As we highlighted in our preview, the CPI matters a lot, again!

After last month's CPI report came in cooler than expected, with Core CPI missing expectations both sequentially and YoY, analysts expect core to accelerate sequentially, but bear in mind we have the annual revisions malarkey to wade through first, so who knows what the 'expectation' will be comparable to.

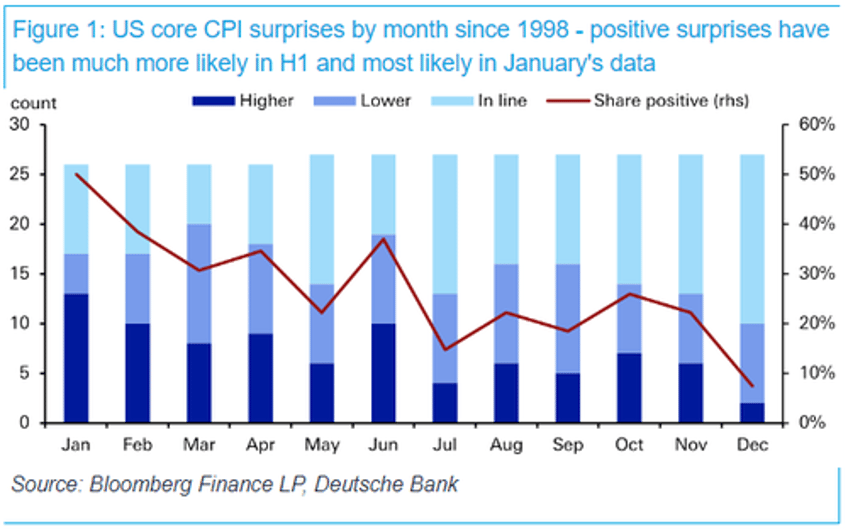

Seasonality screams big beat today, as Deutsche Bank's Jim Reid points out, surprises to CPI over the last 25-plus years have been more likely to be biased to the upside in H1 than in H2. January’s release (which we will see today) has seen the largest number of beats (50%) and the lowest number of downside misses (15%).

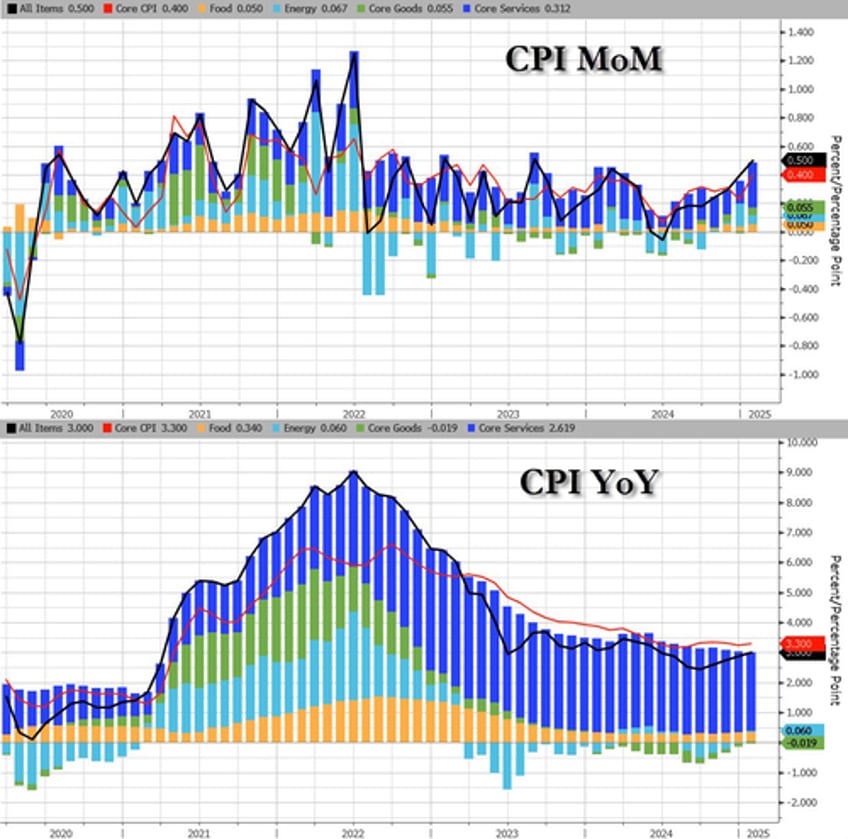

And sure enough, both headline and core CPI rose more than expected in January. Headline CPI jumped 0.5% MoM (+0.3% exp) dragging the price series up 3.0% YoY (+2.9% exp). That is the seventh straight month of accelerating MoM CPI prints...

