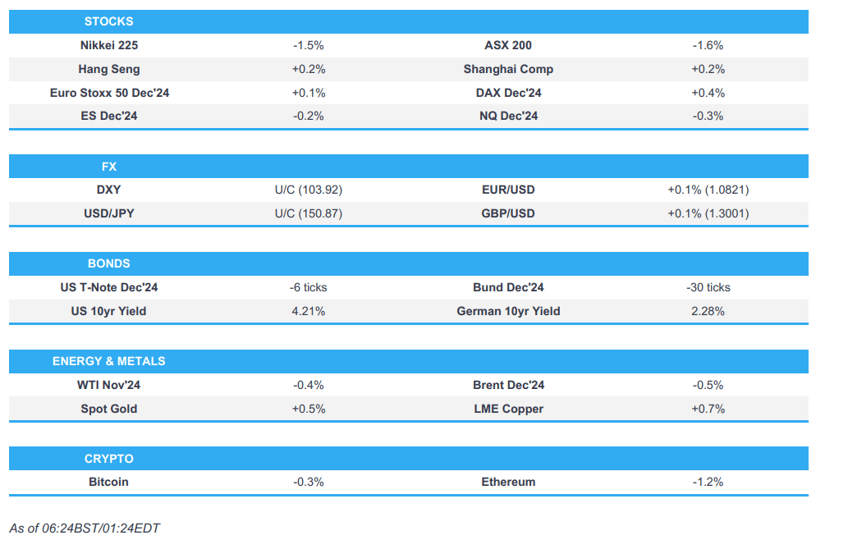

- APAC stocks traded mixed with participants somewhat cautious following the mostly negative bias stateside.

- European equity futures are indicative of a slightly positive cash open with the Euro Stoxx 50 future +0.1% after the cash market closed lower by 0.9% on Monday.

- DXY is just below the 104 mark, antipodeans are looking to claw back recent losses, USD/JPY is north of the 150 level.

- Fed's Daly (2024 voter) said she has not seen anything so far that would suggest the FOMC would not continue to cut rates.

- Looking ahead, highlights include ECB's Lagarde & Lane, BoE's Greene, Bailey & Breeden, Fed's Harker, NBH Policy Announcement, Supply from Germany & UK.

- Earnings from L'Oreal, IHG, Boliden, Logitech, Danaher, General Electric, Raytheon Technologies, 3M, General Motors, Philip Morris International, Sherwin-Williams, Fiserv, Verizon Communications, Lockheed Martin, Freeport-McMoRan & Texas Instruments.

SNAPSHOT

More Newsquawk in 3 steps:

More Newsquawk in 3 steps:1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks ultimately closed mixed with most indices in the red amid a firmer dollar and higher yield environment although the Nasdaq outperformed thanks to strength in technology which was the only sector to finish higher and was primarily buoyed by gains in big tech names such as Nvidia (NVDA) and Apple (AAPL), while Communications closed relatively flat alongside gains in Google (GOOGL) and Netflix (NFLX). Elsewhere, T-notes sold off across the curve in little newsflow with the downside following on from weakness in EGBs after a flurry of supply while higher oil prices also weighed and some also cited the "Trump trade" with Trump showing no loss of momentum in the polls and the 538 averages showed Trump leading in four of seven swing states.

- SPX -0.18% at 5,854, NDX +0.18% at 20,361, DJIA -0.80% at 42,932, RUT -1.60% at 2,240.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Daly (2024 voter) said the Fed will continue to adjust policy and a 50bps cut was to right-size policy, while she expects additional cuts going forward. Daly said the recent Fed rate cut was a close call and she came down strongly in favour of a 50bps cut, as well as noted that a 50bps cut was needed and they didn’t want to find out they had overtightened and taken jobs from people. Furthermore, she said they will be data-dependent for the Fed's November meeting and haven't seen anything so far that would suggest they would not continue to cut rates, while she noted policy is absolutely still tight and would want to be open-minded to continue to ease policy if inflation is falling, even if the economy is strong.

- Fed's Schmid (2025 voter) called for a cautious, gradual and deliberate approach to rate cuts, while he prefers to avoid outsized rate cuts and noted that they are seeing a normalisation of the labour market, not a deterioration. Furthermore, Schmid said current policy is restrictive, but not very restrictive, as well as noted the balance sheet is probably influencing longer-term rates and that they should be normalising the Fed's balance sheet on both size and duration.

- Fed's Kashkari (2026 voter) said that a rise in the budget deficit would mean that on the margin interest rates would be higher and noted it was not the labour market that caused inflation. Kashkari said going forward, the Fed will look at all the data to decide on rate policy and evidence of a quick labour market weakening could lead to faster rate cuts but added that resilience makes him wonder if the neutral rate is higher and he currently sees modest cuts over the next quarters.

APAC TRADE

EQUITIES

- APAC stocks traded mixed with participants somewhat cautious following the mostly negative bias stateside amid a lack of major catalysts, ongoing geopolitical tensions in the Middle East and a higher yield environment.

- ASX 200 retreated from the open with Real Estate and Healthcare leading the broad downturn seen across sectors.

- Nikkei 225 was pressured following its recent failure to hold on to the 39,000 level despite a weaker currency.

- Hang Seng and Shanghai Comp shrugged off early weakness to trade in the green albeit with price action choppy as the attention turned to earnings updates, while the PBoC conducted its first swap operation involving securities brokerages, funds and insurance companies worth CNY 50bln on Monday.

