- The Fed delivered a 50bps rate cut and the dot plot suggested a further 50bps of reductions this year.

- US indices finished marginally lower and yields higher with Powell stating that markets should not assume 50bps is the new pace.

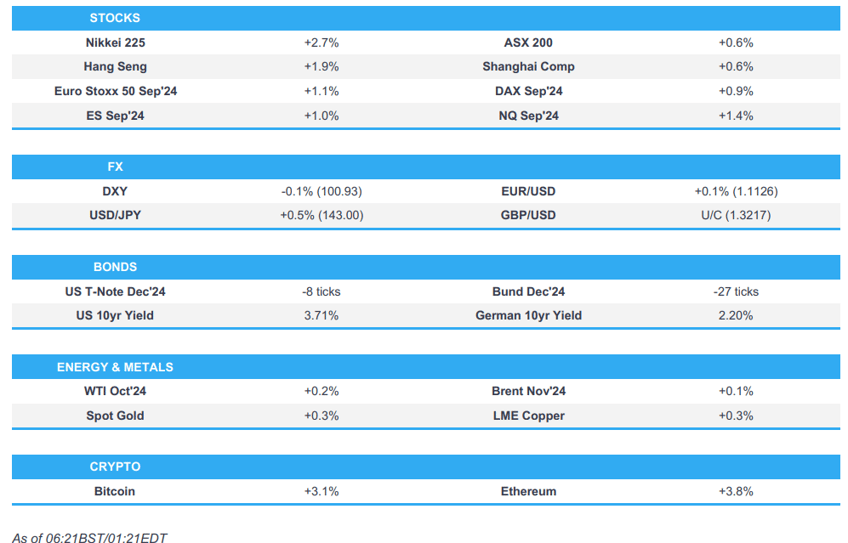

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +1.1% after the cash market closed lower by 0.5% on Wednesday.

- DXY was seen lower post-FOMC decision before recouping lost ground during the press conference. JPY lags across the majors.

- Looking ahead, highlights include US Philly Fed Index, BoE, Norges, SARB & CBRT Policy Announcement, BoE Agents Summary of Business Conditions (Q3), Comments from ECB’s Schnabel, Norges Bank's Bache & BoC’s Vincent, Supply from Spain, France & US

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks saw two-way price action and the major indices finished marginally lower with an initial dovish knee-jerk reaction spurred following the Fed's decision to deliver a 50bps rate cut and with the dot plot suggesting a further 50bps reduction this year. However, the initial boost in stocks was then faded during the post-meeting press conference and Q&A as Fed Chair Powell kept the Fed's options open in which he noted that they could go quicker, or slower, or pause on rate cuts if it is appropriate, with decisions to be made in a meeting-by-meeting approach and he also suggested to not take the move as the new pace.

- SPX -0.3% at 5,618, NDX -0.5% at 19,344, DJIA -0.3% at 41,503, RUT Flat at 2,206.

- Click here for a detailed summary.

FOMC

- FOMC cut rates by 50bps to 4.75-5.00% (exp. 5.00-5.25%) through an 11-1 vote (Bowman called for a cut of 25bps) and it sees 50bps more cuts this year. Fed stated that inflation has made further progress toward the 2% objective and remains 'somewhat elevated', while the FOMC has gained greater confidence in inflation moving sustainably toward 2% and judged that risks to employment and inflation goals are roughly in balance. Furthermore, it will carefully assess incoming data, the evolving outlook and the balance of risks in considering additional rate adjustments, as well as noted that the economic outlook is uncertain and the FOMC is attentive to risks on both sides of the mandate.

- Fed sees rates ending 2024 at 4.4% (prev. 5.1%) and 2025 at 3.4% (prev. 4.1%), while it sees rates ending 2026 at 2.9% (prev. 3.1%) and 2027 at 2.9% (exp. 2.9%), with the longer run view at 2.9% (exp. 2.9%, prev. 2.8%).

- Fed Chair Powell said in the post-meeting statement that the Fed is not on a preset course and will go meeting-by-meeting on decisions, as well as noted that economic projections are not a plan or decision, and that policy will be adjusted as necessary. Powell also said if the economy remains solid, the Fed can dial back the pace of cuts and equally if the labour market deteriorates, the Fed can respond the economy is strong overall, while he added the is Fed committed to maintaining the economy's strength and expects GDP growth to remain solid. Furthermore, he said the rate decision reflects growing confidence that strength in the labour market can be maintained and noted that inflation has eased notably but remains above the Fed's goal.

