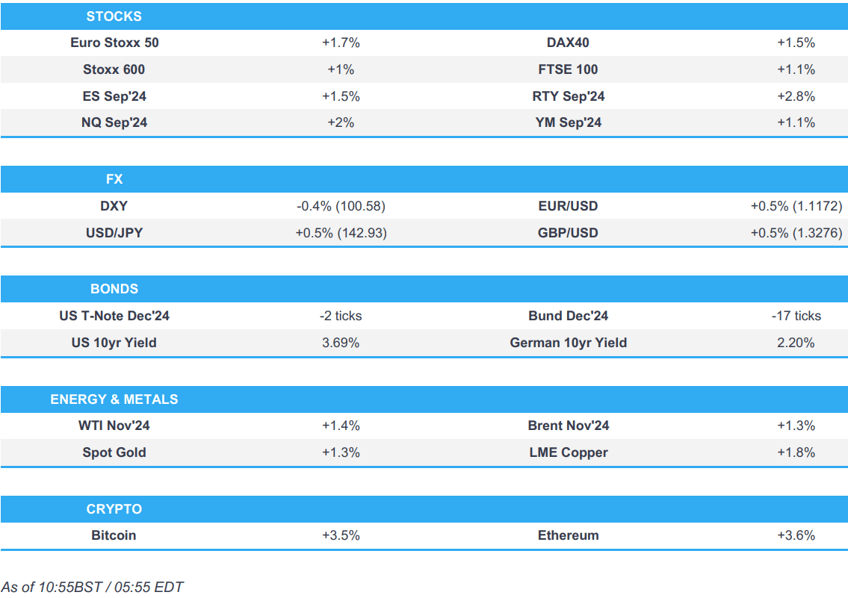

- European equities opened on a very strong footing and remain at elevated levels; US futures are bid, with the RTY outperforming post-Fed

- Dollar continues to sink, the typical haven currencies JPY & CHF lags, whilst Antipodeans outperform; the AUD also benefits from the region’s jobs report

- Bonds are incrementally lower (but off worst levels), Gilts remain steady ahead of the BoE policy announcement

- Crude benefits from the softer Dollar and risk-tone; XAU and base metals also in the green

- Looking ahead, US Initial Jobless Claims, Philly Fed, BoE, SARB & CBRT Policy Announcements, BoE Agents Summary of Business Conditions (Q3), Comments from BoC’s Vincent.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+1%) opened the session on a very strong footing, taking positive leads from firm APAC session overnight as the region digested the Fed’s decision to opt for a 50bps cut.

- European sectors hold a strong positive bias; Basic Resources takes the top spot alongside Tech, owing the positive risk on sentiment. Utilities and Telecoms are the laggards.

- US Equity Futures (ES+1.4%, NQ +1.6%, RTY +2%) are indicative of a very strong open, with clear outperformance in the economy-linked RTY, benefitting from the Fed’s decision to opt for a larger 50bps cut.

- Apple (AAPL) faces a warning from the EU to open up its iPhone operating system to rival technologies, according to Bloomberg; failure to comply could risk a fineFine could be up to 10% of global annual turnover.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is mostly lower vs. peers (CHF and JPY the exceptions), after the two-way price action seen in the aftermath of the FOMC rate decision and press conference. DXY is still holding above the YTD low printed yesterday at 100.21 in the aftermath of the 50bps cut.

- EUR is firmer vs. the USD but below yesterday's post-FOMC best at 1.1189. Attention is on whether the decisions taken on Wednesday by the Fed will be enough to make a sustained breach of the 1.12 mark.

- GBP is firmer vs. the USD but below yesterday's best levels which saw Cable print a fresh YTD peak before running out of steam ahead of 1.33 during Powell's press conference. Attention today turn's to the BoE, where it is widely-expected to keep the Base Rate at 5%, most likely via a 7-2 vote split.

- JPY is losing out to the USD despite the dollar being broadly softer vs. peers. This in part could be more a by-product of the current risk environment rather than a policy read between the Fed vs. BoJ.

- Antipodeans are both benefiting from the current risk environment whilst also digesting domestic data releases. AUD is the top performer across the majors post-strong employment data, albeit, it is worth noting that a lot of the increase was driven by part-time jobs.

- EUR/NOK fell from 11.70 to 11.6657 in an immediate reaction to the Norges Bank policy announcement before extending to an 11.6517 session low. The Bank kept rates unchanged at 4.50% (as expected), and guided the first rate cut to be in Q1'25 (prev. guided Q2'25); disappointing some expectations of potentially guiding towards Q4-2024 (i.e. December's meeting).

