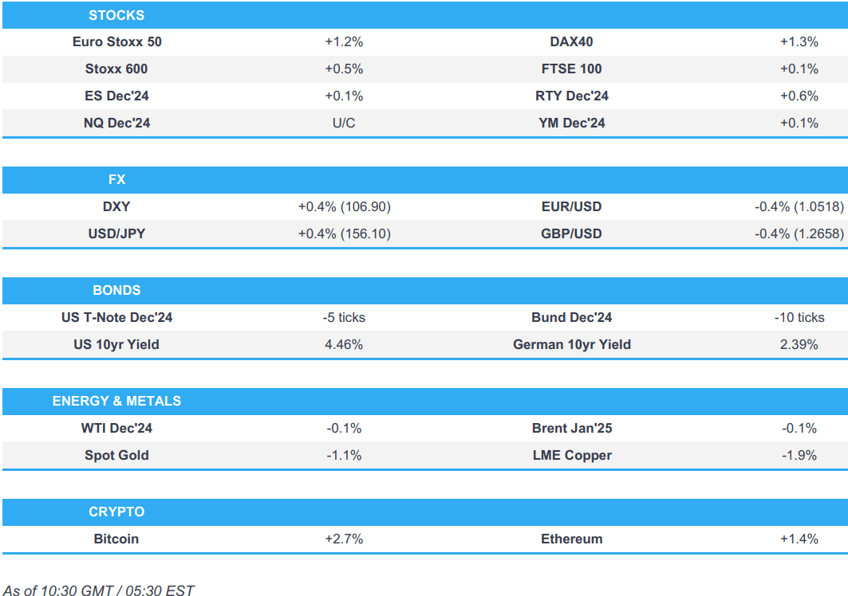

- European bourses gain with clear outperformance in the Euro Stoxx 50, lifted by gains in ASML +5.2% after it reiterated its 2030 sales outlook; US futures are modestly firmer whilst the RTY outperforms.

- Dollar continues to extend gains having surpassed 107.00, USD/JPY tops 156.00.

- Bonds are subdued with slight underperformance in Gilts ahead of Fed Chair Powell and BoE Governor Bailey.

- Metals succumb to the Dollar strength while crude trades choppily in a tight range.

- Looking ahead, US Initial Jobless Claims, US PPI, Japanese GDP, ECB Minutes. Speakers include ECB’s Lagarde, Schnabel, Fed’s Powell, Barkin, Williams & Kugler, BoE's Bailey & Mann. Supply from the US. Earnings from Disney, Brookfield, Applied Materials & Advanced Auto Parts.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses hold a positive bias, with only a couple of indices residing in the red. Indices opened mixed/modestly firmer and sentiment gradually improved into the morning; indices generally reside at highs.

- European sectors hold a positive bias vs initially opening mixed. Tech is by far the clear outperformer, lifted by strength in ASML (+4.5%) after it reiterated its 2030 sales outlook. Healthcare resides at the foot of the pile, with Merck (-2.4%) weighing on the sector. Basic Resources is also incrementally in negative territory, with underlying metals prices hit by the continued strength in the Dollar.

- US equity futures are modestly firmer across the board, but with slight outperformance in the RTY as it attempts to pare back the hefty losses seen in the prior session.

- Cisco Systems Inc (CSCO) Q1 2025 (USD): Adj. EPS 0.91 (exp. 0.87), Revenue 13.80bln (exp. 13.77bln). Guides Q2 Adj. EPS USD 0.89-0.91 (exp. 0.87). Guides Q2 revenue USD 13.75bln-13.95bln (exp. 13.74bln). Raised FY Adj. EPS guidance to USD 3.60-3.66 from 3.52-3.58 (exp. 3.57). Raises FY revenue guidance to USD 55.3bln-56.3bln from 55bln-56.2bln (exp. 55.88bln). Shares -3.9% in pre-market trade

- ASML (ASML NA) keeps its 2030 sales outlook unchanged between EUR 44-60bln. "The annual semiconductor market growth rate is anticipated to be approximately 9% during the period 2025-2030."

