Coming into today's CPI number, which followed three previous red-hot inflation prints, we said that it's time for a "miss" (the first of 2024) not because the data demands it - on the contrary, prices continue to rise at a frightening pace - but because a dovish CPI print today would be the last opportunity for the Fed to set a timetable for a rate cut calendar ahead of November's election.

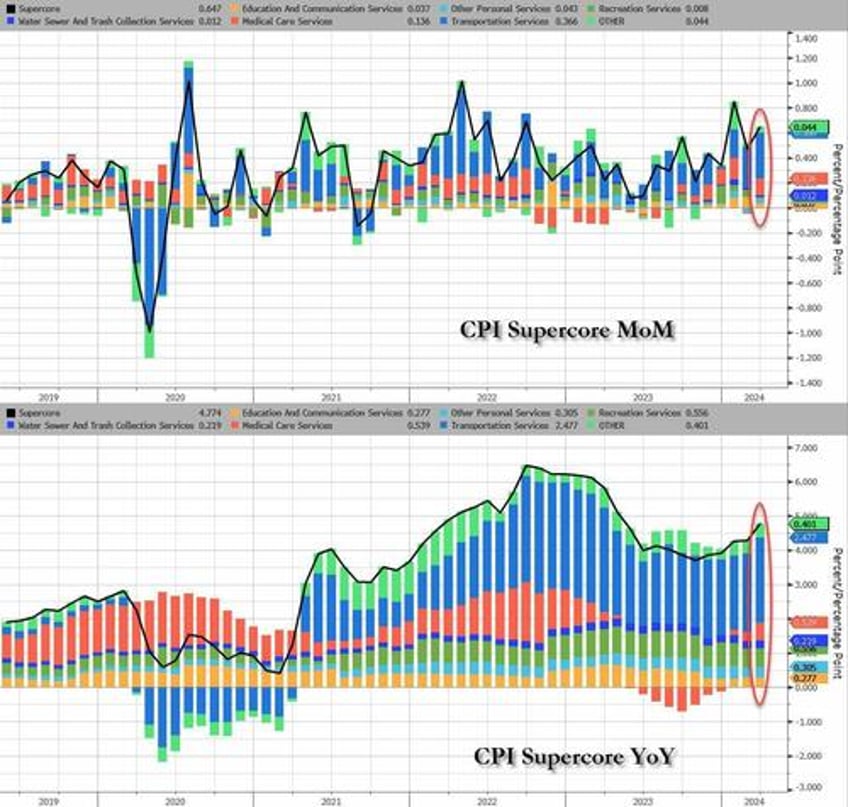

Well, you can wave goodbye to all that, especially with supercore inflation coming in blazing hot...

... and so - the unexpectedly hot inflation print which saw every single CPI metric coming in hotter than expected - was a shock, not because it reflected reality, but because it effectively sealed Biden's fate because as Bloomberg's Chris Antsey writes, "obviously, this is very bad news for Joe Biden... we’re approaching the point where high inflation is bound to still be in voters’ minds when they head to the polls, regardless of how the price figures come in over summer."

With that in mind, here is a snapshot of kneejerk reactions by various other Wall Street economists and strategists to today's print courtesy of Bloomberg.

Morgan Stanley economist Ellen Zentner is the first sellside to warn her June rate-cut call is in jeopardy.

“The upside surprise in core CPI is moving the inflation data further away from the convincing evidence the Fed needs to start cutting in June. Dependent on the PPI data tomorrow, this print tilts the Fed toward a later start to the cutting cycle than our current forecast for June.”

Brian Coulton, chief economist at Fitch

“The so-called ‘Super-core’ CPI measure – services excluding rents – jumped from 3.9% y/y in February to 4.8% in March. This latter metric is heading the wrong way and quite quickly at that.”

David Kelly, Chief Global Strategist at JPMorgan asset management:

“I wish the Federal Reserve would pay more attention to what they do to financial markets with their manipulation of interest rates and not worry too much about what they are doing to the economy. Last decade, we mispriced housing terribly and now a large chunk of younger Americans can’t buy a house.”

