Almost two months after the SEC unexpectedly cracked and granted 19b-4 approval for Ethereum ETFs, moments ago Bloomberg's in-house ETF guru Eric Balchunas reported that he is hearing the SEC has "finally gotten back to issuers today, asking them to return FINAL S-1s on Wed (incl fees) and then request effectiveness on Monday after close for a TUESDAY 7/23 LAUNCH."

Ironic and kinda funny 7/23 is right in the middle of the biggest bitcoin conf of the year, which @JSeyff will be at btw

— Eric Balchunas (@EricBalchunas) July 15, 2024

And as Balchunas also notes, the presumed start of ETH ETF trading would coincide with the biggest bitcoin conf of the year, one where Donald Trump himself will be present.

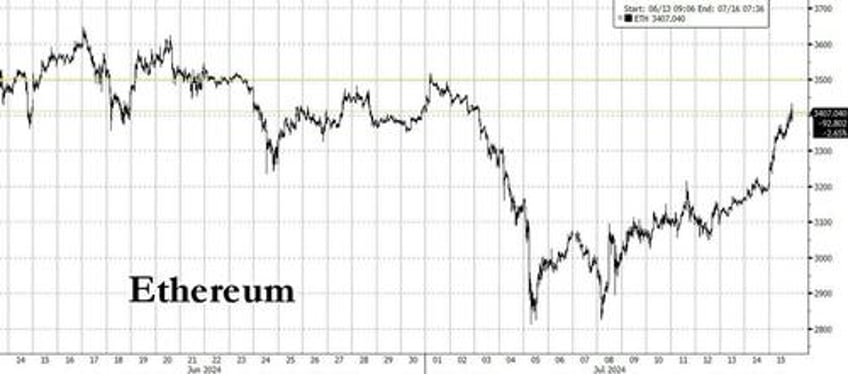

The news helped push Ether to a session - and two week - high just above $3,425 before some modest profit-taking kicked in following an impressive surge in ETH which jumped from $2800 - thanks largely to the recent German liquidation - to $3400 in just ten days.

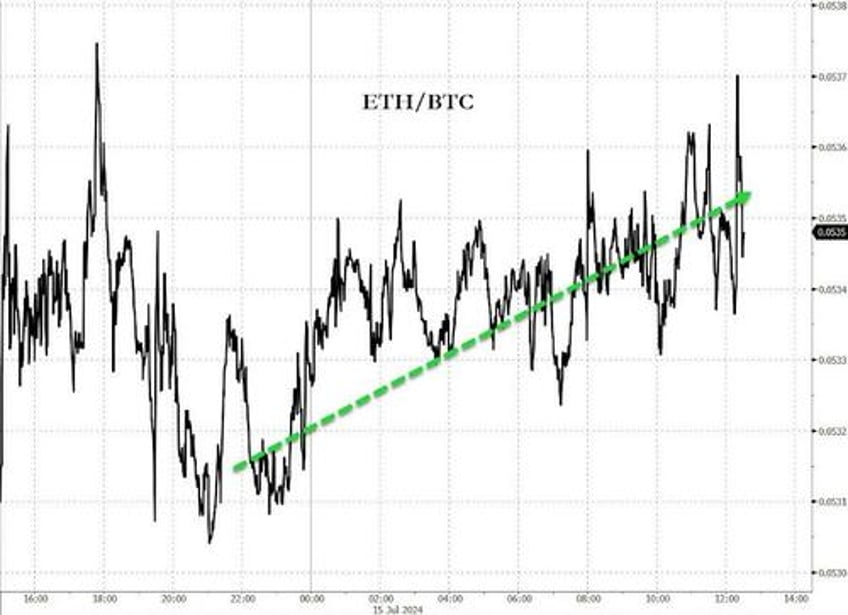

The lift in ETH also helped push the ETH/BTC ratio modestly higher, even though it still remains far below its post-2021 average of 0.065, which implied a fair value for ETH is above $4,000.