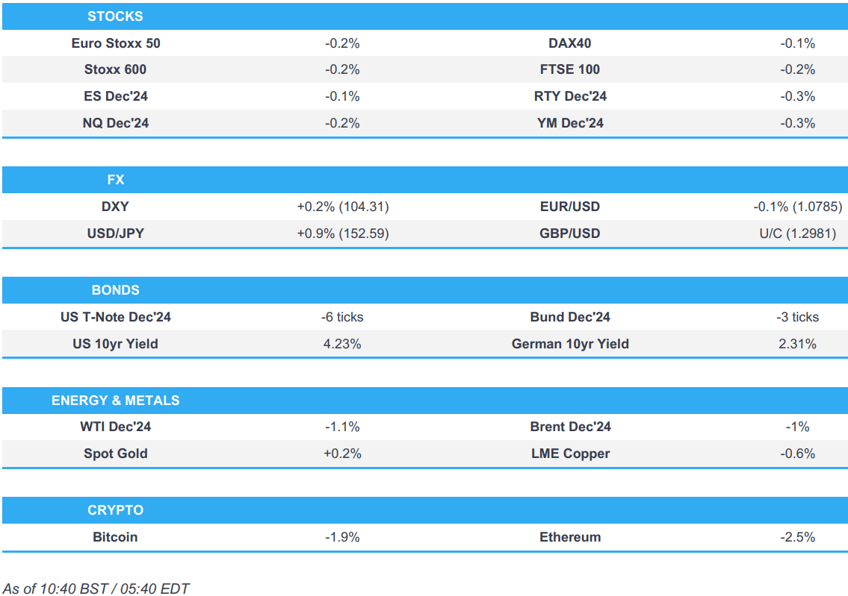

- European bourses are generally trading in negative territory; US futures follow suit, ahead of a busy earnings slate.

- DXY continues to march higher, USD/JPY climbs back above 152 to a current 152.74 peak.

- USTs are modestly lower ahead of 20yr supply; Bunds were unreactive to a well-received 10yr auction.

- Crude is subdued and continues to await geopolitical updates; XAU is slightly higher whilst base metals are mostly in the red.

- Looking ahead, US Existing Home Sales, BoC Policy Announcement, Comments from BoE's Breeden & Bailey, Fed's Bowman, ECB's Lagarde, Lane & Cipollone, RBNZ's Governor Orr, BoJ Governor Ueda, BoC's Macklem & Rogers. Supply from the US.

- Earnings: Michelin, Carrefour, AT&T, Boston Scientific, GE Vernova, Coca-Cola, Roper Technologies, General Dynamics, Boeing, T-Mobile US, Tesla, IBM & ServiceNow.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (-0.1%) began the session on a mixed footing, but sentiment continued to slip as the morning progressed, with almost the entirety of European indices in modest negative territory.

- European sectors are mixed; Optimised Personal Care tops the pile, assisted by post-earning strength in Reckitt Benckiser. Consumer Products is weighed on by poor earnings in L’Oreal.

- Key European earnings: Volvo Car (-3.2%) Q3 Revenue (SEK) 93bln (exp. 89.65bln), Adj. EBIT 5.7bln (exp. 4.78bln); sees FY Retail Sales +7-8% (prev. guided +12-15%). Roche (+0.1%) Q3 (CHF): Sales 15.14bln (exp. 14.93bln). FY Outlook confirmed. Deutsche Bank (-2.8%) Q3 (EUR) PBT 2.26bln (exp. 2.1bln), Revenue 7.5bln (exp. 7.3bln). FY Guidance: Confident in Revenue guide of "around" 30bln (exp. 29.44bln).

- US Equity Futures (ES -0.1%, NQ -0.2%, RTY -0.3%) are modestly lower across the board, but with price action fairly rangebound given the lack of pertinent newsflow.

- Nvidia (NVDA) CEO says TSMC (2330 TT/TSM) helped them recover from a design flaw in Blackwell chips, allowing them to resume work at an incredible pace

- CDC says McDonald's (MCD) is linked to a severe E.coli outbreak and 10 people have been hospitalised, while one older person has died. Shares -6.2% in pre-market trade

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is continuing to out-muscle peers as the US yield environment in the run-up to next month's Presidential election continues to provide support. Accordingly, the DXY has gained a firmer footing on a 104 handle and ventured as high as 104.36.

