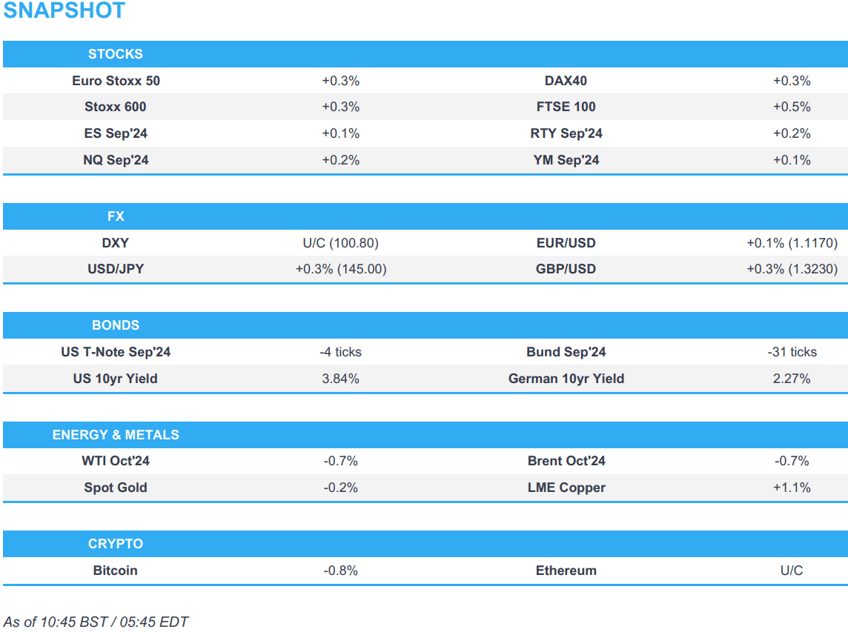

- Equities are modestly firmer across the board, despite a mostly lower APAC session overnight

- Dollar is flat, GBP outperforms with Cable back above 1.32, JPY is lower

- Bonds hold a bearish bias, with Bunds unreactive to the poor German GDP/GfK metrics

- Crude is on the back foot, XAU is slightly softer and base metals gain

- Looking ahead, US Richmond Fed, NBH Policy Announcement, Fed Discount Rate Minutes, and Supply from the US

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.4%) are modestly firmer across the board, with indices slowly edging higher as the session progressed.

- European sectors are mostly firmer; Basic Resources takes the top spot, benefiting from underlying strength in metals prices and after BHP earnings overnight. Retail is found near the foot of the pile.

- US Equity Futures (ES +0.1%, NQ +0.2%, RTY +0.2%) are modestly firmer across the board, continuing the optimism seen in early European trade. The docket for the remainder of the day is fairly thin, with focus on the Richmond Fed Index and Fed Discount Rate Minutes.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is flat with the USD showing differing performance vs. peers. For now DXY is still unable to test 101.00 to the upside with the pre-Powell peak residing at 101.55.

- EUR is marginally firmer vs. the USD but ultimately unable to launch a retest of the 1.12 mark after briefly breaching the level yesterday. German GDP confirmed the bleak growth picture for the nation but ultimately failed to sway price action.

- Cable is back on a 1.32 handle after bottoming out around the 1.3180 mark yesterday and overnight. UK-specifics light.

- JPY is the marginal laggard across the majors in a mild extension of yesterday's price action. 145.17 is the high thus far with the next level of note to the upside coming via the high from Friday at 146.48.

- Antipodeans are both marginally firmer vs. the USD with AUD/USD still holding below the 0.68 mark. Similar price action for NZD/USD with focus on whether it can eclipse Friday's 0.6236 high which was the highest level since January.

- PBoC set USD/CNY mid-point at 7.1249 vs exp. 7.1245 (prev. 7.1132)

- Barclays passive month-end rebalancing model: weak USD selling against most majors and neutral against EUR and JPY.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are under modest pressure but very much towards the top-end of the bullish-move that has been in-play since early-July. Docket ahead is devoid of Fed speak but does feature a handful of data points and then 2yr supply. At a 113-14+ WTD low, support comes into play at Friday's 113-08+ and then Thursday's 113-05+ base.

- Bunds are softer, and below the 134.00 mark which hadn't been breached to the downside since August 8th; no real move to another set of poor German data, this time via GfK. Currently at the low-end of 133.92-134.28 bounds. Bunds were unmoved by the German Bobl auction.

- Gilts opened around 30 ticks below Friday's 99.94 base, with the region catching up to Monday's price action. Since, the benchmark has waned further in-line with broader fixed action and finds itself at a 99.38 trough.

