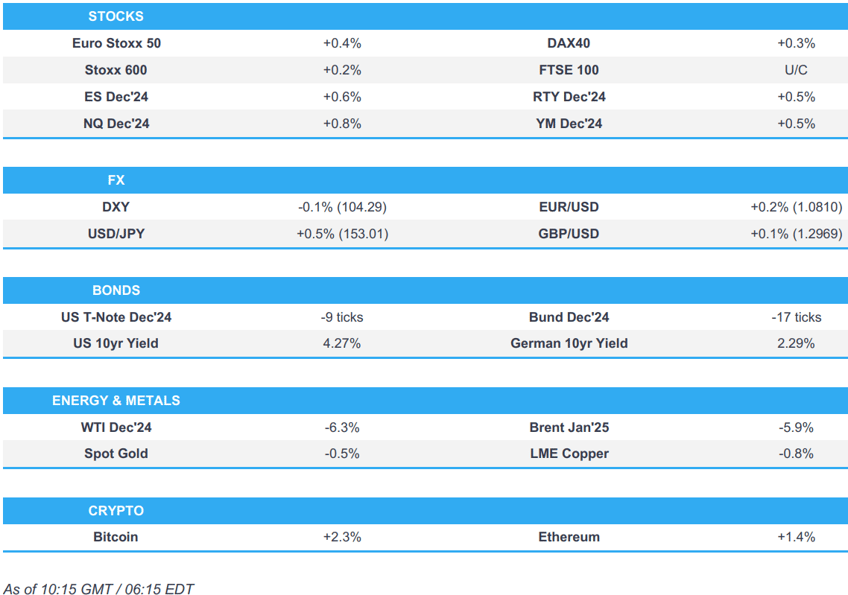

- European bourses are on a firmer footing, traders garnering optimism following the relatively moderate Israeli attack on Iran, which saw the former avoid hitting energy/nuclear facilities; US futures also benefit.

- USD is mixed, losing vs EUR & GBP but significantly stronger vs JPY after the Japanese general election which has seen the ruling coalition lose its parliamentary majority.

- Bonds are pressured by the removal of geopolitical risk premia, but have lifted off lows in recent trade given the continued pressure in oil prices.

- Crude gapped lower overnight and has continued to slip since the European cash open; Brent Jan’25 currently at lows of USD 71/bbl. XAU/base metals are also pressured.

- Looking ahead, Japanese Unemployment, Comments from BoC Governor Macklem & ECB’s de Guindos, Supply from US, Earnings from Waste Management, Welltower, Ford.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.4%) are almost entirely in the green (ex-AEX), with traders garnering optimism following the relatively moderate Israeli attack on Iran, which saw the former avoid hitting energy/nuclear facilities; indices have slipped off best levels in recent trade.

- European sectors hold a strong positive bias; Construction & Materials takes the top spot with Chemicals in second and Media in third. Energy is by far the clear underperformer, hampered by losses in the crude complex, following the aforementioned geopolitical updates.

- US Equity Futures (ES +0.4%, NQ +0.5%, RTY +0.4%) are entirely in the green, continuing the price action seen in Europe, which have ultimately benefited from the moderate Israeli attacks on Iran over the weekend.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is mixed vs. peers (softer vs. EUR, firmer vs. JPY) with DXY a touch lower but firmly on a 104 handle. Today's docket is fairly thin, but picks up in the form of US ADP, GDP, PCE, NFP and ISM Manufacturing all due later in the week.

- EUR is firmer vs. the USD and the best performer across the majors in an attempt to claw back recent losses that dragged the pair as low as 1.0760 last week. EUR/USD has made its way back onto a 1.08 handle but is yet to threaten Friday's 1.0839 peak.

- GBP is marginally firmer vs. the USD but with Cable unable to make its way above Friday's high at 1.2999 and back onto a 1.30 handle. UK Budget will be in focus this week; Chancellor Reeves is expected include a series of tax hikes but ultimately be viewed as expansionary. For now, Cable is pivoting around its 100DMA at 1.2969.

