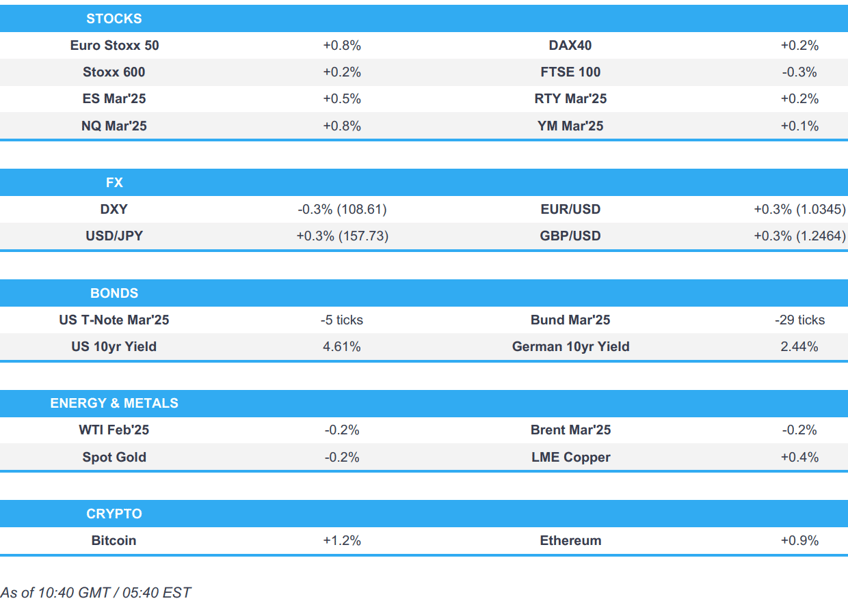

- European bourses are generally in the green; the NQ outperforms, with Tech lifted after Foxconn reported record Q4 revenue.

- USD is on the backfoot which has helped to lift G10 peers, JPY underperforms.

- USTs are pressured ahead of 3yr supply; Gilts underperform after a survey showed that 55% of UK businesses intend to lift prices in the next three months (prev. 39%).

- Crude and gold are on the backfoot despite the softer Dollar.

- Looking ahead, German Prelim. CPI, US Services & Composite PMI (Final), Factory Orders, Comments from Fed's Daly, Supply from US.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses are almost entirely in positive territory (ex-FTSE 100), with sentiment lifted by strength in Tech names. Bourses slipped a touch in early morning trade, but managed to stabilise and then head back to best levels where they generally reside.

- European sectors initially opened with a slight positive bias, but now displays a bit more of a mixed picture. Tech is by far the clear outperformer today, for a couple of reasons. Firstly, Foxconn reported strong December sales figures, helping to lift sentiment in the sector. Elsewhere, reports suggest that Microsoft plans to spend USD 80bln to build out AI this FY.

- US equity futures are entirely in the green, with slight outperformance in the tech-heavy NQ, taking impetus from the sectoral strength seen in Europe thus far.

- Microsoft plans to invest USD 80bln in FY25 to construct AI-capable data centres, with over half of this expenditure directed towards the US, CNBC reports. The investment is part of the company’s broader strategy to support AI advancements, including its partnership with OpenAI.

- Foxconn’s Q4 revenue hit a record USD 64.7bln (+15% Y/Y), exceeding estimates, driven by strong AI server demand. While consumer electronics, including iPhones, saw flat growth, Foxconn expects significant year-on-year growth in Q1 2025. NOTE: Foxconn denied reports that its chairman expressed positive outlook, that 2025 sales will trend upwards topping TWD 7tln, and said the company did not make any such financial forecasts.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- A subdued start to the week thus far with DXY continuing the downward action from Friday and falling further under the 109.00 level to print a current range between 108.43-109.06 (vs Friday's 108.89-109.22 parameter). US Services & Composite PMI (Final) due, with Fed speak from Daly thereafter.

- EUR is firmer amid the broader Dollar weakness and clawing back some of last Thursday's losses, with today's range currently between 1.0296-1.0352 (vs Thursday's best at 1.0372). Further support for the EUR was seen after the German state of Hesse reported December CPI at 2.7% Y/Y (prev. 2.0%).

- Weakness in JPY despite the softer Dollar but as a function of higher US yields, with Tokyo traders returning to the markets following their Christmas and New Year break. The pair was also unfazed by overnight comments from BoJ Governor Ueda who stated that he plans to increase interest rates with continued economic improvements but added the timing of an adjustment is dependent on the economy and inflation. USD/JPY resides in a 157.14-82 current range and eyes last Thursday's peak at 157.84.

