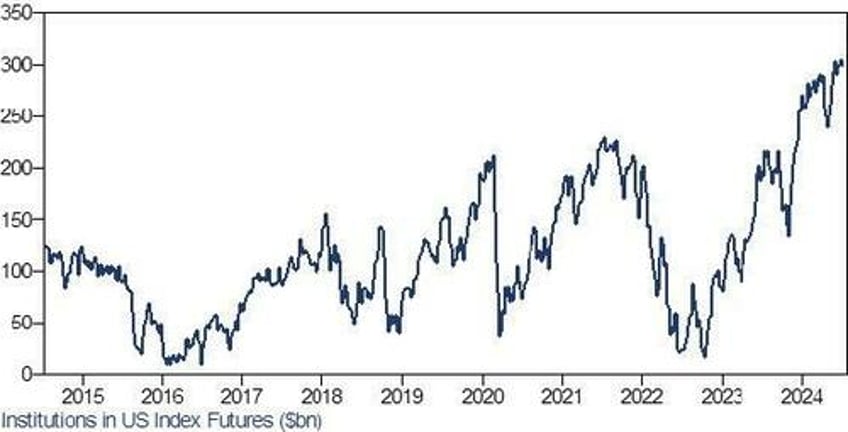

Institutional asset managers - not to be confused with retail investors or hedge funds, who are turning increasingly short- are at record nominal net positions across numerous financial futures markets.

According to Goldman futures trader Robert Quinn, in US equities they are $300BN long (also a record 40% of Total Open Interest), up from nearly net flat 2 years ago and a 5-yr average of $150bn.