Market Shakes Off Inflation Data

I am back from traveling, and we have a good bit to catch up on since our last report. If you missed it, I provided an update on Tuesday, updating all the weekly technical and statistical data we produce. Most noteworthy in that report was the sharp increase in money flows into the market despite the tariff announcement by the Trump administration and the latest inflation reports.

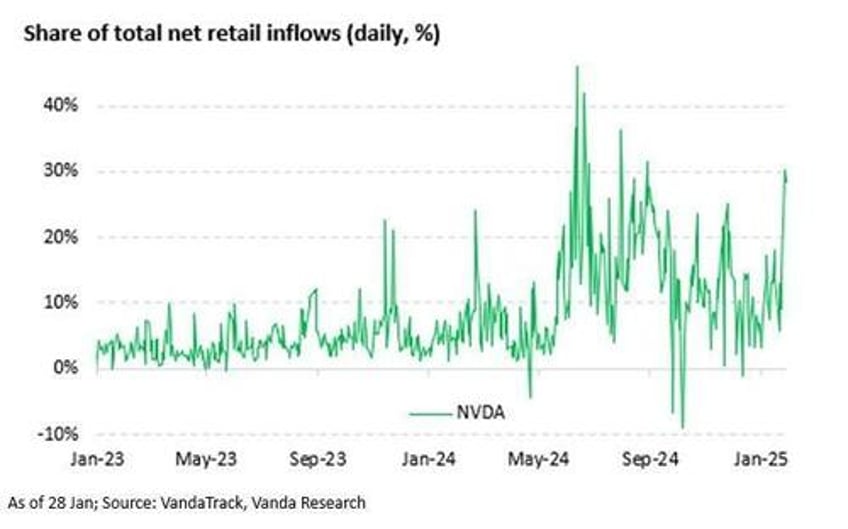

On Thursday, the market broke out of the bullish consolidation over the last few weeks, successfully retesting and holding support at the 50-DMA. Notably, the bullish trend remains intact, and retail investors continue to pour money into the market, with money flows reaching typical peak levels. With the market elevated, downside risk over the next few weeks will likely be contained to recent January lows. What would cause such a correction is unknown, but if money flows begin to reverse, such will likely provide the evidence needed to rebalance risks accordingly.

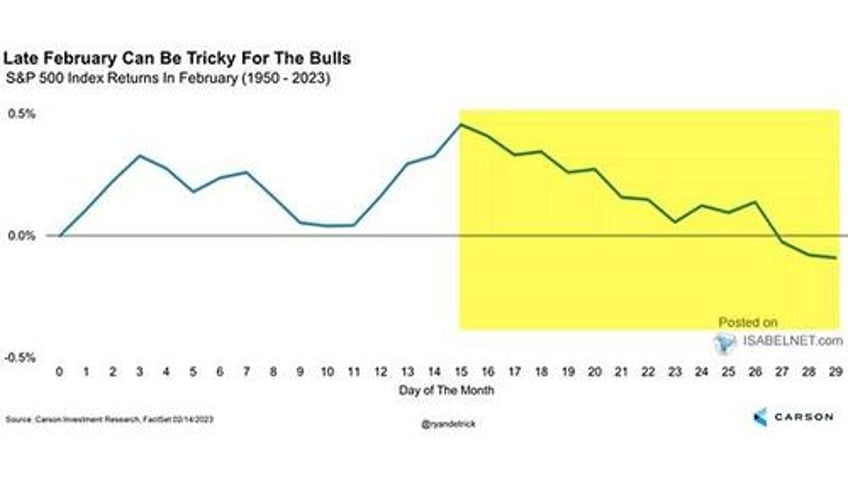

The bullish bias is evident, as witnessed by the recent surge in retail money flows into leveraged ETFs and speculative options trading. However, as is always the case, whenever investors are crowded on “one side of the boat,” it is often a decent contrarian signal to be a bit more cautious. Furthermore, while there is currently no evidence of a catalyst for a correction, it is worth noting that we are entering into the seasonally weak part of February.

While this is the average of daily market returns, it does not guarantee that market weakness will present itself. But it is worth being aware of the potential possibility of such a development.

