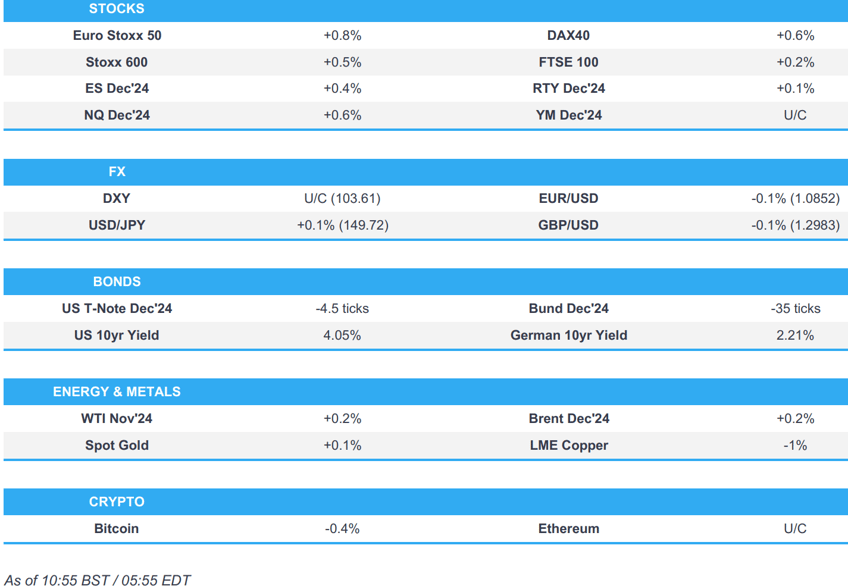

- European bourses trade mostly firmer but to varying degrees, with tech sentiment briefly lifted after strong TSMC results; US futures also gain.

- The dollar is flat, AUD benefits from the stronger-than-expected jobs data, whilst the Loonie underperforms.

- Bonds are on the backfoot and awaiting today’s key risk events which include US Retail Sales and the ECB Policy Announcement.

- Crude oil is choppy and trading on either side of the unchanged mark, XAU is modestly firmer whilst base metals are mostly lower.

- Looking ahead, highlights include US Initial Jobless Claims, Philly Fed Index, Retail Sales, US Industrial Production, ECB & CBRT Policy Announcements, ECB President Lagarde & Fed’s Goolsbee. Earnings from Elevance Health, Truist Financial, M&T Bank, KeyCorp, Travelers, Blackstone, Netflix, EssilorLuxottica.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.4%) began the session modestly firmer and gradually edged to session highs as the morning progressed before coming off best levels. Sentiment across European futures improved following the release of TSMC’s earnings, with tech opening in the green but then faltering.

- European sectors hold a slight positive bias; Banks take the top spot, lifted by post-earning strength in Nordea Bank (+3.5%). The Basic Resources sector is found towards the bottom of the pile, hampered by broader weakness in the base metals complex.

- US Equity Futures (ES +0.3%, NQ +0.6%, RTY +0.2%) are modestly firmer across the board, ahead of key US data which includes US Initial Jobless Claims, Philly Fed Index, Retail Sales and Industrial Production. NVIDIA (NVDA) +2% pre-market after TSMC's earnings.

- TSMC (2330 TW) Q3 (TWD): Net 325.3bln (exp. 299.3bln), Gross Margin 57.8% (exp. 54.8%), Capex 6.4bln (prev. 6.36bln Q/Q), EPS 12.54 (exp. 11.41). Q4 Guidance (USD): Revenue 26.1-26.9bln (exp. 24.2bln), Gross Margin 57-59% (exp. 54.7%), Operating Margin 46.5-48.5% (exp. 44.3%)

- Earnings include: Nestle (revenue & guidance soft), Nokia (missed, maintained outlook), Pernod Ricard (Miss, China sales -26%).

- EU is weighing using Elon Musk's empire revenue as a potential fine for X, according to Bloomberg sources; Tesla (TSLA) would be exempt as it is a publicly-traded company.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is showing a mixed performance vs. peers, however, that could change later in the session amid a slew of US data points with retail sales being the standout highlight. To the upside for DXY, the 200DMA is at 103.77.