- Fed Chair Powell said during the Q&A that there has been a lot of data including during the blackout in response to why the Fed has opted for a 50bps move and that benchmark revisions showed payrolls may be revised down, while he stated the Committee concluded that a 50bps rate cut was the right thing for the economy and reiterated that future decisions will be made on a meeting-by-meeting basis, as well as noted there is nothing in the projections that suggests the Fed is in a rush and they can go quicker, or slower, or pause on rate cuts if it is appropriate. Powell also commented that no one should look at today and think this is the new pace and he does not think the Fed is behind the curve with the rate move timely and a sign of the Fed's commitment to not get behind.

NOTABLE HEADLINES

- US House defeated the Republican stopgap funding bill, while House Speaker Johnson said he will craft a new stopgap spending bill.

- Teamsters union said a poll of members showed that 58% supported Trump compared with 31% for Harris, while it later announced that it is not making a US presidential election endorsement.

- Iranian cyber actors in late June and early July sent unsolicited emails to individuals then associated with Biden’s campaign that contained excerpts taken from stolen material from Trump’s campaign, while Iranian cyber actors have continued their efforts since June to send stolen material associated with Trump’s campaign to US media organisations, according to US intelligence agencies.

APAC TRADE

EQUITIES

- APAC stocks were in the green as the region reacted to the Fed's oversized 50bps rate cut.

- ASX 200 was underpinned and printed a fresh record high albeit despite somewhat ambiguous jobs data which showed headline Employment Change topped forecast but was entirely due to Part-Time work as Full-Time jobs contracted.

- Nikkei 225 outperformed and surged above the 37,000 level on the back of a weaker currency.

- Hang Seng and Shanghai Comp conformed to the positive mood with the former led higher by strength in tech and property after the HKMA cut rates by 50bps in lockstep with the Fed, while the mainland index was also boosted following the PBoC's continued liquidity efforts and despite the lingering EU tariff concerns.

- US equity futures (ES +1%, NQ +1.4%) made some headway again overnight after whipsawing post-Fed decision and presser.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +1.1% after the cash market closed lower by 0.5% on Wednesday.

FX

- DXY Initially dipped to a fresh YTD low in reaction to the Fed's surprise 50bps rate cut and projection for another 50bps this year, but then recouped its losses and then some owing to the rhetoric from Fed Chair Powell who said they could go quicker, or slower, or pause on rate cuts if it is appropriate, while decisions are to be made in a meeting-by-meeting approach and he suggested to not take the 50bps move as the new pace.

- EUR/USD briefly slipped beneath the 1.1100 handle as the single currency gave way to the recovery of the dollar.

- GBP/USD was uneventful after fading the prior day's early advances, while the attention turns to the incoming BoE rate decision.

- USD/JPY continued its post-FOMC resurgence with the help of rising US yields although is off today's highs after stalling just shy of the 144.00 handle.

- Antipodeans saw two-way price action following recent data releases including New Zealand GDP for Q2 which showed a narrower-than-feared contraction, while Australian Employment Change topped forecasts but was solely fuelled by Part-Time jobs.

- PBoC set USD/CNY mid-point at 7.0983 vs exp. 7.0924 (prev. 7.0870).

- Brazil Central Bank raised its Selic rate by 25bps to 10.75%, as expected with the decision unanimous, while it stated the pace of future adjustments and overall adjustment magnitude will be guided by the firm commitment to reaching the inflation target and that the current scenario requires more restrictive monetary policy.

- BoC minutes stated that ahead of the meeting, some governing council members were more concerned about downside risks to inflation and the concern about downside risks was linked to a potential further weakening of the economy and labour market. However, other members took the view that risks to the inflation outlook were balanced and the governing council agreed it would like to see the economy grow at a rate above potential output.

FIXED INCOME

- 10yr UST futures traded subdued after Fed Chair Powell stressed a meeting-by-meeting approach and to not think 50bps is the new pace.

- Bund futures extended on the prior day's declines to test the 134.00 level to the downside where support has held.

- 10yr JGB futures tracked the declines in global counterparts, while the enhanced liquidity auction for longer-dated JGBs resulted in a slightly lower bid-to-cover.

COMMODITIES

- Crude futures were indecisive after yesterday's fluctuations and as intraday dollar strength counterbalanced geopolitical-related tailwinds.

