The management team of Foxconn Technology Group, formerly known as Hon Hai Precision Industry, the world's largest contract electronics manufacturer, responsible for assembling Apple's iPhones and artificial intelligence servers for tech giants like Amazon and Nvidia, shared valuable insights into AI server demand and potentially where the AI bubble is headed with Goldman analysts.

Goldman analysts led by Allen Chang summarized the key takeaways from a call with Foxconn management on Wednesday.

"Overall, management remains positive on the AI servers business, which continues to enjoy sequential revenue growth in 3Q24 and 4Q24," Chang wrote in a note for clients. He said Foxconn plans to begin small-volume production of the full rack AI servers by the end of the year and enter mass production and shipment ramp-up in 2025.

Chang said his team remains "positive" on Foxconn and "see its vertical integration, comprehensive customer base, R&D capability, strong balance sheet and global production sites as continuing to secure the company's leading market position in AI servers."

He added, "The EV business is also on track with the next passenger car production to start in 1H25. The company is also working with a Japanese car OEM on a MOU, targeting to finalize details of the contract by the end of 2024."

Foxconn is strategically positioned to capture 40% of the global AI server market. With the worldwide rise of AI applications, these new advanced servers are becoming one of the company's primary growth drivers. Management's optimistic outlook shared with Goldman analysts underscores that the AI bubble might not totally collapse this year or early next, though some argue that the valuations of some chip companies are exceedingly elevated.

The analysts penned the note titled "Mgmt Call takeaways: AI servers continue to ramp up in 2H24; still positive on liquid cooling and EVs"...

Here are the key takeaways from the call with management:

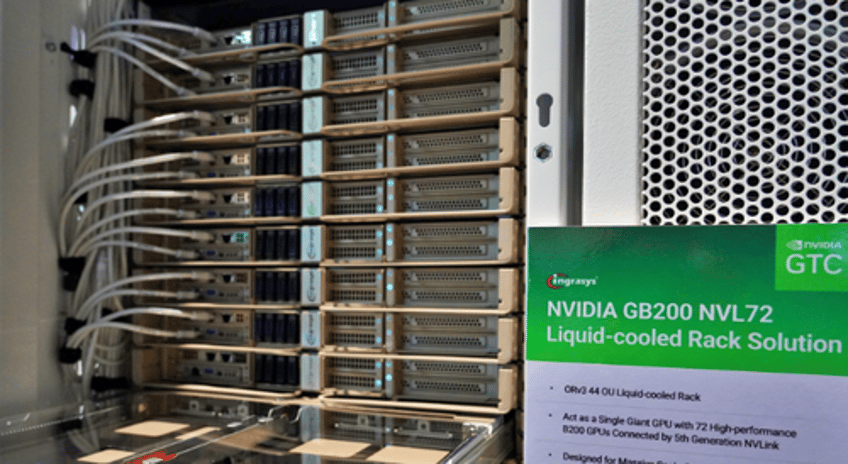

AI servers business outlook: AI servers revenues contributed 40%+ of Hon Hai's total server revenues in 2Q24, or 60%+ QoQ, or 100%+ YoY revenues growth in 2Q24. Management continues to expect sequential revenue growth of AI servers through 2024E. The full rack AI server timeline remains pretty much in line with Hon Hai's previous expectation for small volume production by the end of 2024E, and to enter mass production and shipment ramp up in 2025E. Management remains confident Hon Hai will be the first supplier to ship out the full rack AI servers by the end of this year.

AI servers' competitive edge: Hon Hai views one of its competitive strengths as its vertical integration, which includes GPU modules, baseboard, computing boards, switch boards, high speed switches, front-end (L6), back-end (L10-12), and liquid cooling. R&D capability is another key strength allowing the company to support customers in designing AI servers, and accelerate the product cycle. On the manufacturing side, Hon Hai provides high automation and global production sites to drive efficiency, onsite services for clients, and to meet clients' needs to diversify production sites to reduce geopolitical risks.

Liquid cooling business outlook: Customers tend to go with high computing power solutions, and management remains confident in liquid cooling market demand. For customers, there are initial costs and running costs to consider together, and 30%+ of running costs come from power consumption, which depends on the cooling system. Air cooling could carry lower initial costs, but is less efficient in terms of running costs vs. liquid cooling. Hon Hai's solutions across direct to chips and immersion cooling, including liquid to air solutions (Side Car), and liquid to liquid solutions (In Rou CDU). Cold plate, UQD, and manifold are the key components that Hon Hai aims to develop in house, while the company also leverages the supply chain at the initial stage. According to management, liquid cooling is not a new business to them, and customer feedback they've received on their solutions is positive.

AI servers capacity expansion: Hon Hai continues to invest in AI servers across L5 to L12; currently it has prepared capacity for demand in 2025, and will keep expanding based on the market demand dynamics. Capex was up 14% in 2023, and up 33% YoY in 1H24 to NT$63bn (US$2bn).

EV business update: Passenger car production in Taiwan is on track, per management. Full-year guidance of 10k+ units is unchanged, which could bring NT$10bn revenues to the company. The next passenger car production is also in the pipeline, aiming to start in 1H25. In the overseas market, Hon Hai signed an MOU with a Japanese car OEM, and targets to finalize details of the contract by the end of 2024. This will mark a key milestone for the company, demonstrating Hon Hai's strong capability and scale advantages in EV production.

