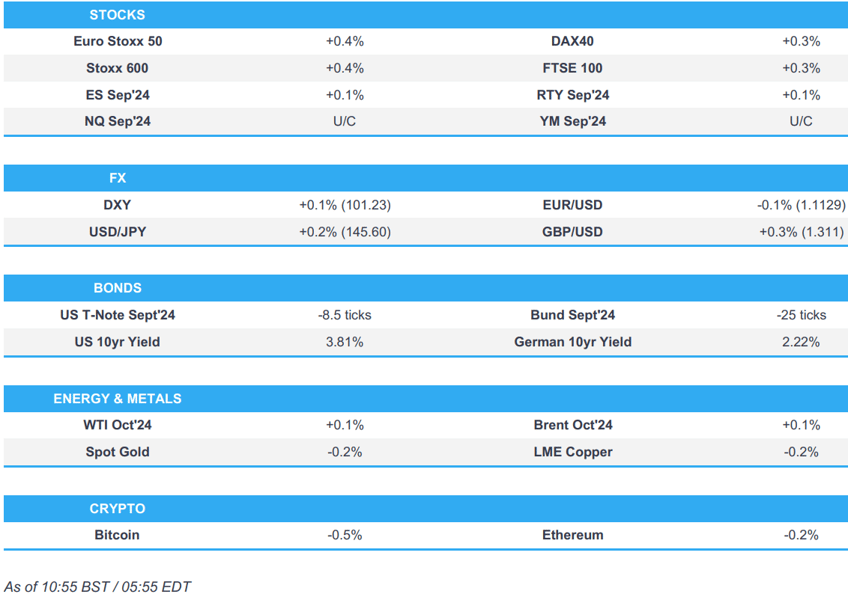

- European bourses are mostly firmer across the board; US futures gain incrementally

- Dollar is trivially higher, GBP outperforms following stronger than expected PMI metrics

- Bonds are lower following the generally better than expected PMI releases, particularly in France the EZ and the UK; Germany continues to print poor metrics

- Crude is flat, XAU is slightly softer but remains above USD 2500/oz

- Looking ahead, US PMIs, US IJC, NZ Retail Sales, Jackson Hole Symposium, ECB Minutes, US Democratic Convention, Supply from US.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.5%) began the session flat/modestly firmer. Indices were choppy following the various PMI releases, but ultimately trudged higher as the morning progressed.

- European sectors hold a positive bias, albeit with the breadth of the market fairly narrow. Retail takes the top spot, propped up by post-earning strength in JD Sports (+3.1%). Basic Resources lags, paring back some of the strength seen yesterday, in line with a pullback in metals prices.

- US Equity Futures (ES U/C, NQ U/C, RTY U/C) are flat/firmer, with traders mindful ahead of the beginning of the Jackson Hole Symposium and Fed Chair Powell's speech on Friday.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is a touch higher but ultimately not showing enough of a resurgence to reverse the recent bearish run for the index. DXY went as low as 100.92 on Wednesday, but currently stands around 101.25.

- EUR is marginally softer vs. the USD in the wake of a slew of EZ PMI metrics which ultimately saw continued outperformance in the service sector vs. the manufacturing industry with the former helping the composite to gain a firmer footing above the 50 mark. Elsewhere, a decline in EZ Negotiated Wages for Q2 had little sustained follow-through into the EUR. For now, EUR/USD is contained within Wednesday's 1.1098-1.1174 range.

- GBP is edging gains vs. both the USD and EUR with solid PMI metrics underpinning the pound. Cable has taken out yesterday's 1.3119 high and therefore brought the 2023 high into view at 1.3142.

- JPY is trivially softer vs. the USD with markets awaiting two potentially key inflection points for the pair tomorrow. 1) Ueda's appearance before Parliament and 2) Powell's appearance at Jackson Hole.

- Antipodeans are both marginally firmer vs. the USD in quiet trade which is showing a mild pro-risk bias.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs moved in tandem with the net-hawkish move seen in Bunds/Gilts on their own metrics. Docket today sees US PMIs ahead of the commencement of the Jackson Hole Symposium. At a 113-19 base, support from the last few session's lows at 113-14+, 113-03+ and 112-31.

- Bund price action today has been dictated by PMI releaes. Bunds were initially pressured by strong French PMIs, but the release is subject to extensive Olympic-related caveats, which led to the upside being mostly pared. Thereafter, German numbers were soft lifting Bunds to a 135.08 peak, spurred by the data erring towards another negative quarter and potential recession talk. Ultimately, Bunds are in the red and just below the knee-jerk base which printed on the initial French numbers.

- Gilts were moving in tandem with Bunds into its own release, which was stronger across the board. Overall, a hawkish reaction was seen with GBP picking up and Gilts probing below the earlier 99.87 base; current low of 99.81.

- Click for a detailed summary

COMMODITIES

- Relatively flat session for crude thus far following Wednesday's losses. Brent Oct is trading within USD 75.77-76.21/bbl parameters.

- Mixed trade across precious metals with slight gains in spot palladium while spot gold and silver trade subdued in what has been a quiet morning this far, and with little move seen in the metals to EZ PMIs. Spot gold trades in a USD 2,514.69-2,499.18/oz range.

- Base metals are flat trade on Thursday, infitting with the broader tentative mood and following the prior day's fluctuations, with markets seemingly on standby ahead of the Fed's Jackson Hole symposium and Fed Chair Powell's speech in the absence of any other macro impulses.

- Russia's Novatek has postponed launched of third line at Artic LNG 2 project to 2028, according RBC citing source.

- Chinese crude steel output -9.0% Y/Y in July to 82.9mln tonnes; world steel output -4.7% Y/Y to 152.8mln tonnes.

