The current rally in the dollar is soon likely to face resistance from rising real-yield differentials with the rest of the world, driven by global inflation that is falling faster than in the US.

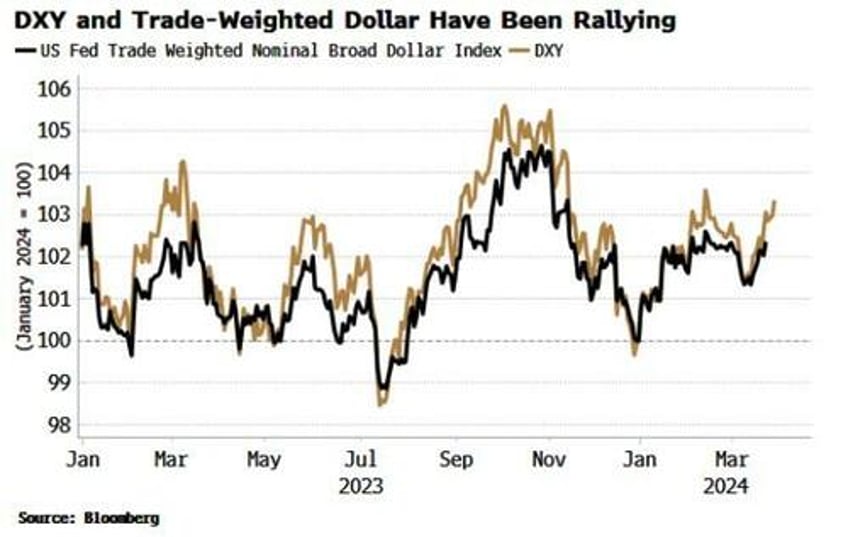

The dollar is on a mini spurt higher, with the DXY up almost 2% from its March lows, and up 3.3% year-to-date.

That has been driven mainly by selloffs in developed-market currencies such as the Swiss franc and the yen, with the DXY outperforming the broad trade-weighted dollar (white line in chart below), which includes EM as well as developed-market currencies.

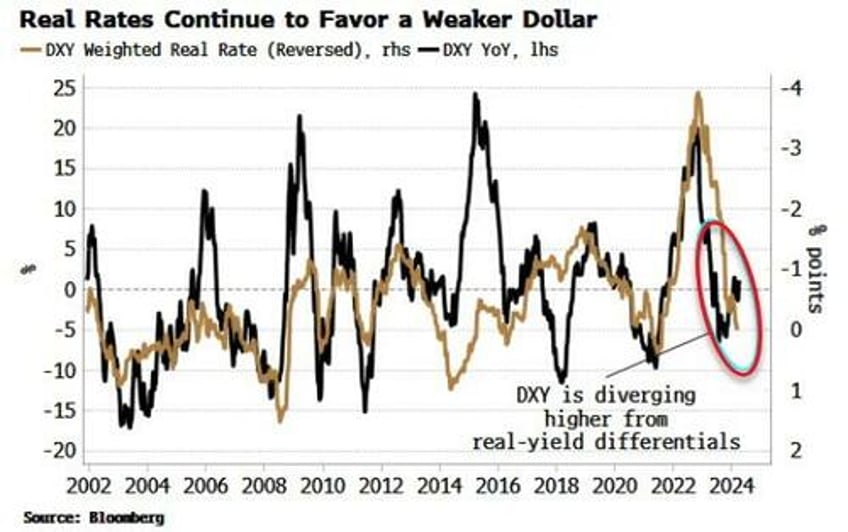

But that is diverging from fundamentals, principally real-yield differentials. We can take the real yields of the currencies in the DXY basket (EUR, JPY, GBP, CAD, SEK and CHF) versus dollar real yields, and sum them using the same weights as in the DXY calculation, to create a DXY Weighted Real Rate. As the chart below shows, the DXY is currently diverging higher from this measure.

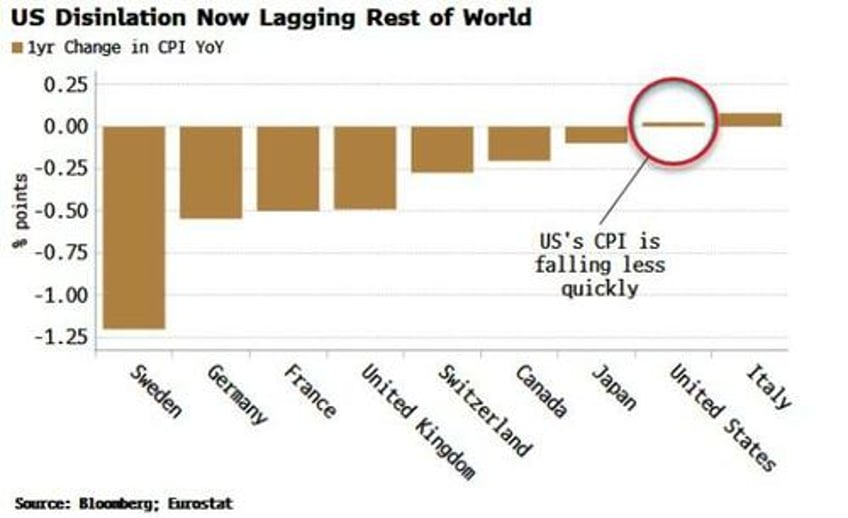

The DXY Weighted Real Rate is rising (it is shown reversed in the chart above) as inflation in the rest of the world is falling faster than in the US.

That trend is likely to continue. The US was among the first countries to experience elevated inflation, and one of the first to see fairly steep disinflation. It is now in the vanguard of countries realizing that inflation will not be a here-today-gone-tomorrow problem, and will instead be sticky and prone to re-accelerating.

In other words, US real yields are likely to remain more buoyant than in the rest of the world, even when central banks begin cutting interest rates, as they are all poised to be more cautious than suggested by current pricing.

The options market implies generous odds for a weaker dollar: about a 1-in-8 chance USD/JPY touches 140 by the end of June; the same odds that EUR/USD touches 1.13; and a 1-in-6 chance GBP/USD touches 1.32 (with sterling also likely structurally underpriced, as Brexit has proven surprisingly positive for the UK’s debt and external-account situation).