Source: Bloomberg

Core Services costs are accelerating rapidly...

Source: Bloomberg

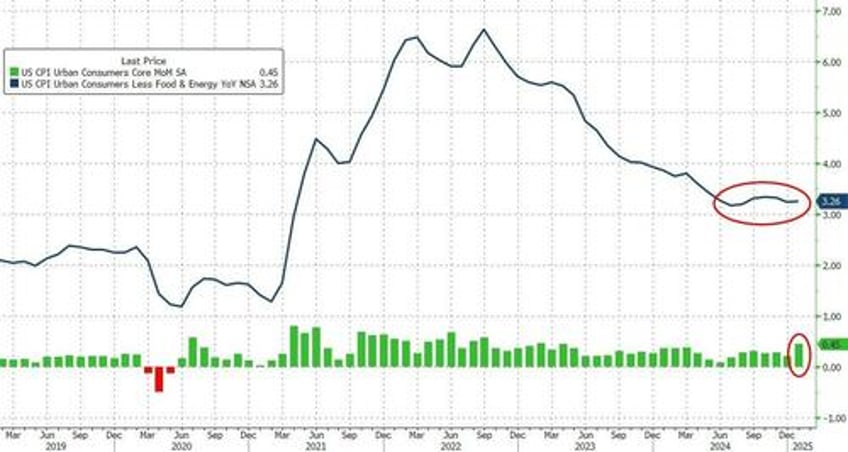

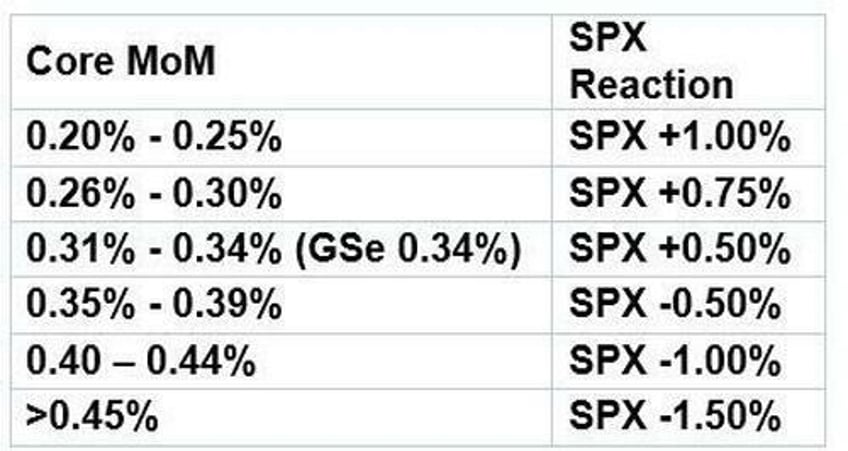

Core CPI - more watched - jumped 0.4% MoM (more than the 0.3% rise expected) and that dragged core consumer prices up 3.3% YoY (3.2% exp)...

Source: Bloomberg

Core Goods prices have shifted away from YoY deflation...

