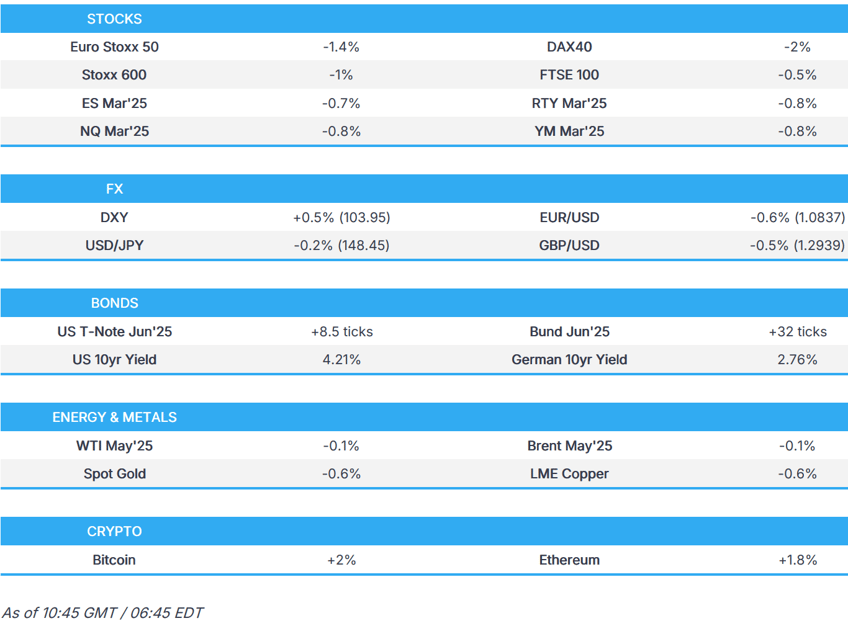

- European risk tone deteriorates with US futures also slumping into the red, potentially driven by EU fiscal focus, post-FOMC pullback and attention returning to tariffs/trade.

- USD up vs. peers, Antipodeans lags, EUR slides and GBP eyes BoE.

- Bonds are bid post FOMC & as the tone deteriorates, Gilts lead on data & reports around the Spring Statement.

- Crude succumbs to the risk-off sentiment, with base metals also heading lower.

- Looking ahead, US Philly Fed Index, Jobless Claims, Japanese CPI, BoE & SARB Policy Announcements, Speakers including ECB’s Lane, BoC’s Macklem. Supply from the US, Earnings from Jabil, Micron, Nike, FedEx.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US President Trump said he believes India is probably going to be lowering tariffs substantially but on April 2nd, the US will be charging them the same tariffs they charge the US.

- EU's Trade Commissioner Sefcovic says the Commission is considering delaying first set of counter tariffs against the US to mid-April.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -1%) opened mixed, but has now succumbed to some significant selling pressure in recent trade, to display a negative picture in Europe. While there is no clear catalyst for the downside, it could be attributed to traders winding down their optimism surrounding the roll out of EU defence spending given it would take time to build up to spending of 1.5% of GDP; also, a pullback post-FOMC, refocussing on tariffs/trade into the April 2nd deadline and general economic/policy uncertainty all weigh. As such, a broad risk-off mood has entered markets since the European cash open, with the Dollar also catching a bid.

- European sectors are mixed and with the breadth of the market fairly narrow aside from the top/bottom performers. Retail takes the top spot, joined closely by Real Estate; the latter buoyed by the relatively lower yield environment – a factor which has led to some of the underperformance in Banks today.

- US equity futures (ES -0.7%) are entirely in the red, with sentiment in the complex hit alongside the tank in European equities with drivers much the same as outlined above.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY has continued to build on yesterday's post-FOMC gains with the release broadly as expected. The announcement failed to appease any of those in the market looking for a dovish lean from the FOMC with Chair Powell reaffirming that the Fed is in no hurry to cut rates. Ultimately, the Fed is in a holding pattern as policymakers look to gain clarity on the Trump administration's trade agenda. DXY has ventured as high as 103.95. If 104 gives way, interim resistance comes via the 14th March peak at 104.09.