- PBoC set USD/CNY mid-point at 7.0983 vs exp. 7.0924 (prev. 7.0870).

- Brazil Central Bank raised its Selic rate by 25bps to 10.75%, as expected with the decision unanimous, while it stated the pace of future adjustments and overall adjustment magnitude will be guided by the firm commitment to reaching the inflation target and that the current scenario requires more restrictive monetary policy.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs lifted from overnight lows but still just about in the red for today’s session as markets continue to digest the FOMC ahead of data this afternoon. Currently holding around the 115-00 mark, which is at the top-end of the day’s range and clear of the overnight 114-22 base.

- Bunds are slightly softer, in-fitting with USTs which continue to digest the FOMC, alongside supply from France and Spain which were well received but sparked no real reaction. Bunds are back above the 134.00 mark though the 134.31 peak is someway shy of Wednesday’s 134.86 best.

- Gilts are essentially flat ahead of the BoE policy announcement, where an unchanged outcome is expected though this will undoubtedly be subject to dissent with 7-2 most likely though 6-3 and 8-1 are also plausible outcomes.

- France sells EUR 12bln vs exp. EUR 10-12bln 2.50% 2027, 0.75% 2028, 2.75% 2030 and 2.00% 2032 OAT.

- Spain sells EUR 5.56bln vs exp. EUR 5-6bln 5.15% 2028, 3.10% 2031, and 3.45% 2043 Bono.

- Click for a detailed summary

COMMODITIES

- Firm trade in the crude complex as a function of the post-FOMC risk appetite, softer Dollar, and heightened geopolitical landscape. Brent'Nov hit a USD 74.54/bbl high following a low print of 72.91/bbl.

- Higher across precious metals, largely as a function of the Dollar, bond yields, and geopolitics. Spot silver outperforms but as it retraces the slump seen yesterday. Spot gold meanwhile found resistance as USD 2,600/oz yesterday before pulling back. XAU trades in a current USD 2,551.16-2,585.13/oz range.

- Strong performance across base metals thus far amid the jumbo Fed rate cut and softer Dollar, whilst the firm APAC performance and report of the likelihood of more Chinese stimulus only added to the tailwinds.

- Qatar set November-loading Al-Shaheen crude term price at USD 2.09/bbl above Dubai quotes which is the highest premium in five months, according to sources.

- Indian refiners using Russian insurance cover for Russian oil Cargoes priced above USD 60bbl, via Indian Gov source.

- Click for a detailed summary

NOTABLE DATA RECAP

- EU Current Account NSA,EUR (Jul) 48.0B (Prev. 52.4B); Current Account SA, EUR (Jul) 39.6B (Prev. 51.0B)

NOTABLE EUROPEAN HEADLINES

- Norwegian Key Policy Rate 4.5% vs. Exp. 4.5% (Prev. 4.5%); the policy rate forecast implies that the policy rate will remain at 4.5% to the end of 2024 before being gradually reduced from Q1-2025. Click for more details.. Norges Bank Forecasts: first cut implied for Q1-2025 (prev. Q2-2025), only a marginal tweak to the Q4-2024 view. Click for more details.

- ECB's Knot says there is room for further cuts if inflation outlook holds. "More or less fine with market's cut expectations".

- ECB's Schnabel slide release: sticky services inflation is keeping headline inflation at elevated level; Real wage catch-up remains incomplete in large parts of the euro area; Signs that transmission of monetary policy tightening is weakening. Labour demand remains high amid low unemployment and persisting labour shortages. Pass-through of higher wages to producer prices is stronger in the services sector. Demand for services has been resilient but is starting to weaken. Price pressures in the services sector are broad-based and global. Geopolitical uncertainty remains a key risk to the outlook.

- Swiss Government Forecasts: Sees 2024 CPI at +1.2% (prev. 1.4%), 2025 CPI seen at +0.7% (prev. 1.1%); 2024 GDP maintained at 1.2%, 2025 GDP seen at +1.6% (prev. +1.7%)

- New car registrations: -18.3% Y/Y in August 2024 (vs +0.2% in July 2024); battery electric market share 14.4% (vs 21% in August 2023), according to ACEA.

NOTABLE US HEADLINES

- US House defeated the Republican stopgap funding bill, while House Speaker Johnson said he will craft a new stopgap spending bill.