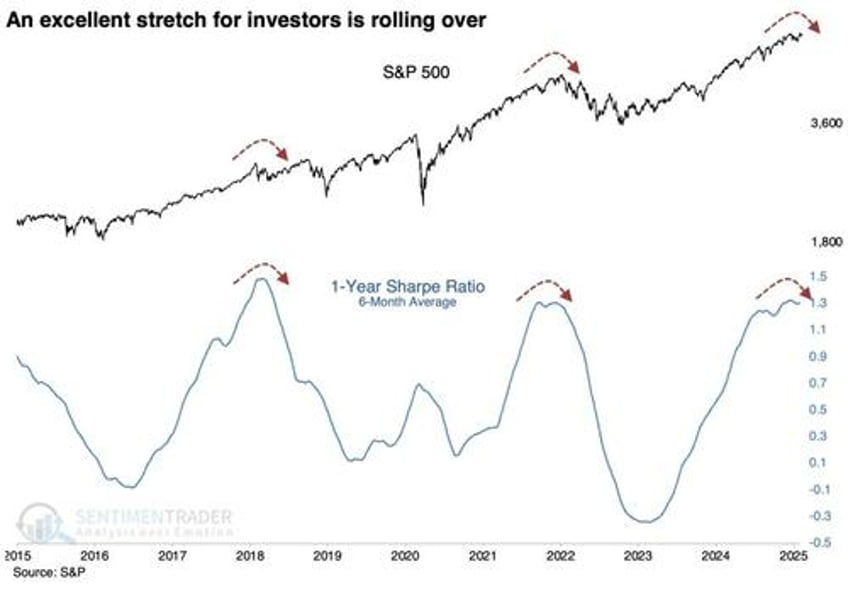

Speaking of excess, Sentiment Trader recently did a great piece on the market’s Sharpe ratio. The conclusion of their report is worth considering.

“When the going gets easy for investors, it’s natural to let one’s guard down and become complacent. That’s a dangerous condition for all but the longest-term, long-term, unleveraged investors. Markets can be their most dangerous when they look the safest.

Using the Sharpe ratio as a proxy for how good it’s been for U.S. investors, we see above that there aren’t many times in history when it’s been better than the past six months, and there are signs that it’s ending. That can mean more volatility, but it doesn’t necessarily mean negative returns. The biggest takeaway has been moderate returns, with much more of a two-way market than investors had gotten used to in the months prior.”

An extended period of speculative complacency in the markets has markedly increased the Sharpe ratio. The problem is that long periods of complacency, a function of price stability, are often followed by periods of instability.

Such is the core of our discussion this week.

Stability Leads To Complacency

“Only those that risk going too far can possibly find out how far one can go.” – T.S. Eliot

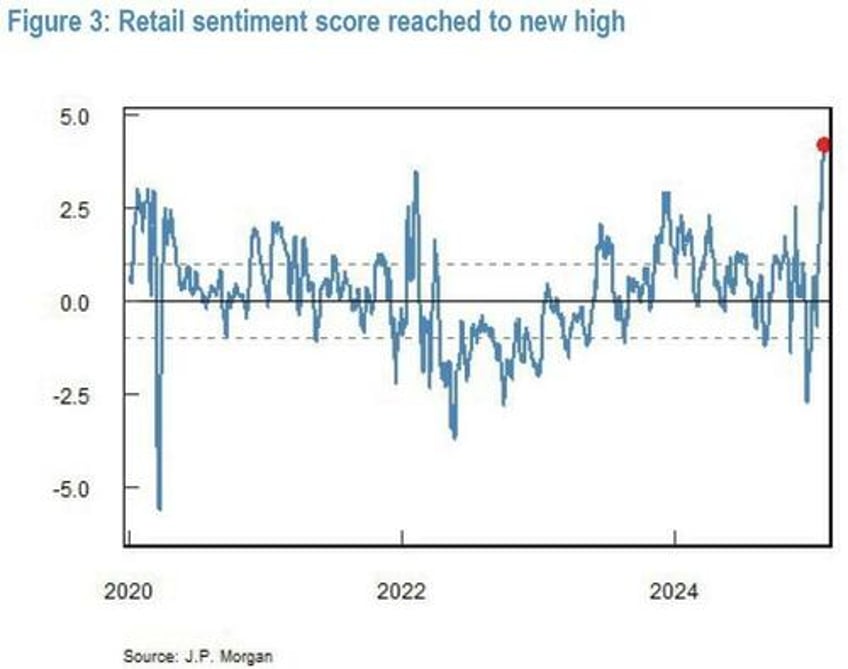

As discussed on Tuesday, retail investors are currently “all-in” in the market. Such is not surprising given the long period of stability in the markets with continually rising prices.

