By Jan-Patrick Barnert, Bloomberg markets live reporter and strategist

There are two pieces of stock market wisdom which — unlike many others — often ring true: “buy protection when you can, not when you must” and “a hedged pot never boils.” Both seem to be at play right now.

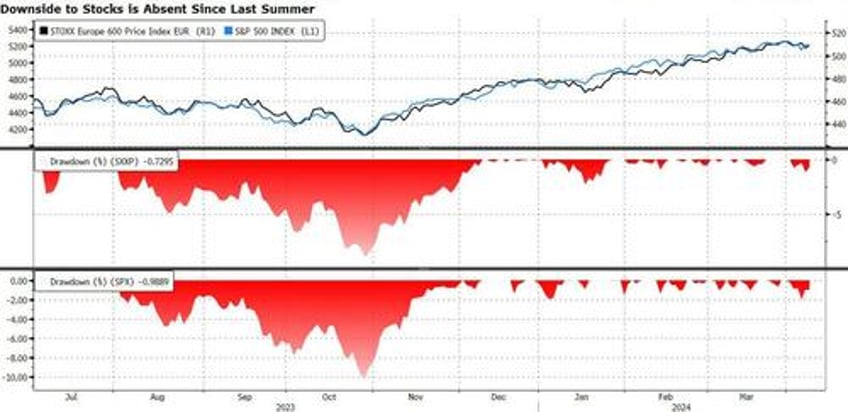

Last Thursday’s equity drop was followed the next day by a 1% gain on Wall Street and a late-session bounce in the Stoxx 600. That fits the pattern we’ve seen since December — that of an uptrend punctuated with occasional drops, before markets to cruise back to record highs in a day or two.

Strategists at Tier 1 Alpha acknowledge Thursday’s move was “one of those exogenous events that took markets unexpectedly for a loop.” But they note that as the selloff accelerated, oil prices and Bitcoin spiked, while US short-term rates and gold snoozed. With no across-the-board flight to safe havens, Thursday was likely more about individual investors hedging positions, rather than everyone rushing for the door, they say adding that “somebody felt more pain than the rest of us.”

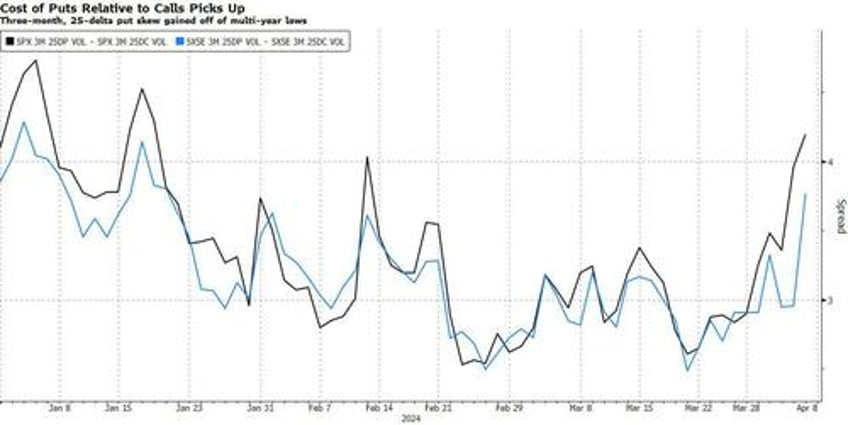

Indeed, buying and pricing of put options is picking up both in Europe and the US. Levels are certainly not extreme but the trend indicates investors are less complacent than before, as the timing of the first US interest-rate cut recedes further into the year.

