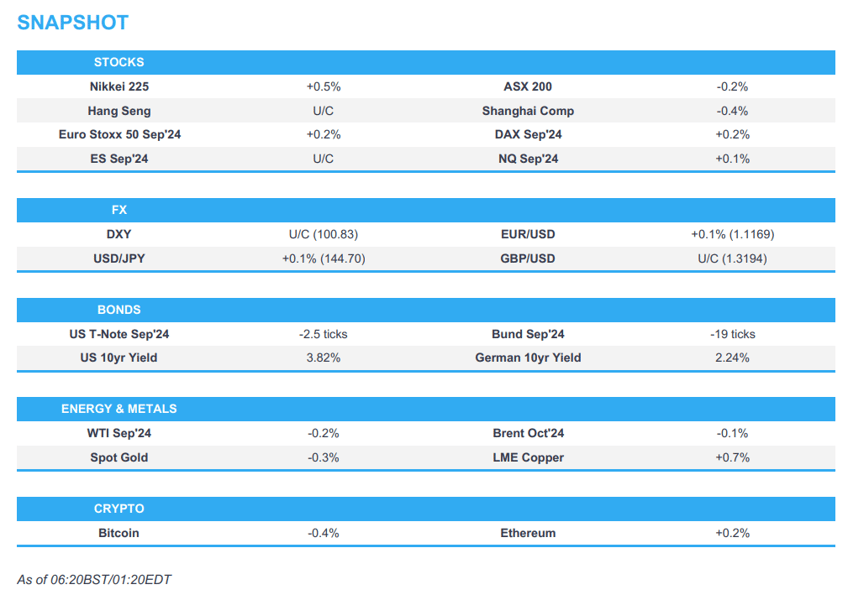

- APAC stocks traded mostly lower in quiet newsflow following a mixed lead from Wall Street, which saw the tech sector lag ahead of NVIDIA earnings on Wednesday.

- DXY traded in a tight range with a mild upward bias. JPY lagged on yield differentials whilst EUR and GBP were flat and Antipodeans rebounded.

- Microsoft (MSFT) CEO Satya Nadella sold 14,398 shares of Microsoft at an average price of USD 417.412/shr on Aug 23rd; Apple (AAPL) named Kevan Parekh as its new CFO.

- European equity futures are indicative of a slightly firmer open with the Euro Stoxx 50 future +0.1% after cash closed with losses of 0.3% on Monday.

- Looking ahead, highlights include German GDP (Detailed), German GfK, US Richmond Fed, NBH Policy Announcement, Fed Discount Rate Minutes, and Supply from Italy, Germany, and the US.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks ultimately closed mixed. The downside was mostly felt in the Nasdaq - with Tech, Consumer Discretionary and Health Care sectors underperforming, while Energy, Consumer Staples and Utilities outperformed.

- A bulk of the tech downside stemmed from weakness in Semiconductors shares with SOXX -2% as all eyes turn to NVIDIA (NVDA) earnings on Wednesday.

- SPX -0.31% at 5,616, NDX -1.04% at 19,516, DJIA +0.16% at 41,240, RUT +0.16% at 2,222.

- Click here for a detailed summary

NOTABLE HEADLINES

- Fed's Daly (2024 voter) said the Fed had been on a path to lower the policy rate for a couple of months but they just needed a bit more confidence inflation was returning to target. She added the labour market is in complete balance, time to adjust policy is upon us, whilst she is not hearing signs that firms are poised for layoffs. She noted the direction of rates is down, but it is too early to know how big rate cuts will be, and she does not want to declare they are on the path to neutral.

- Apple (AAPL) announced Kevan Parekh as new CFO; to succeed Luca Maestri effective January 1st 2025.

- Apple (AAPL) announced an iPhone event for September 9th, via CNBC.

- Microsoft (MSFT) CEO Satya Nadella reported open market sale of 14,398 shares of Microsoft at an average price of USD 417.412/shr on Aug 23rd (vs Monday's close of USD 413.49/shr), according to an SEC filing.

- Decision Desk HQ Presidential Forecast (8/26) Probabilities: Harris: 54.6%, Trump: 45.4%.

- Republican Presidential Candidate Trump said he would like Tesla (TSLA) CEO Musk in Cabinet, but Musk is busy with his businesses; the time has come for a space national guard.

APAC TRADE

EQUITIES

- APAC stocks traded mostly lower following a mixed lead from Wall Street, which saw the tech sector lag ahead of NVIDIA earnings on Wednesday. News flow in APAC hours was quiet and catalysts light, with the overall tone of the market tentative.

- ASX 200 saw its early modest gains fade with the index trading flat throughout most of the APAC session, although BHP shares were lifted some 2% following earnings.

- Nikkei 225 opened in the red but gradually edged higher in tandem with the weakness in the JPY, with the index confined to a tight intraday range.