“The market defies more negative news because retail investors continue to step in and “buy the dip.” In our recent Bull Bear reports, we discussed the push by retail investors, but looking at retail sentiment is quite remarkable. Since the pandemic, retail investors have never been this bullish on the stock market. Such is amazing, given that their mailboxes are not being stuffed with government stimulus checks”

“At the same time, their optimism about stock market returns is supported by putting their money where their mouth is.”

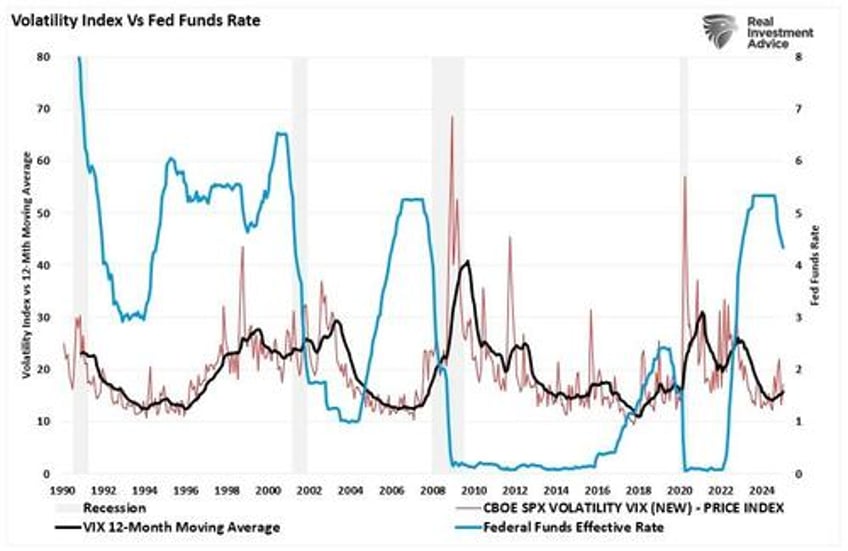

These periods of stability have always led to high levels of investor complacency concerning risk. However, historically speaking, such periods of complacency are often built on rationalizations with weak underpinnings. Investors are confident that the Fed will continue cutting interest rates, easing monetary policy, and supporting higher future stock valuations. However, that expectation may be misguided as the Fed remains unconcerned about any near-term recessionary impact. However, policy actions by the current Administration to reduce the deficit, cut Government employment, and impose tariffs are factors that could slow economic growth rates more than anticipated. Such is particularly the case now as evidence of weakening employment and consumers is emerging.

As Michael Lebowitz commented recently:

” While labor market data is generally good, there are signs the labor market is at a standstill. Continuing jobless claims are steadily rising at their highest level in over three years. The JOLTS hires rate is at ten-year lows. While the number of layoffs remains low, employers aren’t hiring either. Accordingly, the broad labor market data may seem good, but the chart below and other data should give the Fed pause so that consumers may start to spend less and save more. As if the chart below wasn’t concerning. It shows employment expectations are also plummeting. Similar changes in expectations have led to a higher unemployment rate previously.”

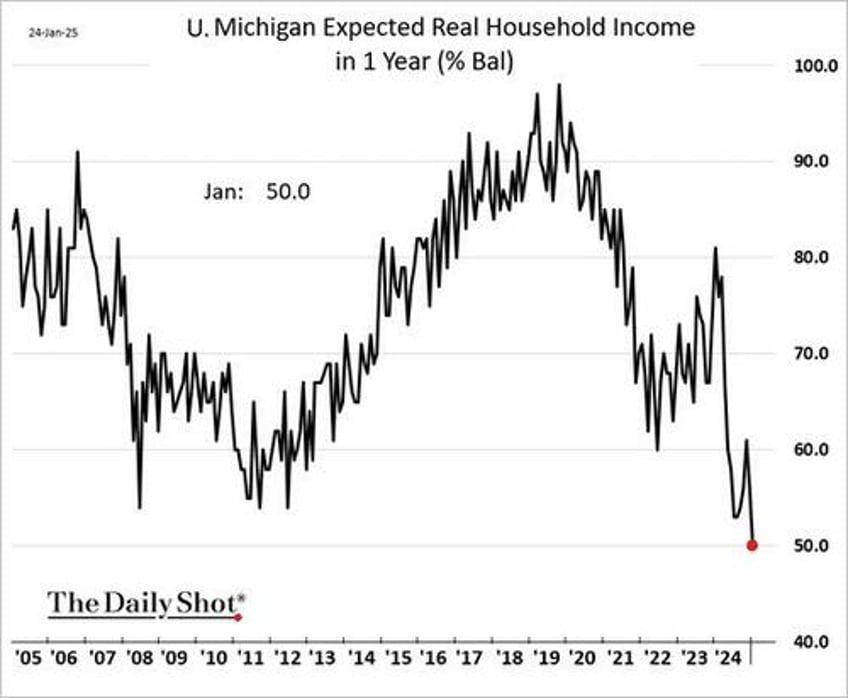

Furthermore, expectations of real household incomes do not suggest a robust consumer backdrop.

