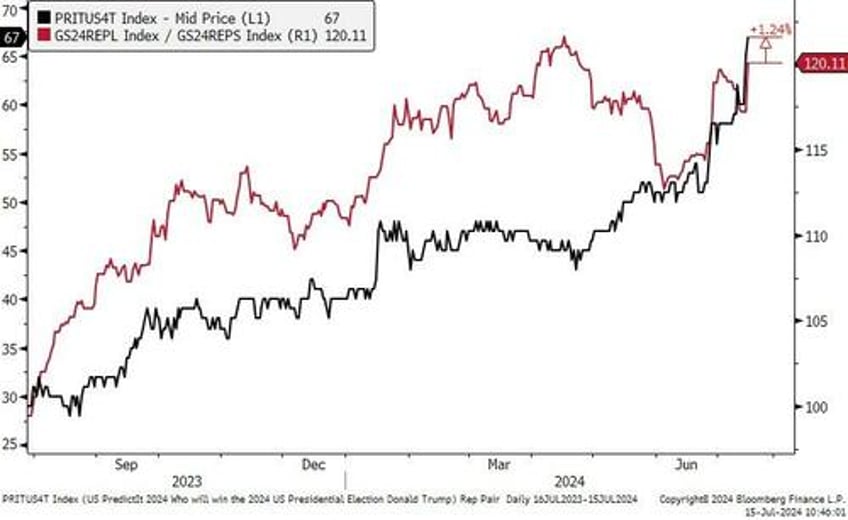

The 'Trump trade' played out today...

Source: Bloomberg

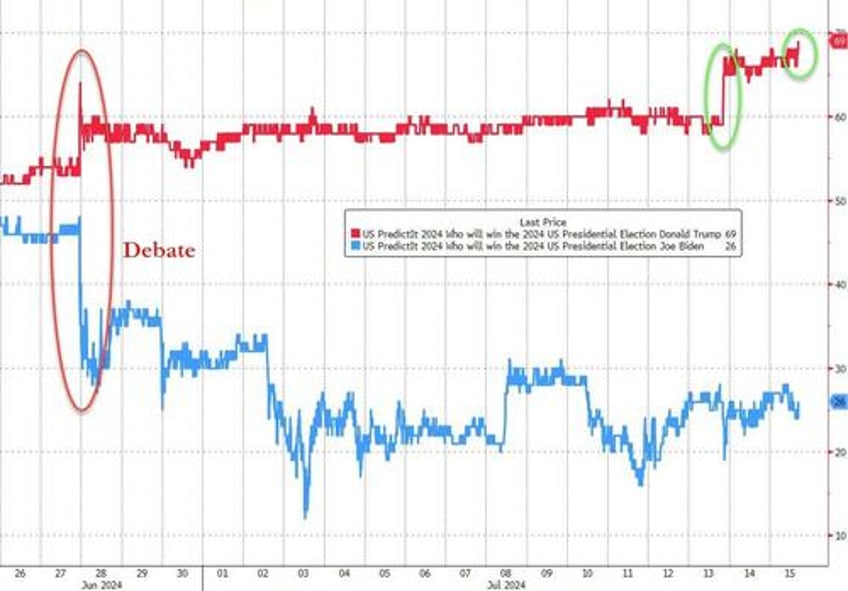

...as prediction markets surge in the former president's favor...

Source: Bloomberg

Trump's media stocks soared...

All the major US equity indices were higher today with Small Caps absolutely ripping and S&P and Nasdaq meh...

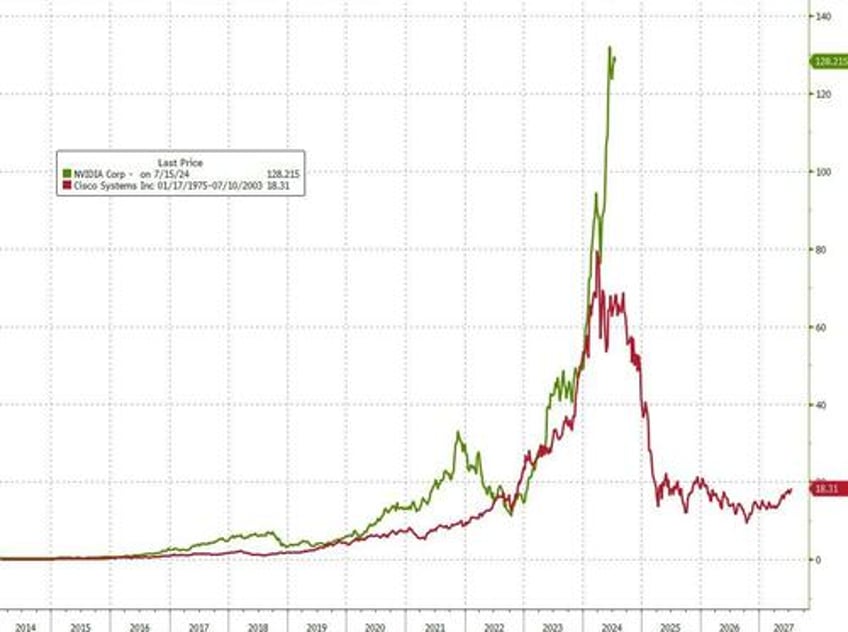

The outperformance of the Russell 2000 over Nasdaq 100 over the past three days is outdone only by the moves made in March 2001 as the dotcom bubble imploded...

