European defense stocks surged on Monday following last week's Munich Security Conference, where global leaders, ministers, and top policymakers discussed the urgent need to increase defense spending across the continent as a deterrent against an increasingly emboldened Russia.

On Friday, European Commission President Ursula von der Leyen told the audience at the annual three-day meeting, "I can announce that I will propose to activate the escape clause for defense investments. This will allow member states to substantially increase their defense expenditure."

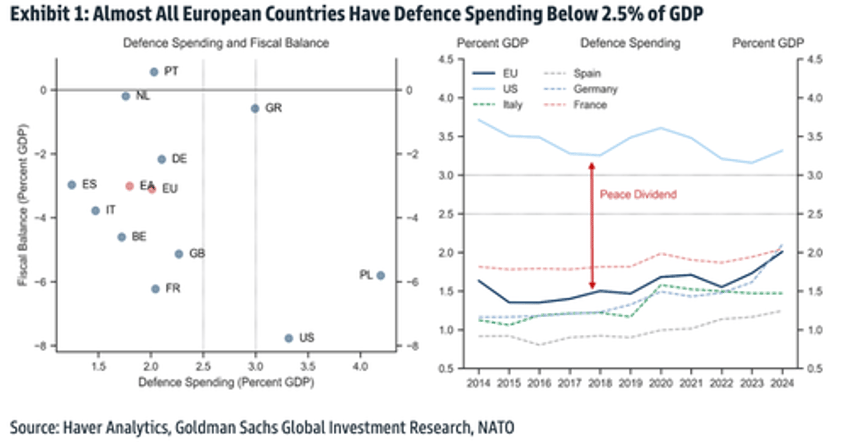

The North Atlantic Treaty Organization (NATO) mandates that European countries allocate about 2% of their GDP to defense spending. However, many member states have failed to meet this target. New commitments over the weekend signaled that military expenditures will rise, fueling EU defense stocks on Monday.

Goldman's Lindsay Matcham told clients earlier that the GS EU Defense basket was the "chart of the day" after surging nearly 8% to a record high, driven by the notion that defense spending will rise and continued support for Ukraine.

In a separate note, Goldman's Matt Atherton explained to clients that bullish comments from the Munich Security Conference about defense spending would act as a "tailwind" for defense stocks:

Additional Defence Spending an Extra Potential Tailwind: Despite little change regarding a Ukraine/Russia peace deal over the weekend amid growing positioning for such an event, the market has not retraced much of last week's price action this morning. We think there was just enough positive soundbites, especially with regards to increased defence spending, to keep the market trading this theme. Notably, EU Commission President von der Leyen stated in a speech at the Munich Security Conference that she "will propose to activate the escape clause for defence investments [similar to a measure used during COVID]. This will allow member states to substantially increase their defence expenditure". While GS Economics have highlighted that wider fiscal deficits across Europe via national debt are not sustainable over the long-term, they are certainly possible for a few years and would be much easier to pass than additional defence spending funded via European issued debt.

Individual names rocketed higher, including Rheinmetall +7.2%, Saab +7.7%, Hensoldt +7.7%, RENK +10%, Leonardo +4.5%, BAE Systems +4.7%.

Bloomberg noted, "Shares of steel and engineering conglomerate Thyssenkrupp soar as much as 11%, hitting the highest level since April 2024; the group is pursuing an IPO of its naval unit, a maker of military ships and submarines."

European leaders have been deeply concerned that President Trump could retreat from NATO, leaving much of the continent unable to defend itself because of its deindustrialized state. The latest data from Goldman's Sven Jari Stehn, Filippo Taddei, and others show that most of the bloc does not meet the NATO defense spending target.

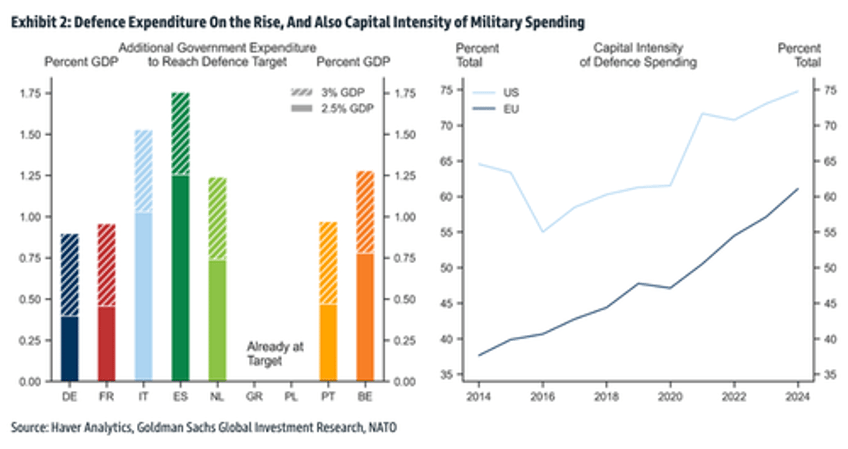

The move towards higher defense spending will occur over several years...

The Goldman analyst outlined three funding options for the bloc to increase defense spending:

- national debts,

- EU debt through existing institutions/programs,

- and a borrowing facility established through a new European program.

They noted, "All these options are unlikely to become operational before 25H2 at the earliest, so we turn to them now."