- APAC stocks were mostly in the green following the rebound of equity markets stateside.

- A press briefing by several Chinese government agencies and the PBoC failed to inspire a turnaround in the property sector.

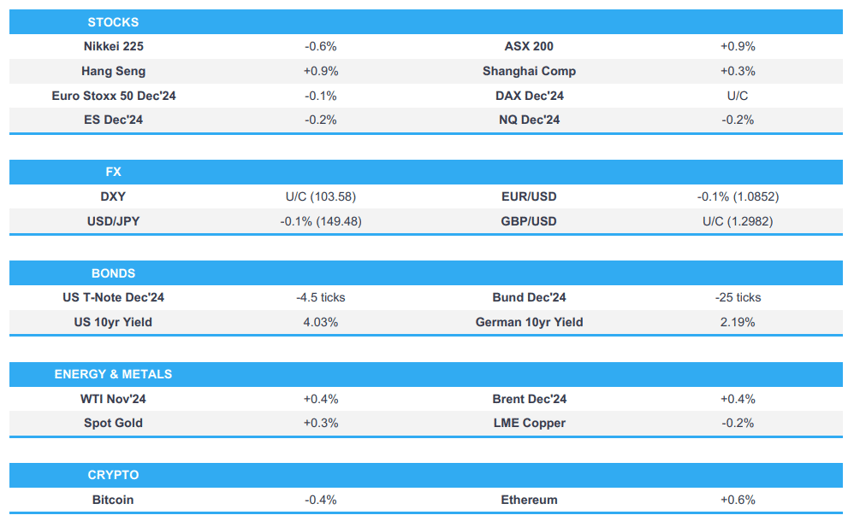

- European equity futures are indicative of a softer cash open with the Euro Stoxx 50 future -0.1% after the cash market closed lower by 0.8% on Wednesday.

- DXY is steady above the 103.50 mark, AUD leads post-jobs data, EUR/USD trades around the 1.0850 level ahead of ECB.

- Looking ahead, highlights include EZ HICP (Final), US Initial Jobless Claims, Philly Fed Index, Retail Sales, US Industrial Production, ECB & CBRT Policy Announcements, ECB President Lagarde & Fed’s Goolsbee, Supply from Spain & France.

- Earnings from Elevance Health, Truist Financial, M&T Bank, KeyCorp, Travelers, Blackstone, TSMC, Netflix, VAT, ABB, Nestle, Nokia, Pernod Ricard, Publicis, EssilorLuxottica, Entain & Rentokil

SNAPSHOT

More Newsquawk in 3 steps:

More Newsquawk in 3 steps:1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks shrugged off the initial weakness seen at the open to close in the green with the attention on earnings season amid a relatively catalyst-light session. Most sectors gained and advances were led by outperformance in Utilities, Real Estate and Financials with the latter buoyed by strong MS earnings, while Communication, Consumer staples and Technology lagged alongside losses in Meta (META) shares.

- SPX +0.47% at 5,842, NDX +0.07% at 20,174, DJIA +0.79% at 43,078, RUT +1.64% at 2,287.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Goldman Sachs expects the Fed to deliver consecutive 25bps cuts from November 2024 through June 2025 to a terminal rate range of 3.25%-3.50%, while it expects the ECB to deliver a 25bps cut at the upcoming meeting and then sequential 25bps of cuts until the policy rate reaches 2% in June 2025.

APAC TRADE

EQUITIES

- APAC stocks were mostly in the green following the rebound of equity markets stateside but with gains capped amid quiet macro catalysts and as China's property sector briefing failed to rally local developers.

- ASX 200 climbed to a fresh record high led by strength in real estate, industrials and financials, while strong jobs data added to the upbeat mood but further lowered the odds of a rate cut this year.

- Nikkei 225 underperformed following disappointing trade data including a surprise contraction in exports.

- Hang Seng and Shanghai Comp advanced at the open with the help of tech strength and consumer-related stocks, although the mainland index briefly wiped out all of its gains amid weakness in property stocks as the press briefing by several Chinese government agencies and the PBoC failed to inspire a turnaround in the sector.

- US equity futures (ES -0.2%) slightly eased back after the prior day's rebound as a slew of data looms.

- European equity futures are indicative of a softer cash open with the Euro Stoxx 50 future -0.1% after the cash market closed lower by 0.8% on Wednesday.

FX

- DXY traded rangebound around the 103.50 level following the prior day's gains with price action quiet as a deluge of US data releases loom including Retail Sales, Industrial Production, Philly Fed Manufacturing and Initial Jobless Claims.

- EUR/USD lacked demand after recent softening and a failed attempt to return to the 1.0900 territory with participants now looking ahead to the ECB policy decision.

- GBP/USD languished near the prior day's lows after slipping beneath the 1.3000 level owing to soft UK CPI data.

- USD/JPY mildly retreated after stalling on its approach towards the 150.00 level and amid the weakness in Tokyo stocks.

- Antipodeans traded positively with outperformance in AUD/USD following stronger-than-expected jobs data in which headline Employment Change printed more than double the consensus and unemployment declined despite higher participation.

FIXED INCOME

- 10yr UST futures faded the previous day's mild gains in rangebound trade ahead of a slew of upcoming data releases.