- EUR is softer vs. the USD with EUR/USD extending its move onto a 1.07 handle in the wake of dovish ECB source reporting which has raised the possibility of the Bank aiming for a terminal rate below neutral.

- GBP is flat vs. the USD with Cable stuck below the 1.30 mark. BoE Governor Bailey & Breeden are due to speak today, though remarks from members on Tuesday failed to materially move the Pound.

- JPY's bruising run has continued into today's session with US yields and domestic Japanese political risks continuing to drag USD/JPY higher. Currently sitting well above 152.00 at a 152.72 peak.

- Antipodeans are both softer vs. the USD after Tuesday's attempted recovery with antipodeans remaining at risk of a Republican clean sweep.

- CAD is relatively steady vs. the USD and tucked within Tuesday's 1.3813-38 range in the run-up to today's BoC rate decision. Expectations are for a 50bps rate cut, and with markets pricing a 50bps cut at 97%.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Bunds are lower by a handful of ticks, but ultimately reside within a contained range, holding around 20 ticks above Tuesday’s 132.58 WTD trough. Potential support could also be attributed to reports that officials are debating whether rates will need to go below the neutral level this cycle. German paper was unreactive to a well-received 10yr auction.

- Gilts are softer than EGBs and were ultimately unmoved by a fairly well-received 2027 outing. Gilts are currently at a 96.40 WTD trough, matching the Oct. 15th low ahead of speak from BoE's Bailey.

- USTs are trading somewhere between Bunds and Gilts in terms of magnitudes, with USTs finding themselves under modest pressure ahead of 20yr supply though as it stands action is relatively even across the curve. At a 111-03+ trough which marks a marginal new WTD base.

- UK sells GBP 4bln 3.75% 2027 Gilt Auction: b/c 3.29x (prev. 3.33x) & average yield 4.082% (prev. 4.068%), tail 0.6bps (prev. 0.3bps).

- Germany sells EUR 3.303bln vs exp. EUR 4bln 2.60% 2034 Bund Auction: b/c 2.30x (prev. 2.0x), average yield 2.31% (prev. 2.08%) & retention 17.43% (prev. 17.69%).

- Click for a detailed summary

COMMODITIES

- Crude is trading on the backfoot, amid a lack of catalysts but as eyes remain on Israel regarding its retaliation against Iran, in which the focus will fall on the targets and the magnitude of the attack for its escalation factor. Brent'Dec trades towards the bottom of a narrow USD 75.47-76.05/bbl parameter.

- Precious metals are mixed. Spot gold continues to print fresh all-time highs against the backdrop of a tense geopolitical landscape whilst silver trims some of Tuesday's gains.

- Base metals are mostly lower and giving back some of yesterday's upside. 3M LME copper just about remains above USD 9,500/t.

- Kazakhstan's Kaztransoil shipped 145,000T oil to Germany; plans to supply 133,000T to Germany in October.

- Private inventory data (bbls): Crude +1.6mln (exp. +0.3mln), Distillate -1.5mln (exp. -1.7mln), Gasoline -2mln (exp. -1.2mln), Cushing -0.2mln.

- Click for a detailed summary

NOTABLE DATA RECAP

- South African CPI YY (Sep) 3.8% vs. Exp. 3.9% (Prev. 4.4%); CPI MM (Sep) 0.1% vs. Exp. 0.1% (Prev. 0.1%)

NOTABLE EUROPEAN HEADLINES

- ECB policymakers are beginning to debate whether rates will have to go below neutral level in the current easing cycle, according to sources cited by Reuters.

- UK Chancellor Reeves is expected to impose national insurance on employer's pension contribution in the Budget, according to The Times.

NOTABLE US HEADLINES

- Fed's Daly (voter) commented on X that the economy is in a better place, inflation has fallen substantially and the labour market has returned to a more sustainable path, while she added that risks to goals are now balanced which is a significant improvement from two years ago. Furthermore, she stated that work to achieve a soft landing is not fully done and they are resolute to finish that job, but noted it cannot be all they are after and ultimately must strive for a world where people aren’t worried about inflation or the economy.

- Former President Trump said he would make car interest payments fully tax deductible if they are domestically built.

- Bill Gates privately said he has backed VP Harris with a USD 50mln donation, according to NYT.

GEOPOLITICS

MIDDLE EAST

- Israel begins strikes on Lebanese port city of Tyre, via Reuters citing witnesses.