Source: Bloomberg

The almost 800bps spread is on par with events such as Lehman (Oct 2008), Trump Election (Nov 2016), and Biden election (Nov 2020).

Goldman's treading desk noted that overall activity levels are up +25% vs. the trailing 2 weeks with market volumes up +4% vs the 10dma, as their floor tilts -1% better for sale, with both HFs and LOs tilted that way

HFs skew -9% better for sale, tilted that way in every sector except Materials & Industrials. Supply is most concentrated in Energy & Staples where short supply is most prevalent. Tech, Fins, HCare and Cons Disc also net for sale, but mostly long supply

LOs are -4% better for sale, as every sector ex-Fins, Energy & Macro Products tilts that way. Supply is heavily concentrated in Disc, HCare & Utes with more modest profit taking in Mega Tech

Energy stocks outperformed and only rate-sensitive Utes were dumped today (and in that context, Real Estate was stronger than expected - Trump?)...

Source: Bloomberg

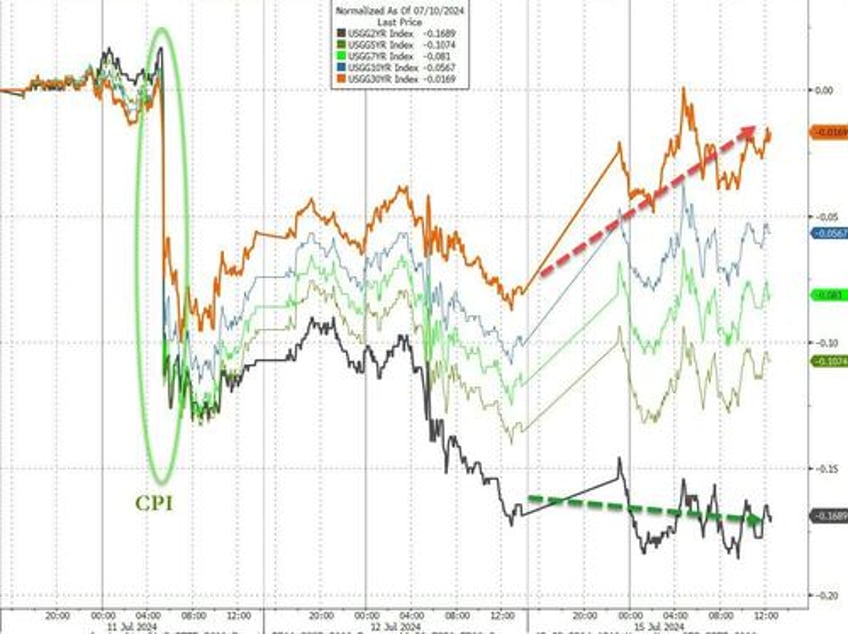

Treasury yields were all higher today but with a notable underperformance at the long-end (30Y +6bps, 2Y unch) which has dragged the long-end basically back to unchanged since CPI (juiced by the Trump trade too) as the short-end doves it up....