Source: Bloomberg

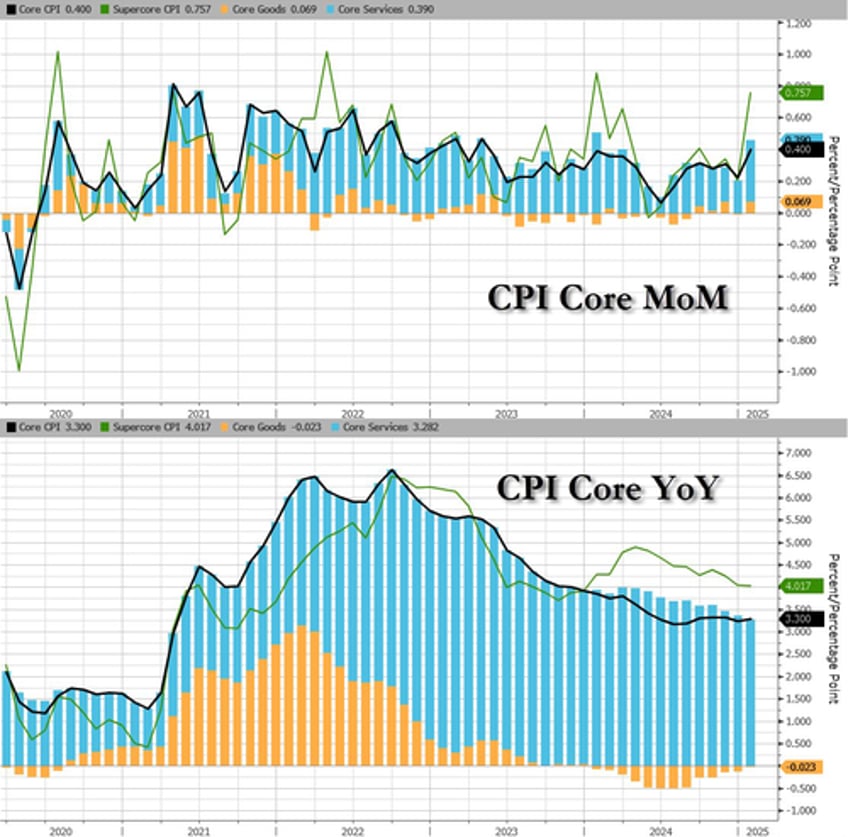

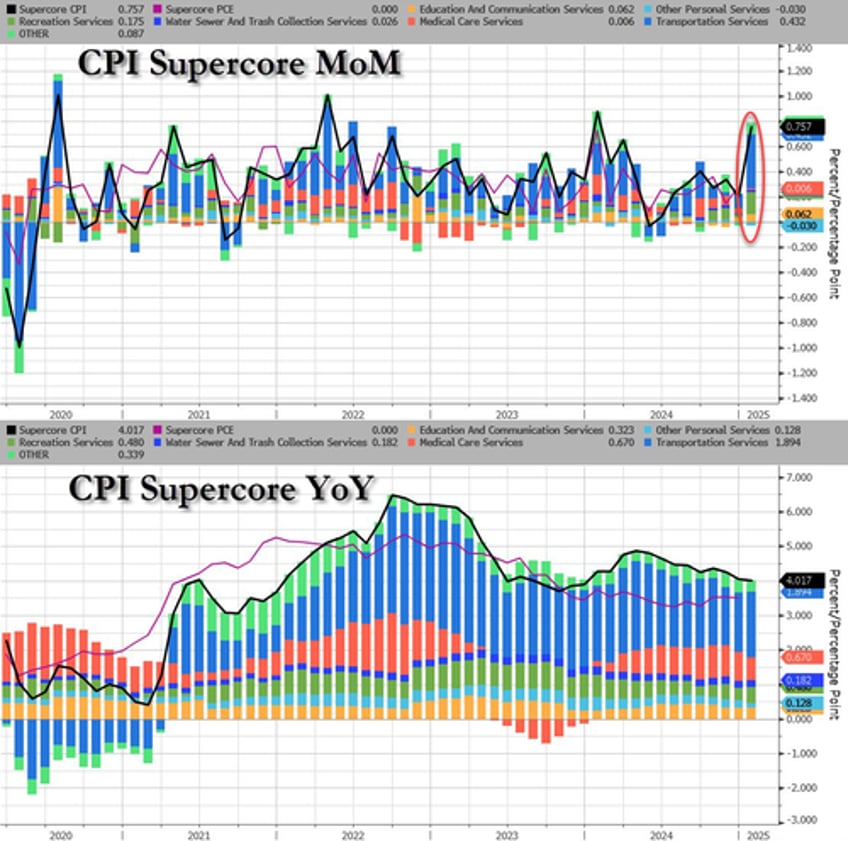

The so-called 'SuperCore CPI' exploded 0.7% MoM higher in January, leaving the YoY rise in prices 'sticky' above 4%...

Source: Bloomberg

Transportation Services costs soared...