- EUR is softer vs. the broadly firmer USD. From a macro perspective in the Eurozone, remarks from ECB President Lagarde largely echoed her introductory statement at this month's ECB press conference. However, she did flesh out the Bank's view on the ongoing trade conflict, noting that ECB analysis suggests that a US tariff of 25% on imports from Europe would lower Euro Area growth by around 0.3ppts in the first year. EUR/USD has slipped further from its YTD peak on Tuesday at 1.0954 and has hit a new low for the week at 1.0839.

- JPY flat vs. the USD and more resilient than peers. Yesterday, USD/JPY slumped beneath the 150.00 level as US yields softened in reaction to the Fed announcement, while the pair then continued its slide and approached closer to the 148.00 level in the absence of Japanese participants who were away from market overnight.

- GBP softer vs. the broadly firmer USD but stronger vs. the EUR. This morning's UK labour market report had no impact on expectations for today's upcoming BoE policy announcement. Cap Eco writes "the latest figures show that the jobs market is not collapsing as some surveys suggest and that there hasn’t been a big rise in the LFS redundancy rate". Cable is currently contained within yesterday's 1.2954-1.3010 range.

- Antipodeans are both at the bottom of the G10 leaderboard with pressure seen in AUD following disappointing jobs data from Australia which showed a surprise contraction in Employment Change and a drop in the Participation Rate, while better-than-expected New Zealand GDP failed to spur a bid.

- SNB delivered a 25bps cut to 0.25%, in-fitting with the majority of views and one that potentially takes the SNB to its terminal rate, with markets pricing in just 9bps of additional easing in 2025, though the still low inflation forecasts and uncertainty ahead (a point the SNB emphasised) mean further policy adjustments cannot be ruled out.

- PBoC set USD/CNY mid-point at 7.1754 vs exp. 7.2402 (Prev. 7.1697).

- Limited reaction seen in EUR/SEK following the widely-expected decision by the Riksbank to hold rates and the Riksbank declaring that it sees rates at current levels going forward, as reflected in the rate path. The lack of additional easing has been attributed to the recent higher-than-expected outturn for inflation.

- Brazil Central Bank hiked the Selic rate by 100bps to 14.25%, as expected, with the decision unanimous, while the committee expects another adjustment of a smaller magnitude at the next meeting and said the current scenario requires a more contractionary monetary policy.

- Morgan Stanley (MS) has paused its long EUR/USD and GBP/USD recommendations, saying investors may de-risk into the US' April 2nd tariff deadline. Adds that there is arguably too much EUR optimism priced in.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are firmer as the benchmark continues the dovish move seen after the Fed with particular focus on the slowing of the balance sheet run-off. Action overnight was contained on account of no Japanese trade, but once cash trade resumed the benchmark continued its climb and is currently at a 111-06+ session high with yields lower across the curve which itself is flattening.

- Bunds are firmer, picked up most recently as the risk tone deteriorated in the European morning with specifics somewhat light but a lot of focus on global economic uncertainty into the April 2nd tariff date and digestion of the EU’s defence white paper. On this, WSJ’s Norman points out there are “reasons to be sceptical EU member states will spend EUR 650bln in additional defence spending” given new 1.5% of GDP flexibility in budget rules. Flexibility which implies that it will take time to reach such a spending level; a view which is potentially weighing on the risk tone.

- Gilts are outperforming on the back of reports that the Chancellor will announce the biggest spending cuts since austerity next week with cuts to Whitehall budgets by billions of pounds more than thought (the general view was already for significant cuts in the Spending Review). Additionally, the morning saw the latest employment data with wage metrics pretty much bang in line with expectations while the unemployment measures, via both LFS and Claimant Count, ticked higher. A point which was ultimately taken dovishly with markets now just about fully pricing a 25bps cut in June and another in November. Reporting/data which Gilts welcomed and, alongside continuing FOMC bullishness, saw the benchmark gap higher by 24 ticks before extending by 25 more to a 92.81 peak; the highest it has been since March 4th.

- Spain sells EUR 6.5bln vs exp. EUR 5.5-6.5bln 0.50% 2030 I/L, 3.15% 2035 & 3.45% 2043 Bono

- Click for a detailed summary

COMMODITIES

- Crude is a little lower, with initial overnight strength fading in the European session alongside the deterioration in risk tone and as the Dollar lifts to session highs. Brent'May currently in a USD 70.89-71.41/bbl range.

- Precious metals are pressured today, with spot gold lower by just under USD 4/oz, trading within a tight USD 3,038.78-3,057.51/oz range. The yellow-metal has cooled a touch from overnight highs, as the Dollar continues to strengthen.