- JPY is the laggard across the majors following the Japanese general election which has seen the ruling coalition lose its parliamentary majority. USD/JPY has made its way onto a 153 handle and is now at levels not seen since late July.

- Antipodeans are both flat vs. the USD. After printing a fresh multi-month low overnight, AUD/USD has pared losses and moved back above the 0.66 mark. NZD/USD remains stuck on a 59 handle.

- PBoC set USD/CNY mid-point at 7.1307 vs exp. 7.1311 (prev. 7.1090).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are pressured by the removal of geopolitical risk premia though also find themselves off lows as the pullback in energy prices begins to weigh on yields and exert upward pressure on benchmarks; though, still very much in the red. US docket is front-loaded on account of the Fed, with 2yr & 5yr supply today serving as another bearish factor and likely explaining the relative. USTs are currently trading around 110-25 and off the lows of 110-18+.

- Bunds are on the back-foot given the aforementioned removal of geopolitical risk premia. Overnight pressure was also a function of ECB speakers, with Knot & Nagel both making relatively hawkish remarks; in recent trade, the complex has lifted off worst levels, given the continued pressure in oil prices; currently looking to test 133.00 to the upside.

- Gilts are softer in-fitting with the above but finding itself under slightly more pressure with the count down to the budget in its final stages. Gilts gapped lower by 71 ticks before slipping a handful further to a 95.52 trough.

- Click for a detailed summary

COMMODITIES

- The crude complex is under marked pressure after Israel’s retaliation against Iran targeted military targets and avoided petroleum or nuclear facilities. Attacks which caused crude to gap lower by around USD 3/bbl before slipping further to current troughs of USD 67.14/bbl and USD 71.00/bbl respectively for WTI & Brent.

- Spot gold is softer, as the metal is tarnished by the removal of some geopolitical premia from the market after Israel’s retaliation. Pressure which has taken gold to a USD 2724/oz base, still comfortably above the last two week’s troughs at USD 2717/oz and USD 2715/oz respectively.

- Base metals are under pressure despite the constructive risk tone. However, the pressure is relatively modest in nature with 3M LME Copper comfortably clear of USD 9.5k.

- China's September YTD gold output fell 1.17% Y/Y to 268 metric tons and gold consumption fell 11.18% Y/Y to 741.7 metric tons, according to the Gold Association.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Lloyds Business Barometer (Oct) 44 (Prev. 47)

- Spanish Retail Sales YY (Sep) 4.1% (Prev. 2.3%)

NOTABLE EUROPEAN HEADLINES

- UK PM Starmer said the Budget will include tough decisions and a long-term plan, with Chancellor Reeves due to announce tax hikes and extra borrowing, according to Bloomberg. The Times suggests that tax hikes could amount to GBP 35bln.

- UK Chancellor Reeves said the UK government is to announce GBP 500mln in aid from energy suppliers, while the announcement could be made in the upcoming budget.

- UK retail investors are "piling" into Gilts amid fears that the Labour government will raise the capital gains tax rate on shares in the budget this week, according to The Times.

- ECB’s Knot said he expects the Eurozone economy will strengthen and inflation risks have become more balanced, while he added it is too soon to declare victory over inflation and that it is important the ECB keeps all options on rates. Furthermore, Knot said need to see a bit more conviction that wages will fall as forecast and the labour market is tight, as well as noted that the market has brought forward the path for rate cuts and they will have to see in December if that was over-enthusiastic.

- ECB’s Nagel said they shouldn’t be too hasty in taking action on rates.

- Georgian President Zourabichvili said regarding the election results that they have been the victims of a Russian special operation and that Georgian authorities took away citizens’ right to choose, while she does not recognise the election results due to fraud and called for protests against the results. Furthermore, European Council President Michel said they call on Georgia’s central election committee and other authorities to swiftly, transparently and independently investigate and adjudicate electoral irregularities and allegations.

