Germany's solar industry is in "a lot of distress" a new report from Financial Times highlighted last week.

A slump in consumer demand has led to bankruptcies and layoffs in Europe's largest rooftop solar market. Many installation and distribution companies have gone under, been acquired, or had to change strategies.

The oversupply of panels has driven prices down for consumers, but industry leaders warn it is deterring investors and jeopardizing a key sector for Europe’s climate goals, according to Financial Times.

Dries Acke, deputy chief executive of industry lobby group SolarPower Europe commented: “To some extent this is consolidation after a few exceptional years. You cannot have a green transition with red numbers. The sector needs to be profitable.”

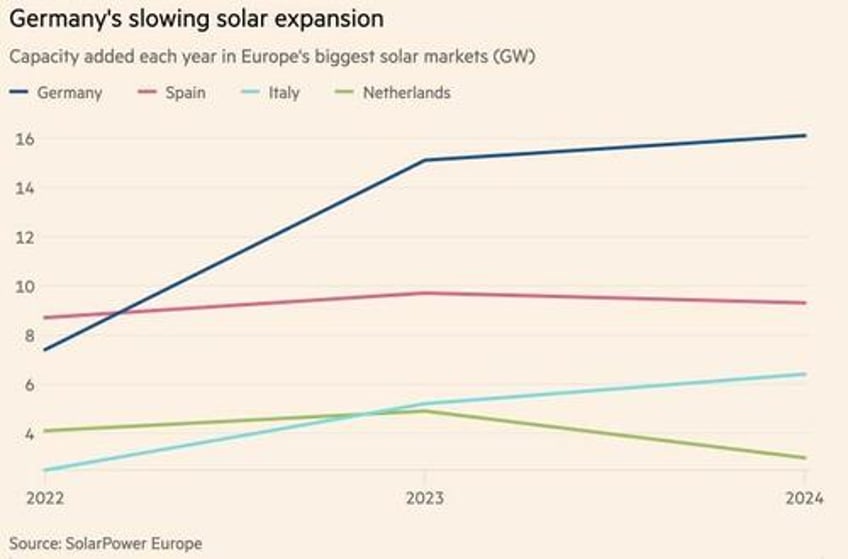

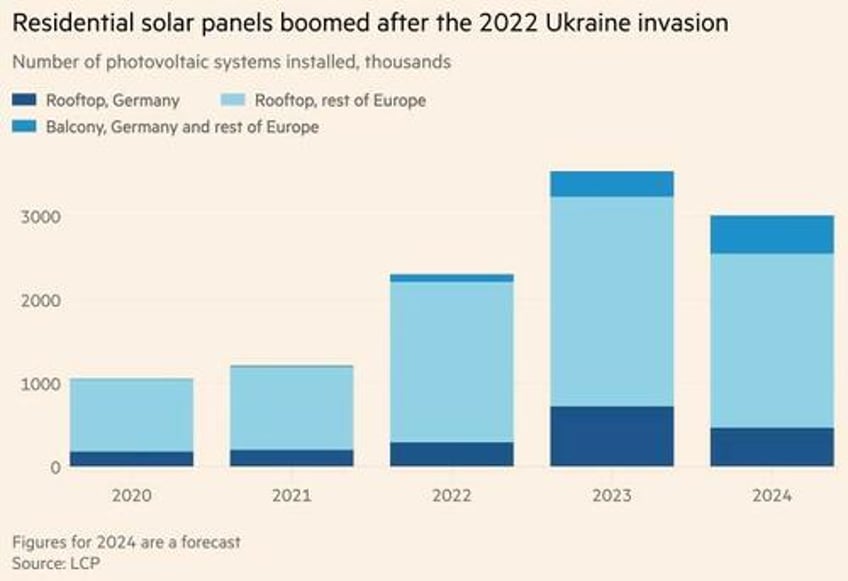

Germany's demand for solar panels surged after Russia's 2022 invasion of Ukraine, driven by soaring energy costs. Manufacturers expanded rapidly, and installations hit 15GW in 2023, a European record. However, growth slowed in 2024, with 16GW installed, as residential demand dropped despite gains in commercial and solar farms.

This slowdown, amid a crowded market, challenges Germany's goal of 19GW annually through 2030 to achieve carbon neutrality by 2045, according to the FT.

The solar market slowdown, also affecting Belgium and the Netherlands, is driven by rising interest rates increasing financing costs and a flood of cheap Chinese panels creating intense competition. European manufacturers like Meyer Burger face pressure, with layoffs and squeezed margins, while subsidies are being reduced.

The FT report noted that start-up Zolar, backed by €300mn in funding, cut over half its workforce and exited direct sales to homeowners due to lower energy prices reducing solar’s appeal. CEO Jamie Heywood noted the reduced financial incentive despite falling installation costs.

Zolar is shifting to support small local installers, which dominate Germany's solar market.

Germany's solar industry faces challenges, with companies like Eigensonne declaring bankruptcy and ESS Kempfle restructuring amid rising costs and reduced demand. Major players like Enpal and 1Komma5, valued at €2.2bn and €1bn respectively, have adapted.

Enpal expanded into heat pumps and smart meters, while 1Komma5 focused on energy optimization and battery development. Despite a tough market, balcony solar systems remain popular, and industry leaders see long-term growth potential, with millions of rooftops untapped.

Experts predict a slow recovery by 2030 but warn of continued short-term turbulence in the sector.