- Qatar set November-loading Al-Shaheen crude term price at USD 2.09/bbl above Dubai quotes which is the highest premium in five months, according to sources.

- Libya’s oil and gas minister said the plan is to double natgas production to 4bln cubic feet over the next 4-5 years.

- Spot gold lacked firm direction after whipsawing in the aftermath of the Fed rate decision and Powell's presser.

- Copper futures remained contained after fading the initial boost from the Fed's oversized rate cut.

CRYPTO

- Bitcoin mildly gained overnight in choppy trade and reclaimed the USD 62,000 level.

NOTABLE ASIA-PAC HEADLINES

- HKMA cut its base rate by 50bps to 5.25%, as expected in lockstep with the Fed, while it stated that the US interest rate cut will have a positive impact on the city's economy and will provide some room for easing of local interest rates.

- China's Commerce Minister said regarding the EU's electric vehicle probe that China will continue to negotiate 'until the last minute' and the investigation has undermined 'confidence' of Chinese companies in investing in Europe. It was separately reported that EU capitals will not get to vote on Chinese EV duties next week with the poll removed from the committee agenda for September 25th, according to Politico.

DATA RECAP

- Australian Employment (Aug) 47.5k vs. Exp. 25.0k (Prev. 58.2k)

- Australian Full Time Employment (Aug) -3.1k (Prev. 60.5k)

- Australian Unemployment Rate (Aug) 4.2% vs. Exp. 4.2% (Prev. 4.2%)

- Australian Participation Rate (Aug) 67.1% vs. Exp. 67.1% (Prev. 67.1%)

- New Zealand GDP QQ (Q2) -0.2% vs. Exp. -0.4% (Prev. 0.2%, Rev. 0.1%)

- New Zealand GDP YY (Q2) -0.5% vs. Exp. -0.5% (Prev. 0.3%, Rev. 0.5%)

GEOPOLITICS

MIDDLE EAST

- Israel submitted a new proposal that includes the release of all hostages at once and securing the exit of Hamas leader Sinwar from the Gaza Strip along with anyone who wishes to leave the Gaza Strip, according to Sky News Arabia citing Israeli media. Furthermore, Israel Broadcasting Corporation said the proposal includes the release of Palestinian prisoners, the disarmament of the Gaza Strip, the application of another mechanism of governance there, and an end to the war.

- Israel's Security Cabinet authorised PM Netanyahu and Galant to take action against Hezbollah, according to Al Jazeera citing Israel’s Channel 12.

- Israeli Army Chief said they have many capabilities they have not yet activated, while he added that Israel plans ahead by stages and the price paid by Hezbollah should be high at every stage.

- Lebanon's Foreign Minister told CNN that Hezbollah was hit hard and a response is a must for it, according to Asharq News.

- Senior Hamas official said the Israeli government is responsible for the repercussions of this continuous attack on Lebanon.

- Iran will follow up on the attack against its envoy in Lebanon and reserves its rights under international law to take required measures deemed necessary to respond, according to a letter from Iran's UN envoy.

- US Defence Secretary Austin spoke to Israel's Defence Minister Gallant to review regional security developments and reiterated US support for Israel amid Iran and Hezbollah threats, according to the Pentagon.

- Germany's government placed war weapons export permits to Israel on hold, according to Reuters citing sources.

- Japan's Icom (6821 JT) said it was investigating facts surrounding reports that two-way radios bearing the Icom logo exploded in Lebanon, while it later stated that it is not possible to confirm whether the radio product related to Lebanon explosions was shipped by the Co. and noted that the sales of batteries required to operate the device were discontinued about 10 years ago.

OTHER

- Russian President Putin ordered the signing of a comprehensive strategic partnership agreement between Russia and Iran, according to Interfax.

- China's government pushed back on a US probe of whether China is helping Russia dodge a US ban on Russian uranium imports and stated that Beijing has always opposed "illegal unilateral sanctions".

- US has no immediate plans to withdraw Typhon missile system from the Philippines which is being used in joint training exercises with the US and the Philippines testing the feasibility of the system's use in the event of a conflict, while a Philippine government source said there is strategic value in keeping the missile system in the Philippines to deter China.

- North Korea said it tested a new tactical ballistic missile on Wednesday which was a modified strategic cruise missile and used a super large warhead in the tactical ballistic missile test which was supervised by North Korean leader Kim. Furthermore, Kim said the country must maintain overwhelming attack capabilities of conventional weapons while continuing to increase nuclear capabilities, according to KCNA.