- US equity futures (ES -0.2%) remained lacklustre after the mostly negative performance on Wall Street.

- European equity futures are indicative of a slightly positive cash open with the Euro Stoxx 50 future +0.1% after the cash market closed lower by 0.9% on Monday.

FX

- DXY traded steadily overnight and held on to the prior day's spoils after having surged to briefly above the 104.00 level as US yields climbed alongside the upside in oil prices and amid a touted Trump trade, while Fed rhetoric did little to shift the dial.

- EUR/USD got some slight respite after giving way to the dollar strength and with the single currency also not helped by softer-than-expected German PPI data and after ECB rhetoric continued to suggest the potential for further rate cuts ahead.

- GBP/USD attempted to nurse some of its losses after recently slipping to the sub-1.3000 territory.

- USD/JPY gradually extended on the prior day's advances and briefly reclaimed the 151.00 handle.

- Antipodeans regained composure following the prior day's slide and clawed back some of the losses.

FIXED INCOME

- 10yr UST futures trickled beneath the prior day's lows following the recent selling pressure as yields and oil prices rose, while some had also attributed the recent price action to the 'Trump trade'.

- Bund futures remained pressured and extended their tumble to beneath the 133.00 level amid recent supply.

- 10yr JGB futures followed suit to the losses in global peers but with the downside stemmed by a lack of fresh catalysts and after firmer demand at the 10yr Climate Transition Bond auction.

COMMODITIES

- Crude futures mildly retreated overnight following the prior day's gains with the WTI December contract back beneath the USD 70/bbl level amid light newsflow and as participants continue to await Israel's response to Iran.

- Spot gold resumed its upward momentum after pulling back from record highs yesterday alongside a stronger dollar.

- Copper futures found reprieve from the prior day's selling but with the upside capped amid the mixed risk sentiment.

- World refined copper markets were in a 54k metric tonnes surplus in August 2024, according to ICSG.

CRYPTO

- Bitcoin remained subdued following Monday's slump to beneath the USD 68,000 level.

NOTABLE ASIA-PAC HEADLINES

- China's FX regulator said the Yuan exchange is basically stable at reasonable and balanced levels, while it added that cross-border capital turned to inflows in the first three quarters of this year and cross-border capital flow has been balanced since the start of 2024. Furthermore, it stated the FX market shows relatively strong resilience and market expectations and trading are in order overall.

DATA RECAP

- New Zealand Trade Balance (NZD)(Sep) -2.1B (Prev. -2.2B, Rev. -2.3B)

- New Zealand Exports (Sep) 5.0B (Prev. 5.0B, Rev. 4.9B)

- New Zealand Imports (Sep) 7.1B (Prev. 7.2B, Rev. 7.2B)

GEOPOLITICS

MIDDLE EAST

- Israeli army issued an evacuation warning to residents of buildings in the neighbourhoods of Al-Lilaki and the boat ramp in the southern suburbs, according to Sky News Arabia.

- Israeli Home Front said sirens sounded in Haifa, its Gulf and dozens of cities and sites in northern Israel, while it was later reported that Israeli media and military announced sirens sounded in central Israel's Samaria area, West Bank settlements, Acre and areas in upper Galilee.

- Israeli military spokesman said an Israeli strike in Syria killed the head of Hezbollah's money transfers unit.

- Syrian Ministry of Defence said two civilians were killed and three others injured in an Israeli shelling of a car in the Mazzeh area of Damascus.

- Israel's Channel 14 reported that the homes of senior officials in Iran were added as possible targets for Israeli attack and the Air Force will know the exact target of the attack shortly before implementation, according to Al Jazeera. Furthermore, Israel's Channel 14 cited Israeli sources that stated plans for the strike against Iran were presented by the military leadership and the Mossad to the Prime Minister and Minister of Defence, according to Sky News Arabia.

- Israeli Ministers of the Political-Security Council reported in recent days that a very large attack will be carried out soon on Iran, while estimates in Israel are that Iran will respond strongly to the Israeli attack, according to Al Jazeera.

- US Secretary of State Blinken said he is heading to Israel and other stations in the region to discuss ending the war in Gaza, returning the hostages and alleviating the suffering of the Palestinians, according to Al Jazeera.

- Iran's UN Mission told the UN that US President Biden's remarks in Berlin on Israel's plan to attack Iran are "inflammatory" and the remarks indicate tacit US approval and explicit support for Israel's unlawful military aggression against Iran, while the US will bear full responsibility for its role in instigating, inciting and enabling any acts of aggression by Israel against Iran.

- Egyptian intelligence chief Hassan Rashad presented Shin Bet chief Ronen Bar during their meeting in Cairo on Monday with an outline for a "small" hostage deal with Hamas that would restart negotiations on a larger hostage deal, according to Axios' Ravid. Israeli officials noted that Shin Bet chief Bar presented the Egyptian outline during a cabinet meeting which involves a small deal that would be carried out as a first stage whereby a number of abductees would be released in exchange for a few days of ceasefire and then parties would move on to negotiations on a large hostage deal.

OTHER

- UK is to lend Ukraine an additional GBP 2.26bln for weapons to fight Russia with the loans to be repaid using interest generated from USD 300bln of Russian frozen assets, according to The Guardian.

- US DoJ proposed barring bulk sales of sensitive US data to China, Russia and Iran due to national security risks.

EU/UK

NOTABLE HEADLINES

- UK Shadow Chancellor Hunt warned Chancellor Reeves against hiking business taxes ahead of next week's Budget, according to FT.