ESG is already dead, as we have been noting over the last couple of years. But with Trump taking office, it'll officially take custody of its death certificate.

Such was the topic of a new Bloomberg op-ed piece this week by John Authers, claiming that Trump is going to "bury" ESG once and for all. In the U.S., Environmental, Social, and Governance investing has taken a sharp downturn, falling victim to political polarization and failing to deliver on its promises.

Initially aimed at promoting sustainable and ethical business practices, ESG became embroiled in culture wars and now faces a retreat as American priorities shift toward a more nationalist, even mercantilist, approach to economics, the piece reminds us.

Conservative leaders have demonized the term “ESG” to the point where prominent figures like BlackRock CEO Larry Fink have abandoned it, calling it “weaponized.” BlackRock, once a major advocate for ESG, has become a target for conservatives who associate the company with identity politics.

Heritage Foundation President Kevin Roberts even listed BlackRock among “decadent” institutions in his new book, sharing this label with organizations as disparate as the Boy Scouts of America and the Chinese Communist Party.

Authers notes that many investors have already grown skeptical, seeing ESG as a marketing gimmick, with big players like Invesco facing fines for “greenwashing.” Europe, in contrast, has tightened ESG standards, requiring fund managers to meet specific environmental thresholds for the ESG label, which complicates U.S. investments for European funds due to regulatory differences.

In the U.S., however, the SEC has scaled back ESG requirements, with its task force on the matter disbanded in September. This deregulation could accelerate if Trump returns to office, likely leading to further cuts to ESG-related mandates, Authers writes.

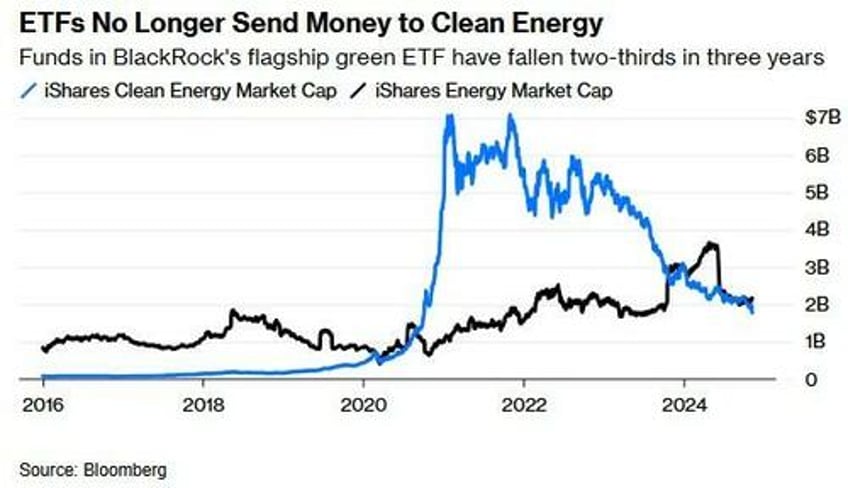

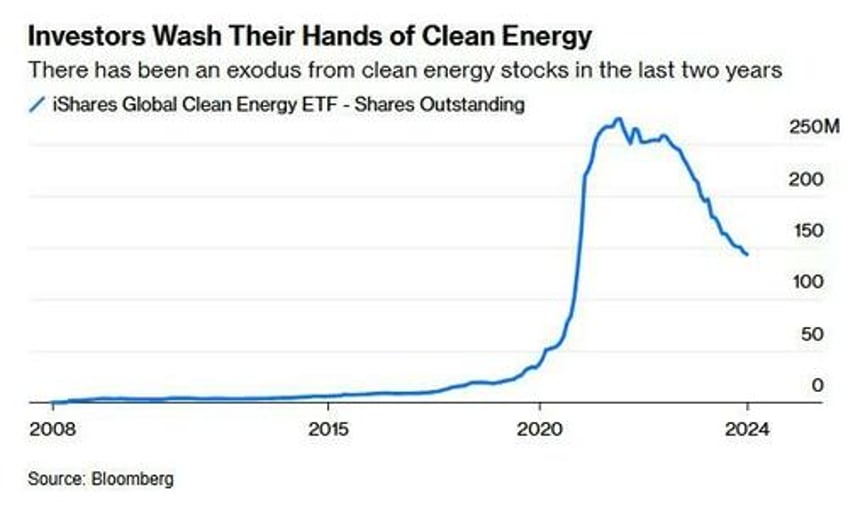

A market shift away from ESG is already evident, as BlackRock’s clean energy ETF has declined significantly since its 2021 peak, with funds moving back toward traditional energy sectors.

Investor interest in ESG has waned considerably, as shown by declining search activity in the U.S. and a drop in ESG mentions during corporate earnings calls. Media coverage of ESG, which surged in 2016, has also fallen, reflecting dwindling public interest. Executives, once eager to discuss ESG initiatives, now mention it far less, a shift apparent in recent earnings call transcripts.

BlackRock’s own support for environmental and social proposals has sharply declined. While the company maintains a commitment to corporate governance, it backed only 4% of ESG proposals last year. With the shift away from ESG in corporate America, any hope of reshaping capitalism through ethical investing appears to be in retreat, leaving questions about what economic direction will replace it.

Recall just days ago we wrote that ESG fund managers are being told to 'keep their lawyers very close'. Aniket Shah wrote in a note last week: “We’d encourage all ESG fund managers to have a lawyer on the team, or on speed-dial.”

He continued: “Antitrust risk remains high for asset managers in ESG; there haven’t been any cases yet, thus there is no legal precedent. Further, legal risks regarding fiduciary duty will stay relevant as states enforce anti-ESG laws.”

Yahoo reports that Trump's victory has already hit green sector stocks, with wind-energy companies among the hardest hit.