- Moody’s affirmed France at Aa2; Outlook revised to negative from stable.

GEOPOLITICS

MIDDLE EAST - EUROPEAN SESSION

- Parties concerned (re. Israel) are looking into the possibility of resuming negotiations and meeting technical teams within days, via AJ Breaking.

MIDDLE EAST - WEEKEND/APAC SESSION

- Israel conducted a military strike on targets in Iran early on Saturday and the military said the retaliatory strike has been completed with the objectives achieved, while targets included missile manufacturing facilities used by Iran in its attacks on Israel over the past year. Furthermore, a US official noted that Israel’s strikes were on military targets in Iran as opposed to oil infrastructure or nuclear sites, while Iran said the Israeli strike killed four people who all served in the country’s military air defence.

- Israeli PM Netanyahu said the Israeli air force hit hard Iran’s ability to defend itself and its ability to produce missiles, while he added Israel’s attack on Iran was strong, precise and achieved all of their objectives, according to Reuters.

- Israeli politicians inside and outside PM Netanyahu’s coalition lamented the strikes as not aggressive enough, according to The New York Times. It was also reported that estimates in Israel indicate Iran would need a year before it can rebuild its missile capabilities, according to Sky News Arabia.

- Israel's Channel 13 quoted military officials that stated they do not rule out that the Air Force will have to carry out another military operation in Iran in which any further attack on Iran will focus on government targets and infrastructure, while they will not strike any Iranian nuclear targets in any new attack, according to Sky News Arabia.

- Israel expects that Iran would launch a counterattack against the Jewish state in response to its successful strike against Iranian military targets including missile production facilities, according to security sources cited by Jerusalem Post.

- Iran’s Supreme Leader Khamenei said Israel’s attack should neither be downplayed nor exaggerated and noted officials should determine how best to demonstrate Iran’s power to Israel, according to IRNA.

- Iran’s President said Iran is not seeking war but will respond appropriately to Israel’s attack, according to state media.

- Iran’s Foreign Minister said Iran has no limits in defending its territorial integrity, according to Tasnim. The minister also stated in a letter to the UN Secretary-General that Tehran reserves the right to respond to Israel’s criminal aggression.

- Iranian air defence said Israel attacked certain military centres in Tehran, Khuzestan and Ilam, while it successfully tracked and countered Israeli aggression although limited damage was caused to some locations, according to Reuters. It was also reported that Israel sent a message to Iran before the attack and warned it not to respond, according to Axios. Furthermore, Sky News Arabia quoted unanimous sources that stated Iran informed Israel through a foreign mediator that it will not respond to the strike.

- IRGC commander said the Israeli attack failed to achieve its goals and the failure confirms Israel's miscalculation, while the commander added that bitter and unimaginable consequences await Israelis, according to Sky News Arabia.

- US President Biden said he hopes the Israeli strikes against Iran are the end and it looks like Israel didn’t hit anything except military targets. It was separately reported that a senior Biden official said the direct military exchange between Israel and Iran should be over and warned that there will be consequences for Iranian responses, according to Reuters.

- Israel conducted an airstrike that targeted some military sites in central and southern areas of Syria, according to Syrian state media.

- Hezbollah urged residents of more than two dozen Israeli settlements to immediately evacuate and said these settlements have become bases for the Israeli military and are now legitimate targets. Hezbollah also said it targeted Israel’s Tel Nof airbase south of Tel Aviv with drones, according to Reuters.

- Egyptian President Sisi said Egypt proposed a two-day ceasefire in Gaza to exchange four Israeli hostages with some Palestinian prisoners, while he added talks will take part within 10 days of implementing a temporary ceasefire to reach a permanent one. However, Israeli media later reported that two ministers rejected the proposal by Egypt regarding a Gaza ceasefire, according to Sky News Arabia.