Source: Bloomberg

Breakfast just got a lot more expensive...

Wow! My Bacon, Egg & Cheese (With a Cup of Coffee) Price Index just saw its largest-ever monthly price jump in January, surging 6.1% (+18 cents)! Here are the details:

— Michael McDonough (@M_McDonough) February 12, 2025

(Chart from WSL POLITICS) pic.twitter.com/iVdg4yMXek

And before everyone blames Trump, this was baked in the cake from the last year of money supply pumping by Bidenomics...

Source: Bloomberg

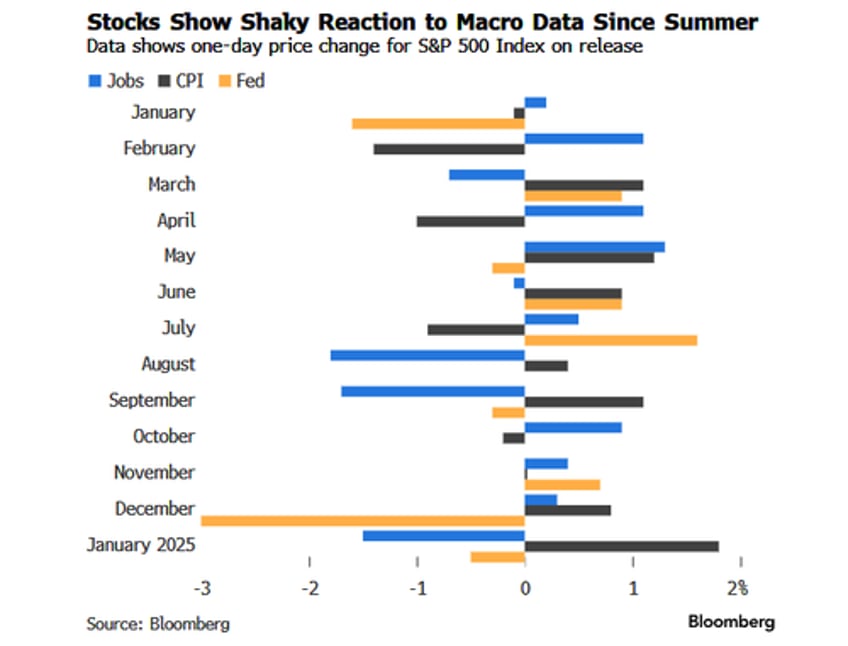

Finally, what will stocks do with this new information?

It's certainly been a wild ride on Payrolls and CPI days, but as Goldman's Lee Coppersmith notes, a hit CPI liked this suggests considerable downside for the S&P today...

And in the pre-market, futures are heading that way...

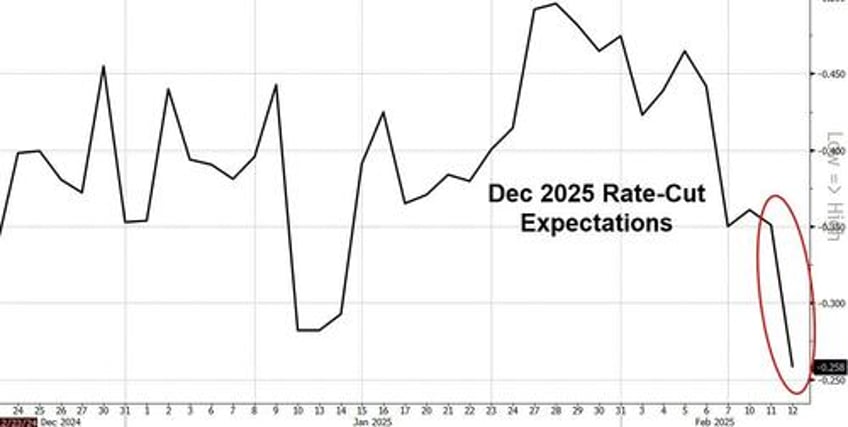

Perhaps more notably, the market is now pricing in just one rate cut this year (pushing expectations from Sept to Dec)...

...but is it different this time under Trump?

Do you see what happens Larry, when Biden's BLS is no longer around to pretend "inflation is contained" pic.twitter.com/bZ2Dcbdmja

— zerohedge (@zerohedge) February 12, 2025