- "Sources for Sky News Arabia: Russia will help Iran to counter the planned Israeli strike in some form", according to Sky News Arabia; "Russia will help Iran without risking harm to its relations with Israel". "Israeli sources to Sky News Arabia: We do not rule out the idea of Russia helping Iran in countering the Israeli strike". "Israeli sources to Sky News Arabia: Russian assistance may be by giving Iran early warning and instructions to protect potential targets.". "Israeli sources to Sky News Arabia: Russian assistance to Iran may include the detection of attacking aircraft and electronic jamming"

- "US asked European countries to develop a vision to support the Palestinian Authority", according to Sky News Arabia sources; "Arab countries hold new talks on ensuring the implementation of the new peace plan". "Arab countries hold new talks on ensuring the implementation of the new peace plan"

- Israel’s army completed its preparations to attack Iran and it seems that it will be within days, according to Israel's Channel 12 citing two sources.

- Israeli PM Netanyahu said in a meeting with US Secretary of State Blinken that there is a need to lead to a security and political change in the north, which would allow Israel to return its residents safely to their homes. Netanyahu added that the killing of Hamas leader Sinwar may have a positive effect on the return of Israeli hostages, the achievement of all the goals of the war, and the day after.

- US Secretary of State Blinken, in meeting with Israeli PM Netanyahu, underscored the need to capitalise on Israel's action to bring Sinwar to justice by securing a hostage release and ending the conflict in Gaza. Furthermore, Blinken sought during his meeting with Israeli PM Netanyahu to soften the response to Iran, according to Al Jazeera citing Israel's Channel 13.

- US Secretary of State Blinken and Israeli PM Netanyahu discussed the concrete steps to capitalise on the death of Hamas leader Sinwar, a senior US official told Reuters. Blinken made it clear that Israel's humanitarian aid steps so far have not been sufficient and Israeli leaders committed to act upon US requests laid out in Blinken's letter on the need for more humanitarian aid. Furthermore, Blinken will no longer go to Jordan on Wednesday but he will be traveling to Saudi Arabia.

- White House said Israel must respond to the Iranian attack and it will not review what they will do, according to Al Jazeera.

- Pentagon said it cannot provide information regarding the Israeli attack on Iran and it is consulting with partners in the region in order to de-escalate, according to Al Jazeera.

- Israel's army confirmed the killing of late Hezbollah leader Nasrallah's presumed successor Hashem Safieddine.

- Israel will continue to attack Hezbollah even after the end of the operation in Lebanon until it withdraws behind the Litani, according to Sky News Arabia citing comments by Galant to Blinken.

- IDF spokesman said the Israeli Air Force intercepted a drone in Syrian airspace launched from the east. It was also reported that Israeli military said it intercepted two UAVs that crossed into Israel's waters in the area of Eilat, while Islamic Resistance in Iraq announced it targeted Israel's Eilat with drones.

- Palestinian media reported continuous aerial and artillery shelling on different areas in the northern Gaza Strip, as well as heavy Israeli shelling on Rafah in the southern Gaza Strip, according to Asharq News.

- Iranian President says they seek to prevent the expansion of conflict within the region, while Israel has shown "it is only looking for conflict", via Al Arabiya.

- Iraqi media reports that the US' air defence system and radar in the Koniko gas field, Syria, were hit by a missile attack on Tuesday night, via IRNA.

- US Secretary of State Blinken says they fully reject any Israeli reoccupation of Gaza.

OTHER

- North Korean leader Kim inspected strategic missile bases, according to KCNA.

CRYPTO

- Bitcoin continues to slip and now holding just above USD 66k.

APAC TRADE

- APAC stocks were ultimately mixed with the upside capped following the inconclusive performance on Wall St amid a lack of fresh macro drivers, recent upside in yields and ongoing geopolitical tensions.

- ASX 200 traded rangebound with strength in consumer stocks offsetting the underperformance in tech and energy.

- Nikkei 225 was the laggard as it failed to benefit from a weaker currency and a surge in Tokyo Metro shares on its debut.

- Hang Seng and Shanghai Comp advanced with risk appetite supported as participants digested earnings releases and after the PBoC upped its liquidity effort, while a Chinese policy think tank called for the issuance of CNY 2tln in special treasury bonds to establish a stock market stabilisation fund.

NOTABLE ASIA-PAC HEADLINES

- Chinese policy think tank CASS called for Beijing to issue CNY 2tln of special treasury bonds to set up a stock market stabilisation fund, according to 21st Century Business Herald.