Source: Bloomberg

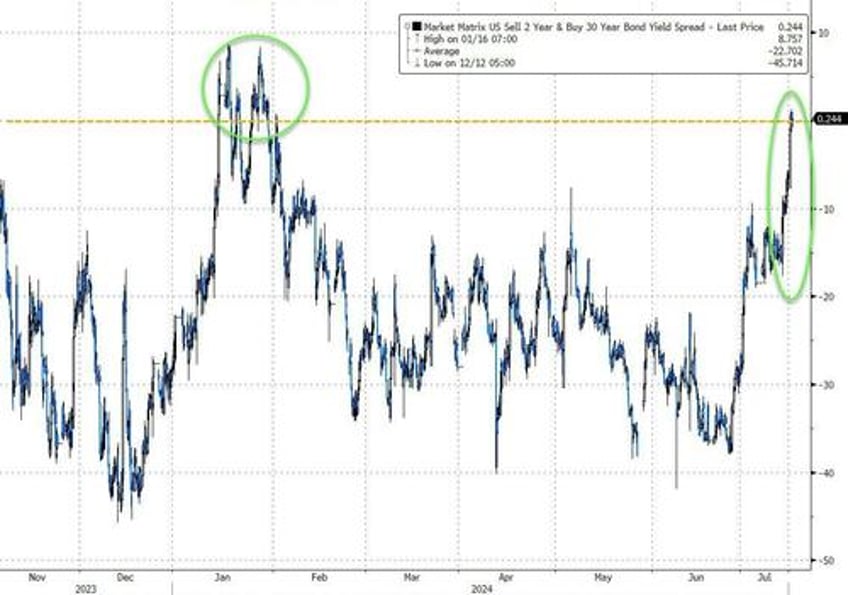

The yield curve (2s30s) disinverted for the first time since January (which some also look at as driven by a 'Trump' bet)...

Source: Bloomberg

Rate-cut odds shifted dovishly for 2024 today (66bps now priced in - so a 50-50 chance of 3 cuts by year-end), while Powell's comments prompted some hawkishness for 2025 (looks like Trump odds just bringing fwd cuts)....

Source: Bloomberg

Bitcoin soared after Trump's assassination survival (as the crypto-friendly candidate)...

Source: Bloomberg

Ethereum also rallied and was juiced a little by today's chatter that ETH ETFs will launch tomorrow, which lifted it back from the weekend's underpeformance relative to BTC...

Source: Bloomberg

Gold surged back up near record highs today...

Source: Bloomberg

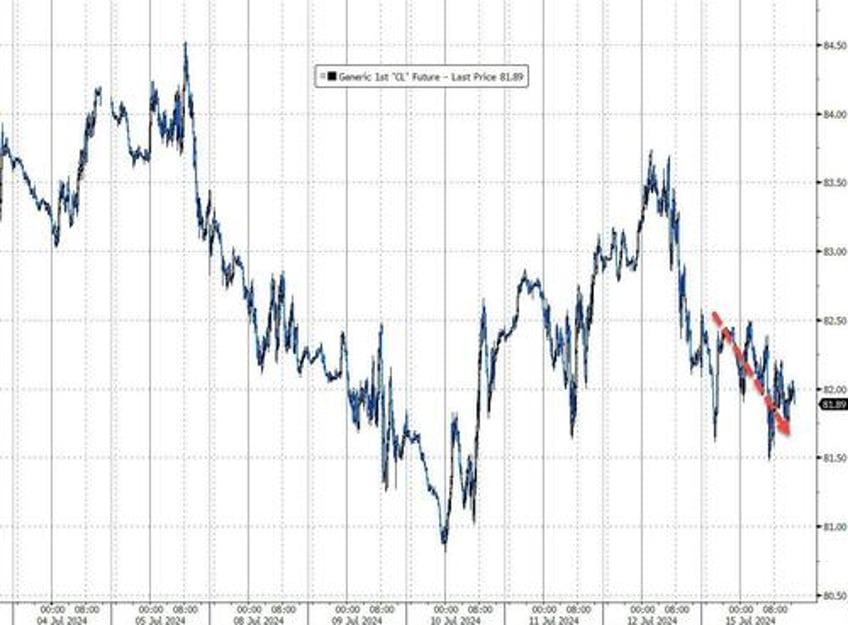

Despite energy stocks' gains, oil prices slipped lower today (drill, baby drill; less geopol risk?)...

Source: Bloomberg

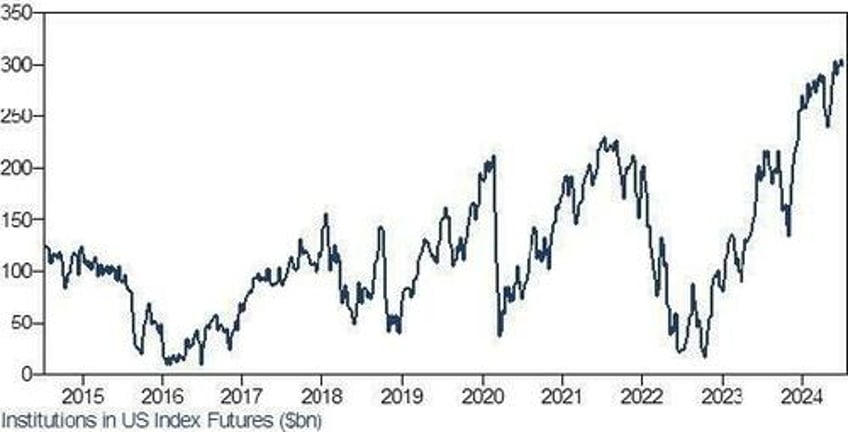

Finally, as we detailed here, US equity futures traders have never, ever been 'longer' than they are now...

What could go wrong?

Source: Bloomberg

Don't worry though, it's different this time.