- APAC stocks were ultimately mixed amid the ongoing mass closures in the region and after the choppy performance stateside in reaction to the FOMC, while the first earnings results from the magnificent 7 stocks were also varied - Meta +2.3%, Microsoft -4.6%, and Tesla +4.1%.

- An immediate hawkish reaction was seen as the Fed held rates at 4.25-4.50%, as expected, while it removed the reference that "inflation has made progress toward the Committee's 2 percent objective" in the accompanying statement.

- However, Fed Chair Powell later noted in the Q&A that it was a language clean-up, as opposed to anything fundamental, which saw a dovish reversal to the initial moves.

- US President Trump said because the Fed and Chair Powell failed to stop problem they created with inflation, he will do it by unleashing American energy production slashing regulation, rebalancing international trade, and reigniting American manufacturing.

- Looking ahead, highlights include Swiss KOF, Spanish CPI (Flash), EZ GDP (Q4), US GDP Advance (Q4), PCE Prices Advance (Q4), Jobless Claims, Japanese Tokyo CPI & Retail Sales, ECB & SARB Policy Announcements, Comments from ECB President Lagarde, Supply from Italy

- Earnings from Nokia, Roche, ABB, H&M, BT, Shell, Sage, STMicroelectronics, Sanofi, Deutsche Bank, Apple, Intel, Visa, US Steel, UPS, Mastercard, Blackstone, Caterpillar, Cigna & Mobileye.

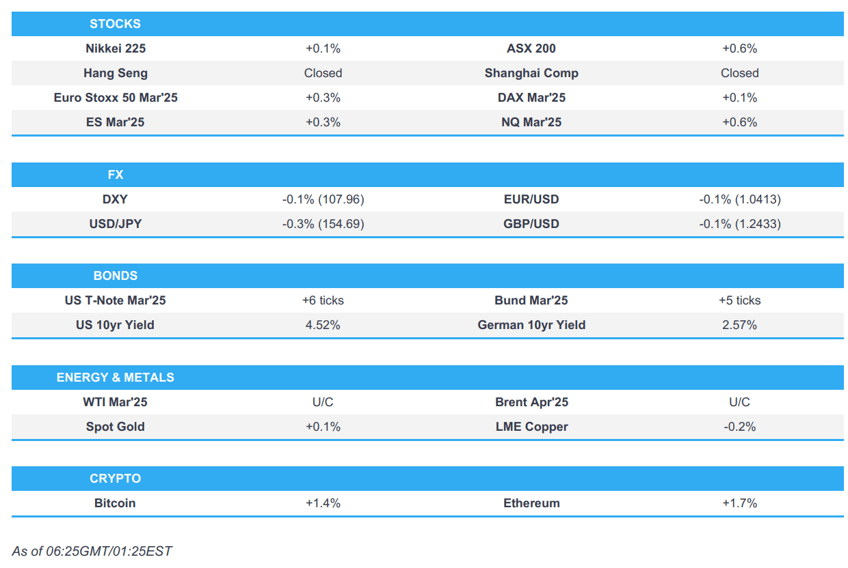

SNAPSHOT

- Holiday: Chinese Spring Festival (Jan 28 - Feb 4 2025)

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

FOMC

STATEMENT

- Federal Reserve kept rates on hold at 4.25-4.50% as expected, while the decision was unanimous and the statement did not include language that inflation had made progress toward the 2% goal as it had in the December statement.

- Fed said the unemployment rate has stabilised at a low level in recent months and labour market conditions remain solid, while inflation remains somewhat elevated (prev. labour market conditions have generally eased, and the unemployment rate has moved up but remains low, while inflation has made progress toward the Committee's 2% objective but remains somewhat elevated).

- Fed maintained that it judges that risks to achieving its employment and inflation goals are "roughly in balance" and that "the economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate." Furthermore, it maintains language that "In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks".

PRESS CONFERENCE

- Fed Chair Powell said in the press conference that they do not need to be in a hurry to adjust the policy stance and are not on a preset course, while he added that reducing policy restraint too fast could hinder progress but too slowly could unduly weaken employment and it will adjust the policy stance to promote goals. Powell also stated that policy is well positioned to deal with risks and uncertainties, and noted that policy framework discussions began at this meeting with the review of the framework to wrap up by late summer and they will retain the 2% inflation goal which will not be a focus of the review.