The rise in part-time employment, slowing hiring rates, and increased continuing jobless claims indicate a weaker labor market. Historically, overestimating employment strength has led the Fed to delay necessary rate cuts. Once economic conditions deteriorate further, the Fed is forced to reverse course.

Unfortunately, the Fed is often “behind the curve” in anticipating such risk, leading to more aggressive monetary policy actions. In other words, market stability leads to policy complacency, which eventually evolves into instability.

The Stability-Instability Paradox

This is the problem facing the Fed.

Investors have been led to believe that no matter what happens, the Fed can bail out the markets and keep the bull market going for a while longer. Or rather, as Dr. Irving Fisher once uttered:

“Stocks have reached a permanently high plateau.”

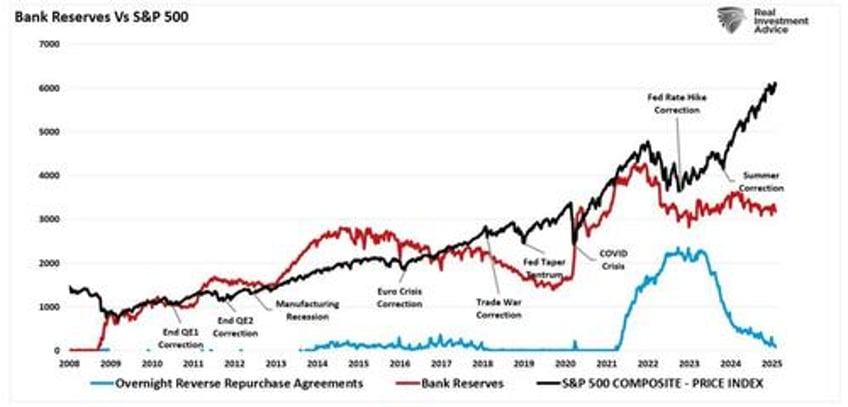

Interestingly, the Fed depends on market participants and consumers believing this idea. With the entirety of the financial ecosystem now more heavily levered than ever due to the Fed’s profligate measures of suppressing interest rates and flooding the system with excessive liquidity over the last 15 years, the “instability of stability paradox” is now the most significant risk.

“The ‘stability/instability paradox’ assumes that all players are rational and such rationality implies an avoidance of complete destruction. In other words, all players will act rationally, and no one will push ‘the big red button.‘”

The Fed is highly dependent on this assumption as it provides the “room” needed to navigate the risks that have built up in the system. The risks of something breaking have increased substantially from elevated market valuations to exceptionally low credit spreads. As we saw in March 2023, the rise in interest rates nearly took down the regional banking sector until the Federal Reserve was forced to step in with the “Bank Term Funding Program.” Fortunately, that banking risk did not become a financial contagion, and the Federal Reserve maintained stability across the markets.

However, the key to that stability depends on “everyone acting rationally.”

Unfortunately, maintaining permanent stability has never been achieved over the long term.

The Fed’s Problem – Being Late

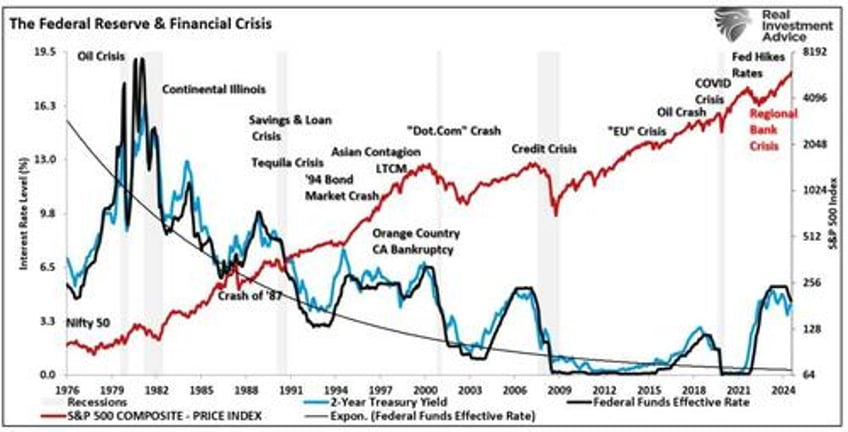

The most serious risk facing the Fed is individuals’ behavioral biases. Throughout history, the market has been plagued with unexpected, exogenous risks that fell outside the Federal Reserve’s regulatory abilities. Despite the best of intentions, changes to monetary policies, combined with investor complacency, preceded mild to disastrous outcomes.

