- APAC stocks began the week mostly positive although gains were capped by the lack of fresh macro catalysts.

- PBoC announced a 25bps cut to China's benchmark LPRs, as expected.

- Israeli PM Netanyahu has said he is undeterred from his war aims following a reported drone attack on his private residence, via BBC.

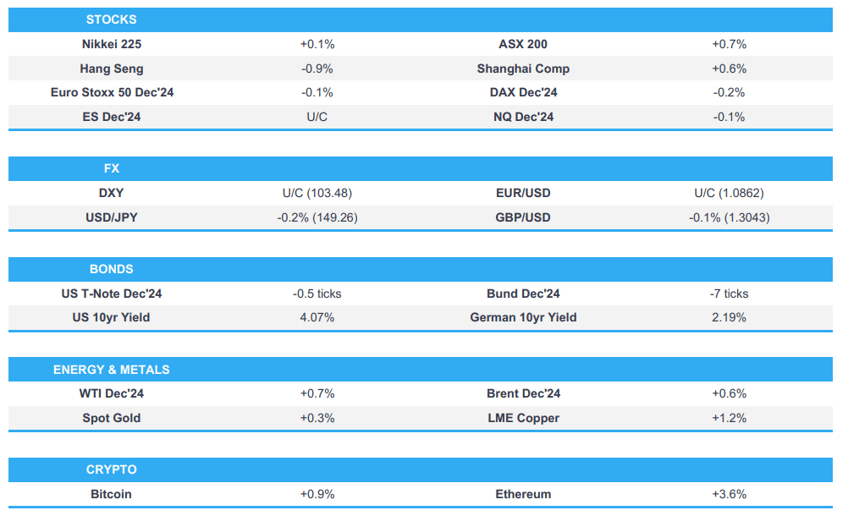

- European equity futures are indicative of a contained cash open with the Euro Stoxx 50 future -0.1% after the cash market closed higher by 0.8% on Friday.

- FX markets are broadly flat, DXY sits around the 103.50 mark, EUR/USD and USD/JPY trade on 1.08 and 149 handles respectively.

- Looking ahead, highlights include German Producer Prices, EU Supply, Comments from Fed's Logan, Kashkari & Schmid, Earnings from SAP.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

US TRADE

EQUITIES

- US stocks traded with a mostly positive bias on Friday in which the S&P 500 and the DJIA printed fresh record closes albeit with price action somewhat choppy as earnings remained in the spotlight. In terms of sectors, Communications was the clear outperformer in the aftermath of a strong earnings report from Netflix, while Financials, Consumer Staples and Energy were the only industries in the red with the latter pressured by recent declines in oil prices.

- SPX +0.40% at 5,865, NDX +0.66% at 20,324, DJIA +0.09% at 43,276, RUT -0.21% at 2,276.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Bostic (2024 Voter) said on Friday that they need to move the policy rate because risks shifted and the neutral policy rate is in the 3.00-3.50% range. Furthermore, Bostic suggested there is no rush to get to neutral and will be patient, while he expects to get to 2% inflation near the end of 2025.

- IAM union said regarding negotiations with Boeing (BA) that the latest proposal includes a 35% general wage increase spread over 4 years and that Boeing workers will receive a one-time ratification bonus of USD 7,000, according to Reuters. It was also reported that Boeing is exploring asset sales that could bring in much-needed cash while shedding non-core underperforming units and reached a deal to offload a small defence subsidiary that makes surveillance equipment for the US military, according to WSJ.

APAC TRADE

EQUITIES

- APAC stocks began the week mixed mostly positive although gains were capped by the lack of fresh macro catalysts from over the weekend and after China lowered its benchmark Loan Prime Rates as widely expected.

- ASX 200 was led by outperformance in the mining, resources and materials sectors.

- Nikkei 225 edged mild gains on a reclaim of the 39,000 level although the upside was limited by currency strength.