- Base metals are mixed; 3M LME Copper extended on this week's rally overnight, and briefly reclaimed the USD 10k/t mark; though in-fitting with the risk tone, has cooled from those overnight peaks to a currently USD 9,930/t.

- US President Trump considers extending Chevron's licence to pump oil in Venezuela, according to WSJ.

- US Energy Secretary Wright confirmed the signing of the LNG export approval for the CP2 project on Wednesday and said they are moving urgently to grow supply of electricity and lower prices with the impact of administration moves expected to be seen later this year, while he also stated they want to grow supply and push oil prices down.

- Norway (Prelim) Feb oil production 1.72mln/bpd (prev. M/M 1.78mln/bpd); Gas Production 9.9bln (prev. 10.7bln) Cubic Metres

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Avg Wk Earnings 3M YY (Jan) 5.8% vs. Exp. 5.9% (Prev. 6.0%, Rev. 6.1%) [note: other data vendors had the newswire consensus at 5.8%]; UK Avg Earnings (Ex-Bonus) (Jan) 5.9% vs. Exp. 5.9% (Prev. 5.9%)

- UK Private Sector 3 Month Average Growth YY (Jan) 6.1% (Prev. 6.20%); HMRC Payrolls Change (Feb) 21k (Prev. 21k); ILO Unemployment Rate (Jan) 4.4% vs. Exp. 4.4% (Prev. 4.4%); Claimant Count Unem Chng (Feb) 44.2k (Prev. 22.0k, Rev. 2.8k); Employment Change (Jan) 144k vs. Exp. 95k (Prev. 107k)

- German Producer Prices YY (Feb) 0.7% vs. Exp. 1.0% (Prev. 0.5%); Producer Prices MM (Feb) -0.2% vs. Exp. 0.1% (Prev. -0.1%)

NOTABLE EUROPEAN HEADLINES

- ECB's Villeroy says "we cannot have a new policy of spending whatever it takes re. defence spending"; says could raise overall economic growth to 1.5% from 1% at present in the near future.

- ECB's Lagarde says ECB analysis suggests that a US tariff of 25% on imports from Europe would lower Euro Area growth by around 0.3ppts in the first year; reiterates data dependant approach. Says the analysis of bond yield shows increase in inflation expectations is not significant.

- SNB cuts its Policy Rate by 25bps to 0.25%, as expected; "prepared to intervene on the foreign exchange market as necessary". The SNB will continue to monitor the situation closely and adjust its monetary policy if necessary, to ensure that inflation remains within the range consistent with price stability over the medium term. SNB Vice Chair Tschudin says inflationary pressure should continue to ease gradually over the next quarters, particularly in Europe. Economic growth in Switzerland was solid in Q4, services sector and parts of manufacturing developed favourably, and there was a further slight increase in unemployment, while the utilisation of overall production capacity was normal. SNB's Schlegel says inflation has developed inline with expectations. Uncertainty about global economic developments and inflation has increased "significantly". Inflation is still being driven by domestic services. Will continue to monitor the situation closely and adjust our monetary policy if necessary. SNB Chair Schlegel (post-meeting Q&A) says monetary conditions are appropriate; will not comment on the value of the CHF.

- Riksbank Statement: Rates left unchanged at 2.25%; sees rates at current levels going forward.

- Norges Bank Regional Network Q1'25: "contacts report a pick-up in growth in 2025 Q1 and expect stable growth in Q2."

- Greek PM Mitsotakis supports the Commissions Defence White Paper; however, adds that at some point the EU will need to discuss whether they move to grants instead of loans to fund increased defence expenditure

NOTABLE US HEADLINES

- US President Trump posts on Truth Social "The Fed would be MUCH better off CUTTING RATES as U.S.Tariffs start to transition (ease!) their way into the economy. Do the right thing. April 2nd is Liberation Day in America!!!"

- BofA total card spending +0.8% Y/Y (vs. 0.3% Feb avg.); biggest slowdowns were in entertainment and home improvement.

- Canadian PM Carney is expected to call a snap election for April 28, according to Bloomberg citing Globe

GEOPOLITICS

MIDDLE EAST

- Iran Foreign Minister says US President Trump letter is 'more of a threat', but adds that there are opportunities, and Tehran will contemplate both.