- In the early 70’s, it was the “Nifty Fifty” stocks,

- Then, Mexican and Argentine bonds a few years after that

- “Portfolio Insurance” was the “thing” in the mid -80’s

- Fed rates led to the bond market crash in 1994.

- Dot.com anything was an excellent investment in 1999

- Real estate has been a boom/bust cycle roughly every other decade, but 2008 was a doozy

- Today, it’s leveraged ETFs, higher risk credit, and “Artificial Intelligence” everything.

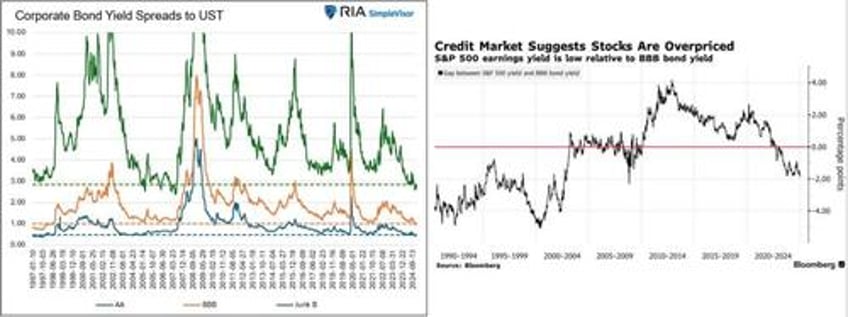

The risk to this entire house of cards is a credit-related event. As Michael Lebowitz noted recently:

“Despite the tight corporate spreads, the difference between the S&P 500 earnings yield and corporate bonds is negative 2%. The Bloomberg graph on the right shows that the spread hasn’t been that tight since 2008. Stocks are riskier, yet corporate earnings yield less than corporate bonds. The graph further confirms very high equity valuations, suggesting investors’ earnings growth expectations are much loftier than historical earnings growth rates.”

“People are skewing toward assets that are giving you more and more upside. You’re really just trying to see people hit home runs here more and more.” – Bloomberg

What happens if, or should I say when, passive funds become large net sellers of credit risk? In that event, those indiscriminate sellers will have to find highly discriminating buyers who–you guessed it–will be asking lots of questions. Liquidity for the passive universe–and thus the credit markets generally–may become problematic. Furthermore, the significant decline in market liquidity indeed suggests rising risks.

If there is a liquidity issue, the risk to “uninformed investors” is substantially higher than most realize.

Risk concentration always seems rational initially, and those early successes create a self-reinforcing behavioral sentiment.

As noted, stability is an illusion of everyone acting rationally. Unfortunately, when it all goes “pear-shaped,” rational calm quickly turns into irrational panic.

Investors Are Ignoring The Cracks In Stability

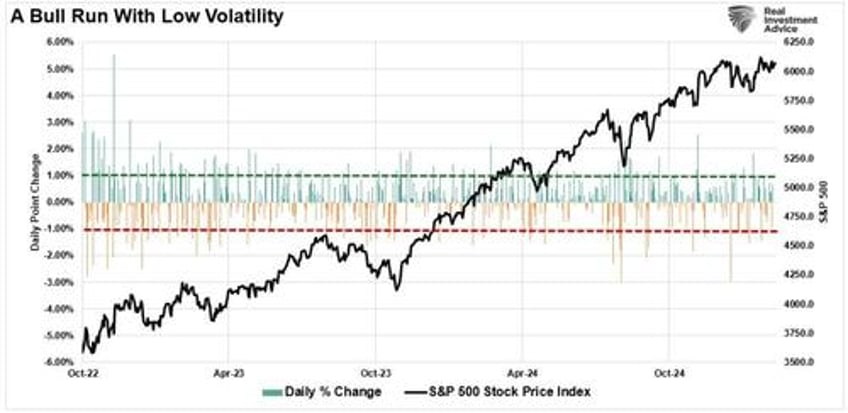

Stability is acceptable until something occurs that causes instability. Since October 2022, the market has steadily risen despite higher interest rates, inflation, and slowing economic growth. Changes to the Fed’s outlook, or as recently as tariffs and Deepseek, have caused market pullbacks. However, market stability has primarily been contained to a relatively narrow range of +/- 1% in daily price movements.