- Fed Chair Powell said during the Q&A that he is not going to comment on what US President Trump said about lowering rates and the public should be confident that the Fed are keeping heads down and doing their work, while he had not had contact with Trump. Powell also noted the assessment of the policy stance has not changed but policy is meaningfully less restrictive than when they started cuts, while he responded it is a language clean up and just used to shorten the sentence when asked about removing reference to inflation progress and noted the Fed got two good readings in a row on inflation.

- Powell stated the Fed is in the mode of waiting to see what policies are enacted and does not know what will happen with fiscal, regulatory, tariffs and immigration policy, and stated that forecasts are highly uncertain and there is currently some elevated uncertainty because of significant policy shifts, but should be passing. Powell added that the Fed is looking at data to guide them and they are in a very good place right now with the economy in quite a good place as well and he expects to see further progress on inflation.

- Furthermore, when asked about ending QT, he said that the most recent data suggests reserves are still abundant and the Fed intends to reduce the balance sheet size and are closely monitoring signals on reserves, while he stated policy stance is meaningfully restrictive and they do not need to wait for 2% inflation to cut rates but want to see further inflation progress.

US TRADE

EQUITIES

- US stocks finished lower with price action choppy amid the Federal Reserve meeting in which there was an immediate hawkish reaction to the Fed holding rates at 4.25-4.50%, as expected, while it removed the reference that "inflation has made progress toward the Committee's 2 percent objective" in the accompanying statement. However, Fed Chair Powell later noted in the Q&A that it was a language clean-up, as opposed to anything fundamental, which saw a dovish reversal to the initial moves. Furthermore, Powell reiterated the Fed does not need to be in a hurry to adjust the policy stance and stated the assessment of the policy stance has not changed but policy is meaningfully less restrictive than when they started cuts.

- SPX -0.47% at 6,039, NDX -0.24% at 21,411, DJIA -0.31% at 44,714, RUT -0.25% at 2,283.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President Trump said because the Fed and Chair Powell failed to stop problem they created with inflation, he will do it by unleashing American energy production slashing regulation, rebalancing international trade, and reigniting American manufacturing, while he will make the US financially, and otherwise, powerful again.

- White House Budget Office officially rescinded the order authorising a federal freeze on grants, according to The Washington Post. However, the White House Press Secretary later said this is not a recission of the Federal funding freeze and it simply a recission of the OMB memo.

- US Government Worker Union sued to block US President Trump from reclassifying and firing thousands of federal employees.

- Ronald Reagan Washington National Airport announced all take-offs and landings were halted and emergency personnel were responding to an aircraft incident. Furthermore, the FAA announced that a PSA Airlines Bombardier regional jet collided in mid-air with a Sikorsky H-60 helicopter as it was approaching the runway at Reagan Washington National Airport, while PSA Airlines was operating Flight 5342 for American Airlines (AAL) which took off from Kansas.

- US Commerce Secretary Nominee Lutnick said tariffs on Canada are to address fentanyl that enters the US and if Canada addresses the flow of fentanyl into the US, there will be no tariffs. In relevant news, Canadian Foreign Minister Joly said she discussed the flow of fentanyl and precursors with US Secretary of State Rubio, while she is 'cautiously optimistic' about the talks related to tariffs.

- BoC Governor Macklem said the Bank of Canada can ease tariff pain but can’t fix the damage and a big increase in tariffs is a big disruption to the Canadian economy, while he added that if a trade battle comes to pass, it would mean the economy will work less efficiently. Macklem also commented that inflation has come down, inflation is low, and it is thought to stay around the target.

KEY AFTER-MARKET EARNINGS

- Meta Platforms Inc (META) Q4 2024 (USD): EPS 8.02 (exp. 6.77), Revenue 48.39bln (exp. 47.03bln) Shares +2.3% after market

- Microsoft Corp (MSFT) Q2 2025 (USD): EPS 3.23 (exp. 3.11), Revenue 69.6bln (exp. 68.78bln). Shares -4.6% after market

- Tesla Inc (TSLA) Q4 2024 (USD): Adj. EPS 0.73 (exp. 0.75), Revenue 25.71bln (exp. 27.21bln) Shares +4.1% after market

APAC TRADE

EQUITIES

- APAC stocks were ultimately mixed amid the ongoing mass closures in the region and after the choppy performance stateside in reaction to the FOMC, while the first earnings results from the magnificent 7 stocks were also varied.

- ASX 200 climbed to a fresh record high amid broad strength across sectors and further calls for a February RBA rate cut with NAB joining the rest of Australia's big 4 banks in forecasting a cut next month.

