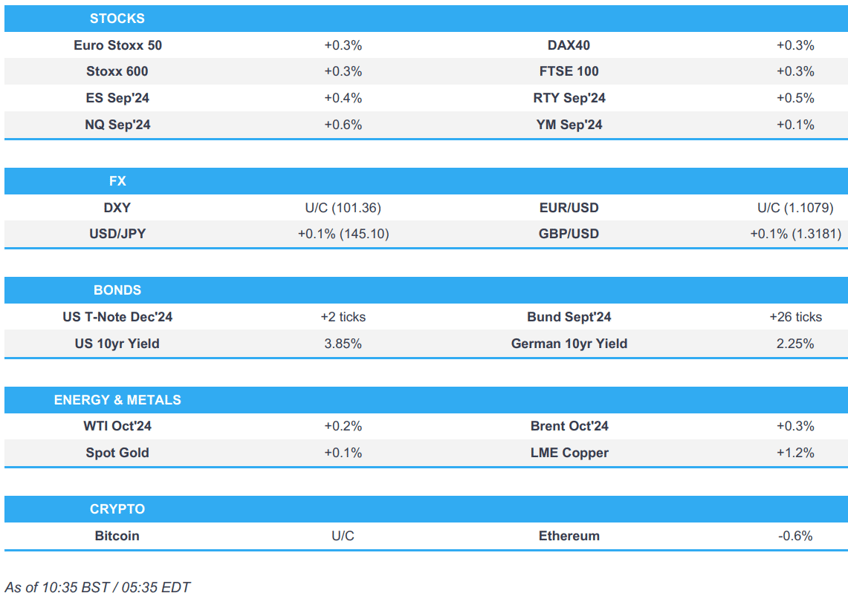

- Equities are trading on the front foot; NVDA +1.6% pre-market

- DXY is flat, EUR unfazed by a slight pick up in Services inflation

- Bonds are incrementally firmer, Bunds climbed above 134.00 into the EZ-inflation metrics, but were unmoved by the release

- Crude holds a modest upward bias, XAU around flat while base metals gain

- Looking ahead, US PCE

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.3%) began the session with a mixed picture, and traded tentatively on either side of the unchanged mark. As the morning progressed, indices gradually picked up and edged towards session highs.

- European sectors hold a strong positive bias; Real Estate is found at the top of the pile, alongside Basic Resources. Tech is found at the foot of the pile, paring back the prior day’s advances and accounting for the post-earning losses in NVIDIA.

- US Equity Futures (ES +0.4%, NQ +0.6%, RTY +0.5%) are entirely in the green, with the NQ outperforming, paring back some of the NVIDIA-induced losses. The docket ahead includes the Fed’s preferred measure of inflation, PCE (July).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- The Dollar is broadly softer vs. peers in the run-up to US PCE metrics. DXY is currently contained within yesterday's 100.88-101.57 range.

- EUR is steady post-EZ inflation data which was broadly in-line. However, greater concern could come via the services metric which rose to 4.2% from 4.0%. EUR/USD is contained just below the 1.11 mark and within yesterday's 1.1055-1.1139 range.

- GBP is firmer vs. the USD but Cable is unable to reclaim the 1.32 handle with the current session high at 1.3198 and south of yesteday's 1.3227 peak.

- JPY was a touch firmer vs. the USD following firm Tokyo inflation data overnight. In terms of price action for USD/JPY, the pair is back on a 144 handle but still some way north of yesterday's 144.22 trough.

- AUD/USD is mildly extending on its recent uptrend which has seen the pair breach 0.68 to the upside with newsflow out of China providing support.

- USD/CNH has continued its recent move to the downside with the latest leg lower prompted by reporting from Bloomberg that China is mulling allowing refinancing on USD 5.4tln in mortgages.

- PBoC set USD/CNY mid-point at 7.1124 vs exp. 7.1116 (prev. 7.1299)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are flat ahead of monthly US PCE, afterwhich conditions will likely become thinner than normal on account of Monday's US market holiday. A few fleeting ticks higher on EGB-drivers, but not sufficient to merit a range of more than a couple of ticks; additionally, yields are pivoting the unchanged mark but with an incremental flattening bias.

- Bunds were slightly firmer after French inflation metrics and climbed above 134.00 into the EZ-wide figures. Headline cooled to 2.2% Y/Y as expected, whilst Services rose to 4.2% (prev. 4%); no real reaction was seen in Bunds.

- Gilts are firmer and specifics quite light, though the UK Nationwide House Price index saw an unexpected drop for the month. Gilts at the top-end of the session's range but shy of the 99.00 handle.