Anna Wong, Bloomberg economist:

“March is a month where the CPI enters a seasonal window that’s favorable for disinflation. The fact that core CPI remained the same in March as February — even if it maps to about 0.3% in core PCE inflation terms – is not a good development. This report, more than February’s, is likely to feed Fed concern that progress on disinflation is stalling — even though the core print for the two months was the same.”

Marvin Loh, State Street economist:

“While the rent component shows a strong disinflationary trend, the more important owner’s occupied component is stubbornly unchanged and well above what is needed to get towards a stable 2% level.”

Ira Jersey, Bloomberg rates strategist:

“The 3-month annualized core CPI climbing to 4.5% is going to keep early Fed-cut calls muted coming up. 50 bps of cuts in 2024 currently being priced may not occur until later in the year. The yield curve flattening isn’t surprising as we continue to price out early and deep cuts.”

* * *

“The timing of 2024 rate-cut expectations are front of mind for market participants, with linear markets pricing just below even odds of a first cut in July. Still, the stickiness of ‘supercore’ inflation, now north of 8% on a 3-month annualized basis, may continue to put upward pressure on expectations of the Fed’s terminal floor.”* * *

“A retest of 4.51% is nearly assured with the higher-than-expected CPI. If that doesn’t hold, 4.7% is the next stopping spot for the 10-year yield.”

Seema Shah, economist at Principal Asset Management

"Today’s print sealed the fate for the June FOMC meeting with a hike now very unlikely. In fact, even if inflation were to cool next month to a more comfortable reading, there is likely sufficient caution within the Fed now to mean that a July cut may also be a stretch, by which point the US election will begin to heavily intrude with Fed decision making.”

Priya Misra, JPM rates strategist

”This was a pivotal report for the market since the last 2 reports were a little high (0.4% mom) and the Fed viewed those readings as a ‘bump in the road’ rather than a change in the trend towards inflation moderation.Rates have risen in the last few weeks as cuts have been priced out but there is more room to go. I also think risk assets will be sensitive to rates if the 10y moves above 4.5%. So far risk assets could ignore the high inflation prints since the Fed was dismissing it. But I think that changes now... Most of the strength in the core explained by firmer motor vehicle insurance costs and medical care -- both of these do not feed into the core PCE deflator in the same way. So incoming Fedspeak will be very important”

Lindsay Rosner, head of multi-sector fixed income investing at Goldman Asset Management

“To be clear, this number did not eclipse the Fed’s confidence; it did, however, cast a shadow on it. When it comes to spread risk, one hotter CPI print does not derail the bigger story which is the economy is strong, defaults remain benign, and the technicals continue to cast sunshine on spreads maintaining this range.”

The bottom line, as Bloomberg's Sebatian Boyd writes is the following:

"today’s CPI print adds to the evidence that US monetary policy just isn’t as restrictive as the Federal Reserve thinks it is, and that interest rates will therefore need to stay higher for longer. There are lots of reasons that might be: The great resignation during the pandemic may well have heightened productivity in the US economy as people found new jobs where they’re a better fit. Higher government spending would also push up the neutral rate of interest. But every time we get a hot indicator, the case builds that it has happened and that conventional measures of neutral interest rates are too low. If that is the case, the upshot is higher yields and a flatter curve, because not only would the Fed be able to cut by less than expected in the short term, but yields will need to be higher in the long term too."

Finally, we conclude where we started, and echoing what we said in our CPI preview, namely that the BLS had Biden's fate in its hands, it appears the bureaucrats just voted for Trump. Here is BBG's Chris Antsey:

Obviously, this is very bad news for Joe Biden. It’s still only April, and we’ll have another half-a-year’s worth of inflation reports before the election. But we’re approaching the point where high inflation is bound to still be in voters’ minds when they head to the polls, regardless of how the price figures come in over summer.

And to underscore how calamitous today's data is for Bidem here is BBG's Enda Curran:

Let’s be clear -- today’s data has both economic and political implications. The economics are straight forward: It looks unlikely that the Fed will be cutting rates near term (barring a shock). The political implications are less clear but no less meaningful: Poll after poll has found that voters are grumpy on the economy and news that it could be a while yet before the inflation story is over won’t brighten their mood.

And with Biden's goose now thoroughly cooked, the next question is how long before somebody raises the possibility of a rate hike.