Retail investors’ historically stretched level of optimism is vulnerable to a reversal of the extreme positioning in the momentum trade.

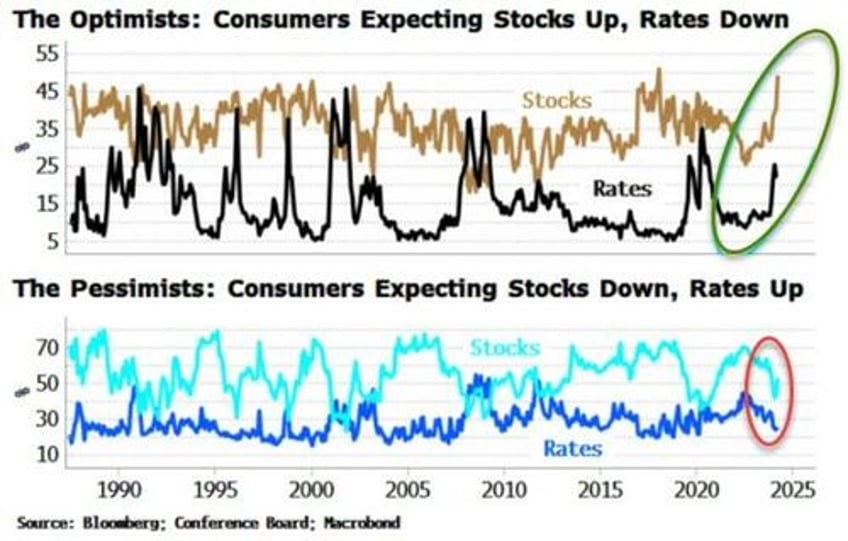

Consumers’ glasses seem very much half full, according to the Consumer Board’s confidence survey. There has been a lurch higher in respondents who are expecting higher stocks and – no doubt encouraged by the pivot mood-music emanating from Jay Powell late last year – lower rates (which may now face crisis after this morning's CPI).

At the same time, realists – or as optimists call them, pessimists – are becoming less downbeat, with the percentage expecting falling stocks and rising rates declining.

Classical tales are replete with examples of hubris being punished. But the retribution today could come in much more prosaic form than the plague or eternal torture meted out by Greek gods: a reversal in momentum.

The momentum factor buys those stocks that are rising the most on e.g. an annual basis, and shorts the ones falling the most.

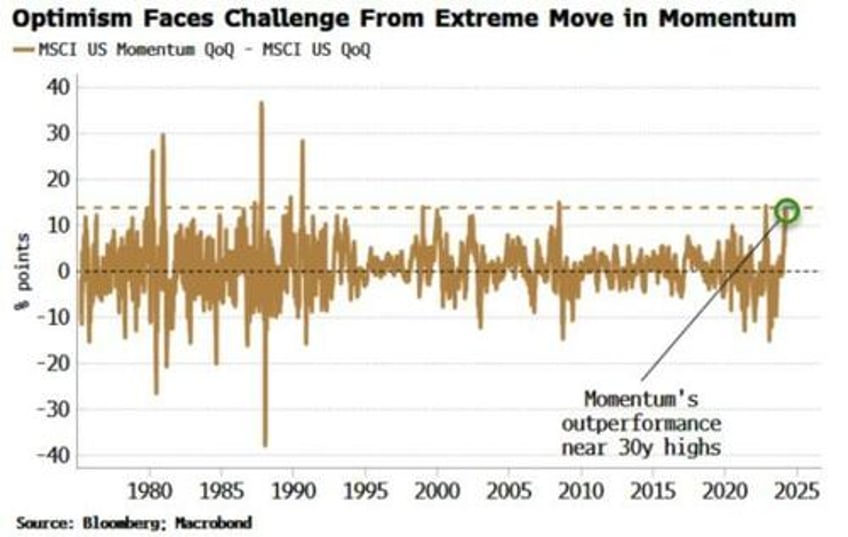

In recent months, the factor has been driving returns – outperforming all other popular factors.

More concerning for optimists, though, is that momentum’s outperformance versus the index is now very near 30-year extremes.

Forward returns in the S&P are poor when momentum is outpacing the index by a similarly wide margin. Moreover, the previous two times in the last three decades when momentum was as stretched as it is today were March 2022 and June 2008, neither of which were particularly agreeable for optimists.

Momentum crashes more often happen in sharp rallies after a downturn, as the strategy is likely to be short high-beta stocks and long low-beta ones, i.e. the factor has a high negative beta as the market rebounds. But that does not mean crashes can’t happen any time a large absolute beta is caught offside.

Currently crowding in momentum stocks is severe, and hedge funds have a very high tilt to the strategy. That raises the risk that a few investors heading for the exit morphs into a groundswell. Given that many of the firms in question are a who’s who of the go-go stocks that have been fueling the rally, such as Nvidia and Meta et al, then a momentum reversal could well trigger a wider market correction.

Fortunately, though, equity hedges are still cheap (or they were before this morning's CPI havoc), meaning realists can indulge their pessimism while still not missing out if stocks live up to optimists’ rosy outlook.