- Fed maintained rates & dots, cut growth & lifted inflation projections. To slow the balance sheet runoff. Powell emphasized uncertainty, a wait-and-see approach.

- Trump posted "The Fed would be MUCH better off CUTTING RATES as U.S.Tariffs start to transition... into the economy"

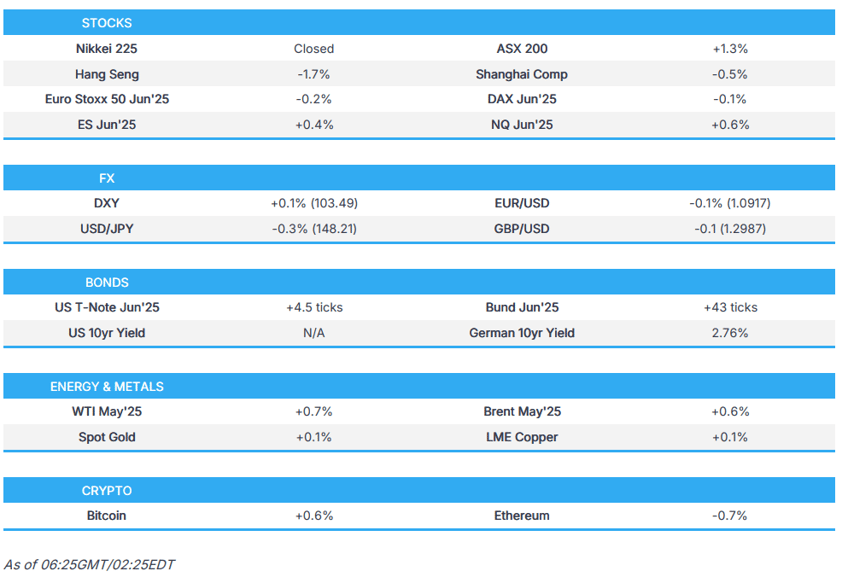

- APAC stocks mixed, US futures saw a dovish reaction to the FOMC

- DXY pulled back, EUR/USD & GBP/USD briefly above 1.09 and 1.30 respectively

- Fixed income bid post-FOMC though further gains were somewhat capped given the Tokyo holiday

- Crude firmer following the risk tone and factoring some geopolitical updates while XAU hit a new USD 3057/oz record high

- Looking ahead, highlights include US Philly Fed Index, Jobless Claims, Japanese CPI, German Producer Prices, BoE, SNB, Riksbank & SARB Policy Announcements, Speakers including ECB’s Lagarde & Lane, SNB’s Schlegel, Riksbank’s Thedeen, BoC’s Macklem & BoE's Bailey. Supply from Spain, France & US, Earnings from PDD, Jabil, Accenture, Micron, Nike, FedEx, RWE & Lanxess.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 daysv

US TRADE

EQUITIES

- US stocks were firmer and rose to highs in the wake of the latest FOMC rate decision in which the Fed left rates unchanged at 4.25-4.5%, as expected, with the dot plots unchanged, growth forecasts cut, and 2025 unemployment and inflation projections raised, while it announced to slow the pace of the balance sheet runoff. In the presser, Fed Chair Powell largely stressed a wait-and-see approach and said they are not in a hurry to cut rates, even when quizzed about cutting in May, as he stressed several times there is a lot of uncertainty ahead, and to bear that in mind when digesting Fed forecasts.

- SPX +1.08% at 5,675, NDX +1.30% at 19,737, DJI +0.92% at 41,965, RUT +1.57% at 2,082.

- Click here for a detailed summary.

FOMC

- Federal Reserve kept rates unchanged at 4.25-4.5%, as expected in a unanimous decision, while it announced the Fed will slow the place of the balance sheet runoff with the monthly Treasury redemption cap to decline to USD 5bln from USD 25bln, while the monthly redemption cap on MBS was unchanged at USD 35bln. There was one dissent from Fed Governor Waller, who supported no change in the policy rate but preferred no change to the balance sheet runoff. Fed said the economy continues to expand at a solid pace but added that uncertainty around the economic outlook has increased (prev. "The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance" has been removed), while the Fed dot plots showed FFR projections were kept unchanged with 2025 at 3.9% (exp. 3.875%, prev. 3.9%), 2026 at 3.4% (exp. 3.500%, prev. 3.4%), 2027 at 3.1% (exp. 3.125%, prev. 3.1%) and Longer-Run at 3.0% (exp. 3.125%, prev. 3.0%). Furthermore, the Fed lowered its GDP projections with 2025 seen at 1.7% (prev. 2.1%), 2026 at 1.8% (prev. 2.0%), 2027 at 1.8% (prev. 1.9%) and the longer-run kept at 1.8% (prev. 1.8%), while the Unemployment Rate forecast was raised for 2025 to 4.4% (prev. 4.3%) but maintained for the rest of the projection horizon, while PCE Inflation view was raised for 2025 to 2.7% (prev. 2.5%) and 2026 to 2.2% (prev. 2.0%).

