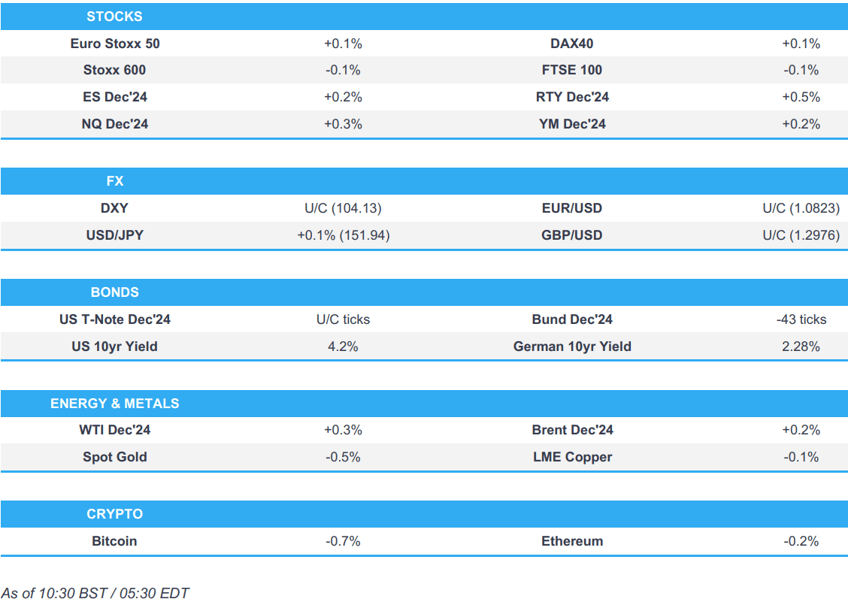

- European bourses hold a slight positive tilt after initially opening on a modestly weaker footing; US futures are entirely in the green.

- Dollar is flat ahead of Durable Goods, JPY was fairly unreactive to mixed Tokyo CPI.

- USTs are flat but directionally in-fitting with the pressure seen in Bunds, sparked by strong German Ifo metrics.

- Crude is very modestly firmer but ultimately within a contained range, XAU/base metals are pressured.

- Looking ahead, US Durable Goods, UoM (Final), Moody's on France, Comments from Fed's Collins, Earnings from Colgate-Palmolive.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.2%) began the session very modestly in negative territory, but have clambered off worst levels in recent trade and now generally reside near session highs.

- European sectors hold a strong negative bias, with only a handful of sectors managing to hold afloat; Banks is lifted by post-earning strength in NatWest (+4.7%). Travel & Leisure is at the foot of the pile, hampered by losses in Accor. Autos are not quiet underperforming, but remain subdued after Mercedes-Benz (-2.6%) cut guidance.

- US Equity Futures (ES +0.2%, NQ +0.3%, RTY +0.5%) are entirely, albeit modestly so, in the green; continuing the upside seen in the prior session.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is net flat vs. peers. Fresh macro drivers for the US have been on the lighter side this week with yesterday's PMI and IJC metrics doing little to sway Fed pricing. Attention going forward is on next week's NFP and upcoming US Presidential election.

- EUR is steady vs. the USD and relatively resilient given soft PMI data yesterday, ECB speak which has increased the odds of a 50bps December rate and looming US election risk in the event of a Trump victory. EUR/USD currently sitting around 1.0825.

- GBP is flat vs. the USD at the end of what was a week that was expected to see BoE speak help guide expectations over future easing. However, interjections by MPC officials have proved relatively non-incremental. Cable is currently trading towards the top end of last Friday's 1.2908-87.

- JPY is steady vs. the USD in the run-up to two crucial Japanese risk events; Japan's general election on Sunday and then the BoJ. USD/JPY is currently holding below the 152 mark but above its 200DMA at 151.41.

- Antipodeans are both softer vs. the USD as attempted recoveries vs. the USD continue to falter amid looming US election risk. AUD/USD is currently lingering around its 200DMA at 0.6628. NZD/USD has continued its drift lower and slipped onto a 0.59 handle.