- Foxconn (2354 TT) expects Q4 and 2024 revenues to grow significantly: 2024 Outlook: Smart consumer electronics revenue to slightly decline (prev. guided flattish); Computing products revenue to grow significantly (prev. guided flattish). 2025: AI servers to account for 50% of server revenue.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY's bull run since the election has continued into today's session with the DXY up around 3 handles since election day. Just above the 107.00 mark at best, if the move continues the 2023 high sits at 107.35. Today's data slate sees the release of US PPI which will be used as an input for PCE. Fed speak includes Powell, Barkin, Williams & Kugler.

- EUR/USD's recent run of losses has extended with the pair slipping further onto a 1.05 handle with a current session low at 1.0507 (fresh YTD low). The next obvious target for the pair is 1.05. If cracked, the 2023 low sits at 1.0448. Looking ahead for the Eurozone, ECB's Lagarde and Schnabel are due to speak.

- JPY is softer once again vs. the broadly stronger USD. In terms of fundamentals for Japan, reports suggest that the nation is planning a JPY 13.5tln extra budget to fund its stimulus package. However, this has done nothing to turn the tide for the pair.

- GBP lower vs. the USD for a 5th consecutive session. For now, this remains more of a USD story rather than one of pure GBP weakness. Today's UK data slate is light. However, BoE's Mann and Bailey are due to speak.

- Both antipodes are softer vs. the USD with AUD in focus following slightly softer-than-expected jobs data overnight. That being said, the release is unlikely to force the hand of the RBA into cutting rates in the immediate future.

- PBoC set USD/CNY mid-point at 7.1966 vs exp. 7.2326 (prev. 7.1991).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- A slightly softer start to the session with USTs at a fresh 109-06 contract low. Yields bid across the curve with the belly leading and a very slight flattening bias overall. Docket ahead has PPI and IJC, which could spur reactions given the relevance for PCE and insight into the labour-side of the Fed’s mandate respectively. Thereafter, markets will await Fed Chair Powell and then Williams.

- Bunds are in the red but well off worst levels, currently near a 131.79 peak having bounced from an early 131.28 trough, a low which printed overnight when newsflow was light. The second read of EZ GDP figures were unrevised, whilst the Employment figures were revised slightly higher; metrics which ultimately had little impact on price action.

- Gilts are underperforming, holding above the 93.00 mark currently but did go as low as 92.97 just after the open. Specifics for the UK are somewhat light, aside from a lot of press focus on Reeves’ upcoming speech on pension reform; on the subject of speakers, BoE’s Bailey is also on the Mansion House docket but before that we expect a text release from Mann.

- Click for a detailed summary

COMMODITIES

- Crude is subdued and in choppy trade but within tight ranges amid a lack of macro catalysts but with eyes on the ever-evolving geopolitical landscape. Brent Jan trades between a USD 71.79-72.46/bbl range.

- Pressure seen across all precious metals as the Dollar continues to ramp higher as DXY rises further above 106.50 to levels closer to 107.00.

- Hefty losses across the board for base metals amid the ongoing USD strength and potential implications from protectionism under a Trump admin.

- IEA OMR: raises 2024 world oil demand growth forecast to 920k BPD (prev. 860k BPD); 2025 forecast at 990k BPD (prev. 1mln BPD); says China is the main drag on global oil demand growth; Chinese demand contracted for a sixth straight month in Oct.

- Private Inventory Data (bbls): Crude -0.8mln (exp. +0.1mln), Gasoline +0.3mln (exp. +0.6mln), Distillate +1.1mln (exp. +0.2mln), Cushing -1.9mln.

- South African Mining Production YY (Sep) 4.7% vs. Exp. 2.2% (Prev. 0.3%); Gold Production YY (Sep) -3.7% (Prev. -4.6%)

- Click for a detailed summary

NOTABLE DATA RECAP

- EU Employment Flash QQ (Q3) 0.2% vs. Exp. 0.1% (Prev. 0.2%); Employment Flash YY (Q3) 1.0% vs. Exp. 0.8% (Prev. 0.8%)

- EU Industrial Production YY (Sep) -2.8% vs. Exp. -2.0% (Prev. 0.1%, Rev. -0.1%); Industrial Production MM (Sep) -2.0% vs. Exp. -1.4% (Prev. 1.8%, Rev. 1.5%)