- EUR is trivially lower vs. the USD in the run-up to today's ECB rate decision which is widely expected to see a 25bps reduction in the deposit rate. To the upside, Wednesday's high lies at 1.0901. On the downside, there is clean air until 1.0800.

- GBP is flat vs. the USD following yesterday's CPI-induced sell-off which saw Cable decline from a 1.3077 high to an overnight trough at 1.2974. However, if the downside resumes, the focus will be on a test of the 100DMA at 1.2954.

- JPY is a touch softer vs. the USD, however, USD/JPY remains unwilling to crack 150.00 to the upside after printing a high at 149.98 on Monday.

- Diverging fortunes for the antipodes with AUD boosted by strong jobs data overnight which has further heightened expectations that the RBA will delay commencing its rate-cutting cycle until next year. NZD is flat vs. the USD in quiet newsflow.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Bunds are on the back foot, holding around a 133.74 trough ahead of resistance at 133.68 from Wednesday before 133.40-42 before 133.00 itself. The Spanish auction was strong but was unable to stop the selling pressure.

- USTs are modestly lower and directionally in-fitting with peers but with magnitudes once again smaller; the docket today holds US Initial Jobless Claims, Philly Fed Index, Retail Sales and Industrial Production. At a 112-11 base, just below Wednesday’s 112-13 low. For Europe, focus on the ECB ahead of which Final EZ HICP was revised down.

- Gilts are the marginal laggard after Wednesday’s inflation-driven upside. Gilts gapped lower by 23 ticks and have since slipped by another 20 ticks to a 97.55 base.

- Spain sells EUR 5.115bln vs exp. EUR 4.5-5.5bln 3.10% 2031, 3.45% 2034, 2.70% 2048 Bonos

- France sells EUR 12bln vs EUR 10-12bln 2.50% 2027, 0.75% 2028, 2.75% 2029, and 2.75% 2030 OAT

- Click for a detailed summary

COMMODITIES

- Crude oil is choppy and trading on either side of the unchanged mark amid light catalysts thus far and following four back-to-back closes in the red. Brent Dec trades in a 73.89-74.92/bbl parameter.

- A mixed session for precious metals with spot palladium flat, silver subdued, and gold eking mild gains at the time of writing. Spot gold incrementally printed fresh record highs of USD 2,685.84/oz in today's session.

- Base metals are mostly lower after being initially underpinned overnight alongside the mostly constructive risk tone in Asia but later faltered as participants were underwhelmed by Beijing's latest press briefing on the property sector.

- Peru copper output rose 10.7% Y/Y in August to 246.6k tons.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU HICP Final YY (Sep) 1.7% vs. Exp. 1.8% (Prev. 1.8%); HICP Final MM (Sep) -0.1% vs. Exp. -0.1% (Prev. 0.1%); HICP-X F&E Final YY (Sep) 2.7% vs. Exp. 2.7% (Prev. 2.7%); HICP-X F,E,A&T Final YY (Sep) 2.7% vs. Exp. 2.7% (Prev. 2.7%); HICP-X F, E, A, T Final MM (Sep) 0.1% vs. Exp. 0.1% (Prev. 0.1%); HICP-X Tobacco YY (Sep) 1.6% (Prev. 2.0%); HICP-X Tobacco MM (Sep) -0.1% (Prev. 0.1%)

NOTABLE EUROPEAN HEADLINES

- BoE's Prudential Regulation Authority is to signal more rules can be relaxed to support growth, according to FT.

- UK Chancellor Reeves will use her Budget to increase capital gains tax on the sale of shares and other assets but will not change the rate for second homes, according to The Times. It was also reported that Reeves's Budget is set to be the largest tax raiser in history in which she may look to increase fuel duty and faces backlash from Cabinet colleagues, according to The Telegraph.

NOTABLE US HEADLINES

- Goldman Sachs expects the Fed to deliver consecutive 25bps cuts from November 2024 through June 2025 to a terminal rate range of 3.25%-3.50%, while it expects the ECB to deliver a 25bps cut at the upcoming meeting and then sequential 25bps of cuts until the policy rate reaches 2% in June 2025.

- BofA Institute Total Card Spending (w/e 12th Oct) +0.8% Y/Y (vs -0.9% average in Sep)

GEOPOLITICS

MIDDLE EAST

- German naval ship reportedly brought down an unmanned flying object in an incident off the coast of Lebanon early Thursday, according to a German Defence Ministry spokesman.