- Hang Seng and Shanghai Comp were both subdued for the entirety of the session, with the mainland overlooking an improvement in Industrial Profits, whilst Hong Kong saw its hefty losses in Alibaba and JD.com after Temu-owner PDD tumbled 28.5% after cautioning that its revenue growth will slow as competition continues to increase.

- US equity futures traded on either side of the unchanged mark for most of the session, although the ES and NQ saw a modest dip following news that the Microsoft CEO filed to sell some shares on August 23rd, albeit at a higher price than Monday's close. Add to that, Apple's CFO replacement prompted some after-market losses in shares

- European equity futures are indicative of a slightly firmer open with the Euro Stoxx 50 future +0.1% after cash closed with losses of 0.3% on Monday.

FX

- DXY traded in a tight range with a mild upward bias. DXY hit an APAC high of 100.93 (vs Monday's high of 100.92). The next upside level is still some way off - the pre-Powell peak at 101.55.

- EUR/USD was flat intraday following the prior day's mild losses. EUR/USD remained in a very tight 1.1160-72 range vs yesterday's 1.1150-1.1201 parameter.

- GBP/USD was uneventful and moved in tandem with the Dollar to trade in a 1.3181-1.3202 band, with UK players set to return from their long weekend.

- JPY stood as the G10 underperformer despite a lack of fresh catalysts but APAC traders reacted to the pullback in US bonds on Monday. USD/JPY traded in a 144.21-97 range after topping yesterday's high (144.65) with the next upside level after 145.00 being Friday's peak (146.48).

- Antipodeans were choppy and rebounded alongside base metals following the Chinese Industrial Profits metrics.

- PBoC set USD/CNY mid-point at 7.1249 vs exp. 7.1245 (prev. 7.1132)

FIXED INCOME

- 10-year UST futures moved sideways for most of the session following Monday's choppiness in which IFR highlighted that a chunky 10-year October put buyer was a factor behind the late selling, with market makers having to sell September 10-year futures as a hedge - ultimately facilitating a lower futures settlement on Monday. Traders look ahead to the US 2-year Note auction later.

- Bund futures were subdued and caught up to the losses on Wall Street whilst European traders look ahead to German GfK Consumer Sentiment ahead of a 2029 Bobl auction.

- 10-year JGB futures were softer with price action in-fitting with the performance seen across US bonds with newsflow on the quieter side.

COMMODITIES

- Crude futures were in consolidation-mode following the prior day's gains, which were spurred amid reports of a production halt in Libya and after Israel and Hezbollah traded a barrage of strikes over the weekend.

- Spot gold gradually edged lower throughout the session as the DXY recouped more ground and amidst a distinct lack of major geopolitical updates despite the tense environment.

- Copper futures eventually saw modest gains whilst LME trading resumed after the long weekend and despite the net bearish market commentary offered by BHP alongside their earnings.

- US seeks about 3.6mln of oil to help replenish SPR for delivery in January through March next year, according to Reuters.

- Shell (SHEL LN) plans to shut in different portions of the Zydeco pipeline from Houston-Houma Port Neches for three to four days starting September 24th for maintenance, according to Reuters.

CRYPTO

- Bitcoin traded on either side of USD 63k in uneventful trade.

NOTABLE ASIA-PAC HEADLINES

- BHP (BHP AT) - FY (USD): Revenue USD 55.7bln (exp. 55.971bln). Underlying profit 13.66bln (exp. 13.49bln). Dividend 0.74, Co. expects volatility in the global commodity market in the near term.

- PBoC injected CNY 472.5bln via 7-day Reverse Repo at a maintained rate of 1.70%.

DATA RECAP

- Chinese Industrial Profits YY (Jul) 4.1% (Prev. 3.6%); YTD 3.6% (Prev. 3.5%)

- Japanese Services PPI YY (Aug) 2.8% vs Exp. 2.9% (Prev. 3.0%)

GEOPOLITICS

MIDDLE EAST

- White House said negotiators were meeting on Monday in Cairo for talks on Gaza ceasefire. US expects working group talks to continue at least for the next few days, according to Reuters.

- White House said it has to assume Iran remains postured and prepared to attack Israel, according to Reuters.

- Top US general said the immediate risk of a broader war in the Middle East has eased somewhat after the Israel-Hezbollah clash, but Iran still poses significant danger as it weighs strike on Israel, according to Reuters.

RUSSIA-UKRAINE

- Explosions were heard for the third time overnight in the Ukrainian capital Kyiv, according to Reuters.

EU/UK

NOTABLE HEADLINES

- UK BRC Shop Price Index (Aug) Y/Y -0.3% (Prev. +0.2%); BRC CEO said "Shop prices fell into deflation for the first time in nearly three years. This was driven by non-food deflation, with retailers discounting heavily to shift their summer stock, particularly for fashion and household goods."

LATAM

- Mexico lower house committee approves proposed judicial reform, paves way for final debate by early September, according to Reuters.

To download the report, please click here If you would like to subscribe to receive the research sheets directly in your inbox, you can now do so under the Research Suite section of the portal. To subscribe simply check the box next to "Email these reports" under the desired category.