- Nikkei 225 swung between gains and losses amid earnings releases and as the index largely shrugged off a firmer currency.

- US equity futures gradually edged higher following the somewhat mixed results from the first batch of the magnificent 7 earnings.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.3% after the cash market closed with gains of 0.7% on Wednesday.

FX

- DXY mildly softened in Asia-Pac hours and was choppy in the aftermath of the FOMC with an initial hawkish reaction seen as the Fed kept rates unchanged but made some changes to its statement whereby it noted that labour market conditions remain solid and removed language that inflation has made progress to the 2% goal. However, the initial hawkish reaction was then reversed during the press conference as Powell stated the reason behind why the progress of inflation had been removed was purely a language clean-up to shorten the sentence, while he also noted how they had two good readings in a row on inflation and reiterated the Fed is not in a hurry to cut rates when asked about a March cut.

- EUR/USD was rangebound after recent fluctuations and as participants now await EU GDP data and an expected ECB rate cut.

- GBP/USD traded little changed after yesterday's intraday rebound with support seen around the 1.2400 handle.

- USD/JPY retreated after breaching through support at 155.00 with the move also facilitated by a mild upside in Japanese yields.

- Antipodeans lacked firm conviction and failed to sustain early gains in the absence of pertinent drivers and tier-1 data releases.

FIXED INCOME

- 10yr UST futures eked mild gains as price action quietened down from the post-FOMC whipsawing through the 109.00 level.

- Bund futures were contained after recent losses and as participants awaited GDP data and the ECB policy decision.

- 10yr JGB futures declined in choppy trade amid mild gains in Japanese yields and with very little in the way of fresh catalysts overnight.

COMMODITIES

- Crude futures traded rangebound following the prior day's mild weakness with headwinds from recent tariff remarks.

- Spot gold lacked conviction after the choppy reaction to the FOMC and Powell's press conference.

- Copper futures faded some of yesterday's gains amid the mixed risk appetite and absence of its largest buyer.

CRYPTO

- Bitcoin steadily gained throughout the session with prices back above the USD 105k level.

NOTABLE ASIA-PAC HEADLINES

- HKMA said interest rates in Hong Kong might still remain at relatively high levels for some time and that the extent and pace of future US interest rate cuts are subject to considerable uncertainty, in response to the Fed keeping rates unchanged.

DATA RECAP

- Australian Export Prices (Q4) 3.6% (Prev. -4.3%)

- Australian Import Prices (Q4) 0.2% (Prev. -1.4%)

- New Zealand ANZ Business Outlook (Jan) 54.4% (Prev. 62.3%)

- New Zealand ANZ Own Activity (Jan) 45.8% (Prev. 50.3%)

GEOPOLITICS

MIDDLE EAST

- Israeli tank fire was reported in the western area of Rafah in the Tel Al-Sultan neighbourhood, according to Al Arabiya.

- Palestinian Authority PM Mustafa said he has every reason to believe the Trump administration will help them all do a right and balanced deal that could hopefully end the conflict in the region, while he added the goal for Gaza is no Hamas or Israel and that the PA rejects the Trump idea of relocating Gazans

RUSSIA-UKRAINE

- European officials are reportedly considering whether Russian gas pipeline sales to the EU should recommence as part of any potential settlement to end the war against Ukraine, via FT citing sources.

US-CHINA

- US President Trump’s officials reportedly discuss tightening curbs on Nvidia’s (NVDA) China sales although any curbs would likely be a long way off as the new team sets goals, while officials held early talks about restricting Nvidia’s H20 chip.

- US Commerce Secretary Nominee Lutnick said China's DeepSeek was able to create AI "dirt cheap" by leveraging what it had taken from the US and that DeepSeek AI misused US technology, while he noted "They stole things, they broke in, they've taken our IP". Lutnick also commented that export controls without tariffs are a "whack-a-mole" model on China and that Chinese tariffs should be the highest, but added the US may also need to impose new tariffs on allies.

LATAM

- Brazilian Central Bank hiked rates 100bps to 13.25%, as expected in a unanimous decision, while it expects a further adjustment of the same magnitude in the next meeting if the scenario evolves as expected. BCB said that beyond the next meeting, the committee reinforces that the total magnitude of the tightening cycle will be determined by the firm commitment to reaching the inflation target and it stated the current scenario requires an even more contractionary monetary policy.