- Sterling is the top G10 performer this morning amid broader USD weakness alongside potential tailwinds from reports that the percentage of UK businesses planning to raise prices in the coming three months rose to about 55% from 39% as tax increases and higher wage costs caused confidence to slump, according to a survey of 5,000 businesses by the British Chambers of Commerce via FT. GBP/USD resides in a USD 1.2408-1.2491 parameter as it eyes last Thursday's high at 1.2535.

- Antipodeans are both firmer amid the broader rise in high-beta FX, with Antipodeans also feeling tailwinds from higher base metals. Overnight, Antipodeans benefitted alongside the early strength in CNH after the PBoC continued to set a much stronger-than-expected yuan reference rate setting although the upside was limited and there was a relatively muted reaction to the varied Caixin PMI data.

- PBoC set USD/CNY mid-point at 7.1876 vs exp. 7.3035 (prev. 7.1878).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are pressured following the downside seen last week post-data and as the region awaits a hefty and frontloaded supply schedule. Furthermore, JGBs influenced overnight with the contract to a fresh low after remarks from Ueda who stated that he plans to increase interest rates with continued economic improvements but added the timing of an adjustment is dependent on the economy and inflation. As it stands, USTs are at lows of 108-12, matching the 30th December base with support from the session’s proceeding at 108-11+ and then the 108-06+ contract trough.

- Bunds are softer in-fitting with the above and as the region counts down to its own supply. Macro focus this morning has been on the Final PMIs, PMIs which were subject to upward revisions across the board sparking some modest pressure in EGBs. Furthermore, while most of the German State CPIs are scheduled for release later in the week after the mainland figure, the metric from Hesse came in much hotter than the prior for December Y/Y; which, if indicative, presents a further upward skew to the mainland numbers later today. Bunds are currently at a 132.22 low, a base which leaves just the contract trough at 132.00 from November as support.

- Gilts underperformed into its own PMI metrics, which saw modest downward revisions and helped to lift Gilts slightly off their base, though the benchmark was unable to reclaim the 92.00 mark or by extension test the opening 92.02 high. The referenced initial pressure stemmed from a British Chambers of Commerce survey which reported that 55% of UK businesses intend to lift prices in the next three months (prev. 39%) amid tax increases and elevated wage costs. Action which has pushed Gilts to a 91.78 base, within reach of the 91.64 contract low from December. As such, the UK’s 10yr yield is back towards highs of 4.65% from end-2024, levels which continue to pressure Chancellor Reeves’s headroom.

- Saudi Arabia mandates USD 3,6,10yr benchmarks, according to IFR. 3yr debt IPT at 120bps over UST. 10yr debt IPT at around 140bps over UST.

- Click for a detailed summary

COMMODITIES

- WTI and Brent are softer with prices failing to garner much support from the declining Dollar and overall positive risk tone in Europe, although APAC sentiment was mostly subdued. Geopolitical updates include reports that Israel wants to keep some sites outside the northern border in Lebanon indefinitely. Brent Mar sits in a USD 76.11-76.89/bbl parameter.

- Nat Gas is modestly softer intraday in fitting with the broader price action in energy. Some upticks were seen amid reports that European gas storage is depleting at the fastest rate since 2018, according to Bloomberg citing sources. Meanwhile, a major winter storm is reported to have hit the US, producing heavy snow and significant ice which is expected to last days, with some 30 states issuing weather alerts; US Nat Gas futures rose 9% intraday.

- Gold is subdued despite the softer Dollar in the run-up to this week's risk events including the FOMC Minutes and NFP jobs data. Spot gold resides in a narrow USD 2,647.49-2,625.26/oz range after dipping under Friday's USD 2,636.70/oz.

- Copper is on a firmer footing amid the softer dollar, Chinese Caixin Services PMI also has provided some tailwinds. 3M LME copper resides in a USD 8,781.50-8,913.00/t range.

- Saudi Aramco February Crude OSP: Arab light to US at + USD 3.50/bbl vs ASCI; Arab light to NW Europe at + USD 0.05/bbl to ICE Brent, via Aramco.

- Ukraine reportedly attempted to attack Zaporizhzhia nuclear power plant on January 5th with drones, according to Ifx citing Russian defence minister.

- US plans more sanctions on tankers carrying Russian oil, according to a source cited by Reuters.

- LNG tanker Coral Nordic will unload at Belgium’s Zeebrugge terminal on January 9th from Ruvys.

- German energy import Uniper’s (UN01 GY) CEO Mike Lewis said the company is working to protect its fleet of LNG tankers from seizure by nations friendly to Russia after it was hit with a EUR 14bln penalty by a Russian court in March as part of an international dispute with a subsidiary of Russian state-backed gas company Gazprom, according to FT.