- Hang Seng and Shanghai Comp were mixed with the Hong Kong benchmark subdued and weakness in tech and casino stocks, while the mainland index edged higher after the PBoC announced a 25bps cut to China's benchmark LPRs.

- US equity futures were little changed in quiet rangebound trade.

- European equity futures are indicative of a contained cash open with the Euro Stoxx 50 future -0.1% after the cash market closed higher by 0.8% on Friday.

FX

- DXY was stuck in a tight range amid a lack of catalysts from over the weekend and a light calendar to start the week.

- EUR/USD traded sideways following last Friday's rebound from a two-and-a-half-month low.

- GBP/USD conformed to the uneventful picture across the FX space after reverting to the 1.3050 focal point where its 10-day moving average resides within very close proximity.

- USD/JPY continued to trickle lower following the recent pullback from the 150.00 territory.

- Antipodeans initially benefitted alongside the early positive risk tone and firmer yuan reference rate setting but eventually faded their gains.

- PBoC set USD/CNY mid-point at 7.0982 vs exp. 7.0990 (prev. 7.1274).

FIXED INCOME

- 10yr UST futures traded little changed after recently recovering from a brief dip beneath the 112.00 level with very little in the way of key events scheduled this week.

- Bund futures took a breather after Friday's whipsawing but with the downside cushioned by a floor at the 134.00 level.

- 10yr JGB futures kept afloat following recent source reports that the BoJ sees little need for a rate hike this month.

COMMODITIES

- Crude futures climbed off earlier lows but remained beneath USD 70/bbl after last week's losing streak.

- Saudi Aramco's CEO said the world must accelerate the development of new energy sources and lower carbon technologies that can compete on price and performance, while he added that they are fairly bullish on China and oil demand, as well as see some more demand for jet fuel and NAPTHA, especially for crude to chemical projects.

- IEA's Birol said more than 25% of global energy demand growth is to come from SE Asia in the next 10 years.

- Shell (SHEL LN) said there was an oil leak from a pipeline at Shell Energy and Chemicals Park in Singapore and it activated emergency response specialists to help manage the situation.

- Turkmenistan signed a deal with Iraq to supply 20mln cubic metres of gas daily.

- Spot gold gradually extended on record levels north of the USD 2,700 level amid light catalysts.

- Copper futures were underpinned after last Friday's rebound and alongside the mostly positive risk tone.

CRYPTO

- Bitcoin was choppy and gradually faded its gains after a brief reclaim of the USD 69,000 level.

NOTABLE ASIA-PAC HEADLINES

- Chinese Loan Prime Rate 1Y (Oct) 3.10% vs. Exp. 3.10-3.15% (Prev. 3.35%)

- Chinese Loan Prime Rate 5Y (Oct) 3.60% vs. Exp. 3.60-3.65% (Prev. 3.85%)

- China-based DJI sues the US government for adding the drone manufacturer to the list of companies allegedly working with the Chinese military.

- US Republican Presidential Candidate Trump said he would impose tariffs on China if China went into Taiwan, according to a WSJ interview.

- Key US lawmakers urged Japan to strengthen restrictions on sales of chipmaking equipment to China and warned that if Tokyo fails to act, Washington could impose its own curbs on Japanese companies or bar toolmakers that sell to China from receiving US semiconductor subsidies.

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu said a drone attack which targeted his home in northern Israel was a "grave mistake", while he and his family were not at their house when the drone attack struck on Saturday and there were no casualties.

- Israeli PM Netanyahu spoke with former US President Trump and told him that Israel considers the issues the US administration raises but will make decisions based on its national interests.

- Israel’s military said it attacked Hezbollah’s intelligence HQ and weapons storage facilities in the southern suburbs of Beirut on Saturday. It was also reported that Israel conducted a fresh raid on the southern suburbs of Beirut on Sunday, as well as targeted the city of Tyre and the towns of Bir al-Salasil and Homine al-Fawqa in southern Lebanon.

