Sen. Elizabeth Warren is adding Tesla's Board of Directors to her very, very, very long list of corporations, mergers, acquisitions, billionaires, cryptocurrencies and other people, places or things she is constantly crowing about to have 'investigated' or generally interfered with.

Today it was revealed that Warren is now seeking to find out whether or not Tesla has violated Board Independence regulations and whether or not there have been conflicts of interest between Tesla and Elon Musk's private companies, according to a Wall Street Journal exclusive.

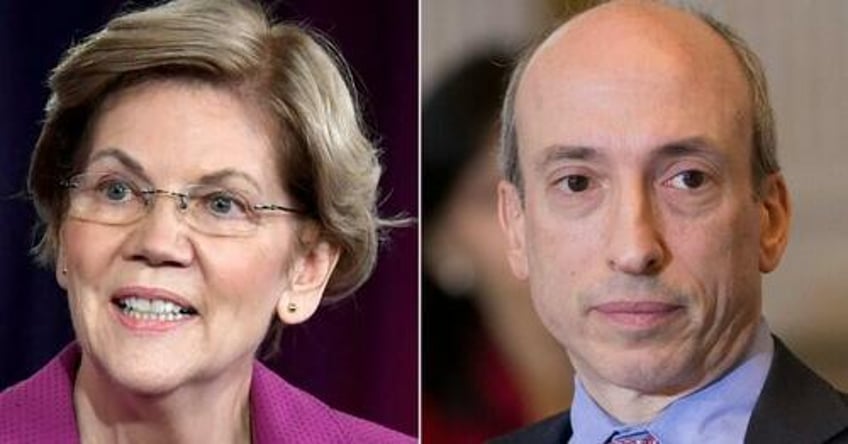

Warren sent a letter this week to the Securities and Exchange commission calling for an investigation, the report says.

“New evidence has emerged in recent months that deepen my concerns that Tesla’s Board lacks independence from Mr. Musk, who uses his control over the Board for his personal benefits, rather than in the best interest of Tesla’s shareholders,” she wrote, according to WSJ.

“Despite the growing concerns posed by Mr. Musk’s conflicting roles at Tesla and his private companies, the Board appears to have taken no action to address these risks or protect its shareholders,” the letter continues.

Warren has reiterated her concerns to the SEC more than once, the Journal notes, this time referencing another Wall Street Journal report on the intimate ties between Elon Musk and Tesla's board.

The report also highlighted that Tesla compensates its directors largely through stock options, leading to significant financial gains for many board members, some of whom have also invested in Musk's other ventures.

The recent allegations of drug use among board members were noted, though Musk, tested regularly at SpaceX, has reportedly never failed a drug test, WSJ writes.

Just days ago during Musk's unceremonious interview with failed journalist Don Lemon, Musk admitted to using ketamine under medical guidance for depression but denied misuse of the drug.

“I can’t really get wasted because I can’t get my work done,” Musk told Lemon. “From a standpoint of Wall Street, what matters is execution.”

Warren also criticized Tesla's advertising on Musk's platform, X, and expressed unease over Musk's aim to hold a significant stake in Tesla for it to lead in AI and robotics, questioning the transparency and independence within Tesla's governance.

Musk responded to the news on X by astutely noting "Senator Karen's main economic & tax advisor is SBF's [Sam Bankman-Fried's] Dad."

"I suspect some of this is coming from him," Musk wrote.

Senator Karen’s main economic & tax advisor is SBF’s Dad.

— Elon Musk (@elonmusk) March 21, 2024

I suspect some of this is coming from him. https://t.co/RZAKyEdFYS