- European gas storage depletes at the fastest rate since 2018, according to Bloomberg citing sources. Storage at 70% full on January 4th vs the 5yr seasonal average of 76%.

- Goldman Sachs cut its gold price forecast in which it sees the precious metal to reach USD 2,910/oz by year-end and pushed back its USD 3,000/oz target to mid-2026, citing slower-than-expected Fed easing.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Hesse State CPI YY (Dec) 2.7% (Prev. 2.0%)

- German HCOB Services PMI (Dec) 51.2 vs. Exp. 51.0 (Prev. 51.0); HCOB Composite Final PMI (Dec) 48.0 vs. Exp. 47.8 (Prev. 47.8)

- French HCOB Services PMI (Dec) 49.3 vs. Exp. 48.2 (Prev. 48.2); HCOB Composite PMI (Dec) 47.5 vs. Exp. 46.7 (Prev. 46.7)

- Italian HCOB Services PMI (Dec) 50.7 vs. Exp. 50.3 (Prev. 49.2); HCOB Composite PMI (Dec) 49.7 (Prev. 47.7)

- Spanish Services PMI (Dec) 57.3 (Prev. 53.1)

- UK S&P Global Service PMI (Dec) 51.1 vs. Exp. 51.4 (Prev. 51.4); S&P Global PMI: Composite (Dec) 50.4 vs. Exp. 50.5 (Prev. 50.5)

- EU HCOB Services Final PMI (Dec) 51.6 vs. Exp. 51.4 (Prev. 51.4)

- EU Sentix Index (Jan) -17.7 vs. Exp. -18.0 (Prev. -17.5)

NOTABLE EUROPEAN HEADLINES

- The percentage of UK businesses planning to raise prices in the coming three months rose to about 55% from 39% as tax increases and higher wage costs caused confidence to slump, according to a survey of 5,000 businesses by the British Chambers of Commerce via FT.

- Austrian Chancellor Nehammer said coalition talks between the two largest centrist parties in Austria on forming a government without the far-right Freedom Party have collapsed, while he will stand down as Chancellor and leader of the People’s Party in the coming days. It was later reported that the Austrian President van der Bellen agreed to meet with far-right Freedom Party leader Kickl on Monday and that Conservative People’s Party (OVP) Secretary-General Stocker was named as interim party leader. Furthermore, Stocker expects far-right leader Kickl will be tasked with forming a government and said the OVP will take part in coalition talks with the far-right Freedom Party and take them seriously.

- Many Eurozone economists warned that the ECB has been too slow to cut interest rates to help the economy and 46% of the economists surveyed said the ECB had fallen behind the curve, according to a poll by FT.

- French Budget Minister reiterates there will be a "Special Tax" on the biggest companies; is convinced they can find a majority in parliament to get a budget through. The 2024 deficit will be "around" 6.1%; sees 2025 deficit in a 5-5.5% range

NOTABLE US HEADLINES

- US President-elect Trump urged his fellow Republicans in Congress to combine his priorities into one bill which would cut taxes, bolster border security and increase domestic energy production, writing "it will all be made up with tariffs, and much more, from countries that have taken advantage of the U.S. for years". (Truth Social)

- Biden-Harris administration announces Arizona state University research park as the planned site for third chips for America R&D flagship facility.

- US National Security Advisor Sullivan says the US is finalising steps to remove roadblocks in civil nuclear partnerships with Indian firms.

- Fed's Kugler (voter) said on Friday that the economy ended 2024 in a good place with good growth and the process of disinflation has kept going, while she added that the labour market remains resilient and has been cooling gradually. Furthermore, Kugler said data will drive what the Fed does with policy and that there is a view that the Fed can take time on future rate cuts, according to CNBC. Kugler also commented over the weekend that inflation has been coming down but the job on inflation is not done, while she said they have moved to a more moderate level of restrictiveness and that they are heading towards the 2% inflation target, according to Reuters.

- Fed’s Daly (2027 voter) said inflation remains uncomfortably above their target, according to Reuters.

- New York became the first US city to launch a congestion charge zone on Sunday, according to FT.

- Canadian PM Trudeau is likely to resign prior to the national caucus meeting on Wednesday, according to Canadian press. There were separate comments from a source familiar with Trudeau's that the PM is increasingly likely to announce he intends to step down but has not made a final decision. Furthermore, Polymarket’s odds for Trudeau to resign before February surged to over 70% over the weekend from around 33% on Friday, while Globe & Mail columnist Lawrence Martin commented on X that “Everybody's gearing up for Trudeau's resignation announcement, expected by Monday”.

GEOPOLITICS

MIDDLE EAST

- US President Biden notified Congress of USD 8bln arms sale to Israel, according to Axios.