- Israeli military spokesperson had warned on Sunday that they would conduct targeted strikes on sites belonging to Hezbollah’s financial arm across Lebanon and urged Lebanese residents to evacuate areas near those facilities, while it was later reported that Israeli strikes hit branches of Hezbollah-linked bank in Beirut and Beqaa Valley, according to Times of Israel.

- Hezbollah announced it conducted a rocket barrage at Beit Hillel base, while it was separately reported that Iraqi armed factions announced the targeting of an Israeli military site in the Golan with drones.

- Israel gave the White House its demands for ending the war in Lebanon, while US President Biden's envoy Amos Hochstein will visit Beirut on Monday to discuss a possible diplomatic solution with Lebanese officials, according to Axios. The report noted one Israeli demand is that IDF be allowed to engage in "active enforcement" to ensure Hezbollah doesn't rearm and Israel also demands its air force have freedom of operation in Lebanese airspace, although a US official said it is highly unlikely Lebanon and the international community would agree to Israel's conditions.

- Iran's Supreme Leader said Hamas leader Sinwar’s death will not halt the axis of resistance and Hamas will live on.

- Iranian Foreign Minister Araghchi alluded to the US and warned that anyone who knows how and when Israel will attack Iran will be held accountable, according to Reuters.

- US House Speaker Johnson said on Sunday that there would be a classified briefing related to leaked US intelligence on Israel-Iran, according to Reuters.

- US Defence Secretary Austin said he would like to see Israel scale back on some of its strikes in and around Beirut, while he raised the issue about UNIFIL security with Israel’s Defence Minister Gallant. Furthermore, Austin reviewed the US defence posture and said he is relieved that PM Netanyahu is safe, while he said he couldn’t confirm reports that North Korean troops are in Russia and readying for combat in the Ukraine war, according to Reuters.

- UN peacekeeping force UNIFIL said an Israeli army bulldozer demolished a watchtower and fence surrounding the UN site in southern Lebanon on Sunday, according to Reuters.

- G7 defence ministers reaffirmed the importance of supporting UNIFIL and the Lebanese armed forces in their role of ensuring the stability and security of Lebanon, while they called on Iran to refrain from providing support to Hamas, Hezbollah, Houthis and other non-state actors. Furthermore, they called on Houthis to immediately cease their escalatory measures that increase regional instability and immediately release the vessel Galaxy Leader and its crew.

OTHER

- Ukrainian President Zelensky thanked countries that 'do not close their eyes' to North Korean involvement in Ukraine's war with Russia and seeks a normal, honest and strong reaction from them, according to Reuters.

- Russian Foreign Minister Lavrov said recent statements by US President Biden on being ready for nuclear talks with Russia without preconditions are deception and he does not see signs at this moment that Moscow and Washington will return to talks on equal terms after the US presidential election, according to RIA.

- G7 defence ministers expressed deep concern at China’s support to Russia which is enabling Russia to maintain its illegal war in Ukraine, while the defence ministers said they support Ukraine on its irreversible path to full Euro-Atlantic integration including NATO membership.

- North Korean Foreign Minister said the new US-led sanctions monitoring team is unlawful, according to KCNA.

EU/UK

NOTABLE HEADLINES

- ECB’s Holzmann said on Friday they are on track to getting inflation under control and that the rate decision in December will depend on the data.

- ECB’s Villeroy said they are on a good way to defeating inflation which is good news and there may be some temporary rebounds in the coming months although this would be due to technical effects, while he added that there will probably be more rate cuts and they will decide depending on the data.

- ECB's Vasle said that back-to-back rate cuts are no indication of future ECB action, according to the FT.

- S&P affirmed the UK’s rating at AA; Outlook Stable, while Fitch affirmed Sweden at AAA: Outlook Stable, affirmed Sweden at AAA; Outlook Stable and affirmed Italy at BBB: Outlook revised to Positive from Stable.

DATA RECAP

- UK Rightmove House Price Index MM (Oct) 0.3% (Prev. 0.8%)

- UK Rightmove House Price Index YY (Oct) 1.0% (Prev. 1.2%)