- China's major state-owned banks seen buying USD in onshore foreign exchange market to prevent CNH from appreciating too fast, via Reuters citing sources.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks began with a modest upward bias and have continued to inch higher throughout the European morning despite a lack of fresh drivers.

- Thus far, WTI & Brent have been as high as USD 76.53/bbl and USD 80.60/bbl respectively, just shy of Thursday's USD 76.87bbl and USD 80.78/bbl best.

- Spot gold is essentially unchanged, in-fitting with the tentative performance of FX into monthly US PCE; in a relatively thin USD 2512-2523/oz band, which is towards the upper-end of yesterday's parameters.

- LME Copper is firmer but around familar levels after a choppy and shortened week; upside being driven by the modestly constructive risk tone and USD pressure.

- Liberian Environmental Protection Agency said China Union's iron ore Bong Mines is shut down for several environmental violations, according to Reuters.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU HICP Flash YY (Aug) 2.2% vs. Exp. 2.2% (Prev. 2.6%); HICP-X F, E, A, T Flash MM (Aug) 0.3% (Prev. -0.20%); X F,E,A&T Flash YY (Aug) 2.8% vs. Exp. 2.8% (Prev. 2.9%); HICP-X F&E Flash YY (Aug) 2.8% vs. Exp. 2.7% (Prev. 2.8%)

- EZ Flash HICP Services (Aug) 4.2% Y/Y (prev. 4.0%)

- EU Unemployment Rate (Jul) 6.4% vs. Exp. 6.5% (Prev. 6.5%)

- French CPI (EU Norm) Prelim YY (Aug) 2.2% vs. Exp. 2.1% (Prev. 2.7%); MM (Aug) 0.6% vs. Exp. 0.5% (Prev. 0.2%)

- French CPI Prelim YY NSA (Aug) 1.9% vs. Exp. 1.8% (Prev. 2.3%); MM NSA (Aug) 0.6% vs. Exp. 0.5% (Prev. 0.2%)

- German Unemployment Chg SA (Aug) 2.0k vs. Exp. 16.0k (Prev. 18.0k); Unemployment Rate SA (Aug) 6.0% vs. Exp. 6.0% (Prev. 6.0%)

- German Import Prices MM (Jul) -0.4% (Prev. 0.4%); YY 0.9% (Prev. 0.7%)

- UK Nationwide house price MM (Aug) -0.2% vs. Exp. 0.2% (Prev. 0.3%); YY 2.4% vs. Exp. 2.9% (Prev. 2.1%)

- UK BOE Consumer Credit (Jul) 1.215B GB vs. Exp. 1.3B GB (Prev. 1.162B GB, Rev. 0.869B GB); Mortgage Lending (Jul) 2.786B GB vs. Exp. 2.45B GB (Prev. 2.653B GB, Rev. 2.625B GB); Mortgage Approvals (Jul) 61.985k vs. Exp. 60.5k (Prev. 59.976k, Rev. 60.611k); M4 Money Supply (Jul) 0.3% (Prev. 0.5%)

- Swiss KOF Indicator (Aug) 101.6 vs. Exp. 100.6 (Prev. 101.0, Rev. 100.6)Italian Consumer Price Prelim YY (Aug) 1.1% vs. Exp. 1.2% (Prev. 1.3%); CPI (EU Norm) Prelim MM (Aug) -0.1% (Prev. -0.9%); Consumer Price Prelim MM (Aug) 0.2% vs. Exp. 0.3% (Prev. 0.4%); CPI (EU Norm) Prelim YY (Aug) 1.3% vs. Exp. 1.3% (Prev. 1.6%)

NOTABLE EUROPEAN HEADLINES

- ECB's Schnabel: "while risks to growth have increased, a soft landing still looks more likely than a recession"; "Incoming data broadly confirm the baseline scenario". "In particular, the closer policy rates get to the upper band of estimates of the neutral rate of interest – that is, the less certain we are how restrictive our policy is –, the more cautious we should be to avoid that policy itself becomes a factor slowing down disinflation."; "In other words, the pace of policy easing cannot be mechanical. It needs to rest on data and analysis."; "Wage pass-through may be stronger.". In short, remarks from Schnabel are in-fitting with the data-dependent approach the ECB has been taking but with a slight hawkish skew from the ECB official, in-fitting with her general bias.

- ECB's Kazaks says services inflation remains sticky. Open to a September discussion on policy easing.

NOTABLE US HEADLINES

- Intel (INTC) is said to mull splitting off foundry and scrapping factory projects; explores options with Goldman Sachs (GS) and Morgan Stanley (MS), according to Bloomberg sources. +2.3% in pre-market trade

- US Democratic Presidential Candidate Harris said prices are still too high and added she will not ban fracking as President, via CNN

- US Republican Presidential candidate Trump said he would make government or insurance companies pay for all costs associated with IVF treatments if elected, according to Reuters.