- Italy sells EUR 2.5bln vs exp. EUR 2.0-2.5bln 3.10% 2026 BTP Short Term: b/c 1.54x (prev. 1.50x) & gross yield 2.89% (prev. 3.10%)

- Germany sells EUR 3.35bln vs exp. EUR 4.00bln 2.50% 2029 Bobl: b/c 2.2x (prev. 1.90x), average yield 2.17% (prev. 2.09%) & retention 16.25% (prev. 17.9%)

- Click for a detailed summary

COMMODITIES

- A softer start for the crude complex, with prices drifting away from the prior day's best levels, sparked by Libya's oilfield production halts. The complex continues to await an update from Cairo talks which were said to have begun late-Monday. Brent currently trading around USD 80.90/bbl with the magnitude of pressure increasing throughout the European morning.

- Spot gold is a touch softer with the narrative somewhat similar to that of crude as the lack of escalation means Monday's haven premia is waning. Holding around yesterday's USD 2508/oz base currently.

- Base metals are firmer as the LME returns from Monday's Bank Holiday. However, upside thus far is modest in nature with 3M LME Copper only just above the USD 9.3k mark as the complex generally digests bearish commentary from BHP.

- Two oilfields in Southeast Libya have shut down whilst another has reduced production to its lowest capacity, according to engineers

- Click for a detailed summary

NOTABLE DATA RECAP

- UK BRC Shop Price Index (Aug) Y/Y -0.3% (Prev. +0.2%); BRC CEO said "Shop prices fell into deflation for the first time in nearly three years. This was driven by non-food deflation, with retailers discounting heavily to shift their summer stock, particularly for fashion and household goods."

- German GDP Detailed QQ SA (Q2) -0.1% vs. Exp. -0.1% (Prev. -0.1%); YY 0.0% vs. Exp. -0.1% (Prev. -0.1%)

- German GDP Detailed YY NSA (Q2) 0.3% vs. Exp. 0.3% (Prev. 0.3%)

- Swedish PPI YY (Jul) -0.1% (Prev. 0.8%); MM -1.4% (Prev. -0.4%)

NOTABLE US HEADLINES

- Apple (AAPL) announced Kevan Parekh as new CFO; to succeed Luca Maestri effective January 1st 2025.

- Apple (AAPL) announced an iPhone event for September 9th, via CNBC.

- Microsoft (MSFT) CEO Satya Nadella reported open market sale of 14,398 shares of Microsoft at an average price of USD 417.412/shr on Aug 23rd (vs Monday's close of USD 413.49/shr), according to an SEC filing.

- Decision Desk HQ Presidential Forecast (8/26) Probabilities: Harris: 54.6%, Trump: 45.4%.

- Republican Presidential Candidate Trump said he would like Tesla (TSLA) CEO Musk in Cabinet, but Musk is busy with his businesses; the time has come for a space national guard.

- Mexico lower house committee approves proposed judicial reform, paves way for final debate by early September, according to Reuters.

- UBS Global Wealth Management has increased odds of a US recession to 25% from 20%

GEOPOLITICS

MIDDLE EAST

- Top US general said the immediate risk of a broader war in the Middle East has eased somewhat after the Israel-Hezbollah clash, but Iran still poses significant danger as it weighs strike on Israel, according to Reuters.

RUSSIA-UKRAINE

- Explosions were heard for the third time overnight in the Ukrainian capital Kyiv, according to Reuters.

- Russian Defence Ministry says Russia carried out high-precision weapon strike on Ukraine overnight, via Interfax

CRYPTO

- Bitcoin is slightly softer and holds beneath USD 63k, whilst Ethereum holds around USD 2.6k.

APAC TRADE

- APAC stocks traded mostly lower following a mixed lead from Wall Street, which saw the tech sector lag ahead of NVIDIA earnings on Wednesday. News flow in APAC hours was quiet and catalysts light, with the overall tone of the market tentative.

- ASX 200 saw its early modest gains fade with the index trading flat throughout most of the APAC session, although BHP shares were lifted some 2% following earnings.

- Nikkei 225 opened in the red but gradually edged higher in tandem with the weakness in the JPY, with the index confined to a tight intraday range.

- Hang Seng and Shanghai Comp were both subdued for the entirety of the session, with the mainland overlooking an improvement in Industrial Profits, whilst Hong Kong saw its hefty losses in Alibaba and JD.com after Temu-owner PDD tumbled 28.5% after cautioning that its revenue growth will slow as competition continues to increase.

NOTABLE ASIA-PAC HEADLINES

- BHP (BHP AT) - FY (USD): Revenue USD 55.7bln (exp. 55.971bln). Underlying profit 13.66bln (exp. 13.49bln). Dividend 0.74, Co. expects volatility in the global commodity market in the near term.

- PBoC injected CNY 472.5bln via 7-day Reverse Repo at a maintained rate of 1.70%.

- Japanese gov't to spend JPY 980bln to fund electricity/gas subsidies from the FY24/25 budgets reserves, via NHK.

DATA RECAP

- Chinese Industrial Profits YY (Jul) 4.1% (Prev. 3.6%); YTD 3.6% (Prev. 3.5%)

- Japanese Services PPI YY (Aug) 2.8% vs Exp. 2.9% (Prev. 3.0%)