- Barclays month-end rebalancing model: weak USD buying against most majors, neutral against EUR and weak USD selling against JPY.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are flat with specifics light so far and while USTs have been dragged to a 111-06 low by EGBs they are yet to convincingly slip into the red. Docket ahead has durables in addition to potential remarks from Fed’s Collins.

- Bunds are in the red, initial action was somewhat contained with a slight positive bias following JGBs after Tokyo CPI. However, another set of relatively strong German metrics placed pressure on EGBs, sending Bunds to a 133.14 trough in the 20-minutes after the data, where they currently reside.

- Gilts opened lower by just two ticks, specifics have been light since yesterday’s Reeves-induced downside. Gilts have followed EGBs lower though only by a few ticks. To a 96.18 base which remains some way clear of Thursday’s 95.68 trough.

- Italy sells EUR 2.5bln vs exp. EUR 2-2.5bln 2026 BTP Short term and EUR 2.5bln vs. exp. EUR 2-2.5bln 1.80% 2036 and 0.40% 2030 I/L BTP

- Click for a detailed summary

COMMODITIES

- WTI and Brent are contained, having attempted to recoup some of the prior day's losses but ultimately failing to materially break out of overnight ranges. Brent'Dec currently sits at around USD 74.70/bbl.

- Precious metals are under modest pressure, though XAU remains comfortably above the USD 2700/oz mark.

- Base metals are pressured, in-fitting with the European risk tone this morning and soft performance in auto names which is weighing on the demand-side for the complex.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Ifo Current Conditions New (Oct) 85.7 vs. Exp. 84.4 (Prev. 84.4); Ifo Business Climate New (Oct) 86.5 vs. Exp. 85.6 (Prev. 85.4); Ifo Expectations New (Oct) 87.3 vs. Exp. 86.8 (Prev. 86.3)

- UK GfK Consumer Confidence (Oct) -21.0 vs. Exp. -21.0 (Prev. -20.0)

- French Consumer Confidence (Oct) 94.0 vs. Exp. 94.0 (Prev. 95.0)

- Italian Consumer Confidence (Oct) 97.4 vs. Exp. 98.5 (Prev. 98.3); Mfg Business Confidence (Oct) 85.8 vs. Exp. 87.0 (Prev. 86.7, Rev. 86.6)

- EU Money-M3 Annual Growth (Sep) 3.2% vs. Exp. 3.0% (Prev. 2.9%); Loans to Non-Fin (Sep) 1.1% (Prev. 0.8%); Loans to Households (Sep) 0.7% (Prev. 0.6%)

NOTABLE EUROPEAN HEADLINES

- UK PM Starmer said Britons who receive additional income from stock holdings don’t count as ‘working people,’ which suggests he is willing to raise taxes on investors, according to Bloomberg.

- The EU Commission says the EU and China have agreed to further technical negotiations on EVs

- ECB's Kazaks says "I don't see case for rates to fall below neutral: it would require a weaker baseline substantial undershooting of target".

- ECB's Simkus doesn't see case for 50bps cut, says "the destination for rates is more important". "We are on a disinflationary path". "Need to reduce still-restrictive rates". "Economy quite sluggish but not doing that badly".

- ECB's Vujcic says he is open on the December rate decision, via Bloomberg.

NOTABLE US HEADLINES

- Big Village public opinion poll showed Harris at 52% vs Trump at 45% which was conducted on October 23rd and involved around 1,600 respondents.

