It's not the economy, it's Nvidia stupid!

With $2 trillion market cap in its crosshairs, NVDA stock soared today, extending overnight gains after beating-and-raising again...

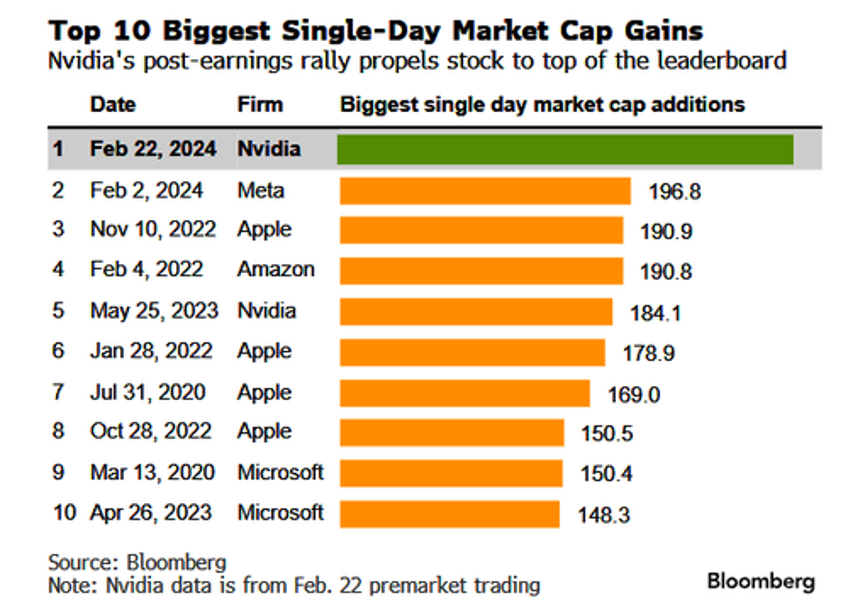

Adding the most market cap in a single-day ever - up $277BN...

That is 2 Goldmans, half a JPMorgan, or a whole Netflix or Adobe added in a day.

MAG7 stocks added over $500BN today to a new record high, second only to 11/10/22's explosion higher driven by AAPL...

Source: Bloomberg

And all that market cap gain was driven by a $2.1BN 'guide-up' on Q1 revenue.

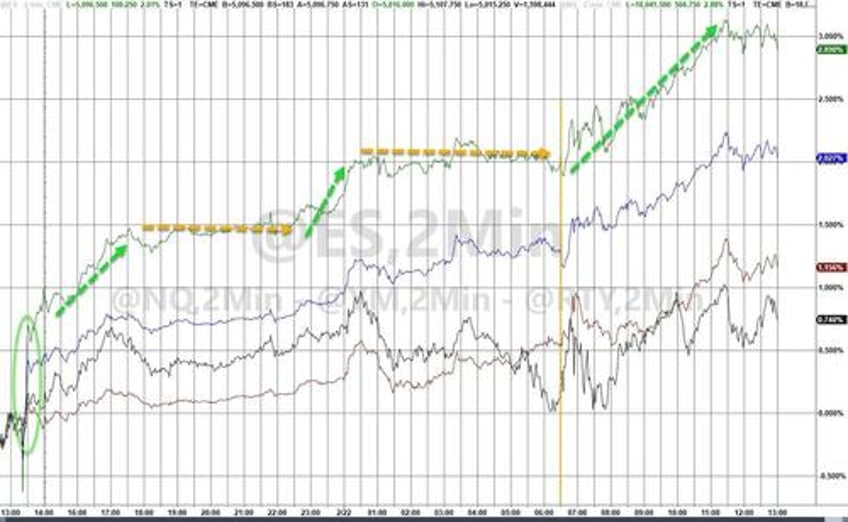

And as goes NVDA, so goes the entire stock market with Nasdaq leading the charge (up 3%) and the S&P up over 2%. Small Caps lagged with a mere 0.75% gain...

YTD, AI 'winners' are up 19% and AI 'losers' are down over 3%...

Source: Bloomberg

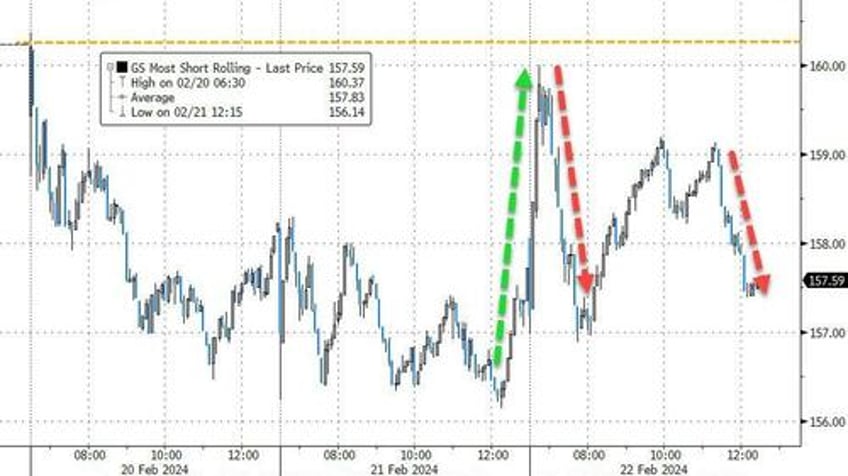

Interestingly, despite the surge in the indices, 'most shorted' stocks ended unchanged...