- EU GDP Flash Estimate YY (Q3) 0.9% vs. Exp. 0.9% (Prev. 0.9%); GDP Flash Estimate QQ (Q3) 0.4% vs. Exp. 0.4% (Prev. 0.4%)

- UK RICS Housing Survey (Oct) 16.0 vs. Exp. 11.0 (Prev. 11.0)

- Swedish CPIF YY (Oct) 1.5% vs. Exp. 1.5% (Prev. 1.5%); CPIF MM (Oct) 0.4% vs. Exp. 0.4% (Prev. 0.4%)

- Spanish HICP Final MM (Oct) 0.4% vs. Exp. 0.4% (Prev. 0.4%); CPI MM Final NSA (Oct) 0.6% vs. Exp. 0.6% (Prev. 0.6%); CPI YY Final NSA (Oct) 1.8% vs. Exp. 1.8% (Prev. 1.8%); HICP Final YY (Oct) 1.8% vs. Exp. 1.8% (Prev. 1.8%)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves is planning on introducing pension legislation changes to create a series of "megafunds" by pooling pension savings, according to Bloomberg.

- ECB's de Guindos says has seen good news recently on inflation, but not so good for economic activity. Says inflation has come down quite a lot, all indicators on core inflation are heading in the right direction. Recent data on prices heading towards 2% goal. If inflation converges towards the goal, monetary policy will respond accordingly.

- German VDMA Engineering Association sees 1.5% revenue growth in China for German engineering companies in 2024

NOTABLE US HEADLINES

- Pennsylvania Senate seat race will be subjected to a recount after the vote result was within the threshold for an automatic recount under state law, according to NBC.

GEOPOLITICS

MIDDLE EAST

- "Syria reports the activation of the air defense system against a UAV in southern Homs in central Syria", according to Israel Radio Correspondent

- Iranian Foreign Minister Araqchi says Iran is ready to negotiate based on it's national interests & inalienable right

- Israeli army warned of striking buildings in Haret Hreik and Burj al-Barajneh in the southern suburbs of Beirut, while it was later reported that Israeli warplanes attacked Beirut's southern suburbs.

- Iraqi armed factions said they attacked a vital target in northern Israel with drones, according to Sky News Arabia.

OTHER

- White House said US President Biden reinforced the need to back Ukraine in the meeting with President-elect Trump.

CRYPTO

- Bitcoin continues to climb higher and sits slightly above USD 91k.

APAC TRADE

- APAC stocks were mostly subdued following the indecisive lead from Wall Street where stock markets were choppy after in-line CPI data and continued 'Trump trade' flows, while there was a lack of fresh major catalysts to drive price action.

- ASX 200 gained as strength in Tech and Financials picked up the slack from the weakness in the commodity-related sectors but with the upside capped by disappointing jobs data.

- Nikkei 225 wiped out all of its initial gains and returned to beneath the 39,000 level despite a weaker currency.

- Hang Seng and Shanghai Comp remained pressured despite the lack of fresh catalysts and ahead of tomorrow's activity data with weakness seen in property stocks, while tech names are mixed ahead of key earnings, although Tencent was an early outperformer in Hong Kong after its quarterly results beat estimates on the bottom line.

NOTABLE ASIA-PAC HEADLINES

- China reportedly armed itself for a potential trade war with Trump as Beijing has enacted sweeping laws since the US President-elect’s first term that would allow it to retaliate if threatened, according to FT.

- Japan is planning a JPY 13.5tln extra budget to fund the stimulus package with PM Ishiba looking to finalise the stimulus package on November 22nd, according to Sankei.

- NetEase (9999 HK) Q3 Revenue (USD) 3.7bln (exp. 3.65bln).

- JD.Com (9618 HK) Q3 (CNY) Revenue 260.4bln (exp. 259.7bln), Net Income 11.7bln (exp. 11.83bln), EPS 8.68 (prev. 6.70 Y/Y)

DATA RECAP

- Australian Employment (Oct) 15.9k vs. Exp. 25.0k (Prev. 64.1k)

- Australian Unemployment Rate (Oct) 4.1% vs. Exp. 4.1% (Prev. 4.1%)

- Australian Participation Rate (Oct) 67.1% vs. Exp. 67.2% (Prev. 67.2%)