- US Presidential Candidates Harris & Trump are tied for the popular vote, both on 48%, according to the final NYT/Siena poll

GEOPOLITICS

- MIDDLE EAST

- Iran's Supreme Leader Khamenei ordered plans to respond to a possible Israeli attack but stressed that Iran will not act if the Israeli attack is limited, according to The New York Times. Iranian officials said Khamenei ordered the military to devise multiple military plans for responding to an Israeli attack in which the scope of any Iranian retaliation will largely depend on the severity of Israel’s attacks with Iran to retaliate if Israeli strikes inflict widespread damage and high casualties, but if Israel limits its attack to a few military bases and warehouses storing missiles and drones, Iran may do nothing. Furthermore, Khamenei directed that a response would be certain if Israel strikes oil and energy infrastructure or nuclear facilities, or if it assassinates senior officials.. "The officials, including two members of the Islamic Revolutionary Guard Corps, said that if Israel inflicted major harm, the responses under consideration included a barrage of up to 1,000 ballistic missiles; escalated attacks by Iranian proxy militant groups in the region; and disrupting the flow of global energy supplies and shipping moving through the Persian Gulf and the Strait of Hormuz."

- Israel conducted raids on the area of Choueifat Amrousiya, Haret Hreik and the Hadath area in the southern suburbs of Beirut, according to Sky News Arabia. Israel also conducted a raid on the Masnaa border crossing between Lebanon and Syria, as well as on the residence of press teams in the southern town of Hasbaya, Lebanon.

- Israel said its spy chief will attend Gaza ceasefire talks, while Hamas vows to stop fighting if a truce is reached, as long-stalled efforts to end the war appeared to gain momentum, according to Arab News via X.

- Egyptian media reported that an Egyptian security and military delegation met with the head of the Mossad and a delegation from the Shin Bet. It was separately reported that a Hamas delegation went to Cairo to listen to proposed ceasefire deal ideas but there is no change in the group's position, according to a Hamas senior official.

- Secretary General of the Gulf Cooperation Council said their recent meetings with Iran focused on the future of relations and ensuring calm, while their main goal is to end military operations in the Gaza Strip and Lebanon.

OTHER

- Russian President Putin said the cross-border payments issue is important and will develop cooperation within BRICS, while he added that BRICS does not pursue a separate common payment system and if the US is open to normal relations with Russia, they will do the same. Putin earlier said they will discuss peaceful settlements of conflict in the Middle East and that Ukraine is being used to create strategic threats to Russia.

- Elon Musk has reportedly been in regular contact with Russian President Putin since late 2022 and at one point, Putin asked him to avoid activating his Starlink internet service over Taiwan as a favour to Chinese President Xi, according to WSJ.

CRYPTO

- Bitcoin is slightly lower and sits beneath USD 68k.

APAC TRADE

- APAC stocks were mostly higher following a similar handover from Wall St albeit with upside capped in a somewhat cautious session amid ongoing geopolitical concerns and heading into next month's key events.

- ASX 200 marginally gained and was led by notable strength in tech after WiseTech's CEO and founder stepped down due to a secret affairs and payments scandal, although the upside in the index was limited by weakness in consumer stocks.

- Nikkei 225 underperformed following recent yen strength and amid uncertainty ahead of Sunday's election.

- Hang Seng and Shanghai Comp rebounded from yesterday's selling with the help of strength in tech and automakers, while the PBoC conducted an MLF operation and kept the 1-year MLF rate unchanged at 2.00%, as expected.

NOTABLE ASIA-PAC HEADLINES

- China's NPC standing committee meeting to start from Nov 4th running until Nov 8th

- PBoC conducted a CNY 700bln (CNY 789bln maturing) 1-year MLF operation with the rate kept at 2.00%.

DATA RECAP

- Tokyo CPI YY (Oct) 1.8% vs. Exp. 1.9% (Prev. 2.2%)

- Tokyo CPI Ex. Fresh Food YY (Oct) 1.8% vs. Exp. 1.7% (Prev. 2.0%)

- Tokyo CPI Ex. Fresh Food & Energy YY (Oct) 1.8% vs. Exp. 1.6% (Prev. 1.6%)

- Japanese Services PPI (Sep) 2.60% (Prev. 2.70%)

- Chinese FDI (YTD) (Sep) -30.4% (Prev. -31.5%)