- Israeli military announced sirens sounded in several areas in Israel following a projectile that was launched from Yemen, while Houthis said they shelled Ben Gurion Airport with missiles and bombarded US aircraft carrier Harry Truman with a number of ballistic and winged missiles and drones, according to Asharq News.

- Houthi media reported the US bombing of targets including a cotton factory in Zabid district and with five raids in Hodeidah, northwestern Yemen, according to Sky News Arabia

- US President Trump's letter to Iran's Supreme Leader Ali Khamenei included a two-month deadline for reaching a new nuclear deal, according to Axios citing sources.

- US Secretary of State Rubio says President Trump seeks to promote peace and resolve the issue of "Iranian nuclear" diplomatically but is ready for all options, while he added that if Trump is forced to choose between a nuclear Iran or take action to prevent that from happening, he will take action.

- French President Macron said he spoke with Saudi Arabia’s Crown Prince MBS and welcomed the Jeddah Initiative, which enabled the start of peace negotiations in Ukraine, while Macron condemned the resumption of Israeli strikes on Gaza and said the conference on a two-state solution, which France will co-chair, must help revive a political perspective for both Israelis and Palestinians.

RUSSIA-UKRAINE

- Russian Kremlin says, on a US-Russia meeting in Jeddah, that it may not be on Sunday but will be in the coming days. Will announce who the Russian representative will be. To discuss the Black Sea initiative and other points of the Ukrainian peace deal.

- Ukrainian President Zelensky said Ukrainian and US officials may meet this Friday, Saturday or Sunday, while he added that his conversation with Trump on Wednesday was substantive and he felt no pressure from Trump. Zelensky said Ukraine is ready to discuss US involvement in the Zaporizhzhia plant's restoration with discussions in the early stages and noted it is not yet clear exactly how the infrastructure ceasefire will be monitored. Furthermore, he said Ukraine will respond in kind if Russia violates the ceasefire and that President Trump understands that Ukraine will not recognise occupied land as Russian.

CRYPTO

- Bitcoin is on a firmer footing and trades just above USD 85k; XRP continues to build on recent strength, which stemmed from positive SEC news.

APAC TRADE

- APAC stocks traded mixed with most indices in the green as the region initially took its cue from the gains on Wall St in the aftermath of the FOMC meeting where the Fed kept rates unchanged and slowed its balance sheet run-off, while Chinese markets bucked the trend and Japanese participants were absent due to Vernal Equinox Day.

- ASX 200 outperformed with gains led by the tech and real estate sectors amid a lower yield environment, while disappointing jobs data did little to derail the momentum in the index.

- KOSPI advanced amid strength in tech including index heavyweight Samsung Electronics which recently held its AGM and announced the appointment of one of its CEOs.

- Hang Seng and Shanghai Comp were subdued as participants navigated through earnings releases and after the lack of surprises from the announcement that China's benchmark Loan Prime Rates were kept unchanged.

NOTABLE ASIA-PAC HEADLINES

- Chinese Loan Prime Rate 1Y (Mar) 3.10% vs. Exp. 3.10% (Prev. 3.10%)

- Chinese Loan Prime Rate 5Y (Mar) 3.60% vs. Exp. 3.60% (Prev. 3.60%)

- HKMA maintained its base rate at 4.75%, as expected.

- US President Trump confirmed a willingness to hold a June summit with Chinese President Xi.

- Chinese battery makers CATL and BYD are targeted for new restrictions in the US under legislation that would bar the Homeland Security Department from procuring clean energy technology made by six companies, according to Nikkei Asia.

- South Korean opposition lawmakers are said to be seeking to impeach Acting President Choi, according to Yonhap citing the main DP opposition floor leader.

DATA RECAP

- Australian Employment (Feb) -52.8k vs. Exp. 30.0k (Prev. 44.0k)

- Australian Unemployment Rate (Feb) 4.1% vs. Exp. 4.1% (Prev. 4.1%)

- Australian Participation Rate (Feb) 66.8% vs. Exp. 67.3% (Prev. 67.3%)

- New Zealand GDP Prod Based QQ (Q4) 0.7% vs. Exp. 0.4% (Prev. -1.0%, Rev. -1.1%)

- New Zealand GDP Prod Based YY (Q4) -1.1% vs. Exp. -1.4% (Prev. -1.5%, Rev. -1.6%)