- Fed Chair Powell said the Fed made a technical decision to slow the pace of the decline in the balance sheet and recent indications point to a moderation in consumer spending and surveys show heightened uncertainty, while he added it remains to be seen how uncertainty will affect outlook. Powell said PCE prices likely rose 2.5% in February and core PCE prices probably rose 2.8%, as well as noted that inflation expectations have recently moved up, with tariffs as a driving factor. Powell said the new administration is implementing significant policy changes and the net effect is what will matter, while he also stated that uncertainty around policy changes and the economic effect is high. Furthermore, he said they do not need to be in a hurry and will await further clarity with uncertainty unusually elevated and policy is not on a preset course.

- Fed Chair Powell said during the Q&A that the base case is that inflation will be transitory and will depend on inflation expectations staying anchored, as well as stated it will be difficult to know how much inflation is from tariffs and goods inflation moved up, with tariffs clearly a part of it and there may be a delay in further inflation progress this year. Powell said that on balance, people wrote down similar forecasts to last time and it is hard to know how this will work out, while policy can move in the direction they need it to and it is appropriate to wait for further clarity, and costs of waiting are very low. Powell also stated that forecasts point to weaker growth and higher inflation, which call for different responses and cancel each other out, while the unemployment rate only rose a tenth, so there ultimately has not been a big change in forecasts. Furthermore, Powell said they are at a place where they can cut, or hold at what is clearly a restrictive stance of policy, as well as repeated the Fed is not going to be in any hurry to move on rate cuts and regarding the balance sheet, he said they looked at pausing and slowing, although people came to be strongly in favour of slowing the balance sheet shrinkage.

TARIFFS/TRADE

- US President Trump said he believes India is probably going to be lowering tariffs substantially but on April 2nd, the US will be charging them the same tariffs they charge the US.

NOTABLE HEADLINES

- US President Trump posts on Truth Social "The Fed would be MUCH better off CUTTING RATES as U.S.Tariffs start to transition (ease!) their way into the economy. Do the right thing. April 2nd is Liberation Day in America!!!"

APAC TRADE

EQUITIES

- APAC stocks traded mixed with most indices in the green as the region initially took its cue from the gains on Wall St in the aftermath of the FOMC meeting where the Fed kept rates unchanged and slowed its balance sheet run-off, while Chinese markets bucked the trend and Japanese participants were absent due to Vernal Equinox Day.

- ASX 200 outperformed with gains led by the tech and real estate sectors amid a lower yield environment, while disappointing jobs data did little to derail the momentum in the index.

- KOSPI advanced amid strength in tech including index heavyweight Samsung Electronics which recently held its AGM and announced the appointment of one of its CEOs.

- Hang Seng and Shanghai Comp were subdued as participants navigated through earnings releases and after the lack of surprises from the announcement that China's benchmark Loan Prime Rates were kept unchanged.

- US equity futures mildly extended on recent gains after climbing in a dovish reaction to the FOMC.

- European equity futures indicate an uneventful open with Euro Stoxx 50 futures down 0.1% after the cash market closed with gains of 0.4% on Wednesday.

FX

- DXY trimmed its gains in reaction to the Fed announcement in which it kept the FFR unchanged as expected at 4.25-4.50% and decided to slow the pace of the balance sheet run-off with the decision on rates made unanimously although Fed's Waller preferred to continue the current pace of decline in securities holdings.

- EUR/USD bounced off lows and briefly reclaimed the 1.0900 status as the dollar softened on the FOMC.

- GBP/USD clawed back some losses and momentarily returned to 1.3000 territory, while participants now look ahead to UK jobs and wages data, as well as the BoE policy announcement.

- USD/JPY slumped beneath the 150.00 level as US yields softened in reaction to the Fed announcement, while the pair then continued its slide and approached closer to the 148.00 level in the absence of Japanese participants.

- Antipodeans were choppy amid the somewhat mixed risk appetite and with pressure seen following disappointing jobs data from Australia which showed a surprise contraction in Employment Change and a drop in the Participation Rate, while better-than-expected New Zealand GDP failed to spur a bid.

- PBoC set USD/CNY mid-point at 7.1754 vs exp. 7.2402 (Prev. 7.1697).

- Brazil Central Bank hiked the Selic rate by 100bps to 14.25%, as expected, with the decision unanimous, while the committee expects another adjustment of a smaller magnitude at the next meeting and said the current scenario requires a more contractionary monetary policy.

FIXED INCOME

- 10yr UST futures were underpinned in reaction to the FOMC decision to slow the balance sheet run-off from April although further upside was contained with cash treasuries trade closed overnight due to the Tokyo holiday.