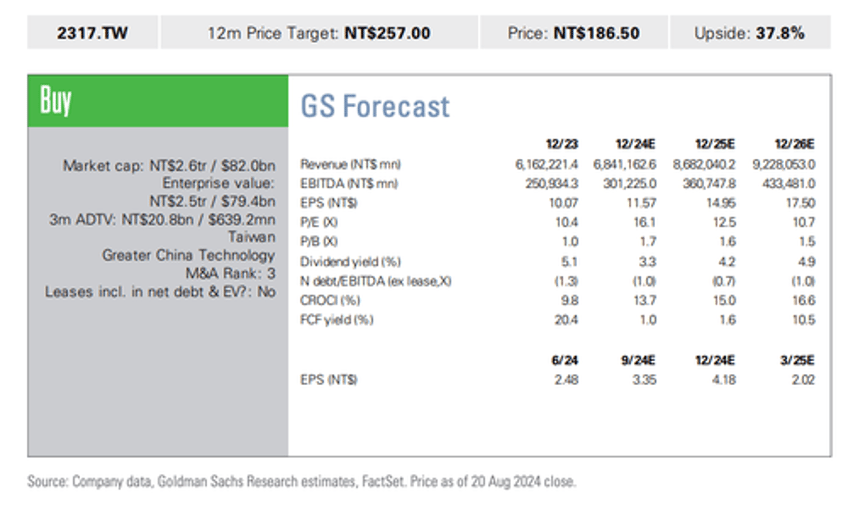

Given all this, the analysts have a 12-month price of NT$257, with nearly 38% upside from here.

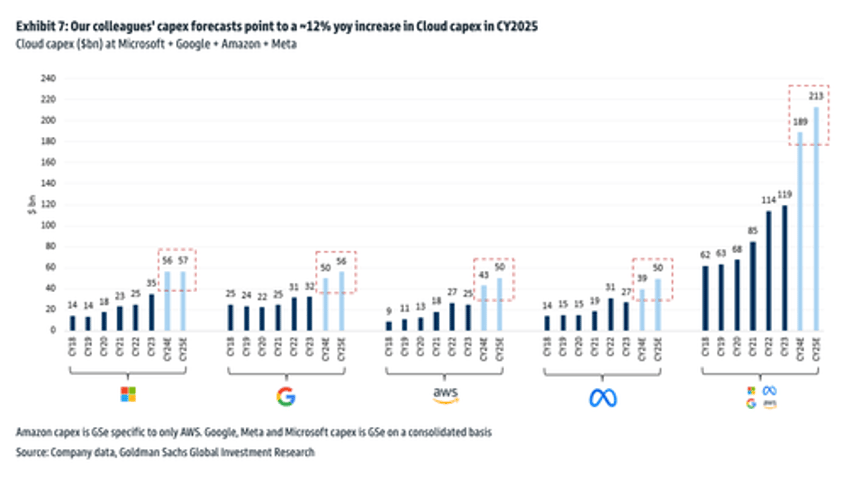

In a separate Goldman note, cloud capex at Microsoft, Google, Amazon, and Meta are expected to surge well into 2025.

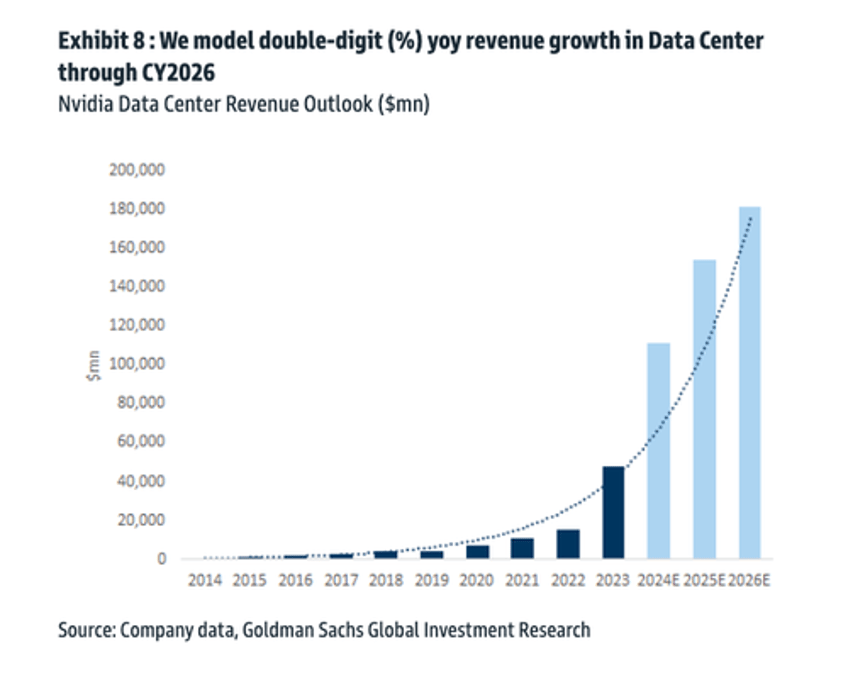

Nvidia's yoy revenue growth forecast in data centers continues to be parabolic.

Shares of Nvidia are back at the highs.

The AI boom has shifted attention to contract electronics manufacturers of AI servers as a key gauge of where we are in the AI bubble cycle. It seems the AI bubble may still have room to expand, provided a deep recession doesn't force big tech to halt its massive capex AI spending spree.