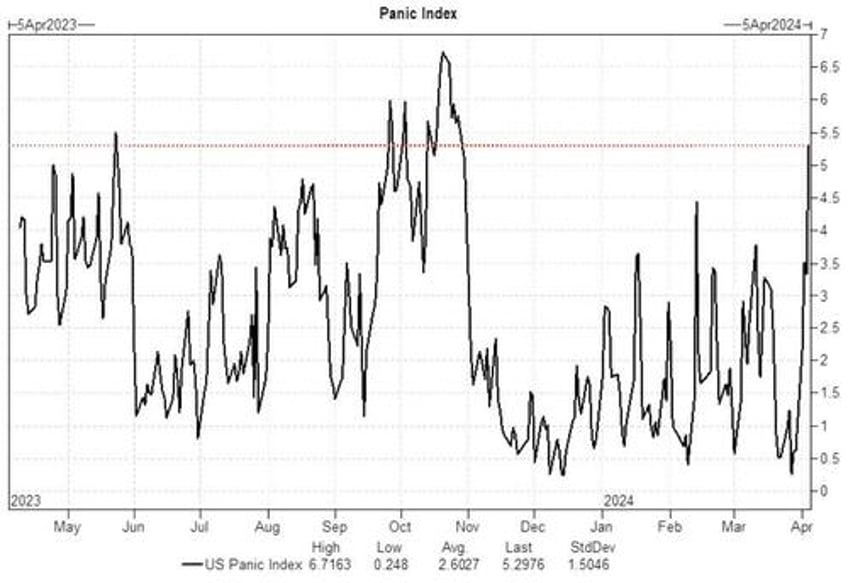

“For the first time this year, we saw real demand for protection on Thursday, as the GS Panic Index reached its highest level since last fall,” Goldman Sachs’s Derivatives Sales Trading desk tells clients. And the bank’s prime desk points to net US equity sales heading into Friday’s non-farm payrolls print, with short sales outpacing long buys.

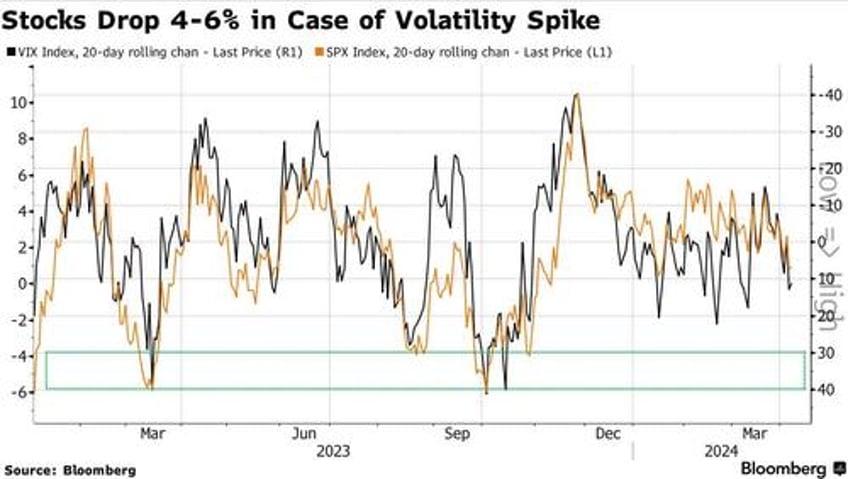

Meanwhile, Thursday’s move lifted the VIX above 16 points — a departure from the pattern of recent months, whereby the gauge mostly closed below the 15-point mark. If the correlations illustrated by our chart below hold true, stocks might be in for some more trouble — essentially a VIX spike along the lines of last spring and summer would imply a 4-6% equity decline over a 20-day rolling period.

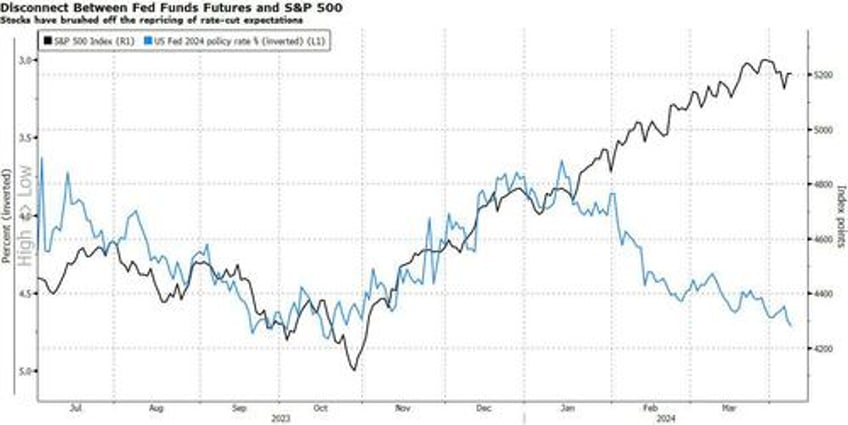

Finally, take a look at market momentum. That’s deteriorated over the past two trading days, with pro-cyclical benchmarks such as DAX and Dow lagging, alongside US mid- and small-cap stocks. These areas are usually sensitive to interest rates, yet for months they have largely ignored the US rate-cut re-pricing, widening the stock-bond gap to a level many would consider uncomfortable.

“This gap combines with various risks, technical indicators and signals to suggest not chasing equity markets here. We would look for better entry points ahead,” writes Berenberg analyst Jonathan Stubbs. His view echoes that of Amundi, which missed the recent rally yet plans to wait for a market pullback before wading into buy.

It all suggests investors plan to stay in the game for now, merely adjusting their portfolios to their highest conviction trades. But at such cheap levels, putting hedges in place increasingly looks like a no-brainer.