Source: Bloomberg

And we also saw 0-DTE traders aggressively fade the uptrend late on...

Source: SpotGamma

But NVDA prompted panic-bids in a lot more stocks - SMCI was the most ridiculous example back up to $1000...

Elsewhere, US macro was positive with initial jobless claims tumbling and existing home sales rising (though admittedly less than expected).

But, as we noted, the economy doesn't matter...

Source: Bloomberg

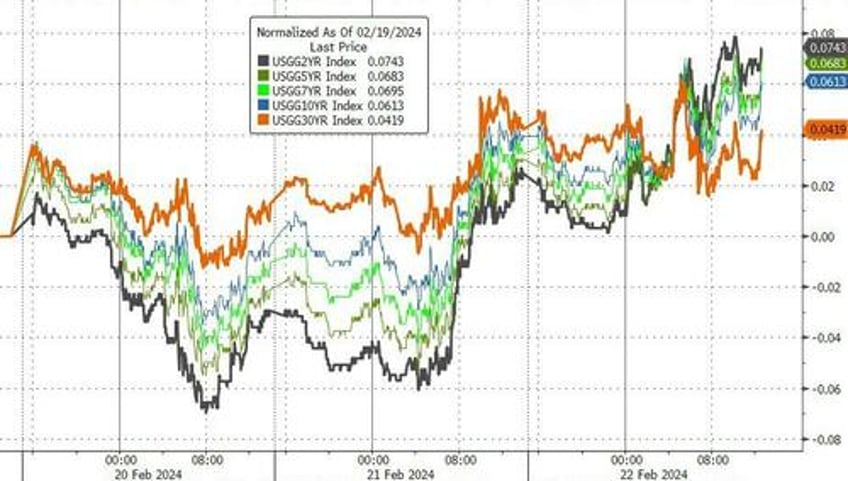

Higher yields don't matter...

Source: Bloomberg

Tumbling rate-cut expectations don't matter...

Source: Bloomberg

Rising bond volatility doesn't matter...

Source: Bloomberg

Valuations don't matter (Tech is now trading 7 turns richer than the market - the highest since 2005)...

Source: Bloomberg

Treasury yields were higher overall but the short-end suffered most today (2Y +5bps, 30Y unch)....

Source: Bloomberg

Which bear-flattened the yield curve (2s30s) back to its most inverted of the year...

Source: Bloomberg

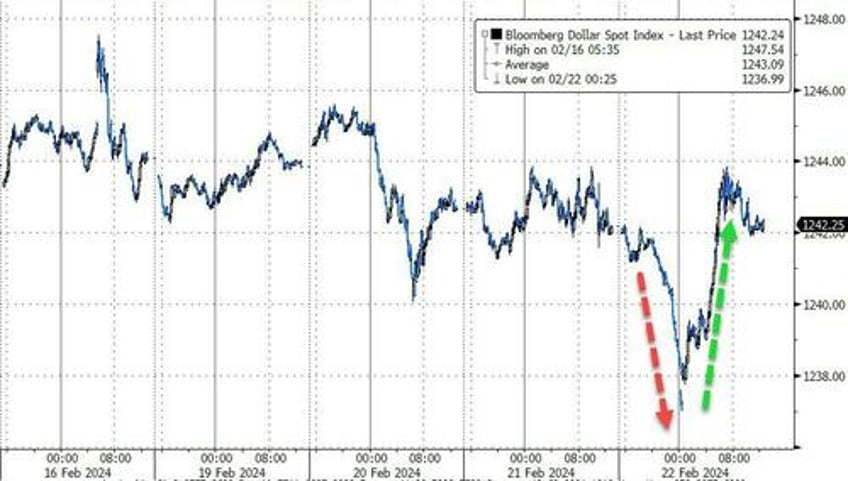

The dollar ended unchanged after a big roller-coaster (plunging into the Asian close and rallying back in Europe)...