- Iranian cyber actors in late June and early July sent unsolicited emails to individuals then associated with Biden’s campaign that contained excerpts taken from stolen material from Trump’s campaign, while Iranian cyber actors have continued their efforts since June to send stolen material associated with Trump’s campaign to US media organisations, according to US intelligence agencies.

GEOPOLITICS

MIDDLE EAST

- "[Israeli PM] Netanyahu holds a security assessment session today at the headquarters of the Ministry of Defense in Tel Aviv", according to Al Arabiya

- Israel submitted a new proposal that includes the release of all hostages at once and securing the exit of Hamas leader Sinwar from the Gaza Strip along with anyone who wishes to leave the Gaza Strip, according to Sky News Arabia citing Israeli media. Furthermore, Israel Broadcasting Corporation said the proposal includes the release of Palestinian prisoners, the disarmament of the Gaza Strip, the application of another mechanism of governance there, and an end to the war.

- Lebanon's Foreign Minister told CNN that Hezbollah was hit hard and a response is a must for it, according to Asharq News.

- US Defence Secretary Austin spoke to Israel's Defence Minister Gallant to review regional security developments and reiterated US support for Israel amid Iran and Hezbollah threats, according to the Pentagon.

- Japan's Icom (6821 JT) said it was investigating facts surrounding reports that two-way radios bearing the Icom logo exploded in Lebanon, while it later stated that it is not possible to confirm whether the radio product related to Lebanon explosions was shipped by the Co. and noted that the sales of batteries required to operate the device were discontinued about 10 years ago.

- Israel army and Hezbollah exchange fire at the border, according to Walla News' Elster.

OTHER

- US has no immediate plans to withdraw Typhon missile system from the Philippines which is being used in joint training exercises with the US and the Philippines testing the feasibility of the system's use in the event of a conflict, while a Philippine government source said there is strategic value in keeping the missile system in the Philippines to deter China.

- North Korea said it tested a new tactical ballistic missile on Wednesday which was a modified strategic cruise missile and used a super large warhead in the tactical ballistic missile test which was supervised by North Korean leader Kim. Furthermore, Kim said the country must maintain overwhelming attack capabilities of conventional weapons while continuing to increase nuclear capabilities, according to KCNA.

CRYPTO

- Bitcoin and Ethereum both climb, taking impetus from the positive risk sentiment.

APAC TRADE

- APAC stocks were in the green as the region reacted to the Fed's oversized 50bps rate cut.

- ASX 200 was underpinned and printed a fresh record high albeit despite somewhat ambiguous jobs data which showed headline Employment Change topped forecast but was entirely due to Part-Time work as Full-Time jobs contracted.

- Nikkei 225 outperformed and surged above the 37,000 level on the back of a weaker currency.

- Hang Seng and Shanghai Comp conformed to the positive mood with the former led higher by strength in tech and property after the HKMA cut rates by 50bps in lockstep with the Fed, while the mainland index was also boosted following the PBoC's continued liquidity efforts and despite the lingering EU tariff concerns.

NOTABLE ASIA-PAC HEADLINES

- HKMA cut its base rate by 50bps to 5.25%, as expected in lockstep with the Fed, while it stated that the US interest rate cut will have a positive impact on the city's economy and will provide some room for easing of local interest rates.

- China's Commerce Minister said regarding the EU's electric vehicle probe that China will continue to negotiate 'until the last minute' and the investigation has undermined 'confidence' of Chinese companies in investing in Europe. It was separately reported that EU capitals will not get to vote on Chinese EV duties next week with the poll removed from the committee agenda for September 25th, according to Politico.

- Chinese policymakers will likely step up measures to at least help the economy meet its 2024 growth target with more focus on boosting demand to fight deflationary pressures, "but any forceful stimulus looks unlikely", via Reuters citing advisors/analysts. Elsewhere, the Chinese government has been urged by a think tank to strengthen coordination of policy in order to improve economic governance, via People's Daily.

- Taiwan raises RRR by 25bps.

DATA RECAP

- Australian Employment (Aug) 47.5k vs. Exp. 25.0k (Prev. 58.2k); Full Time Employment (Aug) -3.1k (Prev. 60.5k)

- Australian Unemployment Rate (Aug) 4.2% vs. Exp. 4.2% (Prev. 4.2%); Participation Rate (Aug) 67.1% vs. Exp. 67.1% (Prev. 67.1%)

- New Zealand GDP QQ (Q2) -0.2% vs. Exp. -0.4% (Prev. 0.2%, Rev. 0.1%); YY (Q2) -0.5% vs. Exp. -0.5% (Prev. 0.3%, Rev. 0.5%)