- Hamas said it approved a list of 34 hostages presented by Israel to be exchanged in a ceasefire deal. However, it stated that any deal would depend on an agreement regarding a withdrawal and ceasefire, while it has not seen progress on issues regarding this, and Israeli PM Netanyahu’s office later stated that Hamas had not provided a list of hostage names.

- Saudi Foreign Minister met with US envoy Hochstein in Riyadh and discussed developments in Lebanon and regional issues.

- Syrian Foreign Minister Al-Shibani travelled to Doha to meet with senior Qatari officials.

- US is to ease aid restrictions for Syria in a limited show of support for the new government, according to WSJ.

- Iran will face a difficult year with the Trump administration which plans to increase sanctions on Iran, while the Trump administration sees Iran as still a threat to US allies and the Trump team is considering the option of air strikes to prevent Iran from building a nuclear weapon, according to WSJ.

- Israel wants to keep some sites outside the northern border in Lebanon indefinitely, via AJA Breaking.

RUSSIA-UKRAINE

- IAEA said staff reported hearing loud blasts near Ukraine's Zaporizhzhia Nuclear Power Plant on Sunday which coincided with reports of a drone attack on the plant's training centre, while the IAEA has not been able to confirm any impact and noted that reports stated there were no casualties and no impact on any nuclear power plant equipment, according to Reuters.

- Ukrainian President Zelensky said security guarantees for Ukraine to end Russia's war will only be effective if the US provides them and he needs to sit down with US President-elect Trump to decide how to stop Russian President Putin before Ukraine can enter talks with the Russian side. Zelensky also said Europe must also have a voice in deciding a course of action before Ukraine talks to Russia and that Putin will destroy Europe if the US leaves the NATO military alliance, while he noted that North Korea has provided Russia with 3.7mln artillery shells in the war and that 3,800 North Korean troops fighting Ukraine in Russia's Kursk region have been killed or wounded so far. Furthermore, Zelensky separately commented that there were heavy Russian and North Korean losses in Russia’s Kursk region.

- Ukraine’s air force said on Sunday morning that it had downed 61 drones launched by Russia in an overnight attack.

- Russia’s Defence Ministry said Russian forces took control of the Nadiya settlement in Ukraine’s Luhansk region, while it also announced that Ukraine launched a counter-attack in Russia’s Kursk region.

OTHER

- North Korea fired a suspected ballistic missile which was reported to have fallen shortly after and appeared to have landed outside of Japan's exclusive economic zone, while the South Korea military said North Korea fired what appeared to be one intermediate-range ballistic missile.

CRYPTO

- Bitcoin is on a firmer footing and holds just above USD 98k; Ethereum sees gains to a lesser magnitude, and sits comfortably above USD 3.6k.

APAC TRADE

- APAC stocks traded mostly subdued following the lack of macro catalysts over the weekend and as participants digested the mixed signals from Chinese Caixin PMI data, while Japanese markets underperformed in their first trading session of 2025.

- ASX 200 failed to sustain early gains as strength in real estate and tech was offset by losses in materials and miners.

- Nikkei 225 retreated on return from the New Year holiday closures amid higher yields and after the US blocked Nippon Steel's bid to take over US Steel, while a weaker currency failed to support the risk appetite as participants also braced for weak results from retailers including Fast Retailing and Seven & I Holdings.

- Hang Seng and Shanghai Comp were choppy following the somewhat mixed PMI data in which Chinese Caixin Services PMI data beat expectations, but the Caixin Composite PMI figure slowed, while comments late last week from the PBoC's MPC, which recommended strengthening the intensity of monetary policy adjustments and said it will cut RRR and interest rates at the proper time, did little to spur demand.

NOTABLE ASIA-PAC HEADLINES

- China's stock exchanges asked some mutual funds to restrict stock selling at the start of the year, according to Reuters sources.

- PBoC pledged more financial support for innovation and consumption, while it will encourage foreign capital to invest in domestic tech.

- PBoC is expected to ramp up offshore yuan bill sales in Hong Kong in January and has ample toolkits and experience to react to yuan depreciation, while China has the ability to keep the yuan basically stable at reasonable and balanced levels, according to PBoC-backed Financial News.

- BoJ Governor Ueda said the virtuous cycle strengthened gradually last year and he plans to increase interest rates with continued economic improvements but added the timing of an adjustment is dependent on economy and inflation, while Ueda added that momentum for wage increases is key and they must be vigilant to various risks in deciding timing for adjusting degree of monetary support.

DATA RECAP

- Chinese Caixin Services PMI (Dec) 52.2 vs. Exp. 51.4 (Prev. 51.5)

- Chinese Caixin Composite PMI (Dec) 51.4 (Prev. 52.3)