Source: Bloomberg

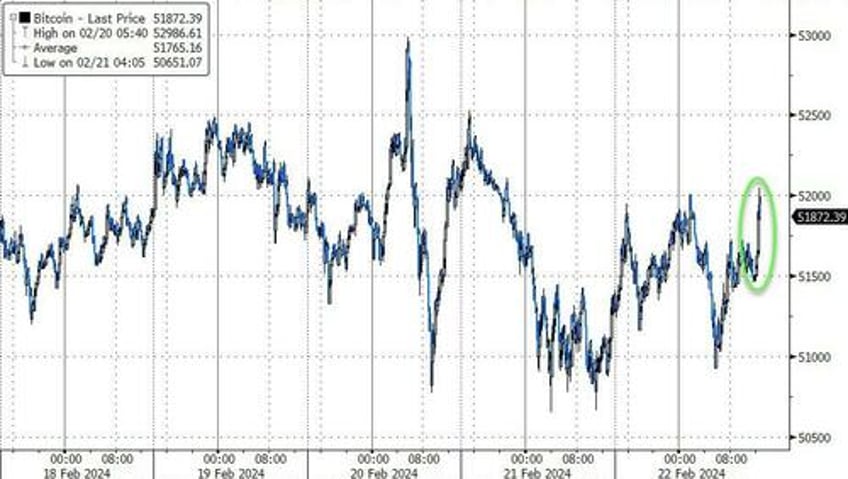

Bitcoin end higher, testing back up to $52,000 (after testing below $51,000 intraday)...

Source: Bloomberg

Gold mirrored the dollar's ride today, ending marginally lower...

Source: Bloomberg

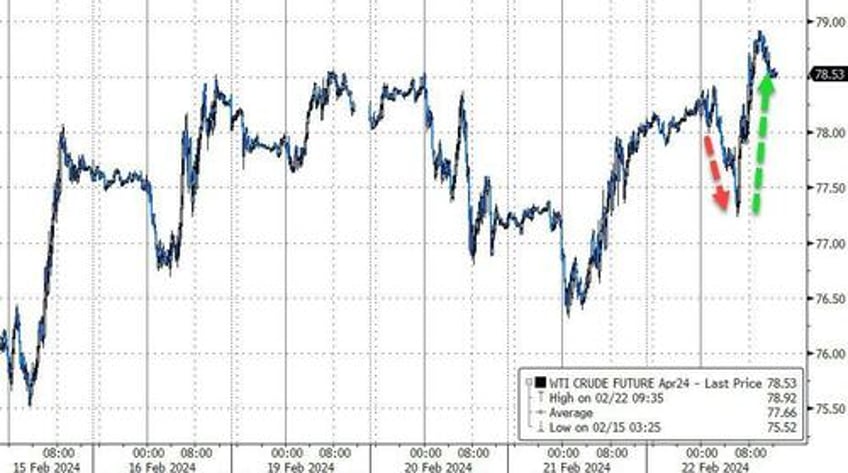

Oil prices pushed higher today (though did see some early weakness), with WTI back above $78.50...

Source: Bloomberg

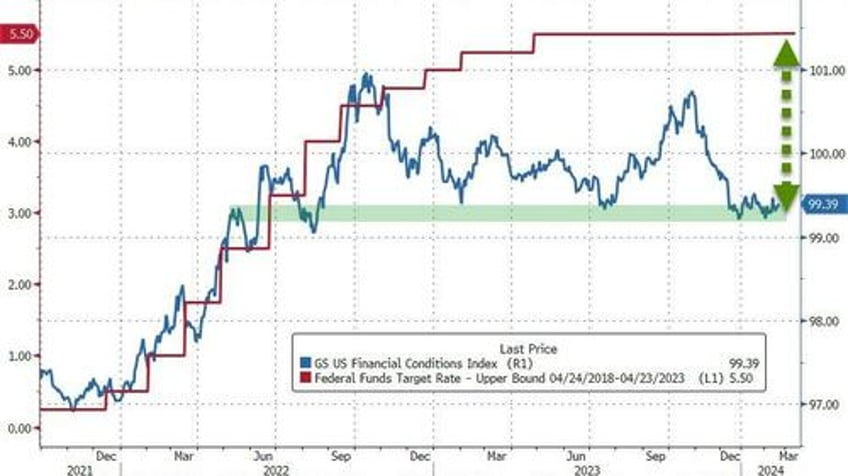

Finally, bear in mind what the FOMC said in the Minutes yesterday

"Several participants mentioned the risk that financial conditions were or could become less restrictive than appropriate, which could add undue momentum to aggregate demand and cause progress on inflation to stall."

Well, financial conditions are very easy compared to Fed Funds...

Source: Bloomberg

...and US financial conditions are extremely easy relative to the EU and UK...

Source: Bloomberg

In other words, the higher NVDA goes, the tighter credit spreads compress, and the more the MOMO and FOMO funboys chase this malarkey, the longer The Fed will sit on its hands and not cut rates. Of course, that assumes we get through March without a banking crisis.