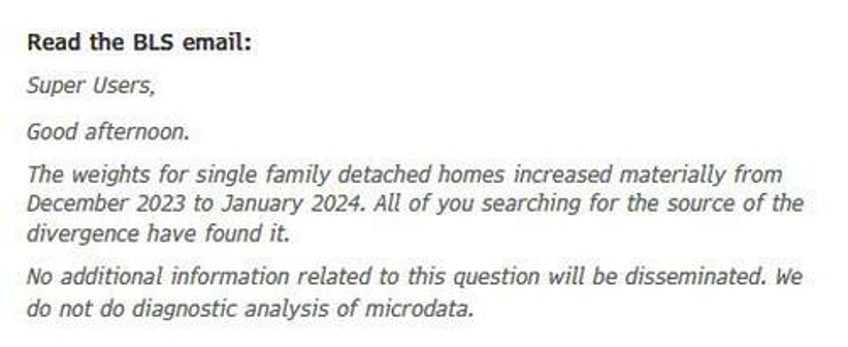

A little over a month ago, a scandal erupted among the (relatively small( group of economists who keep a close eye on the monthly inflation data reported by the Biden Department of Labor, when they learned that there is an even smaller, and much more exclusive group of economists called "super users" who get preferential treatment from the BLS, including wink-wink-nudge-nudge explanations of where the data may diverge from expectations. That was the case for the January CPI when as Bloomberg first reported, the BLS sent an email to a group of data “super users”, which "explained suggested a surge in a measure of rental inflation — which left analysts puzzled — was caused by an adjustment to how subcomponents of the index are weighted":

Once it became public knowledge that there was a super secret group of preferential "accounts" receiving economic data, immediately following the Bloomberg report, a recipient of the email said that BLS Statistics "tried to retract it and that they were told to disregard its contents." Almost as if they were trying to hide it after the fact.

In retrospect, it appears the BLS really did have something to hide, because in a follow up from both the NYT and Bloomberg, we now learn that an economist from the Bureau of Labor Statistics was corresponding on data related the monthly CPI print with major firms like JPMorgan and BlackRock, in what Bloomberg said "raised questions about equitable access to economic information."

Extending on the report from February, records requested by Bloomberg revealed that the unnamed BLS economist answered numerous inquiries about details within the CPI in recent months, mostly related to computations in key categories within shelter as well as used cars, according to

The back and forth between the financial firms and the economist "who has been with the BLS for many years" was first reported by the New York Times; as discussed previously, the government bureaucrat sent several emails to a broader group, which he called “my super users” in one of the emails obtained by Bloomberg. The BLS previously lied when it said it doesn’t maintain a list of “super users.”

In mid-February, one user asked if they could be added to the “super user email list,” to which the BLS economist replied minutes later, “Yes I can add you to the list.” The move was an attempt by the lowly paid government worker to curry favor with his much better paid peers on the sell- and buyside so that he could, one day, trade the preferential data access for a cushier job in some hedge fund or Wall Street firm.

As Bloomberg details, while the recipients’ names were redacted from the request, email signature details or disclosures from their employers were visible in some of the provided records. And in addition to BlackRock and JPMorgan, other banks, hedge funds and research firms — Brevan Howard, Millennium Capital Partners LLP, Citadel, Moore Capital Management, High Frequency Economics, Nomura Securities International and BNP Paribas — appeared in the exchanges and declined to comment. Pharo Management and Wolfe Research also came up in the emails but didn’t provide comment.

Understandably, economists - at least those who were not important enough to be on the "super user" list - have been clamoring to find out more about these “super users” are after the BLS staffer addressed an email to those people in February, suggesting that a change to the weights of underlying data within a key measure of rental inflation was behind its surge in January’s CPI. As we reported at the time, the BLS told recipients to disregard its contents, and subsequently tried to clear the confusion with a notice on its website. The agency also said that the email was “a mistake.”

But, as noted above, we now know that this was merely the latest lie by a Biden agency; and so this latest revelation "is likely to prompt a deeper look at the dissemination of economic information that has implications for how major assets trade as well as Federal Reserve policy."

The BLS encourages people to ask questions and makes its staff available to engage with the public, but they strive to create equal access to information for everyone, said Emily Liddel, associate commissioner for publications and special studies at the BLS. Clearly, granting access only to Wall Street giants is not quite the equitable treatment the agency's woke DEI staffers envisioned.

“Obviously this has been an embarrassment for the agency,” Liddel said. “The public puts a lot of trust in us to be fair, and our data providers put a lot of trust in us for the data to be secure. It’s our goal to repair that trust.”

And while the BLS economist often pointed users to relevant links on the agency’s website, at least one case, he shared information that wasn’t publicly available at the time, related to the calculation for the used cars index within the CPI.

Liddel said it is “still under review” whether the employee shared other nonpublic information, and that the issues appear to be isolated to this one staffer. He is not answering incoming user questions at this time, she said.

While it remains unclear who the economist is, the NYT reported that emails obtained through a Freedom of Information Act request show that the agency — or at least the economist who sent the original email, a longtime but relatively low-ranking employee — was in regular communication with data users in the finance industry, apparently including analysts at major hedge funds. And they suggest that there was a list of super users, contrary to the agency’s denials.

At the time, the Bureau of Labor Statistics said the email had been an isolated “mistake” and denied that it maintained a list of users who received special access to information.

And while there is no evidence (yet) that the employee provided early access to coming statistical releases or directly shared other data that wasn’t available to the public, in several instances, the employee did engage in extended, one-on-one email exchanges with data users about how the inflation figures are put together. Such details, though highly technical, can be of significant interest to forecasters, who compete to predict inflation figures to hundredths of a percentage point. Those estimates, in turn, are used by investors making bets on the huge batches of securities that are tied to inflation or interest rates.

Analysts regularly interact with government economists to make sure that they understand the data, but “when such access can move markets, the process for that access needs to be transparent,” said Jeff Hauser, executive director of the Revolving Door Project in Washington. “This stuff is so valuable, and then someone just emails it out.”

In at least one case, emails to super users appear to have shared methodological details that were not yet public. On Jan. 31, the employee sent an email to his super users describing coming changes to the way the agency calculates used car prices, at the time a crucial issue for inflation watchers. The email included a three-page document providing detailed answers to questions about the change, and a spreadsheet showing how they would affect calculations.

“Thank you all for your very difficult, challenging and thoughtful questions,” the email said. “It is your questions that help us flesh out all the potential problems.”

The Bureau of Labor Statistics had announced the change in a news release in early January, but did not publish details about it on its website until mid-February, two weeks after the email from the employee.

It isn’t clear when the employee began providing information to super users, or whether he was the only economist at the agency to do so. Several of his emails were also sent to an internal Bureau of Labor Statistics email alias, suggesting that he did not believe his actions to be inappropriate... or he was simply an idiot.

The super users issue came to light in February, when the employee emailed the group saying that he had identified a technical change that explained an unexpected divergence between rental and homeownership costs in a recent data release. “All of you searching for the source of the divergence have found it,” he wrote.

About an hour and a half after that email went out, a follow-up told recipients to disregard it. In a subsequent online presentation, Bureau of Labor Statistics economists presented evidence that the change identified in the employee’s email was not, in fact, the source of the divergence.