- Iran’s Interior Ministry said ten Iranian border guards were killed in the attack in southeastern Iran in the latest clash with suspected Sunni Muslim militants.

OTHER

- Russian President Putin said he hopes NATO heard his words about permitting Ukraine to fire Western long-range weapons at Russia and warned Russia will use a range of responses if Ukraine is permitted to strike into Russia with Western long-range weapons, according to TASS.

- Russian forces took control of the village of Izmailivka in Ukraine’s Donetsk region and captured Oleksandropil in eastern Ukraine, according to RIA.

- NATO said a high-level delegation from South Korea will brief the North Atlantic Council on Monday regarding North Korean troop deployment to Russia.

- Foreign and defence ministers from South Korea and the US will hold talks on October 31st.

- US State Department approved the potential sale of radar turnkey systems to Taiwan for an estimated cost of USD 828mln and the potential sale of advanced surface-to-air missiles system to Taiwan for an estimated cost of USD 1.19bln. It was also reported that China said it filed a diplomatic complaint with the US and reserved the right to retaliate after the weapons sales to Taiwan, according to Bloomberg.

CRYPTO

- Bitcoin benefits from the positive risk tone and climbs back above USD 68k.

APAC TRADE

- APAC stocks were mostly positive as markets digested key events over the weekend including Israel's strike on Iran which was aimed at military targets and not petroleum or nuclear facilities, while the election in Japan saw the ruling coalition lose its majority.

- ASX 200 traded indecisively as gains in tech and the mining sectors offset the weakness in real estate, utilities and energy.

- Nikkei 225 quickly shrugged off the initial post-election jitters and surged on the back of a weaker currency and prospects that the political uncertainty could delay the resumption of the BoJ's rate normalisation.

- Hang Seng and Shanghai Comp swung between gains and losses but ultimately eked mild gains after the PBoC announced it is to utilise outright reverse repo operations today, which will be conducted on a monthly basis and is a new policy tool aimed at managing liquidity.

JAPANESE ELECTION

- Japan’s ruling coalition lost its parliamentary majority in Sunday’s election in which the LDP and its junior coalition partner won 209 seats with all but 20 of the 465 seats accounted for, which is short of the 233 needed for a majority although the ruling party may seek partners in an effort to form a government, according to reports citing Japanese press.

- Japanese PM Ishiba said the election results were very difficult, while he responded “That would be the case” when asked if he would continue in his current position despite the election results. Furthermore, Ishiba commented that they cannot allow any gaps in domestic politics amid very difficult security and economic conditions, while he added that they must go ahead with various measures including compiling an extra budget. Furthermore, Ishiba said he is not thinking at this moment specifically about a new coalition and will compile an economic stimulus package and extra budget taking into account various parties' ideas.

- Japan's gov't & ruling bloc are to arrange to convene a special parliament session to vote on the PM on November 11th, via Kyodo.

NOTABLE ASIA-PAC HEADLINES

- PBoC announced to conduct an outright reverse repo operation today and will conduct monthly outright reverse repo operations once a month with a tenor of less than one year which it will use to trade with primary dealers in the opening market. Chinese press noted that the PBoC's new outright reverse repo will cover tenors including 3-month and six-month, while it will improve liquidity adjustments in the year ahead with the tool meant to counteract the maturing Medium-term Lending Facility loans towards year-end.

- CNOOC (883 HK) Q3 (CNY): Net 36.9bln, +9% Y/Y, Revenue 99.2bln (prev. 114.8bln Y/Y).

- Sinopec (386 HK) Q3 (CNY) IFRS Net 8.03bln, -55% Y/Y.

DATA RECAP

- Chinese Industrial Profits YY (Sep) -27.1% (Prev. -17.8%)

- Chinese Industrial Profits YTD YY (Sep) -3.5% (Prev. 0.5%)