- Bund futures remained afloat after climbing in tandem with US counterparts in reaction to the Fed, while participants look ahead to German Producer Prices and the latest ECB comments including from Lagarde.

COMMODITIES

- Crude futures remained afloat after the prior day's gains amid geopolitical tensions in the Middle East and the mostly constructive post-FOMC risk sentiment.

- US President Trump considers extending Chevron's licence to pump oil in Venezuela, according to WSJ.

- US Energy Secretary Wright confirmed the signing of the LNG export approval for the CP2 project on Wednesday and said they are moving urgently to grow supply of electricity and lower prices with the impact of administration moves expected to be seen later this year, while he also stated they want to grow supply and push oil prices down.

- Spot gold held on to recent gains and printed a fresh record high north of the USD 3050/oz level.

- Copper futures extended on this week's rally and reclaimed the USD 10,000/ton status.

CRYPTO

- Bitcoin was subdued overnight and gradually retreated beneath the USD 86,000 level.

NOTABLE ASIA-PAC HEADLINES

- Chinese Loan Prime Rate 1Y (Mar) 3.10% vs. Exp. 3.10% (Prev. 3.10%)

- Chinese Loan Prime Rate 5Y (Mar) 3.60% vs. Exp. 3.60% (Prev. 3.60%)

- HKMA maintained its base rate at 4.75%, as expected.

- US President Trump confirmed a willingness to hold a June summit with Chinese President Xi.

- Chinese battery makers CATL and BYD are targeted for new restrictions in the US under legislation that would bar the Homeland Security Department from procuring clean energy technology made by six companies, according to Nikkei Asia.

- South Korean opposition lawmakers are said to be seeking to impeach Acting President Choi, according to Yonhap citing the main DP opposition floor leader.

DATA RECAP

- Australian Employment (Feb) -52.8k vs. Exp. 30.0k (Prev. 44.0k)

- Australian Unemployment Rate (Feb) 4.1% vs. Exp. 4.1% (Prev. 4.1%)

- Australian Participation Rate (Feb) 66.8% vs. Exp. 67.3% (Prev. 67.3%)

- New Zealand GDP Prod Based QQ (Q4) 0.7% vs. Exp. 0.4% (Prev. -1.0%, Rev. -1.1%)

- New Zealand GDP Prod Based YY (Q4) -1.1% vs. Exp. -1.4% (Prev. -1.5%, Rev. -1.6%)

GEOPOLITICS

MIDDLE EAST

- Israeli military announced sirens sounded in several areas in Israel following a projectile that was launched from Yemen, while Houthis said they shelled Ben Gurion Airport with missiles and bombarded US aircraft carrier Harry Truman with a number of ballistic and winged missiles and drones, according to Asharq News.

- Houthi media reported the US bombing of targets including a cotton factory in Zabid district and with five raids in Hodeidah, northwestern Yemen, according to Sky News Arabia

- US President Trump's letter to Iran's Supreme Leader Ali Khamenei included a two-month deadline for reaching a new nuclear deal, according to Axios citing sources.

- US Secretary of State Rubio says President Trump seeks to promote peace and resolve the issue of "Iranian nuclear" diplomatically but is ready for all options, while he added that if Trump is forced to choose between a nuclear Iran or take action to prevent that from happening, he will take action.

- French President Macron said he spoke with Saudi Arabia’s Crown Prince MBS and welcomed the Jeddah Initiative, which enabled the start of peace negotiations in Ukraine, while Macron condemned the resumption of Israeli strikes on Gaza and said the conference on a two-state solution, which France will co-chair, must help revive a political perspective for both Israelis and Palestinians.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said he had a 'frank and substantial' talk with US President Trump and Trump informed him about the call with Putin, while they agreed that Ukraine and the US should continue working together to achieve a real end to the war and lasting peace. Zelensky added that one of the first steps toward fully ending the war could be ending strikes on energy and other civilian infrastructure which they support and Ukraine confirmed it is ready to implement.

- Ukrainian President Zelensky said Ukrainian and US officials may meet this Friday, Saturday or Sunday, while he added that his conversation with Trump on Wednesday was substantive and he felt no pressure from Trump. Zelensky said Ukraine is ready to discuss US involvement in the Zaporizhzhia plant's restoration with discussions in the early stages and noted it is not yet clear exactly how the infrastructure ceasefire will be monitored. Furthermore, he said Ukraine will respond in kind if Russia violates the ceasefire and that President Trump understands that Ukraine will not recognise occupied land as Russian.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves will announce the biggest spending cuts since austerity at next week’s Spring Statement after ruling out tax rises as a way to close her budget deficit and will tell MPs she intends to cut Whitehall budgets by billions of pounds more than previously expected, which could mean reductions of 7% for unprotected departments over the next four years, according to the Guardian.