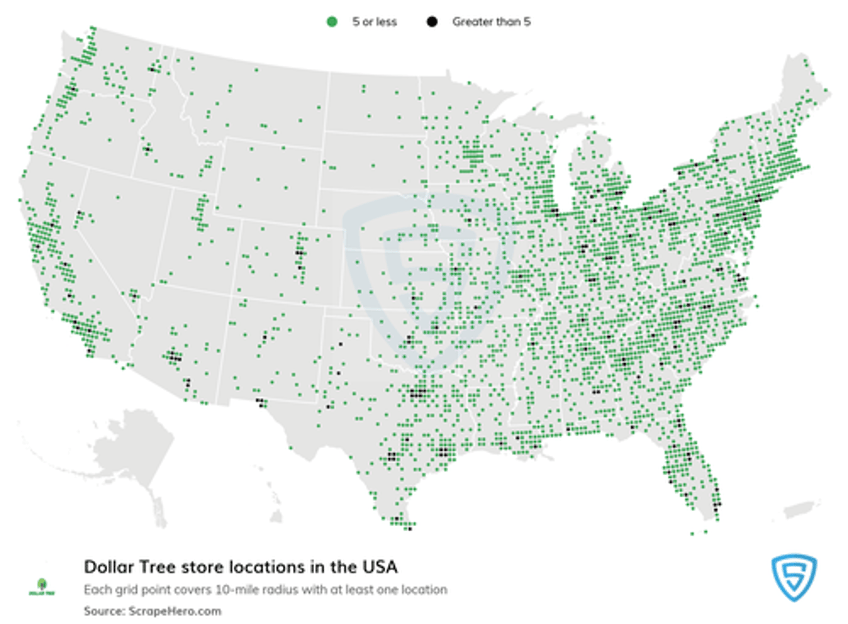

Total location count 16,774, +2.7% y/y, estimate 16,793

Dollar Tree Locations 8,415, +3.5% y/y, estimate 8,391

Family Dollar locations 8,359, +1.9% y/y, estimate 8,368

While same-store sales increased by 3%, beating estimates of 2.8%, the retailer said the average ticket size declined by 1.5%, indicating consumers are pulling back on spending in the era of failed Bidenomics.

As of last quarter, Dollar Tree operated 16,770 stores across 48 states and Canada. In the previous quarter, it "initiated a comprehensive store portfolio optimization review which involved identifying stores for closure, relocation, or re-bannering based on an evaluation of current market conditions and individual store performance, among other factors."

The store optimization strategy will result in the closure of 600 Family Dollar stores in the first half of this year. Additionally, 370 Family Dollar and 30 Dollar Tree stores will close over the next several years at the end of each store's current lease term.

Bloomberg Intelligence analysts Jennifer Bartashus and Jibril Lawal wrote in a note that store closures appear to be "a prudent decision, but echoes the move to close 400 stores in 2019."

The analysts added: "Nearly $2 billion in assorted impairment charges suggests widespread efforts to improve operations have had mixed results and that the right formula remains elusive."

Shares of Dollar Tree are down nearly 7% in premarket trading in New York.

Looking ahead, the company expects first-quarter sales earnings per share between $1.33 and $1.48, well below analysts surveyed by Bloomberg of $1.70.