- Bund futures trickled lower from a weekly peak but with the downside cushioned by support around the 134.00 level.

- 10yr JGB futures were lacklustre and failed to benefit from the enhanced-liquidity auction for long to super-long JGBs.

COMMODITIES

- Crude futures were kept afloat after WTI rebounded from support around the USD 70/bbl level albeit with price action contained despite the latest private sector inventory data which showed a surprise draw in headline crude stockpiles.

- US Private inventory data (bbls): Crude -1.6mln (exp. +1.8mln), Gasoline -5.9mln (exp. -1.5mln), Distillates -2.7mln (exp. -2.2mln), Cushing +0.4mln.

- Spot gold was choppy and lacked conviction in quiet trade and as the dollar held on to recent gains.

- Copper futures were initially underpinned alongside the mostly constructive risk tone in Asia but later faltered as participants were underwhelmed by Beijing's latest press briefing on the property sector.

- Peru copper output rose 10.7% Y/Y in August to 246.6k tons.

CRYPTO

- Bitcoin traded indecisively in which prices fluctuated back and forth of the USD 67,500 level.

NOTABLE ASIA-PAC HEADLINES

- China's Housing Minister vowed to stabilise the property market from declining further in the press briefing and said the government has announced a raft of policies on housing, while he announced they will add 1mln village urbanisation projects, as well as expand the white list of projects and bank lending to CNY 4tln. Furthermore, they will adopt monetisation measures for urbanisation projects and cities will make their own decisions regarding property restrictions based on the economic situation and local property market conditions.

- PBoC Deputy Governor said regarding existing mortgage rate cuts that most stock of existing mortgage loans interest rates will be adjusted on October 25th and real estate development loans will be extended until end-2026, while interest rates on existing mortgages are expected to fall by an average 50bps, benefitting 50mln households and 150mln residents.

- China's Assistant Finance Minister said regarding housing purchases that the use of special loans is to support the local government in accordance with the actual situation and they will further broaden local funding sources, while he said they will reduce the burden on developers and home buyers regarding property taxes.

- China NFRA Deputy Director said all commercial housing loans are to be included in the 'whitelist' and management of real estate projects are to be further standardised, while financing will be made more convenient and quicker. The official added that commercial banks should make full use of loans and they should optimise the allocation of loans and method of appropriation.

DATA RECAP

- Japanese Trade Balance (JPY)(Sep) -294.3B vs. Exp. -237.6B (Prev. -695.3B, Rev. -703.2B)

- Japanese Exports YY (Sep) -1.7% vs. Exp. 0.5% (Prev. 5.6%, Rev. 5.5%)

- Japanese Imports YY (Sep) 2.1% vs. Exp. 3.2% (Prev. 2.3%)

- Australian Employment (Sep) 64.1k vs. Exp. 25.0k (Prev. 47.5k)

- Australian Full Time Employment (Sep) 51.6k (Prev. -3.1k)

- Australian Unemployment Rate (Sep) 4.1% vs. Exp. 4.2% (Prev. 4.2%)

- Australian Participation Rate (Sep) 67.2% vs. Exp. 67.1% (Prev. 67.1%)

GEOPOLITICS

MIDDLE EAST

- Israeli source cited by ABC said PM Netanyahu agreed to a set of targets to be hit inside of Iran without specifying a timeline for the attack, according to Al Jazeera.

- Israeli PM Netanyahu said he held an emergency discussion on increasing aid to Gaza, according to Reuters citing three Israeli officials.

- Israeli officials have been assuring their US counterparts that Israel will act quickly to improve the dire humanitarian situation in Gaza following an ultimatum from the Biden administration, according to two Israeli officials cited by Axios.

- US President Biden's envoy told aid groups that Israel is too close an ally for the US to suspend arms, according to POLITICO. It was separately reported that US Defence Secretary Austin spoke to his Israeli counterpart on Wednesday and reinforced the importance of taking all necessary measures to ensure the safety and security of UNIFIL forces and Lebanese armed forces, according to the Pentagon.

- Qatari PM said there has been no engagement at all from all parties in the last three to four weeks regarding Gaza ceasefire talks.

- Yemen's Houthi Al Masirah TV reported US-British air strikes which targeted the capital of Sanaa and city of Saada, while US Defence Secretary Austin said US forces targeted several Houthi underground facilities housing various weapons components in Yemen.

- Explosions were heard amid reported Israeli aggression targeting Syria's Latakia, according to Syrian state media.

OTHER

- China's Coast Guard said a Japanese fishing boat illegally entered the territorial waters of Diaoyu Island and the Chinese Coast Guard drove away Japanese vessels on October 15th-16th in accordance with the law, according to state media.

- North Korea said roads and railways with South Korea were completely cut off under its constitution that defines the South as a hostile state, while it will continue to take measures to permanently fortify the border with South Korea, according to KCNA.

EU/UK

NOTABLE HEADLINES

- BoE's Prudential Regulation Authority is to signal more rules can be relaxed to support growth, according to FT.

- UK Chancellor Reeves will use her Budget to increase capital gains tax on the sale of shares and other assets but will not change the rate for second homes, according to The Times. It was also reported that Reeves's Budget is set to be the largest tax raiser in history in which she may look to increase fuel duty and faces backlash from Cabinet colleagues, according to The Telegraph.