- Israeli source cited by ABC said PM Netanyahu agreed to a set of targets to be hit inside of Iran without specifying a timeline for the attack, according to Al Jazeera.

- Israeli PM Netanyahu said he held an emergency discussion on increasing aid to Gaza, according to Reuters citing three Israeli officials.

- US President Biden's envoy told aid groups that Israel is too close an ally for the US to suspend arms, according to POLITICO. It was separately reported that US Defence Secretary Austin spoke to his Israeli counterpart on Wednesday and reinforced the importance of taking all necessary measures to ensure the safety and security of UNIFIL forces and Lebanese armed forces, according to the Pentagon.

- Yemen's Houthi Al Masirah TV reported US-British air strikes which targeted the capital of Sanaa and the city of Saada, while US Defence Secretary Austin said US forces targeted several Houthi underground facilities housing various weapons components in Yemen.

- Explosions were heard amid reported Israeli aggression targeting Syria's Latakia, according to Syrian state media.

OTHER

- China's Coast Guard said a Japanese fishing boat illegally entered the territorial waters of Diaoyu Island and the Chinese Coast Guard drove away Japanese vessels on October 15th-16th in accordance with the law, according to state media.

- North Korea said roads and railways with South Korea were completely cut off under its constitution that defines the South as a hostile state, while it will continue to take measures to permanently fortify the border with South Korea, according to KCNA.

CRYPTO

- Bitcoin is slightly lower and dipped below USD 67.5k, whilst Ethereum manages to remain afloat.

APAC TRADE

- APAC stocks were mostly in the green following the rebound of equity markets stateside but with gains capped amid quiet macro catalysts and as China's property sector briefing failed to rally local developers.

- ASX 200 climbed to a fresh record high led by strength in real estate, industrials and financials, while strong jobs data added to the upbeat mood but further lowered the odds of a rate cut this year.

- Nikkei 225 underperformed following disappointing trade data including a surprise contraction in exports.

- Hang Seng and Shanghai Comp advanced at the open with the help of tech strength and consumer-related stocks, although the mainland index briefly wiped out all of its gains amid weakness in property stocks as the press briefing by several Chinese government agencies and the PBoC failed to inspire a turnaround in the sector.

NOTABLE ASIA-PAC HEADLINES

- Japan Bankers Association Chair said "Personally, I think the Japanese economy is really at a tipping point with wage increases"

- China's Housing Minister vowed to stabilise the property market from declining further in the press briefing and said the government has announced a raft of policies on housing, while he announced they will add 1mln village urbanisation projects, as well as expand the white list of projects and bank lending to CNY 4tln. Furthermore, they will adopt monetisation measures for urbanisation projects and cities will make their own decisions regarding property restrictions based on the economic situation and local property market conditions.

- PBoC Deputy Governor said regarding existing mortgage rate cuts that most stock of existing mortgage loans interest rates will be adjusted on October 25th and real estate development loans will be extended until end-2026, while interest rates on existing mortgages are expected to fall by an average 50bps, benefitting 50mln households and 150mln residents.

- China's Assistant Finance Minister said regarding housing purchases that the use of special loans is to support the local government in accordance with the actual situation and they will further broaden local funding sources, while he said they will reduce the burden on developers and home buyers regarding property taxes.

- China NFRA Deputy Director said all commercial housing loans are to be included in the 'whitelist' and management of real estate projects are to be further standardised, while financing will be made more convenient and quicker. The official added that commercial banks should make full use of loans and they should optimise the allocation of loans and method of appropriation.

DATA RECAP

- Japanese Trade Balance (JPY)(Sep) -294.3B vs. Exp. -237.6B (Prev. -695.3B, Rev. -703.2B)

- Japanese Exports YY (Sep) -1.7% vs. Exp. 0.5% (Prev. 5.6%, Rev. 5.5%); Imports YY 2.1% vs. Exp. 3.2% (Prev. 2.3%)

- Australian Employment (Sep) 64.1k vs. Exp. 25.0k (Prev. 47.5k); Full Time Employment 51.6k (Prev. -3.1k)

- Australian Unemployment Rate (Sep) 4.1% vs. Exp. 4.2% (Prev. 4.2%); Participation Rate 67.2% vs. Exp. 67.1% (Prev. 67.1%)