- UBS continue to expect Brent to recover into a USD 85-90/bbl range over the coming months; Reiterate a step up in Gold ETF inflows required for next leg higher toward their mid-2025 gold target of USD 2700/oz

- OPEC Secretariat received updated compensation plans from Iraq and Kazakhstan.

- Click for a detailed summary

NOTABLE DATA RECAP

- French HCOB Composite Flash PMI (Aug) 52.7 vs. Exp. 49.1 (Prev. 49.1); Manufacturing Flash PMI (Aug) 42.1 vs. Exp. 44.4 (Prev. 44); Services Flash PMI (Aug) 55.0 vs. Exp. 50.3 (Prev. 50.1)

- EU HCOB Composite Flash PMI (Aug) 51.2 vs. Exp. 50.1 (Prev. 50.2); Services Flash PMI (Aug) 53.3 vs. Exp. 51.9 (Prev. 51.9); Manufacturing Flash PMI (Aug) 45.6 vs. Exp. 45.8 (Prev. 45.8)

- German HCOB Composite Flash PMI (Aug) 48.5 vs. Exp. 49.2 (Prev. 49.1); Manufacturing Flash PMI (Aug) 42.1 vs. Exp. 43.5 (Prev. 43.2); Services Flash PMI (Aug) 51.4 vs. Exp. 52.3 (Prev. 52.5)

- UK Flash Services PMI (Aug) 53.3 vs. Exp. 52.8 (Prev. 52.5); Composite PMI (Aug) 53.4 vs. Exp. 52.9 (Prev. 52.8); Manufacturing PMI (Aug) 52.5 vs. Exp. 52.1 (Prev. 52.1)

- EU EZ Negotiated Wage Rates (Q2) 3.55% (Prev. 4.74%); Modest and ultimately fleeting dovish reaction seen on the release.

OTHER DATA RECAP

- Norwegian GDP Growth Mainland (Q2) 0.1% vs. Exp. 0.2% (Prev. 0.2%, Rev. 0.1%); GDP Growth (Q2) 1.4% (Prev. 0.2%, Rev. 0.3%)

- Swedish New Orders Manuf. YY (Jun) 0.8% (Prev. -8.9%)

GEOPOLITICS

MIDDLE EAST

- Ambrey reports a fire at sea approx. 58NM southwest of Salif, Yemen; likely related to the destruction of a suspected unmanned surface vessel

- Israeli forces besiege Tulkarm refugee camp east of the city in the West Bank, while it was also reported that the Israeli army launched raids on 10 areas in Lebanon.

- US officials said to believe that Iranian leaders have decided to postpone the response to Haniyeh's assassination but fear that Tehran will urge Hezbollah to attack, according to The Washington Post.

- US military announced on Wednesday that the USS Abraham Lincoln entered the Central Command area of responsibility in the Middle East, according to Iran International.

- A fire broke out at a military facility in Russia's Volgograd region after a drone crashed into it, according to Interfax.

OTHER

- US Embassy within Kyiv says they see an increased risk of Russian drone/missile attacks in the coming days, due to Ukraine's Independence Day on 24th August

CRYPTO

- Bitcoin is flat and holds just beneath USD 61k, with Ethereum also rangebound just above USD 2.6k.

APAC TRADE

- APAC stocks traded with a mild positive bias after the gains on Wall St where a downward payrolls revision and the FOMC Minutes further supported the consensus for a September Fed rate cut.

- ASX 200 edged higher but with gains capped as participants digested a slew of earnings, while data showed an improvement across Australia's flash PMIs although manufacturing remained in contraction.

- Nikkei 225 marginally outperformed its peers and returned to above the key 38,000 level.

- Hang Seng and Shanghai Comp. were somewhat varied with notable strength in Hong Kong tech stocks after a solid earnings report from Xiaomi, although pharmaceutical stocks and WuXi biologics were at the other end of the spectrum after the latter reported a 24% drop in H1 net, while the mainland remained lacklustre amid growth concerns, trade frictions and a net liquidity drain.

NOTABLE ASIA-PAC HEADLINES

- BoK kept its base rate unchanged at 3.50% as expected, with the decision made unanimously. BoK said it will examine the proper timing of rate cuts and said confidence is greater that inflation will converge on the target level, while it dropped the phrase 'sufficient period of time' in saying it will maintain a restrictive policy stance. BoK Governor Rhee said inflation conditions are appropriate for a cut and that four board members said room for a rate cut should remain open although Rhee also stated that rising financial stability risks warranted the BoK's decision to hold rates today. Furthermore, Rhee said the pace and extent of an interest rate cut in South Korea will be smaller than that of the US and noted the BoK is communicating with markets using a three-month horizon forward guidance but also stated that forward guidance doesn't guarantee a rate cut.

- Baidu Inc (BIDU) Q2 2024 (USD): EPS 2.89 (exp. 2.57), Revenue 4.669bln (exp. 4.7bln).

- NetEase Inc (NTES) Q2 2024 (USD): EPS 1.67 (exp. 1.69), Revenue 3.5bln (exp. 3.58bln).

- BoJ is considering adding wage-related items to the Tankan survey, according to Jiji News; aims to analyse wage trends in Tankan survey, reflects on monetary policy decision

DATA RECAP

- Japanese JibunBK Manufacturing PMI Flash SA (Aug) 49.5 (Prev. 49.1); Services PMI 54.0 (Prev. 53.7)

- Japanese JibunBK Composite Op Flash SA (Aug) 53.0 (Prev. 52.5)

- Australian Judo Bank Manufacturing PMI Flash (Aug) 48.7 (Prev. 47.5); Services PMI 52.2 (Prev. 50.4)

- Australian Judo Bank Composite PMI Flash (Aug) 51.4 (Prev. 49.9)