GEOPOLITICS

- "Lebanese sources: Israeli raids on different areas in southern Lebanon", according to Sky News Arabiya.

- Missile attack launched on US military base in eastern Syria, according to IRNA.

- There is now a planned call at the theatre commander level between the US and China, according to Fox's Heinrich. "It comes after China bristled at US Indo-Pacific Command's Adm. Paparo suggesting this week US forces could escort Philippine ships through the South China Sea, following a months-long series of violent confrontations between Chinese and Philippine ships".

- Israeli military says local Hamas commander in West Bank City of Jenin killed by Israeli police.

CRYPTO

- Bitcoin is holding steady just above USD 59.5k, whilst Ethereum slips slightly.

- Elon Musk and Tesla (TSLA) win dismissal of lawsuit claiming they rigged Dogecoin (DOGE)

APAC TRADE

- APAC stocks traded higher across the board despite a lack of fresh catalysts following a mixed lead from Wall Street, and ahead of US PCE and the US long weekend.

- ASX 200 remained in a narrow range (8,045.10-8,085.00) but was propped up by its Industrials, Energy, and Gold names.

- Nikkei 225 traded firmer following a choppy start after August Tokyo core CPI surprisingly ticked higher, whilst the Japanese unemployment rate surprisingly rose.

- Hang Seng and Shanghai Comp opened with modest gains and eventually soared despite a lack of newsflow, whilst Bloomberg suggested the CSI 300 rallied amid heavy volume. Sentiment in China could've also seen tailwinds from the PBoC yesterday suggesting it will step up counter-cyclical adjustments and will strengthen financial support to the real economy, whilst the mood was further lifted amid Bloomberg reports China reportedly mulls allowing refinancing on USD 5.4tln in mortgages.

NOTABLE ASIA-PAC HEADLINES

- China reportedly mulls allowing refinancing on USD 5.4tln in mortgages, according to Bloomberg.

- Japanese government official on industrial output, said if output falls short of plans, August production could fall M/M. September is expected to fall M/M on lower production of semiconductor production equipment and electronic component devices, although the assessment is revised upward, need to be vigilant about the outlook. The official added that the impact of Typhoon Shanshan was not taken into account in August data.

- PBoC injected CNY 30.1bln via 7-day Reverse Repo at a maintained rate of 1.70%.

- China's major state-owned banks seen buying USD in onshore foreign exchange market to prevent CNH from appreciating too fast, via Reuters citing sources.

- China's FX Regulator to launch foreign currency non-deliverable forwards (NDFs) on 2nd September within the interbank market.

- PBoC purchased net CNY 100bln of gov't bonds from dealers during August, via Bloomberg.

DATA RECAP

- ANZ Roy Morgan New Zealand Consumer Confidence Index (Aug) 92.2 (Prev. 87.9)

- New Zealand Building Consents (Jul) 26.2% (Prev. -13.8%, Rev. -17.0%)

- South Korean Industrial Output Growth (Jul) -3.6% vs. Exp. -0.4% (Prev. 0.5%); marks the fastest fall since Dec 2022

- South Korean Industrial Output YY (Jul) 5.5% vs. Exp. 7.0% (Prev. 3.8%)

- Japanese CPI Tokyo Ex fresh food YY (Aug) 2.4% vs. Exp. 2.2% (Prev. 2.2%)

- Japanese CPI, Overall Tokyo (Aug) 2.6% (Prev. 2.2%)

- Japanese Unemployment Rate (Jul) 2.7% vs. Exp. 2.5% (Prev. 2.5%)

- Japanese Jobs/Applicants Ratio(Jul) 1.24 vs. Exp. 1.23 (Prev. 1.23)

- Japanese Retail Sales YY (Jul) 2.6% vs. Exp. 2.9% (Prev. 3.7%, Rev. 3.8%)

- Japanese Industrial O/P Prelim MM SA (Jul) 2.8% vs. Exp. 3.3% (Prev. -4.2%)

- Japanese IP Forecast 2 Mth Ahead (Sep) -3.3% (Prev. 0.7%)

- Japanese IP Forecast 1 Mth Ahead (Aug) 2.2% (Prev. 6.5%)

- Australian Retail Sales MM Final (Jul) 0.0% vs. Exp. 0.3% (Prev. 0.5%)

- Australian Private Sector Credit (Jul) 0.5% (Prev. 0.6%)

- Australian Housing Credit (Jul) 0.5% (Prev. 0.4%)