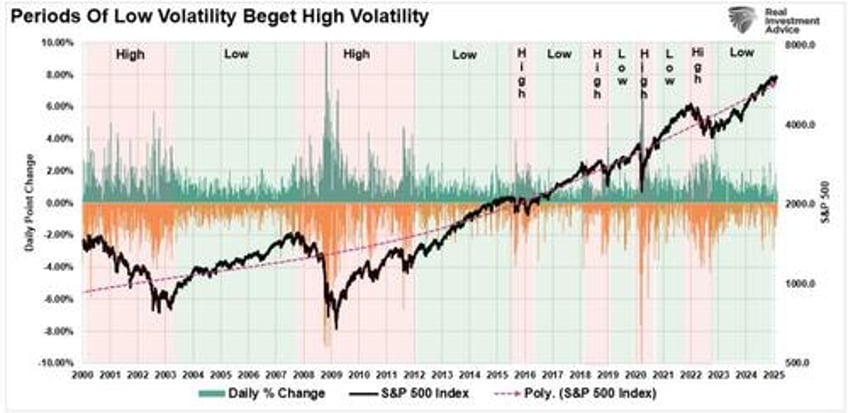

The chart below shows the importance of paying attention to volatility. As is always the case, periods of “low volatility” beget “high volatility.” For example, following the 2020 “Pandemic shutdown,” a period noted by increased ranges of daily price movements (high volatility), investors experienced an 18-month winning streak with low volatility. That period ended with the Russian invasion of Ukraine and the Federal Reserve embarking upon one of its most aggressive rate hiking campaigns since the late 70s.

However, alternating periods of low to high volatility and vice versa have been a hallmark of the financial markets since the turn of the century. What should be obvious is that these periods of low volatility are truncated by unexpected, exogenous events that cause market participants to reevaluate consensus expectations. For example, in 2000, the collapse of Enron called into question the entirety of the “Dot.com” thesis. 2008 Lehman’s failure ended the belief that “subprime was contained.” Today, the market is highly confident in superior economic growth and sustained and elevated levels of earnings growth due to “Artificial Intelligence.” What disrupts that thesis is unknown but is the most significant risk to investors today.

It is also worth noting that periods of stability have historically been truncated by the Federal Reserve and its rate-cutting cycle.

The reason, of course, is that by the time the Federal Reserve is cutting rates aggressively, something has broken in the financial system. While that has not happened yet, it does not mean it won’t.

The Single Biggest Risk To Your Money

In extremely long bull market cycles, investors become “willfully blind” to the underlying inherent risks. Or rather, it is the “hubris” of investors that they are now “smarter than the market.”

Yet, the list of concerns remains despite being completely ignored by investors and the mainstream media.

- Growing economic ambiguities in the U.S. and abroad.

- Political instability

- The failure of fiscal policy to ‘trickle down.’

- A pivot towards easing in global monetary policy (global economic weakness)

- Geopolitical risks from Trade Wars to Iran

- Un-inversions of yield curves

- Potential deteriorating in earnings and corporate profit margins.

- Record levels of private and public debt.

None of that matters for now, as the markets hope for continued easing in monetary accommodation. The more the market rises, the more reinforced the belief that “this time is different” becomes.

Yes, our investment portfolios remain invested on the long side for now. (Although we continue to carry slightly higher levels of cash and hedges.)

However, that will change rapidly at the first sign of the “instability of stability.”

How We Are Trading It

Given the market uncertainty, the high levels of complacency, and the risks to stability, managing portfolio risks is worth considering. That is why we have started rebalancing portfolio risk accordingly. With both technical and sentiment readings suggesting the short-term market risks are elevated, it is wise to take some “small” actions now, which you will likely appreciate later.

- Tighten up stop-loss levels to current support levels for each position.

- Hedge portfolios against more significant market declines.

- Take profits in positions that have been big winners.

- Sell laggards and losers.

- Raise cash and rebalance portfolios to target weightings.

Therefore, from a portfolio management perspective, we have to trade the market we have rather than the one we think should be. This can make battling emotions difficult from week to week. However, as noted, we expect a correction sooner rather than later, providing a better risk/reward opportunity to increase equity exposure if needed.

* * *

Feel free to reach out if you want to navigate these uncertain waters with expert guidance. Our team specializes in helping clients make informed decisions in today’s volatile markets.